Gartley Pattern Kya Hai?

Gartley pattern ek technical analysis pattern hai jo forex trading mein istemal hota hai. Is pattern ko Richard Gartley ne 1935 mein pehli baar introduce kiya tha. Yeh pattern price action ke specific sequence ko represent karta hai, jo ki reversal points ko identify karne mein madadgar hota hai. Gartley pattern ko bullish aur bearish dono form mein identify kiya ja sakta hai, aur isse traders price reversal ke possible points ka andaza lagate hain.

Gartley Pattern Ki Shakal

Gartley pattern ki shakal "M" ya "W" jaisi hoti hai. Is pattern ko samajhne ke liye kuch specific points ka khayal rakhna zaroori hai:

Gartley pattern ki shakal kuch is tarah se hoti hai:

css

Copy code

X ---- A ---- B ---- C ---- D

Yahaan par har point ka Fibonacci levels ke saath taluq hota hai, jo is pattern ko banata hai.

Gartley Pattern Ka Analysis

Gartley pattern ko analyze karne ke liye, traders ko Fibonacci retracement levels ka istemal karna hota hai. Yeh levels price action ko samajhne mein madadgar hote hain. Gartley pattern ko identify karne ke liye kuch khas Fibonacci levels hain:

Yeh levels help karte hain traders ko entry aur exit points ko define karne mein. Agar price is pattern ke dauran in levels ko cross kar jati hai, toh yeh trend reversal ka indication ho sakta hai.

Gartley Pattern Ka Istemal Trading Mein

Gartley pattern ko trading mein istemal karne ke liye kuch important steps hain:

Fawaid

Gartley pattern ko successful trading strategy ke taur par istemal karne ke liye kuch important tips hain:

Gartley pattern forex trading ka ek powerful tool hai jo traders ko price action ke reversal points ko identify karne mein madad karta hai. Is pattern ko samajhne aur sahi tarah istemal karne se traders apne trading strategies ko improve kar sakte hain. Halankeh is pattern ke sath kuch nuqsanat bhi hain, lekin agar traders risk management aur market analysis par focus karein, toh yeh unki trading journey ko asaan aur faida mand bana sakta hai. Trading mein success hasil karne ke liye education, practice, aur discipline ka hona zaroori hai.

Gartley pattern ek technical analysis pattern hai jo forex trading mein istemal hota hai. Is pattern ko Richard Gartley ne 1935 mein pehli baar introduce kiya tha. Yeh pattern price action ke specific sequence ko represent karta hai, jo ki reversal points ko identify karne mein madadgar hota hai. Gartley pattern ko bullish aur bearish dono form mein identify kiya ja sakta hai, aur isse traders price reversal ke possible points ka andaza lagate hain.

Gartley Pattern Ki Shakal

Gartley pattern ki shakal "M" ya "W" jaisi hoti hai. Is pattern ko samajhne ke liye kuch specific points ka khayal rakhna zaroori hai:

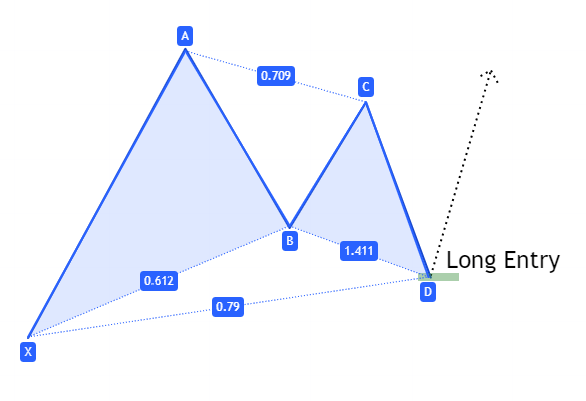

- Point X: Yeh pattern ka starting point hai.

- Point A: Yeh point X se upward movement ke baad aata hai.

- Point B: Yeh point A se downward movement ke baad aata hai. Yeh generally 61.8% Fibonacci retracement level par hota hai.

- Point C: Yeh point B se upward movement ke baad aata hai aur 78.6% Fibonacci retracement level par hota hai.

- Point D: Yeh point C se downward movement ke baad aata hai aur yeh entry point hota hai. Is point par traders market mein enter karte hain.

Gartley pattern ki shakal kuch is tarah se hoti hai:

css

Copy code

X ---- A ---- B ---- C ---- D

Yahaan par har point ka Fibonacci levels ke saath taluq hota hai, jo is pattern ko banata hai.

Gartley Pattern Ka Analysis

Gartley pattern ko analyze karne ke liye, traders ko Fibonacci retracement levels ka istemal karna hota hai. Yeh levels price action ko samajhne mein madadgar hote hain. Gartley pattern ko identify karne ke liye kuch khas Fibonacci levels hain:

- AB = XA: Yeh measurement pattern ka basic structure define karta hai.

- BC = 61.8% of AB: Iska matlab hai ke point B ka level A se 61.8% niche hona chahiye.

- CD = 78.6% of XA: Yeh level pattern ki completion ka signal hota hai.

Yeh levels help karte hain traders ko entry aur exit points ko define karne mein. Agar price is pattern ke dauran in levels ko cross kar jati hai, toh yeh trend reversal ka indication ho sakta hai.

Gartley Pattern Ka Istemal Trading Mein

Gartley pattern ko trading mein istemal karne ke liye kuch important steps hain:

- Pattern Ko Identify Karna: Sabse pehle trader ko chart par Gartley pattern ko identify karna hota hai. Yeh analysis ke liye price action aur Fibonacci levels ko samajhna zaroori hai.

- Entry Point Ko Determine Karna: Point D par entry kiya jata hai. Jab price is point par aati hai, tab traders ko market mein enter karne ka sochna chahiye.

- Stop Loss Aur Take Profit Set Karna: Stop loss ko point C ke neeche set karna chahiye. Yeh risk management ke liye zaroori hai. Take profit level ko point A par set kiya ja sakta hai, lekin traders apne risk-reward ratio ke hisaab se isay adjust kar sakte hain.

- Market Ki Monitoring: Trader ko market ko closely monitor karna chahiye, taake wo kisi bhi unexpected movement ke liye tayyar rahein.

- Multiple Time Frame Analysis: Gartley pattern ko multiple time frames par dekhna bhi beneficial hota hai. Is se traders ko zyada reliable signals milte hain.

Fawaid

- Trend Reversals Ka Andaza: Gartley pattern trend reversals ko identify karne mein madad karta hai.

- Risk Management: Is pattern ke sath stop loss set karne ka asan tareeqa hota hai, jo traders ko apne losses se bacha sakta hai.

- Fibonacci Levels Ka Istemal: Is pattern mein Fibonacci levels ka istemal hota hai, jo price action ko samajhne mein madadgar hote hain.

- False Signals: Gartley pattern kabhi kabhi false signals de sakta hai, jo traders ko galat trades karne par majboor kar sakta hai.

- Market Conditions: Agar market volatile hai, toh Gartley pattern ka success rate kam ho sakta hai.

- Complexity: Kuch traders ke liye Gartley pattern ki complexity samajhna mushkil ho sakta hai, jo unke trading decisions par asar dal sakta hai.

Gartley pattern ko successful trading strategy ke taur par istemal karne ke liye kuch important tips hain:

- Practice: Gartley pattern ko samajhne ke liye traders ko practice karni chahiye. Charts par pattern ko identify karne ki koshish karein.

- Education: Is pattern ki theory aur practice par research karen. Trading courses ya webinars mein shamil hoke knowledge badha sakte hain.

- Risk Management: Risk management ko hamesha first priority rakhein. Stop loss aur position sizing ka sahi istemal karna zaroori hai.

- Combination with Other Patterns: Gartley pattern ko dusre technical analysis patterns ke sath combine karke bhi istemal kar sakte hain, taake accuracy ko badha sakein.

- Emotional Control: Trading mein emotional control bhi bohot zaroori hai. Apne emotions ko control karne ki koshish karein aur trading decisions ko logical banayein.

Gartley pattern forex trading ka ek powerful tool hai jo traders ko price action ke reversal points ko identify karne mein madad karta hai. Is pattern ko samajhne aur sahi tarah istemal karne se traders apne trading strategies ko improve kar sakte hain. Halankeh is pattern ke sath kuch nuqsanat bhi hain, lekin agar traders risk management aur market analysis par focus karein, toh yeh unki trading journey ko asaan aur faida mand bana sakta hai. Trading mein success hasil karne ke liye education, practice, aur discipline ka hona zaroori hai.

تبصرہ

Расширенный режим Обычный режим