what is Dragon Pattern in forex market

forex market mein Dragon pattern W or M ke shape say melta julta pattern hota hey yeh forex market mein aik reversal kesam ka chart pattern hota hey yeh esbat ko zahair karte heykeh anay wale price forex market mein tabdele wakay ho ge forex market ke rice mein tadele ka samna kara parta hey Dragon bearish bhe ho sakte hey bullish bhe ho sakte hey

4 important component Dragon Pattern

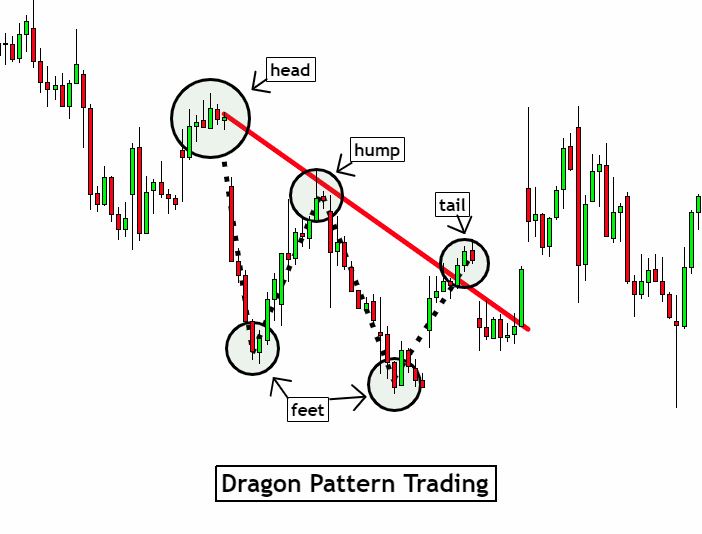

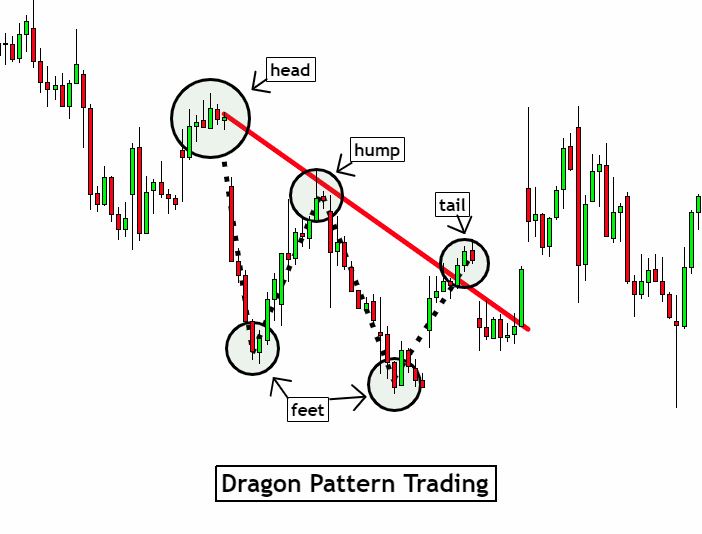

Head

Dragon pattern ka head hota hey jo keh forex market kay pechlay trend ko he identify kar sakta hey jo keh dragon k sorat mein pehlay say he bearish ka trend tha dosree taraf aik bearish dragon pehlay bullish kay trend kay oper banta tha

Feet

forex market mein Dragon pattern kay 2 feet hotay hein forex market mein feet ke position es tarah say he hote hey keh dosra foot pehlay foot say thora sa nechay hota hey es say olta aam tor par thora sa zyada hota hey

Hump

yeh dragon kay competition mein prices mein mamole sahe ezafa hota hey yeh forex market mein 2 foot kay darmeanmein wakay hota hey laken bullish wale dragon kay competition mein high level par he hota hey bearish dragon ke sorat mein hump feet kay nechay hota hey

Tail

forex market kay dragon pattern kay end mein tail hote hey yeh woh pot hota hey jahan par forex market ka breakout ho jata hey bullish Dragon ke sorat mein tail ke tashkeel mein price barhna start ho jate hey forex market new highs ko layna start kar dayte hey or yeh forex market mein bullish ka jazba hota hey yeh woh time hota hey ja forex market mein bullish ka he jazba hota hey

forex market mein bearish Dragon bearish breakout he hota hey es sorat mein seller kundgan ke tadad forex market par have ho jate hey or forex market ke prices gerna start ho jate hein

Types of Dragon Pattern

Bearish Dragon

Bullish Dragon

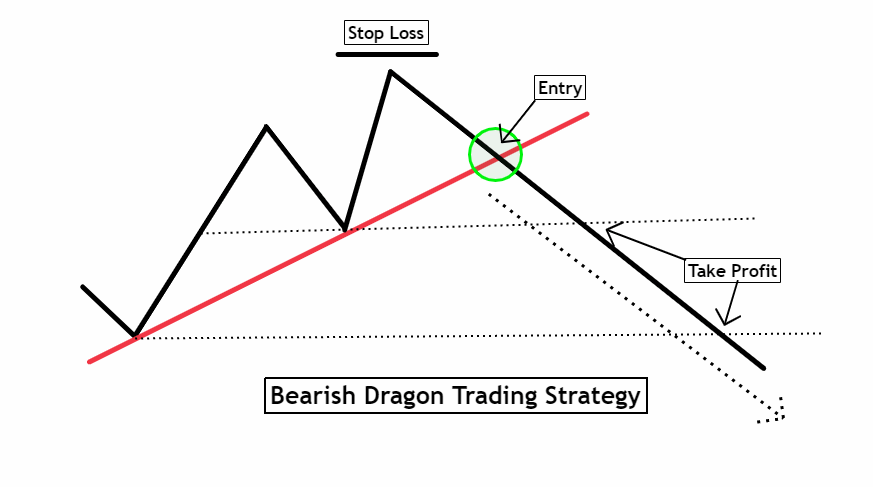

Bearish Dragon Trading Strategy

aik bar jab yeh dragon forex chart par zahair hota hey forex market mein entry kay ley best time hota hey jo keh forex market mein dosray foot kay he nechay hota hy forex market mein Dragon kay head mein trend line draw karne chihay jo keh hump ko cross karte ho woh area hota hey jahan par trend line dosray foot kay area ko cross kar sakte hey forex trade mein enter kay ley he important point he hota hey

mokhtasar yeh keh ap forex trade mein enter honay kay ley Dragon kay head par aik parallel trend line raw karne chihay to dosree taraf ap long position mein enter ho saktay hein to forex market kay pattern kay ley ap ko bearish breakout ka he intazar karna chihay

Risk Management

forex market mein apnay losses ko limited karnay kay ley stop ko pehlay feet kay nechay he rakhna chihay ager forex market ke price Dragon ka asol ke tameel nahi karte hey to ap ko forex market ka account safe rakhnay mein he madad mel sakte hey

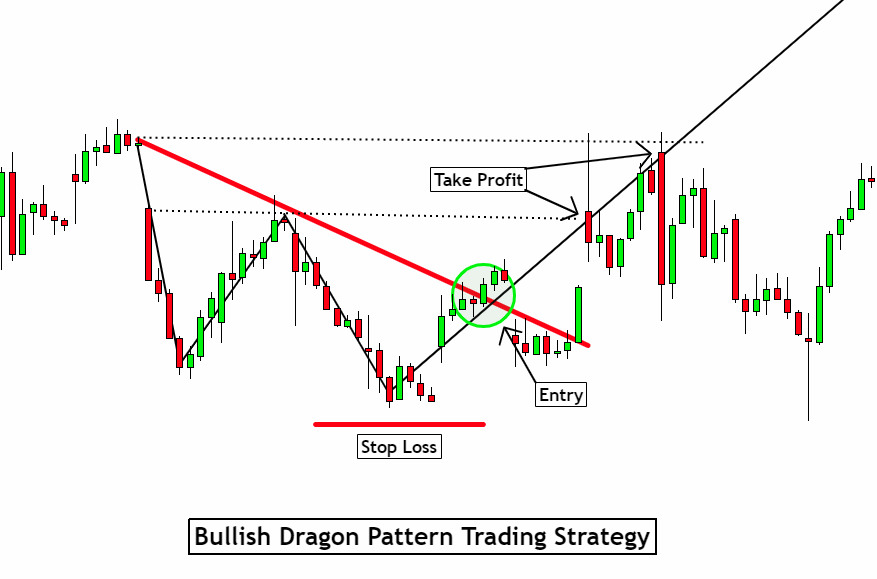

Bullish Dragon Trading Strategy

Dragon kay dosray foot ke tashkeel kay bad forex market mein bullish Dragon ke confirmation ho jate hey or forex market mein enter honay ka best time hota hey jab forex market mein bullish kay jazbaat zahair honay lagtay hein

forex market mein best entry point talash karnay kay ley bad mein es ko entry point tak lay kar jain forex market ke pricemein halke ce kame wakay ho sakte hey or forex market mein bullish breakout hota hey

ager forex market mein bullish dragon say nametna ho to forex market mein profit kay ley 2 option he majod hotay hein or ap forex market ke short trade mein zyada dilchaspe lay saktay hein jab forex market ke prices barna start ho jate hein to ap forex market ke dragon ke tail mein he enter ho saktay hein head or hump kay barabar profit lay saktay hein

forex market ke long trade kay ley ap forex market ke trade ka intazar kr saktay hein bullish dragon mein zahair honay kay bad ap forex market ke prices mein he ezafa kar saktay hein professional trader esko forexmarket mein ezafay kay tor par he zahair kar sakta hey

Risk Management

forex market mein risk management aik important step hota hey jes mein reversal dragon ke trade ho sakte hey ap forex market mein stop loss ko dragon kay dosray foot kay nechay he rakhna chihay forex market ke prices reversal jate hein ap dragon kay mumkana losses ko kam kar saktay hein

forex market mein Dragon pattern W or M ke shape say melta julta pattern hota hey yeh forex market mein aik reversal kesam ka chart pattern hota hey yeh esbat ko zahair karte heykeh anay wale price forex market mein tabdele wakay ho ge forex market ke rice mein tadele ka samna kara parta hey Dragon bearish bhe ho sakte hey bullish bhe ho sakte hey

4 important component Dragon Pattern

Head

Dragon pattern ka head hota hey jo keh forex market kay pechlay trend ko he identify kar sakta hey jo keh dragon k sorat mein pehlay say he bearish ka trend tha dosree taraf aik bearish dragon pehlay bullish kay trend kay oper banta tha

Feet

forex market mein Dragon pattern kay 2 feet hotay hein forex market mein feet ke position es tarah say he hote hey keh dosra foot pehlay foot say thora sa nechay hota hey es say olta aam tor par thora sa zyada hota hey

Hump

yeh dragon kay competition mein prices mein mamole sahe ezafa hota hey yeh forex market mein 2 foot kay darmeanmein wakay hota hey laken bullish wale dragon kay competition mein high level par he hota hey bearish dragon ke sorat mein hump feet kay nechay hota hey

Tail

forex market kay dragon pattern kay end mein tail hote hey yeh woh pot hota hey jahan par forex market ka breakout ho jata hey bullish Dragon ke sorat mein tail ke tashkeel mein price barhna start ho jate hey forex market new highs ko layna start kar dayte hey or yeh forex market mein bullish ka jazba hota hey yeh woh time hota hey ja forex market mein bullish ka he jazba hota hey

forex market mein bearish Dragon bearish breakout he hota hey es sorat mein seller kundgan ke tadad forex market par have ho jate hey or forex market ke prices gerna start ho jate hein

Types of Dragon Pattern

Bearish Dragon

Bullish Dragon

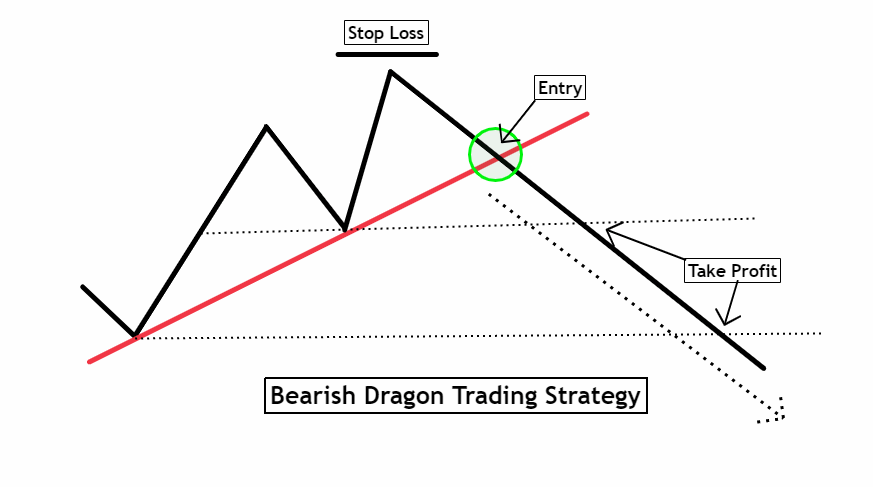

Bearish Dragon Trading Strategy

aik bar jab yeh dragon forex chart par zahair hota hey forex market mein entry kay ley best time hota hey jo keh forex market mein dosray foot kay he nechay hota hy forex market mein Dragon kay head mein trend line draw karne chihay jo keh hump ko cross karte ho woh area hota hey jahan par trend line dosray foot kay area ko cross kar sakte hey forex trade mein enter kay ley he important point he hota hey

mokhtasar yeh keh ap forex trade mein enter honay kay ley Dragon kay head par aik parallel trend line raw karne chihay to dosree taraf ap long position mein enter ho saktay hein to forex market kay pattern kay ley ap ko bearish breakout ka he intazar karna chihay

Risk Management

forex market mein apnay losses ko limited karnay kay ley stop ko pehlay feet kay nechay he rakhna chihay ager forex market ke price Dragon ka asol ke tameel nahi karte hey to ap ko forex market ka account safe rakhnay mein he madad mel sakte hey

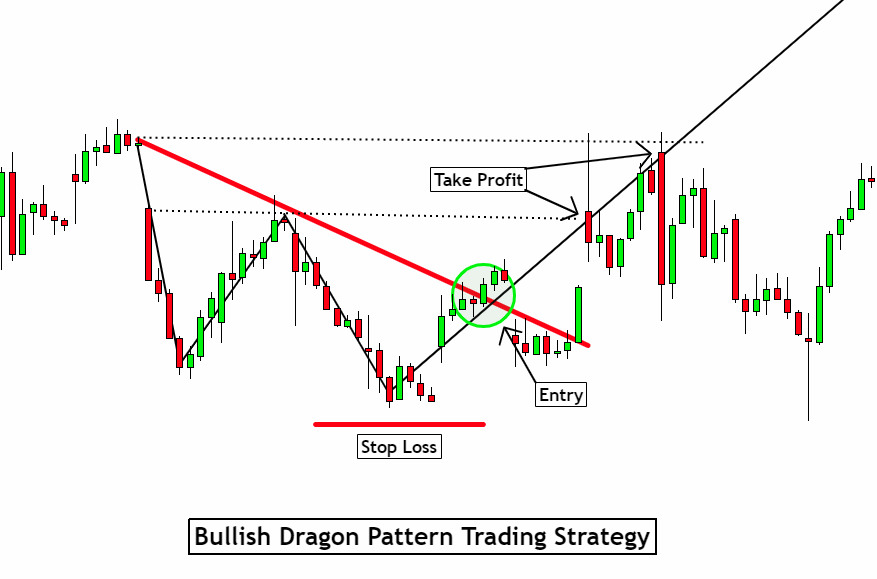

Bullish Dragon Trading Strategy

Dragon kay dosray foot ke tashkeel kay bad forex market mein bullish Dragon ke confirmation ho jate hey or forex market mein enter honay ka best time hota hey jab forex market mein bullish kay jazbaat zahair honay lagtay hein

forex market mein best entry point talash karnay kay ley bad mein es ko entry point tak lay kar jain forex market ke pricemein halke ce kame wakay ho sakte hey or forex market mein bullish breakout hota hey

ager forex market mein bullish dragon say nametna ho to forex market mein profit kay ley 2 option he majod hotay hein or ap forex market ke short trade mein zyada dilchaspe lay saktay hein jab forex market ke prices barna start ho jate hein to ap forex market ke dragon ke tail mein he enter ho saktay hein head or hump kay barabar profit lay saktay hein

forex market ke long trade kay ley ap forex market ke trade ka intazar kr saktay hein bullish dragon mein zahair honay kay bad ap forex market ke prices mein he ezafa kar saktay hein professional trader esko forexmarket mein ezafay kay tor par he zahair kar sakta hey

Risk Management

forex market mein risk management aik important step hota hey jes mein reversal dragon ke trade ho sakte hey ap forex market mein stop loss ko dragon kay dosray foot kay nechay he rakhna chihay forex market ke prices reversal jate hein ap dragon kay mumkana losses ko kam kar saktay hein

تبصرہ

Расширенный режим Обычный режим