Introduction

Three Line Strike ek candlestick pattern hai jo trading mein frequently use hota hai. Yeh pattern typically reversal signal hota hai, jo market ki direction ko badalne ka indicator hota hai. Is pattern ko traders aksar is liye prefer karte hain kyun ke yeh asaan hota hai samajhna aur is se significant market moves ka pata lagaya ja sakta hai. Is pattern ka analysis karna traders ko profitable trades execute karne mein madad karta hai.

Formation of Three Line Strike

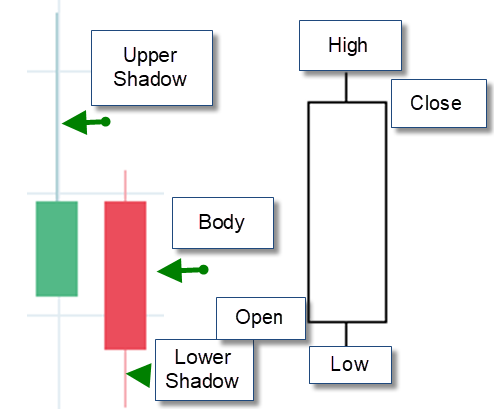

Three Line Strike pattern char candlesticks se mil kar banta hai. Yeh pattern bullish aur bearish dono conditions mein appear ho sakta hai. Agar yeh pattern uptrend mein nazar aaye, to pehle teen candles bullish hoti hain, jo gradually upar ki taraf move kar rahi hoti hain. Chauthi candle pehle teen candles ki range ko puri tarah cover kar leti hai aur yeh bearish hoti hai. Yeh indicate karta hai ke market apne trend ko reverse karne ke liye ready hai.

Bullish vs Bearish Three Line Strike

Agar yeh pattern downtrend mein form hota hai to isay Bearish Three Line Strike kehte hain. Is case mein, pehli teen candles bearish hoti hain aur chauthi candle bullish hoti hai jo pehle teen candles ki range ko pura cover kar leti hai. Bullish Three Line Strike downtrend ko reverse karne ka signal deta hai, jab ke Bearish Three Line Strike uptrend ke reversal ka signal hota hai. Yeh patterns aksar trend ki exhaustion ko indicate karte hain.

Trading Strategies

Three Line Strike pattern ka use karte hue, traders different strategies adopt karte hain. Agar yeh pattern bullish reversal indicate kar raha ho, to trader short positions ko close karke long positions ko open kar sakta hai. Is pattern ko identify karne ke baad, confirmation ke liye volume aur other technical indicators jese ke RSI ya MACD ko bhi use karna zaroori hota hai. Yeh ensure karta hai ke pattern sahi hai aur market expected direction mein move karega.

Three Line Strike ek candlestick pattern hai jo trading mein frequently use hota hai. Yeh pattern typically reversal signal hota hai, jo market ki direction ko badalne ka indicator hota hai. Is pattern ko traders aksar is liye prefer karte hain kyun ke yeh asaan hota hai samajhna aur is se significant market moves ka pata lagaya ja sakta hai. Is pattern ka analysis karna traders ko profitable trades execute karne mein madad karta hai.

Formation of Three Line Strike

Three Line Strike pattern char candlesticks se mil kar banta hai. Yeh pattern bullish aur bearish dono conditions mein appear ho sakta hai. Agar yeh pattern uptrend mein nazar aaye, to pehle teen candles bullish hoti hain, jo gradually upar ki taraf move kar rahi hoti hain. Chauthi candle pehle teen candles ki range ko puri tarah cover kar leti hai aur yeh bearish hoti hai. Yeh indicate karta hai ke market apne trend ko reverse karne ke liye ready hai.

Bullish vs Bearish Three Line Strike

Agar yeh pattern downtrend mein form hota hai to isay Bearish Three Line Strike kehte hain. Is case mein, pehli teen candles bearish hoti hain aur chauthi candle bullish hoti hai jo pehle teen candles ki range ko pura cover kar leti hai. Bullish Three Line Strike downtrend ko reverse karne ka signal deta hai, jab ke Bearish Three Line Strike uptrend ke reversal ka signal hota hai. Yeh patterns aksar trend ki exhaustion ko indicate karte hain.

Trading Strategies

Three Line Strike pattern ka use karte hue, traders different strategies adopt karte hain. Agar yeh pattern bullish reversal indicate kar raha ho, to trader short positions ko close karke long positions ko open kar sakta hai. Is pattern ko identify karne ke baad, confirmation ke liye volume aur other technical indicators jese ke RSI ya MACD ko bhi use karna zaroori hota hai. Yeh ensure karta hai ke pattern sahi hai aur market expected direction mein move karega.

تبصرہ

Расширенный режим Обычный режим