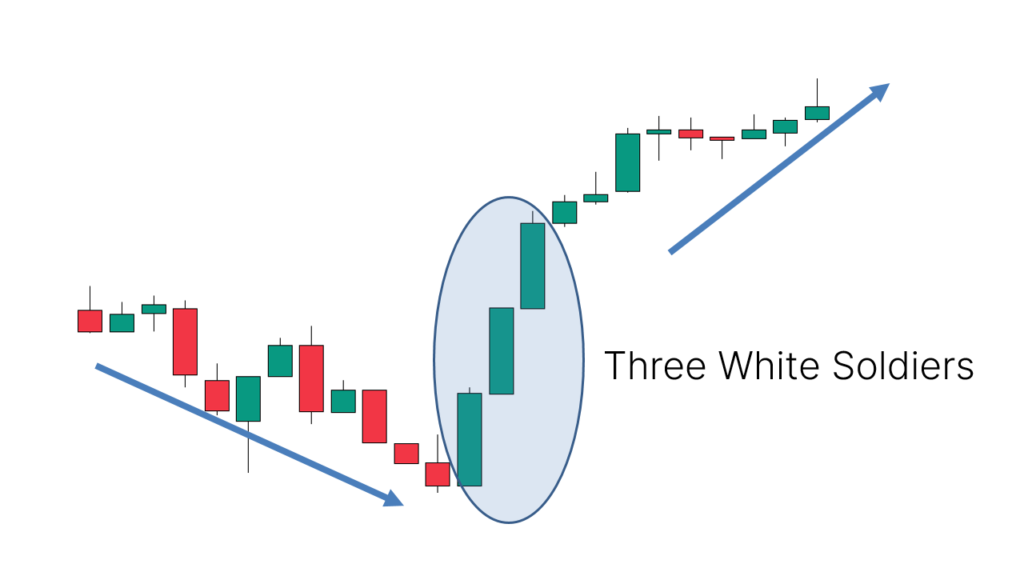

Three White Soldier pattern:

Dear my friends Three White Soldier, forex market mein aik reversal pattern hy jo bearish trend ke badle mein bullish trend ko represent karta hy. Is pattern mein teesri achhi wali candle, pehli do candles ko follow karti hy aur price mein strong buying activity ko dikhata hy.

Confirmation of Three White Soldier pattern:

Dear forex traders Three White Soldier pattern, teesri candlestick ki madad se banaya jata hy. Is pattern mein pehli do candles bearish hoti hein, jabki teesri candle bullish hoti hy. Pehli candle aik downtrend ke baad close hoti hy aur doosri candle uske upar open hoti hy. Doosri candle ki range pehli candle se kam hoti hy, jo bearish momentum ko dikhata hy. Tesri candle ki range pehli do candles se badi hoti hy, jise strong buying activity represent karti hy.Three White Soldier pattern ka matlab hy ki market sentiment bearish se bullish ho rahi hy. Ye pattern, price ko neeche jaane ke bajaye upar ki taraf move karne ka indication deta hy. Traders is pattern ko daikh kar buying opportunities explore kar sakte hein, kyunke bullish trend mein price ka further increase expected hota hy.

Explanation of Three White Soldier pattern:

Dear trading partners Three White Soldier pattern ke confirmation ke liye, traders dusre technical indicators aur tools ka istemal karte hein. Ismein RSI (Relative Strength Index), moving averages, aur trend lines shamil ho sakte hein. Ye tools aur indicators price ka movement aur trend ki tasdeeq karte hein.

Trading with Three White Soldier pattern:

Dear forex members Three White Soldier pattern ke liye stop loss aur take profit levels traders ke risk appetite aur market conditions par depend karte hein. Stop loss ko normally teesri candle ke low se neeche place kiya jata hy jabki take profit level ko previous resistance level ya technical indicator ki madad se set kiya jata hy.Three White Soldier candlestick pattern, bullish reversal pattern hy jo forex market mein istemal kiya jata hy. Ye pattern price mein trend change ko indicate karta hy aur traders ke liye buying opportunities create karta hy. Traders ko is pattern ke confirmation ke liye dusre technical indicators aur tools ka istemal karna chahiye aur stop loss aur take profit levels ko carefully set karna chahiye.

Dear my friends Three White Soldier, forex market mein aik reversal pattern hy jo bearish trend ke badle mein bullish trend ko represent karta hy. Is pattern mein teesri achhi wali candle, pehli do candles ko follow karti hy aur price mein strong buying activity ko dikhata hy.

Confirmation of Three White Soldier pattern:

Dear forex traders Three White Soldier pattern, teesri candlestick ki madad se banaya jata hy. Is pattern mein pehli do candles bearish hoti hein, jabki teesri candle bullish hoti hy. Pehli candle aik downtrend ke baad close hoti hy aur doosri candle uske upar open hoti hy. Doosri candle ki range pehli candle se kam hoti hy, jo bearish momentum ko dikhata hy. Tesri candle ki range pehli do candles se badi hoti hy, jise strong buying activity represent karti hy.Three White Soldier pattern ka matlab hy ki market sentiment bearish se bullish ho rahi hy. Ye pattern, price ko neeche jaane ke bajaye upar ki taraf move karne ka indication deta hy. Traders is pattern ko daikh kar buying opportunities explore kar sakte hein, kyunke bullish trend mein price ka further increase expected hota hy.

Explanation of Three White Soldier pattern:

Dear trading partners Three White Soldier pattern ke confirmation ke liye, traders dusre technical indicators aur tools ka istemal karte hein. Ismein RSI (Relative Strength Index), moving averages, aur trend lines shamil ho sakte hein. Ye tools aur indicators price ka movement aur trend ki tasdeeq karte hein.

Trading with Three White Soldier pattern:

Dear forex members Three White Soldier pattern ke liye stop loss aur take profit levels traders ke risk appetite aur market conditions par depend karte hein. Stop loss ko normally teesri candle ke low se neeche place kiya jata hy jabki take profit level ko previous resistance level ya technical indicator ki madad se set kiya jata hy.Three White Soldier candlestick pattern, bullish reversal pattern hy jo forex market mein istemal kiya jata hy. Ye pattern price mein trend change ko indicate karta hy aur traders ke liye buying opportunities create karta hy. Traders ko is pattern ke confirmation ke liye dusre technical indicators aur tools ka istemal karna chahiye aur stop loss aur take profit levels ko carefully set karna chahiye.

تبصرہ

Расширенный режим Обычный режим