**Continuation Patterns**

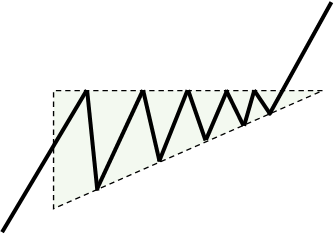

Continuation patterns yeh batate hain ke current trend ka barqarar rehna mumkin hai. Yeh patterns aksar trend ke rukh mein rukawat ya consolidation ke waqt bante hain, aur phir uske baad trend ki direction mein aage barhne ka signal dete hain.

**Characteristics:**

1. **Trend ke dauran bante hain:** Continuation patterns ek trend ke doran ubhartay hain, chahe woh uptrend ho ya downtrend.

2. **Pause ya consolidation:** Yeh patterns trend mein rukawat ya consolidation ko zahir karte hain.

3. **Breakout:** Pattern tab mukammal hota hai jab price consolidation area se breakout karta hai.

4. **Trend continuation:** Breakout ke baad trend apni pehle ki direction mein aage barhta hai.

**Examples:**

1. **Flags:** Ek chhota rectangle ya pennant-shaped pattern jo trend ke dauran banta hai.

2. **Pennants:** Ek chhota symmetrical triangle jo trend ke dauran banta hai.

3. **Triangles:** Symmetrical, Ascending, aur Descending triangles jo trend ke dauran bante hain.

4. **Rectangles:** Ek horizontal pattern jo trend ke dauran banta hai.

5. **Cup and Handle:** Ek pattern jo continuation aur reversal dono ka ishara de sakta hai, depending on the context.

**Reversal Patterns**

Reversal patterns yeh zahir karte hain ke current trend palatne wala hai. Yeh patterns aksar trend ke aakhri marahil mein bante hain, aur phir uske baad direction mein tabdeeli ka pata dete hain.

**Characteristics:**

1. **Trend ke aakhri marahil mein bante hain:** Reversal patterns ek trend ke aakhir mein ubhartay hain, chahe woh uptrend ho ya downtrend.

2. **Direction mein tabdeeli:** Yeh trend ki direction mein tabdeeli ka ishara dete hain.

3. **Breakout:** Pattern tab mukammal hota hai jab price pattern area se breakout karta hai.

4. **Reversal:** Breakout ke baad trend ki direction palat jati hai.

**Examples:**

1. **Head and Shoulders:** Ek pattern jisme teen peaks hote hain, jahan darmiyani peak sabse buland hota hai.

2. **Inverse Head and Shoulders:** Ek pattern jisme teen troughs hote hain, jahan darmiyani trough sabse gehra hota hai.

3. **Double Tops and Bottoms:** Ek pattern jisme do peaks ya troughs hote hain, jahan doosra peak ya trough pehle se neeche hota hai.

4. **Triple Tops and Bottoms:** Ek pattern jisme teen peaks ya troughs hote hain, jahan doosra aur teesra peak ya trough pehle se neeche hota hai.

5. **Hammer and Inverted Hammer:** Ek pattern jisme lambay lower shadow aur chhoti body hoti hai.

6. **Shooting Star and Inverted Shooting Star:** Ek pattern jisme lambay upper shadow aur chhoti body hoti hai.

**Key Differences:**

1. **Maqsad:** Continuation patterns trend ki barqarari ko zahir karte hain, jabke reversal patterns trend ke palatne ko indicate karte hain.

2. **Formation:** Continuation patterns trend mein rukawat ke waqt bante hain, jabke reversal patterns trend ke aakhir mein bante hain.

3. **Direction:** Continuation patterns ke baad trend apni direction mein aage barhta hai, jabke reversal patterns ke baad direction palat jati hai.

Continuation aur reversal patterns ke darmiyan ka fark samajhna ahem hai taake trading mein behtareen faisle kiye ja sakein.

Continuation patterns yeh batate hain ke current trend ka barqarar rehna mumkin hai. Yeh patterns aksar trend ke rukh mein rukawat ya consolidation ke waqt bante hain, aur phir uske baad trend ki direction mein aage barhne ka signal dete hain.

**Characteristics:**

1. **Trend ke dauran bante hain:** Continuation patterns ek trend ke doran ubhartay hain, chahe woh uptrend ho ya downtrend.

2. **Pause ya consolidation:** Yeh patterns trend mein rukawat ya consolidation ko zahir karte hain.

3. **Breakout:** Pattern tab mukammal hota hai jab price consolidation area se breakout karta hai.

4. **Trend continuation:** Breakout ke baad trend apni pehle ki direction mein aage barhta hai.

**Examples:**

1. **Flags:** Ek chhota rectangle ya pennant-shaped pattern jo trend ke dauran banta hai.

2. **Pennants:** Ek chhota symmetrical triangle jo trend ke dauran banta hai.

3. **Triangles:** Symmetrical, Ascending, aur Descending triangles jo trend ke dauran bante hain.

4. **Rectangles:** Ek horizontal pattern jo trend ke dauran banta hai.

5. **Cup and Handle:** Ek pattern jo continuation aur reversal dono ka ishara de sakta hai, depending on the context.

**Reversal Patterns**

Reversal patterns yeh zahir karte hain ke current trend palatne wala hai. Yeh patterns aksar trend ke aakhri marahil mein bante hain, aur phir uske baad direction mein tabdeeli ka pata dete hain.

**Characteristics:**

1. **Trend ke aakhri marahil mein bante hain:** Reversal patterns ek trend ke aakhir mein ubhartay hain, chahe woh uptrend ho ya downtrend.

2. **Direction mein tabdeeli:** Yeh trend ki direction mein tabdeeli ka ishara dete hain.

3. **Breakout:** Pattern tab mukammal hota hai jab price pattern area se breakout karta hai.

4. **Reversal:** Breakout ke baad trend ki direction palat jati hai.

**Examples:**

1. **Head and Shoulders:** Ek pattern jisme teen peaks hote hain, jahan darmiyani peak sabse buland hota hai.

2. **Inverse Head and Shoulders:** Ek pattern jisme teen troughs hote hain, jahan darmiyani trough sabse gehra hota hai.

3. **Double Tops and Bottoms:** Ek pattern jisme do peaks ya troughs hote hain, jahan doosra peak ya trough pehle se neeche hota hai.

4. **Triple Tops and Bottoms:** Ek pattern jisme teen peaks ya troughs hote hain, jahan doosra aur teesra peak ya trough pehle se neeche hota hai.

5. **Hammer and Inverted Hammer:** Ek pattern jisme lambay lower shadow aur chhoti body hoti hai.

6. **Shooting Star and Inverted Shooting Star:** Ek pattern jisme lambay upper shadow aur chhoti body hoti hai.

**Key Differences:**

1. **Maqsad:** Continuation patterns trend ki barqarari ko zahir karte hain, jabke reversal patterns trend ke palatne ko indicate karte hain.

2. **Formation:** Continuation patterns trend mein rukawat ke waqt bante hain, jabke reversal patterns trend ke aakhir mein bante hain.

3. **Direction:** Continuation patterns ke baad trend apni direction mein aage barhta hai, jabke reversal patterns ke baad direction palat jati hai.

Continuation aur reversal patterns ke darmiyan ka fark samajhna ahem hai taake trading mein behtareen faisle kiye ja sakein.

تبصرہ

Расширенный режим Обычный режим