Parabolic Pattern: Ek Mukammal Jaiza

Parabolic pattern ek technical chart pattern hai jo financial markets, jaise ke stocks, forex, commodities, aur cryptocurrencies mein dekha jata hai. Is pattern ka naam uske unique “parabola” ya curved shape ki wajah se pada, jo rapid price movement ko highlight karta hai. Ye pattern aksar strong trends aur market mein significant changes ko indicate karta hai.

Parabolic Pattern Kya Hai?

Parabolic pattern ek aisi price movement hai jo shuru mein slow hoti hai, lekin waqt ke saath accelerate karti hai aur ek steep curve banati hai. Ye pattern upward ya downward dono directions mein ban sakta hai aur trading decisions ke liye kaafi useful hota hai.

Is pattern ka structure aksar do main phases mein divide hota hai:

1. Acceleration Phase: Jab price slow speed se move karta hai aur gradually fast hota jata hai.

2. Exhaustion Phase: Jab trend apni peak ya bottom par pohanchta hai aur price reverse hone lagta hai.

Parabolic Pattern Ki Types

1. Bullish Parabolic Pattern:

Jab price upward curve banata hai aur consistently higher highs aur higher lows banata hai.

Ye strong buying demand ka signal hota hai.

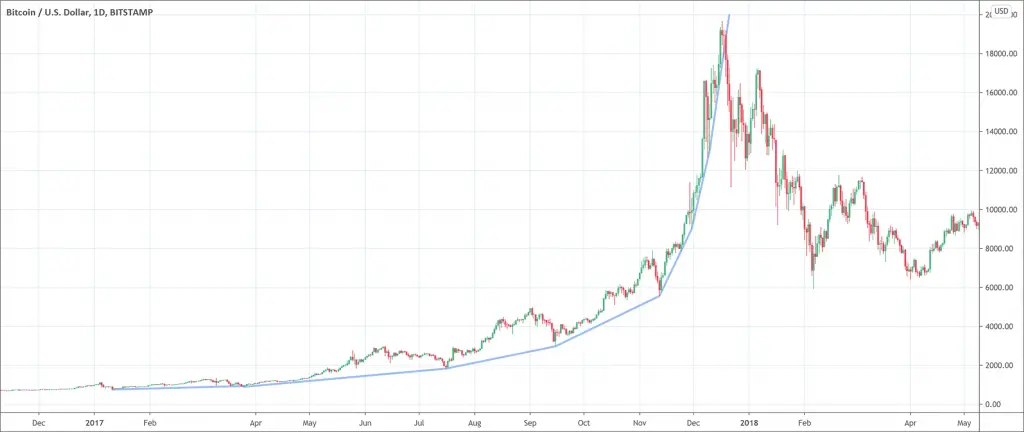

Example: Bitcoin ka 2017 ka bull run jisme price ne parabola follow kiya aur ek high pe pohanch kar crash hua.

2. Bearish Parabolic Pattern:

Jab price downward curve follow karta hai aur lower highs aur lower lows banata hai.

Ye strong selling pressure ka indicator hota hai.

Example: Market crashes, jaise 2008 ka financial crisis, aksar bearish parabola ki shakal mein dekhe gaye hain.

Parabolic Pattern Kaise Banta Hai?

Parabolic pattern tab banta hai jab market mein:

1. High Volatility: Price rapidly move karta hai.

2. Strong Momentum: Buyers ya sellers dominate karte hain.

3. Exponential Growth Ya Decline: Price steady growth/decline ke baad sharp movement karta hai.

Trading Mein Parabolic Pattern Ka Istemaal

1. Trend Identification:

Parabolic pattern ek strong trend ko identify karne mein madad karta hai.

Agar price parabola ke andar hai, toh trend intact hai.

2. Entry Points:

Bullish pattern mein, jab price lower curve se upward accelerate kare, toh ye buying ka signal ho sakta hai.

Bearish pattern mein, downward acceleration selling ka signal deta hai.

Understanding the Parabolic Arc Pattern

3. Exit Points:

Jab parabola ka curve break hota hai, toh ye aksar trend reversal ka signal hota hai.

4. Risk Management:

Parabolic pattern ke sath stop-loss orders lagana zaroori hai taake aap apne losses minimize kar sakein.

Parabolic pattern ek technical chart pattern hai jo financial markets, jaise ke stocks, forex, commodities, aur cryptocurrencies mein dekha jata hai. Is pattern ka naam uske unique “parabola” ya curved shape ki wajah se pada, jo rapid price movement ko highlight karta hai. Ye pattern aksar strong trends aur market mein significant changes ko indicate karta hai.

Parabolic Pattern Kya Hai?

Parabolic pattern ek aisi price movement hai jo shuru mein slow hoti hai, lekin waqt ke saath accelerate karti hai aur ek steep curve banati hai. Ye pattern upward ya downward dono directions mein ban sakta hai aur trading decisions ke liye kaafi useful hota hai.

Is pattern ka structure aksar do main phases mein divide hota hai:

1. Acceleration Phase: Jab price slow speed se move karta hai aur gradually fast hota jata hai.

2. Exhaustion Phase: Jab trend apni peak ya bottom par pohanchta hai aur price reverse hone lagta hai.

Parabolic Pattern Ki Types

1. Bullish Parabolic Pattern:

Jab price upward curve banata hai aur consistently higher highs aur higher lows banata hai.

Ye strong buying demand ka signal hota hai.

Example: Bitcoin ka 2017 ka bull run jisme price ne parabola follow kiya aur ek high pe pohanch kar crash hua.

2. Bearish Parabolic Pattern:

Jab price downward curve follow karta hai aur lower highs aur lower lows banata hai.

Ye strong selling pressure ka indicator hota hai.

Example: Market crashes, jaise 2008 ka financial crisis, aksar bearish parabola ki shakal mein dekhe gaye hain.

Parabolic Pattern Kaise Banta Hai?

Parabolic pattern tab banta hai jab market mein:

1. High Volatility: Price rapidly move karta hai.

2. Strong Momentum: Buyers ya sellers dominate karte hain.

3. Exponential Growth Ya Decline: Price steady growth/decline ke baad sharp movement karta hai.

Trading Mein Parabolic Pattern Ka Istemaal

1. Trend Identification:

Parabolic pattern ek strong trend ko identify karne mein madad karta hai.

Agar price parabola ke andar hai, toh trend intact hai.

2. Entry Points:

Bullish pattern mein, jab price lower curve se upward accelerate kare, toh ye buying ka signal ho sakta hai.

Bearish pattern mein, downward acceleration selling ka signal deta hai.

Understanding the Parabolic Arc Pattern

3. Exit Points:

Jab parabola ka curve break hota hai, toh ye aksar trend reversal ka signal hota hai.

4. Risk Management:

Parabolic pattern ke sath stop-loss orders lagana zaroori hai taake aap apne losses minimize kar sakein.

تبصرہ

Расширенный режим Обычный режим