Introduction

Assalamu alaikum kaise hain friend main theek hoon aap bhi inshallah aap bilkul khairiyat ke sath honge I am topic ki and knowledge share Karta Hoon aur aap koshish kijiega ise ek likes dijiyega aur is topic ko samjhega

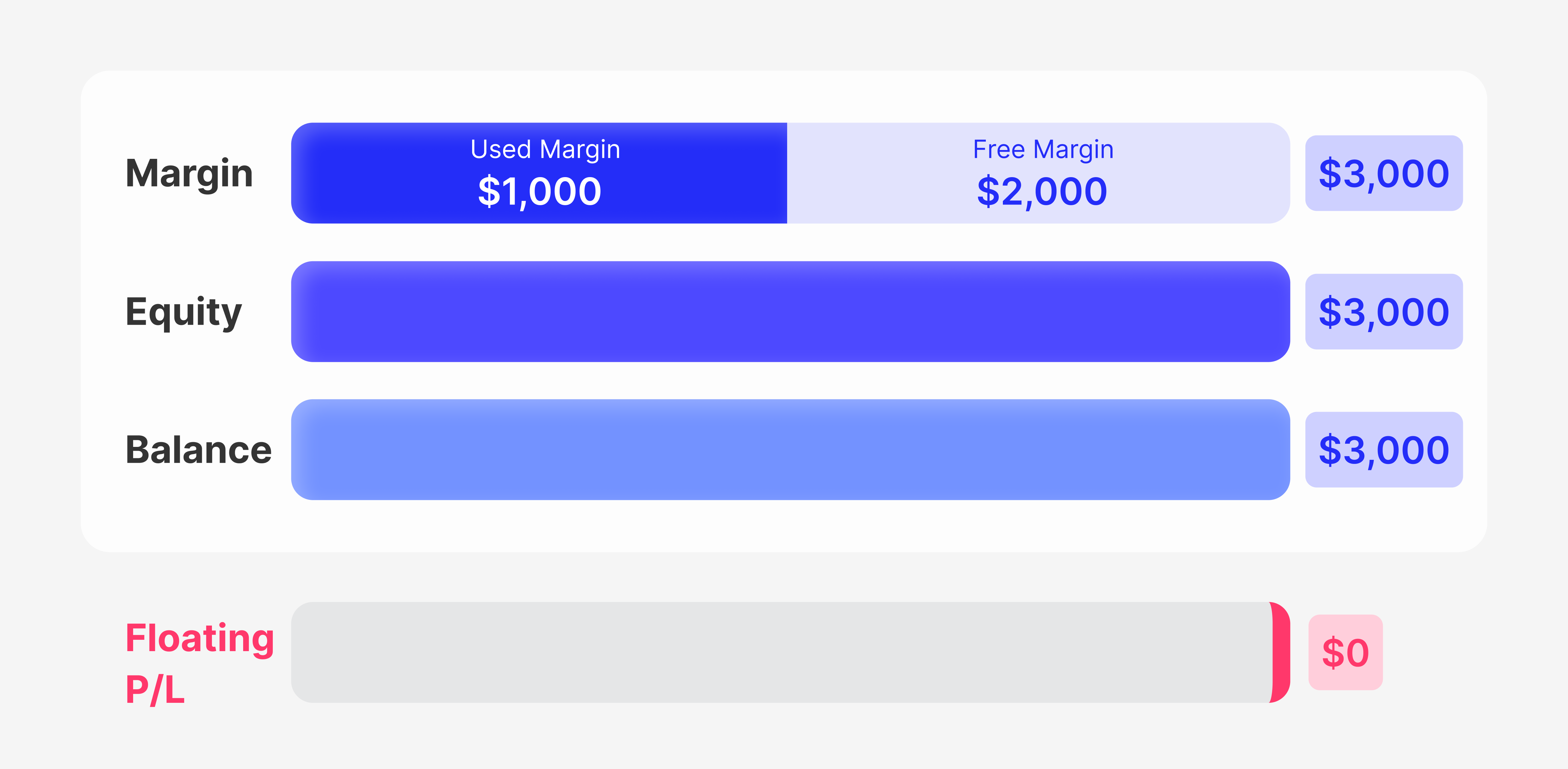

**Margin aur Free Margin in Forex Trading:**

Forex trading mein, margin aur free margin do ahem concepts hain. Yeh dono traders ko apne trades ko control karne mein madadgar hote hain.

**Margin:**

Margin ek aisa deposit hai jo traders ko broker ke paas rakhna hota hai. Yeh deposit traders ko apne trades ko perform karne ki ijazat deta hai. Margin ki amount traders ke account balance se nikaali jaati hai.

**Free Margin:**

Free margin woh paisa hota hai jo traders ke account mein bachta hai jab unke trades chal rahe hote hain. Yeh paisa traders ko naye trades ko initiate karne ki ijazat deta hai.

**Fayde:**

**Margin:**

1. **Leverage:** Margin traders ko leverage ka faida deta hai, jisse ve apne trades ka size badha sakte hain.

2. **Zyada Kamai Ki Sambhavana:** Margin traders ko zyada kamai karne ka mauka deta hai.

3. **Lachilepan:** Margin traders ko trades manage karne mein lachilepan deta hai.

**Free Margin:**

1. **Naye Trades:** Free margin traders ko naye trades ko shuru karne ki ijazat deta hai.

2. **Risk Management:** Free margin traders ko apne risk ko manage karne mein madad karta hai.

3. **Account Balance Maintain:** Free margin traders ke account balance ko banaye rakhne mein sahayak hota hai.

**Nuksan:**

**Margin:**

1. **Margin Call:** Agar margin call ho jaye, toh traders ko apne trades band karne padte hain.

2. **Nuksan:** Margin par trading se traders ko nuksan uthana pad sakta hai.

3. **Account Closure:** Margin account closure hone par traders ko apna account band karna padta hai.

**Free Margin:**

1. **Limited Trades:** Free margin kam hone par traders ko naye trades shuru karne mein mushkil hoti hai.

2. **Badhawa Risk:** Free margin kam hone par traders ke risk badh jate hain.

3. **Margin Call:** Free margin kam hone par margin call aane ki sambhavana hoti hai.

**Nishkarsh:**

Margin aur free margin forex trading mein ahem concepts hain. Apne trades ko safalta se manage karne ke liye traders ko in dono concepts ka samajh hona zaroori hai. Fayde aur nuksan ko samajhkar traders apne trades ko behtar tareeke se manage kar sakte hain.

Assalamu alaikum kaise hain friend main theek hoon aap bhi inshallah aap bilkul khairiyat ke sath honge I am topic ki and knowledge share Karta Hoon aur aap koshish kijiega ise ek likes dijiyega aur is topic ko samjhega

**Margin aur Free Margin in Forex Trading:**

Forex trading mein, margin aur free margin do ahem concepts hain. Yeh dono traders ko apne trades ko control karne mein madadgar hote hain.

**Margin:**

Margin ek aisa deposit hai jo traders ko broker ke paas rakhna hota hai. Yeh deposit traders ko apne trades ko perform karne ki ijazat deta hai. Margin ki amount traders ke account balance se nikaali jaati hai.

**Free Margin:**

Free margin woh paisa hota hai jo traders ke account mein bachta hai jab unke trades chal rahe hote hain. Yeh paisa traders ko naye trades ko initiate karne ki ijazat deta hai.

**Fayde:**

**Margin:**

1. **Leverage:** Margin traders ko leverage ka faida deta hai, jisse ve apne trades ka size badha sakte hain.

2. **Zyada Kamai Ki Sambhavana:** Margin traders ko zyada kamai karne ka mauka deta hai.

3. **Lachilepan:** Margin traders ko trades manage karne mein lachilepan deta hai.

**Free Margin:**

1. **Naye Trades:** Free margin traders ko naye trades ko shuru karne ki ijazat deta hai.

2. **Risk Management:** Free margin traders ko apne risk ko manage karne mein madad karta hai.

3. **Account Balance Maintain:** Free margin traders ke account balance ko banaye rakhne mein sahayak hota hai.

**Nuksan:**

**Margin:**

1. **Margin Call:** Agar margin call ho jaye, toh traders ko apne trades band karne padte hain.

2. **Nuksan:** Margin par trading se traders ko nuksan uthana pad sakta hai.

3. **Account Closure:** Margin account closure hone par traders ko apna account band karna padta hai.

**Free Margin:**

1. **Limited Trades:** Free margin kam hone par traders ko naye trades shuru karne mein mushkil hoti hai.

2. **Badhawa Risk:** Free margin kam hone par traders ke risk badh jate hain.

3. **Margin Call:** Free margin kam hone par margin call aane ki sambhavana hoti hai.

**Nishkarsh:**

Margin aur free margin forex trading mein ahem concepts hain. Apne trades ko safalta se manage karne ke liye traders ko in dono concepts ka samajh hona zaroori hai. Fayde aur nuksan ko samajhkar traders apne trades ko behtar tareeke se manage kar sakte hain.

تبصرہ

Расширенный режим Обычный режим