Bearish 3 Line Strike Pattern Kya Hai?

Bearish 3 Line Strike Pattern aik candlestick pattern hai jo technical analysis mein use hota hai. Yeh pattern usually downtrend (girta hua bazaar) ke dauran banta hai aur is se ye signal milta hai ke market aur zyada girne wala hai. Is pattern ko traders is liye dekhte hain kyun ke yeh unhain stock ya asset ke aane wale girawat ke bare mein warn karta hai. Yeh aik reversal pattern hota hai, jiska matlab hai ke yeh market ke trend ko reverse karne ka ishara deta hai.

Bearish 3 Line Strike Pattern Ki Pehchan

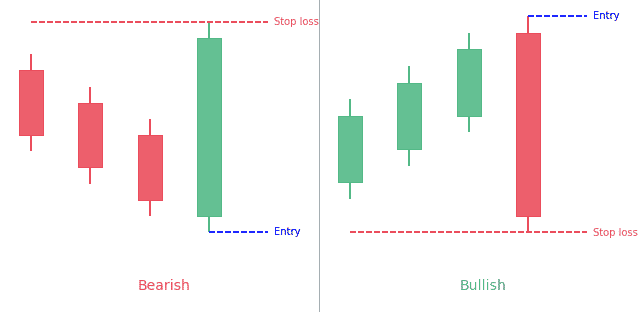

Is pattern ki pehchan chaar candles se hoti hai. Pehle teen candles red hote hain jo ke bearish trend ko reflect karte hain. Yeh teen candles lagataar chhote hotay hain, jo ke market mein girawat ko dikhate hain. Chauthi candle aik strong bullish candle hoti hai jo pehle teen candles ki poori range ko cover kar leti hai. Is chauthi candle ke bawajood, yeh pattern bearish hi hota hai kyun ke yeh signal deta hai ke bullish momentum market ko stable nahi kar sakega aur market phir se neeche giray ga.

Is Pattern Ki Shakal Aur Samajh

Is pattern ko dekhne ka tareeqa kuch is tarah hota hai:

Yeh pattern market mein negative sentiment aur sell-off ka indication hota hai. Jab yeh pattern banta hai, traders aur investors ko yeh signal milta hai ke price girne wala hai aur market ka overall trend bearish hai. Is pattern ka significance is liye zyada hota hai kyun ke yeh ek reliable reversal signal provide karta hai.

Aksar yeh pattern un markets mein dekha jata hai jahan demand kam aur supply zyada hoti hai. Yeh pattern jab banta hai to investors ko apni positions close kar deni chahiye ya short-selling ki taraf dekhna chahiye, taake unhein nuksan na ho.

Bearish 3 Line Strike Pattern Ka Istemaal

Traders is pattern ka istemaal apni trading strategy mein karte hain taake market ke movements ka faida utha sakein. Bearish 3 Line Strike Pattern aksar support and resistance levels ke qareeb banta hai, is liye iska analysis doosri technical indicators ke sath karna zyada faidemand hota hai. Is pattern ko agar moving averages, RSI (Relative Strength Index), aur volume indicators ke sath mila kar dekha jaye, to yeh aur bhi powerful signal de sakta hai.

Is pattern ka istemaal short-selling ke liye bhi hota hai. Jab market mein yeh pattern dekhne ko milta hai, to short-sellers apni positions ko market ke downtrend ka faida uthane ke liye use karte hain.

Is Pattern Ka Limitation

Jitna yeh pattern powerful hai, utni hi iski kuch limitations bhi hain. Har candlestick pattern ki tarah, Bearish 3 Line Strike bhi hamesha 100% accurate nahi hota. Yeh pattern false signals bhi de sakta hai agar yeh badi market volatility ya sideways market mein banta hai. Aise waqat mein yeh zaroori hai ke traders doosri technical tools ka istemaal karein taake woh is pattern ke bare mein confirm kar sakein.

Aik aur limitation yeh hai ke yeh pattern sirf short-term ke liye faidemand hota hai. Long-term investments ke liye is par sirf bharosa karna theek nahi hoga. Is liye traders ko is pattern ka use apne portfolio aur strategy ke mutabiq karna chahiye.

Natija

Bearish 3 Line Strike Pattern ek acha signal provide karta hai jab market downtrend mein ho. Iska istamal dekh kar traders apne decision ko plan kar sakte hain, lekin hamesha doosri technical indicators ke sath is pattern ka analysis karna zaroori hai. Is pattern ki madad se, short-term bearish trends ka faida uthaya ja sakta hai, lekin false signals se bachne ke liye technical analysis aur market conditions ka ghor se jaiza lena chahiye.

Yeh pattern market mein girawat ke bare mein warn karta hai, lekin hamesha yeh nahi samajhna chahiye ke har dafa yeh market ke reversal ka signal hoga. Hamesha smart aur informed decision making zaroori hoti hai taake trading ya investment mein munafa hasil kiya ja sake.

Bearish 3 Line Strike Pattern aik candlestick pattern hai jo technical analysis mein use hota hai. Yeh pattern usually downtrend (girta hua bazaar) ke dauran banta hai aur is se ye signal milta hai ke market aur zyada girne wala hai. Is pattern ko traders is liye dekhte hain kyun ke yeh unhain stock ya asset ke aane wale girawat ke bare mein warn karta hai. Yeh aik reversal pattern hota hai, jiska matlab hai ke yeh market ke trend ko reverse karne ka ishara deta hai.

Bearish 3 Line Strike Pattern Ki Pehchan

Is pattern ki pehchan chaar candles se hoti hai. Pehle teen candles red hote hain jo ke bearish trend ko reflect karte hain. Yeh teen candles lagataar chhote hotay hain, jo ke market mein girawat ko dikhate hain. Chauthi candle aik strong bullish candle hoti hai jo pehle teen candles ki poori range ko cover kar leti hai. Is chauthi candle ke bawajood, yeh pattern bearish hi hota hai kyun ke yeh signal deta hai ke bullish momentum market ko stable nahi kar sakega aur market phir se neeche giray ga.

Is Pattern Ki Shakal Aur Samajh

Is pattern ko dekhne ka tareeqa kuch is tarah hota hai:

- Pehli 3 Candles: Yeh candles market ki girawat ko dikhati hain, aur lagataar har ek candle ka closing price pichle se neeche hota hai. Yeh girawat continue rehti hai jo ke negative market sentiment ko dikhata hai.

- Chauthi Candle: Yeh candle aik bullish candle hoti hai jo ke pehle teen candles ko "strike" karti hai, yani is ka price movement in sab se zyada hota hai. Yeh candle aik momentary uptrend ko dikhati hai, lekin yeh sustainable nahi hoti.

- Market Reaction: Chauthi candle ke baad, asar yeh hota hai ke market phir se bearish ban jata hai, aur downtrend continue hota hai. Yeh pattern warn karta hai ke chhoti si bullish movement ke bawajood, market ka trend bearish hi rahega.

Yeh pattern market mein negative sentiment aur sell-off ka indication hota hai. Jab yeh pattern banta hai, traders aur investors ko yeh signal milta hai ke price girne wala hai aur market ka overall trend bearish hai. Is pattern ka significance is liye zyada hota hai kyun ke yeh ek reliable reversal signal provide karta hai.

Aksar yeh pattern un markets mein dekha jata hai jahan demand kam aur supply zyada hoti hai. Yeh pattern jab banta hai to investors ko apni positions close kar deni chahiye ya short-selling ki taraf dekhna chahiye, taake unhein nuksan na ho.

Bearish 3 Line Strike Pattern Ka Istemaal

Traders is pattern ka istemaal apni trading strategy mein karte hain taake market ke movements ka faida utha sakein. Bearish 3 Line Strike Pattern aksar support and resistance levels ke qareeb banta hai, is liye iska analysis doosri technical indicators ke sath karna zyada faidemand hota hai. Is pattern ko agar moving averages, RSI (Relative Strength Index), aur volume indicators ke sath mila kar dekha jaye, to yeh aur bhi powerful signal de sakta hai.

Is pattern ka istemaal short-selling ke liye bhi hota hai. Jab market mein yeh pattern dekhne ko milta hai, to short-sellers apni positions ko market ke downtrend ka faida uthane ke liye use karte hain.

Is Pattern Ka Limitation

Jitna yeh pattern powerful hai, utni hi iski kuch limitations bhi hain. Har candlestick pattern ki tarah, Bearish 3 Line Strike bhi hamesha 100% accurate nahi hota. Yeh pattern false signals bhi de sakta hai agar yeh badi market volatility ya sideways market mein banta hai. Aise waqat mein yeh zaroori hai ke traders doosri technical tools ka istemaal karein taake woh is pattern ke bare mein confirm kar sakein.

Aik aur limitation yeh hai ke yeh pattern sirf short-term ke liye faidemand hota hai. Long-term investments ke liye is par sirf bharosa karna theek nahi hoga. Is liye traders ko is pattern ka use apne portfolio aur strategy ke mutabiq karna chahiye.

Natija

Bearish 3 Line Strike Pattern ek acha signal provide karta hai jab market downtrend mein ho. Iska istamal dekh kar traders apne decision ko plan kar sakte hain, lekin hamesha doosri technical indicators ke sath is pattern ka analysis karna zaroori hai. Is pattern ki madad se, short-term bearish trends ka faida uthaya ja sakta hai, lekin false signals se bachne ke liye technical analysis aur market conditions ka ghor se jaiza lena chahiye.

Yeh pattern market mein girawat ke bare mein warn karta hai, lekin hamesha yeh nahi samajhna chahiye ke har dafa yeh market ke reversal ka signal hoga. Hamesha smart aur informed decision making zaroori hoti hai taake trading ya investment mein munafa hasil kiya ja sake.

تبصرہ

Расширенный режим Обычный режим