Bearish Candlestick Patterns

Candlestick charts trading ka aik ahem hissa hain, jo traders ko market ki mood aur price movements ka pata dene mein madad karte hain. Jab market bearish hoti hai, to yeh kuch khas candlestick patterns bante hain jo ye dikhate hain ke price niche ki taraf ja rahi hai. Aayiye, kuch mashhoor bearish candlestick patterns par nazar dalte hain.

1. Shooting Star

Shooting star ek bearish reversal pattern hai jo tab banta hai jab price pehle se upar ja rahi hoti hai, lekin phir niche gir jati hai. Is pattern ka shape ek choti body aur lambi upper shadow hoti hai. Yeh batata hai ke buyers ne market ko upar ki taraf push kiya, lekin sellers ne control le liya aur price ko wapas niche kar diya. Jab yeh pattern aik resistance level par banta hai, to yeh bearish trend ki shuruaat ka ilzam deta hai.

2. Inverted Hammer

Inverted hammer bhi ek reversal pattern hai, lekin yeh tab hota hai jab price pehle se niche ja rahi hoti hai. Is pattern mein bhi choti body hoti hai, lekin iski upper shadow bahut lambi hoti hai. Iska matlab yeh hai ke buyers ne thodi der ke liye control hasil kiya, lekin baad mein sellers ne price ko niche ki taraf bhej diya. Agar yeh pattern kisi support level ke paas ban raha ho, to yeh bearish trend ki shuruaat ka ilzam deta hai.

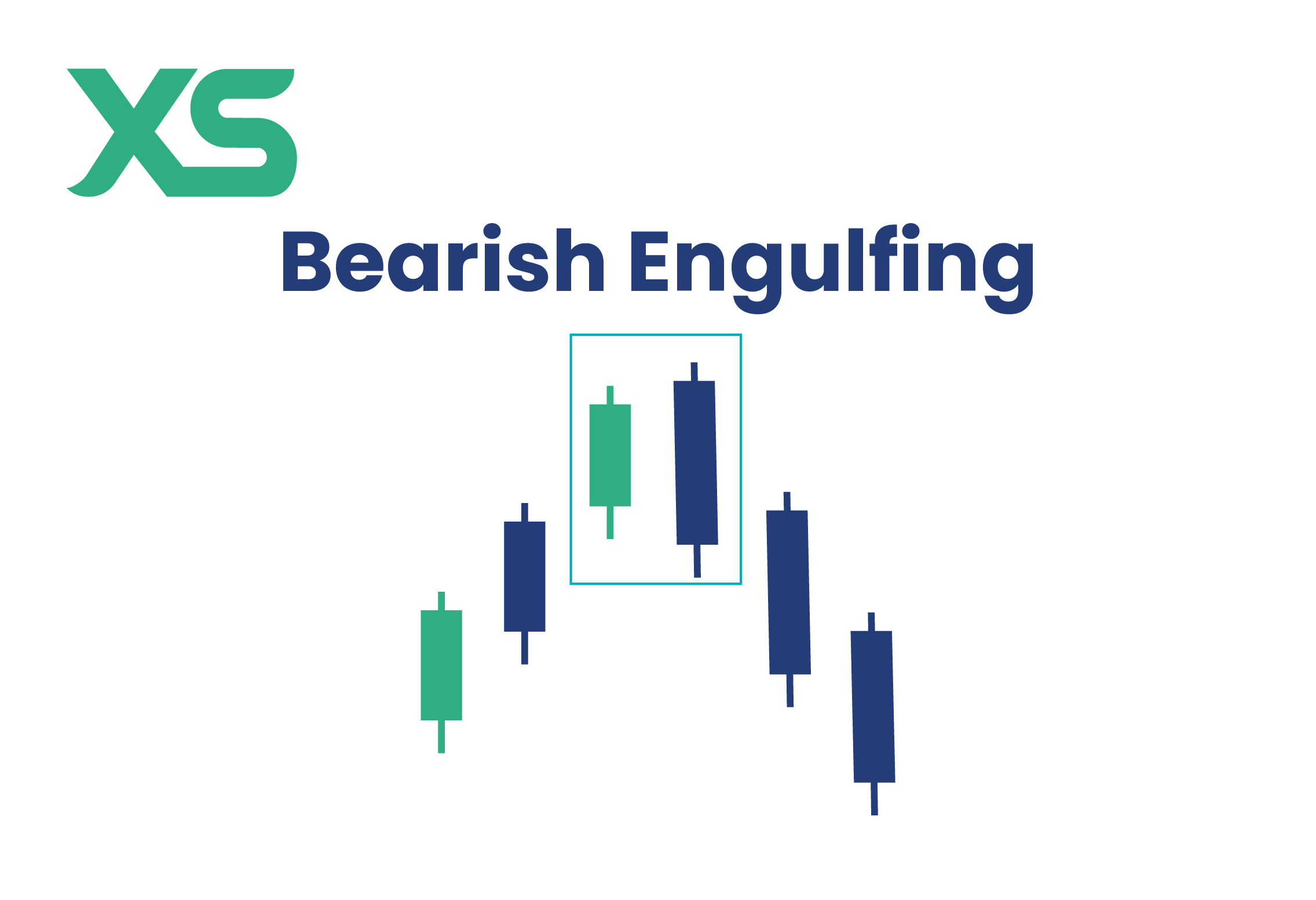

3. Bearish Engulfing

Bearish engulfing pattern do candlesticks ka combination hota hai. Is pattern mein pehli candlestick choti hoti hai aur bullish (green) hoti hai, jabke doosri candlestick badi hoti hai aur bearish (red) hoti hai. Yeh doosri candlestick pehli candlestick ko puri tarah engulf karti hai, jo yeh dikhata hai ke sellers ne kharidari ka pressure pura tor diya hai. Yeh pattern aksar bullish trend ke baad banta hai aur iska matlab hai ke market ab bearish ho sakti hai.

4. Dark Cloud Cover

Dark cloud cover bhi ek bearish reversal pattern hai. Is pattern mein pehli candlestick bullish hoti hai, jabke doosri candlestick bearish hoti hai jo pehli candlestick ke half tak chali jaati hai. Yeh pattern tab banta hai jab price pehle se upar ja rahi hoti hai, lekin phir sellers ka pressure aata hai jo price ko niche laata hai. Yeh pattern indicate karta hai ke market mein bearish trend shuru ho sakta hai.

5. Three Black Crows

Three black crows pattern teen consecutive bearish candlesticks ka hota hai, jinki bodies relatively barhiyan hoti hain. Is pattern ka matlab hota hai ke market mein strong bearish momentum hai. Yeh pattern aksar kisi bullish trend ke baad aata hai aur yeh traders ko warn karta hai ke bearish trend aane wala hai. Agar aap is pattern ko dekhein to yeh dikhata hai ke sellers market par control hasil kar rahe hain.

Conclusion

Bearish candlestick patterns market ki bearish trends aur reversal points ka pata dene mein madadgar hain. In patterns ko samajhne se traders ko apne trading decisions behtar banane mein madad milti hai. Har pattern ko achi tarah samajhna zaroori hai taake aap inhe market mein effectively istamal kar sakein. Agar aap in bearish patterns ka sahi istemal karte hain, to yeh aapko profit kamaane mein madad de sakte hain. Hamesha yaad rakhein ke trading mein risk management bhi intehai zaroori hai, isliye in patterns ko dusre technical indicators ke sath mila kar dekhen.

Candlestick charts trading ka aik ahem hissa hain, jo traders ko market ki mood aur price movements ka pata dene mein madad karte hain. Jab market bearish hoti hai, to yeh kuch khas candlestick patterns bante hain jo ye dikhate hain ke price niche ki taraf ja rahi hai. Aayiye, kuch mashhoor bearish candlestick patterns par nazar dalte hain.

1. Shooting Star

Shooting star ek bearish reversal pattern hai jo tab banta hai jab price pehle se upar ja rahi hoti hai, lekin phir niche gir jati hai. Is pattern ka shape ek choti body aur lambi upper shadow hoti hai. Yeh batata hai ke buyers ne market ko upar ki taraf push kiya, lekin sellers ne control le liya aur price ko wapas niche kar diya. Jab yeh pattern aik resistance level par banta hai, to yeh bearish trend ki shuruaat ka ilzam deta hai.

2. Inverted Hammer

Inverted hammer bhi ek reversal pattern hai, lekin yeh tab hota hai jab price pehle se niche ja rahi hoti hai. Is pattern mein bhi choti body hoti hai, lekin iski upper shadow bahut lambi hoti hai. Iska matlab yeh hai ke buyers ne thodi der ke liye control hasil kiya, lekin baad mein sellers ne price ko niche ki taraf bhej diya. Agar yeh pattern kisi support level ke paas ban raha ho, to yeh bearish trend ki shuruaat ka ilzam deta hai.

3. Bearish Engulfing

Bearish engulfing pattern do candlesticks ka combination hota hai. Is pattern mein pehli candlestick choti hoti hai aur bullish (green) hoti hai, jabke doosri candlestick badi hoti hai aur bearish (red) hoti hai. Yeh doosri candlestick pehli candlestick ko puri tarah engulf karti hai, jo yeh dikhata hai ke sellers ne kharidari ka pressure pura tor diya hai. Yeh pattern aksar bullish trend ke baad banta hai aur iska matlab hai ke market ab bearish ho sakti hai.

4. Dark Cloud Cover

Dark cloud cover bhi ek bearish reversal pattern hai. Is pattern mein pehli candlestick bullish hoti hai, jabke doosri candlestick bearish hoti hai jo pehli candlestick ke half tak chali jaati hai. Yeh pattern tab banta hai jab price pehle se upar ja rahi hoti hai, lekin phir sellers ka pressure aata hai jo price ko niche laata hai. Yeh pattern indicate karta hai ke market mein bearish trend shuru ho sakta hai.

5. Three Black Crows

Three black crows pattern teen consecutive bearish candlesticks ka hota hai, jinki bodies relatively barhiyan hoti hain. Is pattern ka matlab hota hai ke market mein strong bearish momentum hai. Yeh pattern aksar kisi bullish trend ke baad aata hai aur yeh traders ko warn karta hai ke bearish trend aane wala hai. Agar aap is pattern ko dekhein to yeh dikhata hai ke sellers market par control hasil kar rahe hain.

Conclusion

Bearish candlestick patterns market ki bearish trends aur reversal points ka pata dene mein madadgar hain. In patterns ko samajhne se traders ko apne trading decisions behtar banane mein madad milti hai. Har pattern ko achi tarah samajhna zaroori hai taake aap inhe market mein effectively istamal kar sakein. Agar aap in bearish patterns ka sahi istemal karte hain, to yeh aapko profit kamaane mein madad de sakte hain. Hamesha yaad rakhein ke trading mein risk management bhi intehai zaroori hai, isliye in patterns ko dusre technical indicators ke sath mila kar dekhen.

تبصرہ

Расширенный режим Обычный режим