Evening Star Candlestick Pattern:

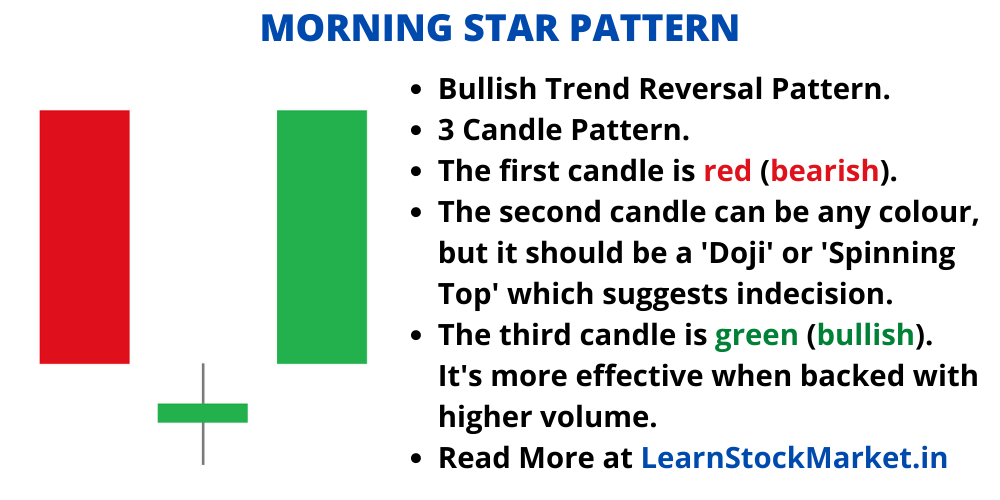

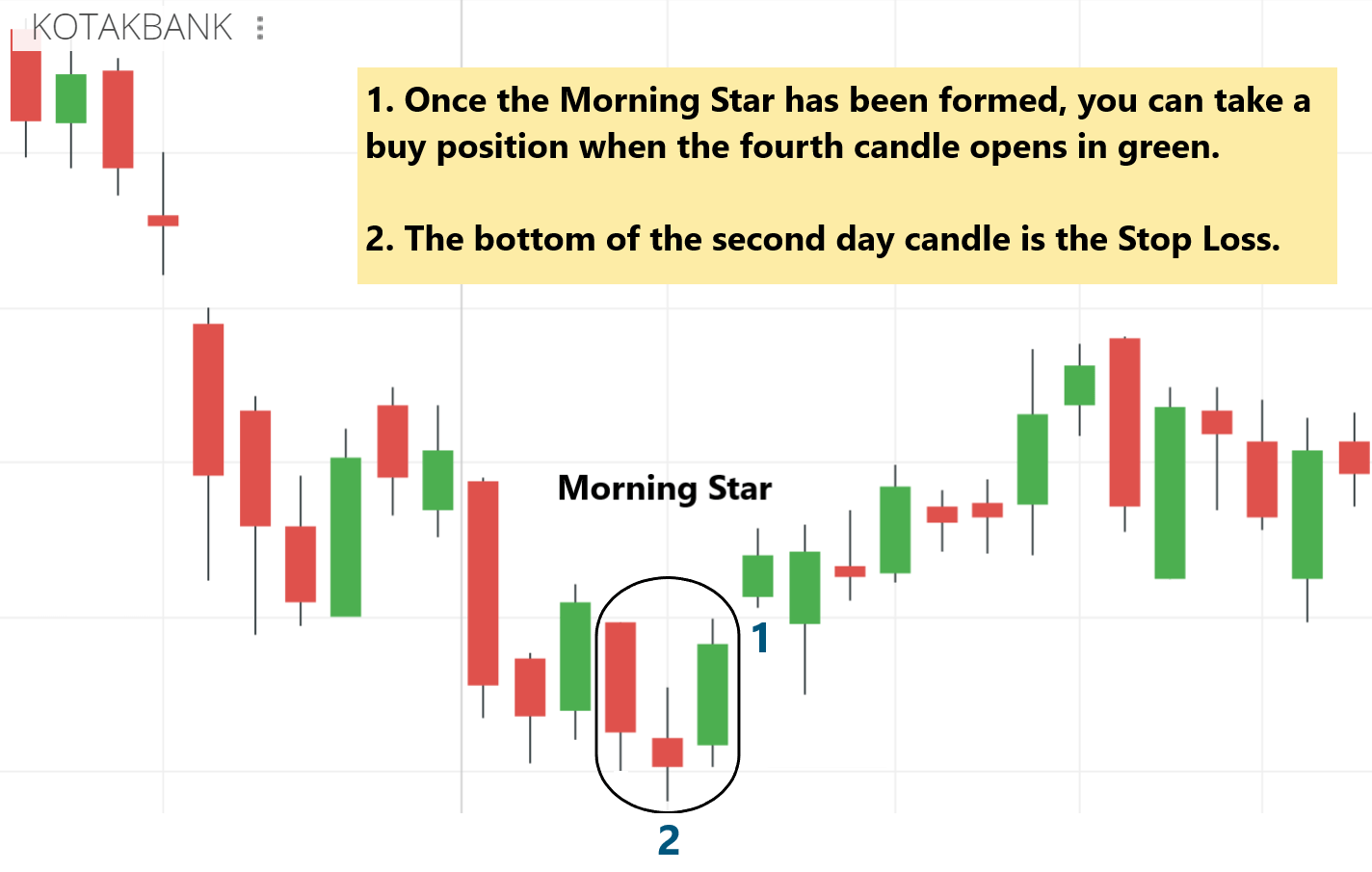

Assalam o Alaikum!Dear Friends "Evening Star candlestick pattern" aik candlestick pattern hy jo technical analysis mein use hota hy aur ye market mein potential trend reversal ko indicate karta hy. Evening Star candlestick pattern bearish reversal pattern hota hy aur ye uptrend ke badh aany wala ho sakta hy.Evening Star Pattern, 3 candlesticks se bana hota hey aur typically uptrend ke baad aata hey. Is pattern ko identify karny ke liye, pehle ek strong bullish candle (preferably long) aati hey, jo market main uptrend ko show karti hey. Dusri candle, jo ki small body wali hoti hey, price range main overlap karty huwy pehli candle ke neechy ya upar close hoti hey. Ye doji ya spinning top candle bhi ho sakti hey. Teesri candle, jo bearish hoti hey, pehli candle ke upar close hoti hey aur ideally pehli candle ke qareeb ka half range cover karti hey

Confirmation about Evening Star Candlestick Pattern:

Dear forex members Evening Star candlestick pattern aik important reversal signal hy jo traders ko alert karta hy ke market dynamics mein change hony ki umeed hy. Hamesha yaad rahy ke kisi single indicator par pura bharosa na karein aur doosre confirmatory signals ko bhi shamil karein trading decisions mein.Evening Star Candlestick Pattern ka appearance market mein potential trend reversal ko suggest karta hai. Jab pehli do candlesticks ek uptrend ko represent karte hain aur teesri candlestick ek bearish movement show karta hai aur pehli do candlesticks ko poori tarah engulf karta hai, toh ye indicate karta hai ke market mein selling pressure aane ki indication hai aur potential bearish reversal hone ke chances hote hain.

Types of Evening Star Candlestick Pattern:

First Candle (Bullish):

Dear Students Pehli candle aik uptrend ko represent karti hy, jo ke bullish hoti hy.

Second Candle (Small):

Dear Brothers Doosri candle choti hoti hy aur iski body pehli candle ke upar ya neechy hoti hy. Ye candle indecision ya trend change ki surat ko darust karti hy.

Third Candle (Bearish):

Dear Forex Members Teesri candle aik downtrend ko indicate karti hy, jo ke bearish (bechne ki taraf) hoti hy. Iski opening first candle ke closing se neechy hoti hy aur iski closing second candle ke body ke beech hoti hy.Ye teeno candles aik saath aksar Evening star pattern banate hein. Is pattern ko daikh kar traders expect karty hein ke market ka trend change hone wala hy aur wo apne positions ko adjust karty hein.

Assalam o Alaikum!Dear Friends "Evening Star candlestick pattern" aik candlestick pattern hy jo technical analysis mein use hota hy aur ye market mein potential trend reversal ko indicate karta hy. Evening Star candlestick pattern bearish reversal pattern hota hy aur ye uptrend ke badh aany wala ho sakta hy.Evening Star Pattern, 3 candlesticks se bana hota hey aur typically uptrend ke baad aata hey. Is pattern ko identify karny ke liye, pehle ek strong bullish candle (preferably long) aati hey, jo market main uptrend ko show karti hey. Dusri candle, jo ki small body wali hoti hey, price range main overlap karty huwy pehli candle ke neechy ya upar close hoti hey. Ye doji ya spinning top candle bhi ho sakti hey. Teesri candle, jo bearish hoti hey, pehli candle ke upar close hoti hey aur ideally pehli candle ke qareeb ka half range cover karti hey

Confirmation about Evening Star Candlestick Pattern:

Dear forex members Evening Star candlestick pattern aik important reversal signal hy jo traders ko alert karta hy ke market dynamics mein change hony ki umeed hy. Hamesha yaad rahy ke kisi single indicator par pura bharosa na karein aur doosre confirmatory signals ko bhi shamil karein trading decisions mein.Evening Star Candlestick Pattern ka appearance market mein potential trend reversal ko suggest karta hai. Jab pehli do candlesticks ek uptrend ko represent karte hain aur teesri candlestick ek bearish movement show karta hai aur pehli do candlesticks ko poori tarah engulf karta hai, toh ye indicate karta hai ke market mein selling pressure aane ki indication hai aur potential bearish reversal hone ke chances hote hain.

Types of Evening Star Candlestick Pattern:

First Candle (Bullish):

Dear Students Pehli candle aik uptrend ko represent karti hy, jo ke bullish hoti hy.

Second Candle (Small):

Dear Brothers Doosri candle choti hoti hy aur iski body pehli candle ke upar ya neechy hoti hy. Ye candle indecision ya trend change ki surat ko darust karti hy.

Third Candle (Bearish):

Dear Forex Members Teesri candle aik downtrend ko indicate karti hy, jo ke bearish (bechne ki taraf) hoti hy. Iski opening first candle ke closing se neechy hoti hy aur iski closing second candle ke body ke beech hoti hy.Ye teeno candles aik saath aksar Evening star pattern banate hein. Is pattern ko daikh kar traders expect karty hein ke market ka trend change hone wala hy aur wo apne positions ko adjust karty hein.

تبصرہ

Расширенный режим Обычный режим