ROLL OF FALLING WEDGE PATTERN IN FOREX TRADING

BASIC CONCEPT

Falling Wedge Pattern ek bullish reversal chart pattern hota hai jo aksar market ke downtrend ke baad form hota hai. Is pattern ka signal hota hai ke market apne niche point par pohanch gaya hai aur ab yeh trend reverse karne ke liye tayar hai.

FORMATION OF FALLING WEDGE PATTERN

DOWNWARD SLOPPING LINES

Yeh pattern do downward sloping lines par mushtamil hota hai, jisme ek line price ke highs ko connect karti hai (resistance) aur doosri line price ke lows ko connect karti hai (support). Yeh lines converge karte hain, yaani aapas mein milne ki taraf badhti hain.

PRICE COMPREHENSION

Is pattern mein, price gradually compress hota hai aur niche ki taraf jaane ka momentum slow ho jata hai. Yeh is baat ka indication hota hai ke sellers ki taqat kam ho rahi hai aur buyers market mein interest le rahe hain.

BREAKOUT

Jab price upper resistance line ko break karta hai, toh yeh bullish breakout ka signal hota hai. Is point par, market mein buying pressure barhta hai aur price upar jaane lagta hai.

UTILIZATION OF FALLING WEDGE PATTERN

REVERSAL SIGNAL

Jab falling wedge pattern form hota hai, toh yeh aksar ek downtrend ke end aur uptrend ke shuru hone ka signal hota hai. Traders is pattern ko identify kar ke apne buy orders place karte hain.

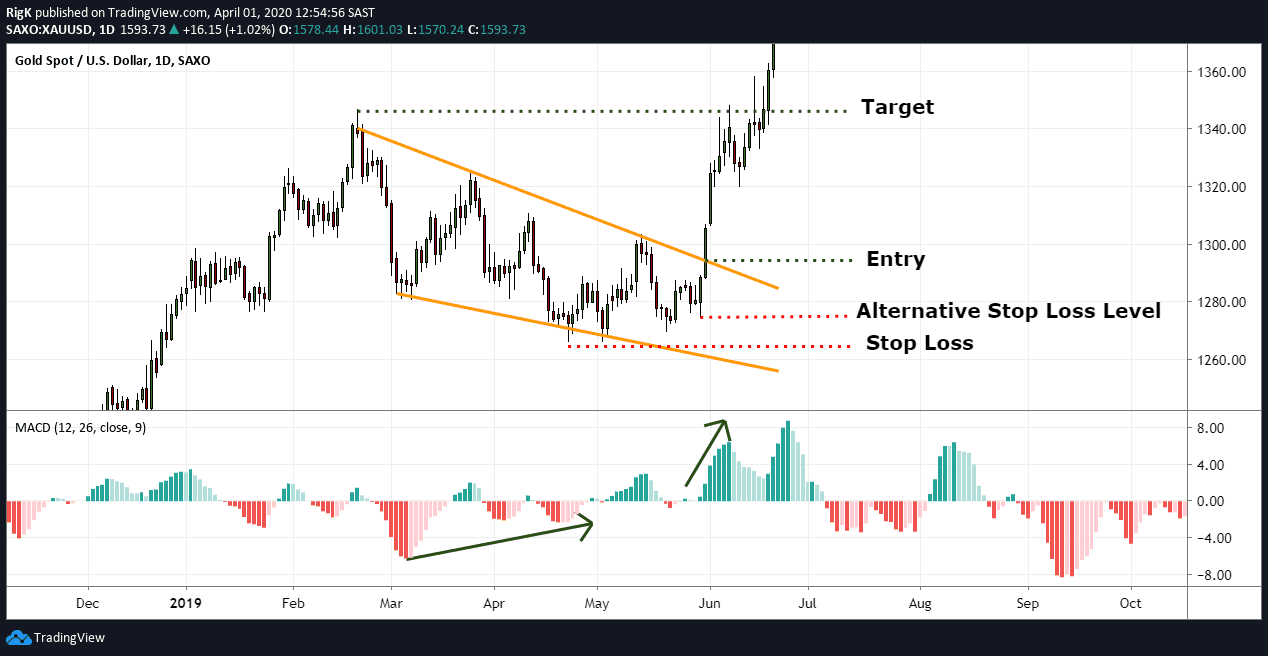

ENTRY POINT AND STOP LOSS

Upper resistance line ke breakout par entry lena sahi strategy hoti hai. Is point par market mein buying pressure hota hai jo price ko upar le ja sakta hai. Stop loss ko pattern ke lowest point ke neeche place karna chahiye taake risk manage ho sake agar price reverse ho jaye.

TECHNICAL ANALYSIS

Falling Wedge Pattern forex trading mein aik important bullish reversal pattern hai. Is pattern ka samajhna aur sahi time par entry lena traders ko market ke reversal points pe trade karne mein madad deta hai. Is pattern ka sahi istimaal kar ke traders significant profits hasil kar sakte hain.

BASIC CONCEPT

Falling Wedge Pattern ek bullish reversal chart pattern hota hai jo aksar market ke downtrend ke baad form hota hai. Is pattern ka signal hota hai ke market apne niche point par pohanch gaya hai aur ab yeh trend reverse karne ke liye tayar hai.

FORMATION OF FALLING WEDGE PATTERN

DOWNWARD SLOPPING LINES

Yeh pattern do downward sloping lines par mushtamil hota hai, jisme ek line price ke highs ko connect karti hai (resistance) aur doosri line price ke lows ko connect karti hai (support). Yeh lines converge karte hain, yaani aapas mein milne ki taraf badhti hain.

PRICE COMPREHENSION

Is pattern mein, price gradually compress hota hai aur niche ki taraf jaane ka momentum slow ho jata hai. Yeh is baat ka indication hota hai ke sellers ki taqat kam ho rahi hai aur buyers market mein interest le rahe hain.

BREAKOUT

Jab price upper resistance line ko break karta hai, toh yeh bullish breakout ka signal hota hai. Is point par, market mein buying pressure barhta hai aur price upar jaane lagta hai.

UTILIZATION OF FALLING WEDGE PATTERN

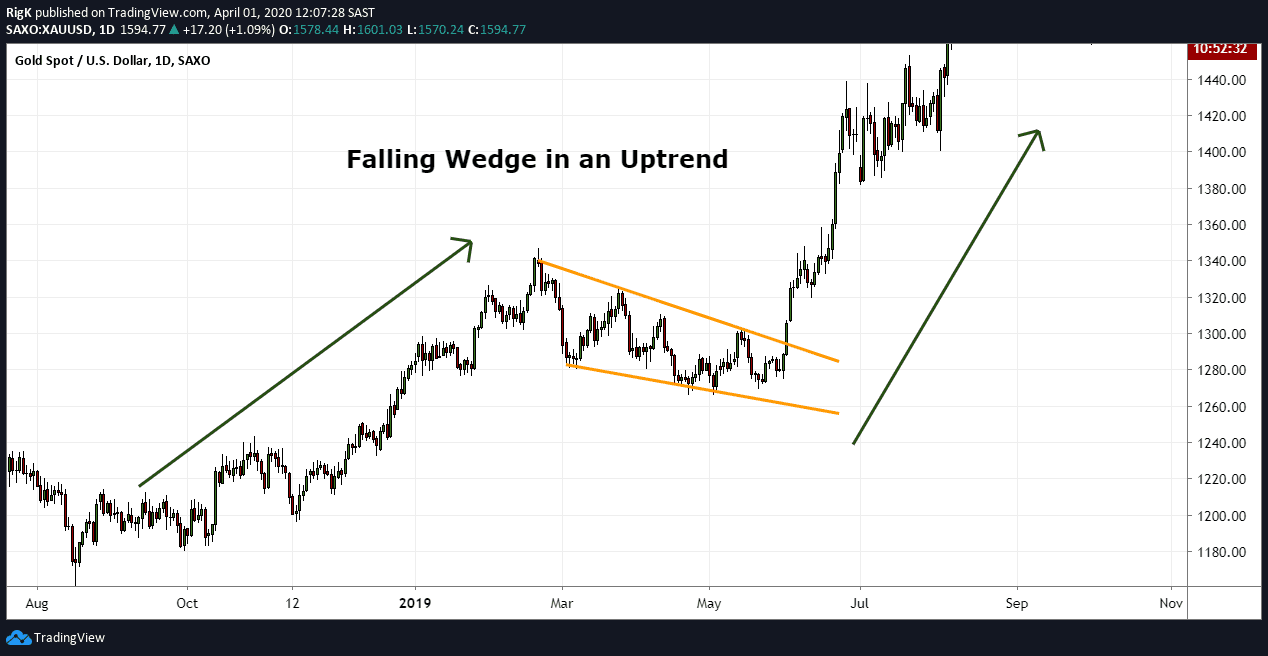

REVERSAL SIGNAL

Jab falling wedge pattern form hota hai, toh yeh aksar ek downtrend ke end aur uptrend ke shuru hone ka signal hota hai. Traders is pattern ko identify kar ke apne buy orders place karte hain.

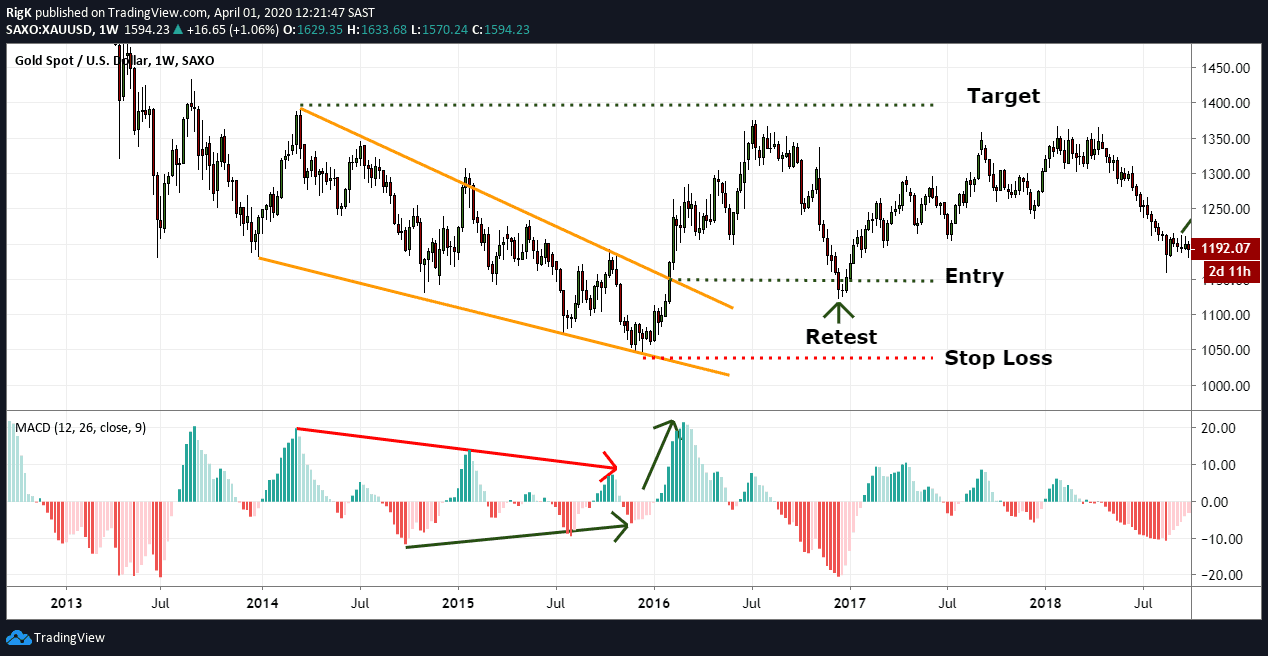

ENTRY POINT AND STOP LOSS

Upper resistance line ke breakout par entry lena sahi strategy hoti hai. Is point par market mein buying pressure hota hai jo price ko upar le ja sakta hai. Stop loss ko pattern ke lowest point ke neeche place karna chahiye taake risk manage ho sake agar price reverse ho jaye.

TECHNICAL ANALYSIS

Falling Wedge Pattern forex trading mein aik important bullish reversal pattern hai. Is pattern ka samajhna aur sahi time par entry lena traders ko market ke reversal points pe trade karne mein madad deta hai. Is pattern ka sahi istimaal kar ke traders significant profits hasil kar sakte hain.

yeh opr deya geya mera last chart hey jokeh market kaygold kay chart ko nechay gertay hovay dekha sakta hey jes kay end honay kay sath trade jare rah sakte hey es kesam kay chart pattern mei qadamat pasand trader ko enter honay ka chance nahi melta hey

yeh opr deya geya mera last chart hey jokeh market kaygold kay chart ko nechay gertay hovay dekha sakta hey jes kay end honay kay sath trade jare rah sakte hey es kesam kay chart pattern mei qadamat pasand trader ko enter honay ka chance nahi melta hey

تبصرہ

Расширенный режим Обычный режим