EXPLAIN THE KELTNER CHANNEL VS BOLLINGER BANDS ANALYSIS

INTRODUCTION

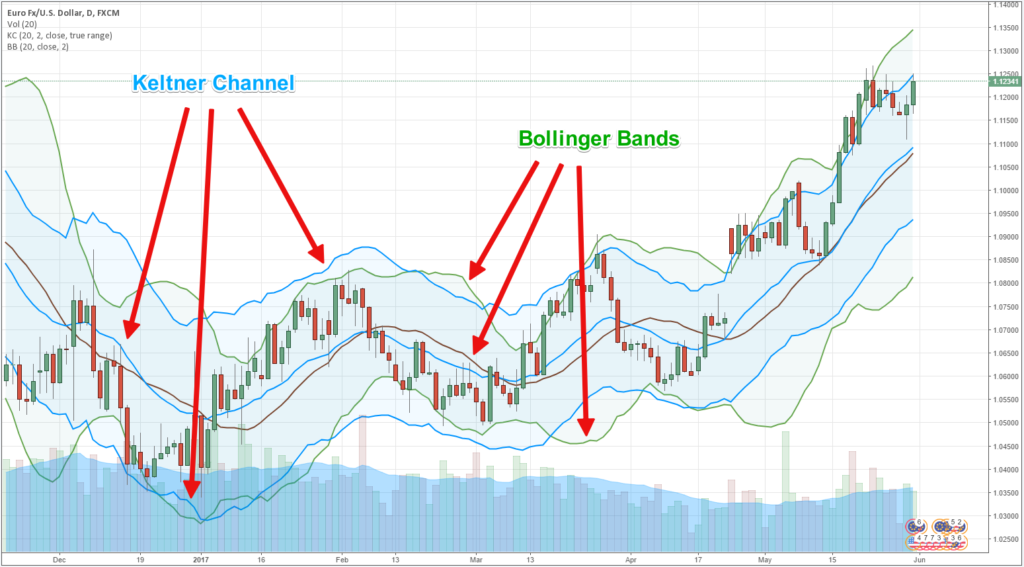

Keltner Channel aur Bollinger Bands dono hi technical indicators hain jo forex trading mein price action aur market volatility ko measure karte hain. Yeh indicators price ke around ek channel banate hain jo aapko trading decisions lene mein madad karte hain. Lekin dono indicators ke structure aur calculation mein farq hota hai, jo unke use ko different trading strategies ke liye ideal banata hai.

KELTNER CHANNEL OVERVIEW

- Keltner Channel mein teen lines hoti hain: ek middle line jo Exponential Moving Average (EMA) hoti hai, aur upper aur lower lines jo Average True Range (ATR) ke multiple se calculate hoti hain.

- Upper aur lower lines price ke upar aur niche ek range define karti hain jo market ki volatility ko dikhati hain.

- Middle line (EMA) market ke recent trend ko follow karti hai.

- Upper aur lower bands EMA ke sath ATR ko add ya subtract karke calculate ki jati hain.

- Keltner Channels zyada tar trending markets mein use hoti hain. Yeh aapko trend ke sath trade karne mein madad karti hain aur potential breakout ya reversal points ko identify karti hain.

BOLLINGER BANDS OVERVIEW

- Bollinger Bands bhi teen lines par mushtamil hoti hain: ek middle line jo Simple Moving Average (SMA) hoti hai, aur upper aur lower bands jo price ke standard deviation par base karti hain.

- Upper aur lower bands market ke volatility ko measure karte hain.

- Middle line (SMA) market ke recent average price ko dikhati hai.

- Upper aur lower bands SMA ke sath standard deviation ko add ya subtract karke calculate ki jati hain.

- Bollinger Bands zyada tar sideways ya range-bound markets mein use hoti hain. Yeh overbought aur oversold conditions ko identify karne mein madad karte hain, jahan se price reversal ka chance hota hai.

DIFFERENCE BETWEEN KELTNER CHANNEL AND BOLLINGER BANDS

- Keltner Channels volatility ko ATR ke zariye measure karte hain, jo price ki range aur movement ko dekhta hai.

- Bollinger Bands volatility ko standard deviation ke zariye measure karte hain, jo price ki spread ko SMA ke around dekhta hai.

- Keltner Channels generally Bollinger Bands se kam sensitive hoti hain, kyunki ATR mein sudden price spikes ka effect kam hota hai.

- Bollinger Bands zyada sensitive hoti hain aur price ke sharp movements ko jaldi capture karti hain, isliye yeh zyada volatile markets mein zyada expand ya contract hoti hain.

- Keltner Channels trending markets mein zyada useful hoti hain kyunki yeh trend continuation ko identify karne mein madad karti hain.

- Bollinger Bands range-bound markets mein zyada effective hoti hain, kyunki yeh price ke reversal points ko highlight karti hain jab market overbought ya oversold ho.

- Keltner Channels breakouts ko identify karne mein madad deti hain, jab price channel ke upar ya niche break karti hai.

- Bollinger Bands breakouts ko bhi signal deti hain, magar yeh zyada tar market ke reversal points ko highlight karti hain, jo opposite direction mein move hone ke chances ko dikhati hain.

TECHNICAL ANALYSIS OF BOTH INDICATORS

- Agar market trending hai, toh Keltner Channels zyada useful hongi, kyunki yeh trend continuation aur breakout opportunities ko dikhati hain.

- Agar market sideways ya range-bound hai, toh Bollinger Bands zyada effective hongi, kyunki yeh overbought aur oversold conditions ko identify karne mein madad karti hain. Keltner Channels aur Bollinger Bands dono forex trading mein bohot useful tools hain, magar inka use market ki conditions par depend karta hai. Keltner Channels trend following aur breakout trading ke liye best hain, jabke Bollinger Bands range-bound markets aur reversal points ko identify karne ke liye zyada effective hain. Apne trading style aur market ke current conditions ke mutabiq, aap dono indicators ko apni strategy mein include kar sakte hain.

INTRODUCTION

Keltner Channel aur Bollinger Bands dono hi technical indicators hain jo forex trading mein price action aur market volatility ko measure karte hain. Yeh indicators price ke around ek channel banate hain jo aapko trading decisions lene mein madad karte hain. Lekin dono indicators ke structure aur calculation mein farq hota hai, jo unke use ko different trading strategies ke liye ideal banata hai.

KELTNER CHANNEL OVERVIEW

- Keltner Channel mein teen lines hoti hain: ek middle line jo Exponential Moving Average (EMA) hoti hai, aur upper aur lower lines jo Average True Range (ATR) ke multiple se calculate hoti hain.

- Upper aur lower lines price ke upar aur niche ek range define karti hain jo market ki volatility ko dikhati hain.

- Middle line (EMA) market ke recent trend ko follow karti hai.

- Upper aur lower bands EMA ke sath ATR ko add ya subtract karke calculate ki jati hain.

- Keltner Channels zyada tar trending markets mein use hoti hain. Yeh aapko trend ke sath trade karne mein madad karti hain aur potential breakout ya reversal points ko identify karti hain.

BOLLINGER BANDS OVERVIEW

- Bollinger Bands bhi teen lines par mushtamil hoti hain: ek middle line jo Simple Moving Average (SMA) hoti hai, aur upper aur lower bands jo price ke standard deviation par base karti hain.

- Upper aur lower bands market ke volatility ko measure karte hain.

- Middle line (SMA) market ke recent average price ko dikhati hai.

- Upper aur lower bands SMA ke sath standard deviation ko add ya subtract karke calculate ki jati hain.

- Bollinger Bands zyada tar sideways ya range-bound markets mein use hoti hain. Yeh overbought aur oversold conditions ko identify karne mein madad karte hain, jahan se price reversal ka chance hota hai.

DIFFERENCE BETWEEN KELTNER CHANNEL AND BOLLINGER BANDS

- Keltner Channels volatility ko ATR ke zariye measure karte hain, jo price ki range aur movement ko dekhta hai.

- Bollinger Bands volatility ko standard deviation ke zariye measure karte hain, jo price ki spread ko SMA ke around dekhta hai.

- Keltner Channels generally Bollinger Bands se kam sensitive hoti hain, kyunki ATR mein sudden price spikes ka effect kam hota hai.

- Bollinger Bands zyada sensitive hoti hain aur price ke sharp movements ko jaldi capture karti hain, isliye yeh zyada volatile markets mein zyada expand ya contract hoti hain.

- Keltner Channels trending markets mein zyada useful hoti hain kyunki yeh trend continuation ko identify karne mein madad karti hain.

- Bollinger Bands range-bound markets mein zyada effective hoti hain, kyunki yeh price ke reversal points ko highlight karti hain jab market overbought ya oversold ho.

- Keltner Channels breakouts ko identify karne mein madad deti hain, jab price channel ke upar ya niche break karti hai.

- Bollinger Bands breakouts ko bhi signal deti hain, magar yeh zyada tar market ke reversal points ko highlight karti hain, jo opposite direction mein move hone ke chances ko dikhati hain.

TECHNICAL ANALYSIS OF BOTH INDICATORS

- Agar market trending hai, toh Keltner Channels zyada useful hongi, kyunki yeh trend continuation aur breakout opportunities ko dikhati hain.

- Agar market sideways ya range-bound hai, toh Bollinger Bands zyada effective hongi, kyunki yeh overbought aur oversold conditions ko identify karne mein madad karti hain. Keltner Channels aur Bollinger Bands dono forex trading mein bohot useful tools hain, magar inka use market ki conditions par depend karta hai. Keltner Channels trend following aur breakout trading ke liye best hain, jabke Bollinger Bands range-bound markets aur reversal points ko identify karne ke liye zyada effective hain. Apne trading style aur market ke current conditions ke mutabiq, aap dono indicators ko apni strategy mein include kar sakte hain.

تبصرہ

Расширенный режим Обычный режим