**Neckline Pattern: Taaruf aur Ahmiyat**

**Introduction**

Assalam o Alaikum Dears,

Umeed hai aap sab khair makdam se honge. Aaj hum ek ahem topic, "Neckline Pattern," ke bare mein detail se baat karenge. Yeh pattern technical analysis mein kafi ahmiyat rakhta hai aur traders ko market trends ko samajhne mein madad karta hai. Isse aapko Forex trading aur stock markets mein behtareen decisions lene mein madad milegi.

**Neckline Pattern Kya Hai?**

**تعریف (Definition)**

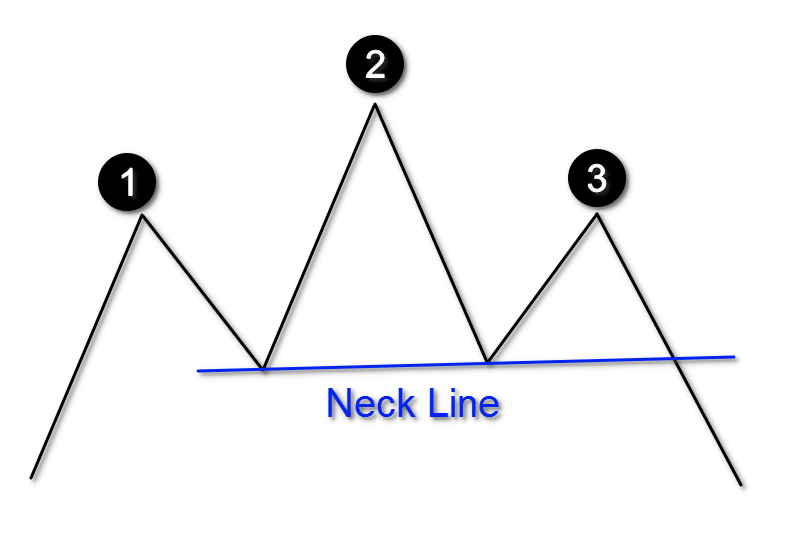

Neckline pattern ek technical analysis tool hai jo generally "Head and Shoulders" aur "Inverse Head and Shoulders" patterns ke sath istemal hota hai. Yeh pattern ek trendline hoti hai jo in patterns ke "shoulders" ke beech mein kheenchhi jati hai. Iska maqsad market ke potential reversal points ko identify karna aur entry aur exit points ko determine karna hota hai.

**Neckline Pattern Ka Kaam Kaise Karta Hai?**

1. **Formation of Neckline:** Neckline ek horizontal ya slightly sloping line hoti hai jo head and shoulders pattern ke shoulders ke low points ko join karti hai. Yeh line market ke support aur resistance levels ko define karti hai.

2. **Support aur Resistance:** Neckline ko support level (head and shoulders pattern mein) ya resistance level (inverse head and shoulders pattern mein) ke tor par dekha jata hai. Jab price neckline ke level ko break karti hai, to yeh ek strong signal hota hai ke trend reverse ya continue ho raha hai.

3. **Confirmation:** Jab price neckline ko break karti hai, traders ko confirmation milta hai ke pattern complete ho gaya hai aur price trend ke direction mein move karne wali hai. Yeh confirmation volume aur other technical indicators ke sath milkar kiya jata hai.

**Neckline Pattern Ki Ahmiyat**

1. **Support Aur Resistance Levels:** Neckline pattern support aur resistance levels ko define karta hai jo price action ke potential reversal points ko indicate karta hai. Yeh levels trading decisions aur stop-loss placements ke liye important hote hain.

2. **Pattern Completion:** Agar price neckline ke level ko break karti hai, to yeh indicate karta hai ke pattern complete ho gaya hai aur market trend ke reversal ya continuation ka signal mil raha hai. Traders is signal ko entry ya exit points set karne ke liye use karte hain.

3. **Risk Management:** Neckline pattern risk management mein bhi madad karta hai. Agar price neckline ke support/resistance level se break ho jati hai, to yeh market trend ke change ka signal hai. Traders yeh dekhte hain ke price level ke upar ya neeche move karti hai aur accordingly stop-loss orders set karte hain.

**Neckline Pattern Ki Characteristics**

1. **Horizontal Ya Sloping:** Neckline zaroori nahi ke horizontal hi ho, yeh slightly upward ya downward slope bhi ho sakti hai. Yeh slope pattern ke context aur market trend ke mutabiq hota hai.

2. **Pattern Validation:** Neckline ke saath price action aur volume ka analysis zaroori hai. Agar neckline ke breakout ke waqt volume increase hota hai, to yeh pattern ki validity ko confirm karta hai.

3. **Market Conditions:** Market conditions aur external factors bhi pattern ke effectiveness ko impact kar sakte hain. Economic news aur geopolitical events bhi pattern ke outcome ko influence kar sakte hain.

**Conclusion**

Neckline pattern technical analysis ka ek important tool hai jo market ke reversal aur continuation signals ko identify karne mein madad karta hai. Is pattern ka sahi istemal karne se traders market trends ko behtar samajh sakte hain aur informed trading decisions le sakte hain. Lekin, kisi bhi technical pattern ki analysis karte waqt market conditions aur other indicators ko bhi consider karna chahiye taake trading decisions well-rounded aur effective hon.

Aapko is topic se bohot si knowledge aur insight milne ki umeed hai.

**Introduction**

Assalam o Alaikum Dears,

Umeed hai aap sab khair makdam se honge. Aaj hum ek ahem topic, "Neckline Pattern," ke bare mein detail se baat karenge. Yeh pattern technical analysis mein kafi ahmiyat rakhta hai aur traders ko market trends ko samajhne mein madad karta hai. Isse aapko Forex trading aur stock markets mein behtareen decisions lene mein madad milegi.

**Neckline Pattern Kya Hai?**

**تعریف (Definition)**

Neckline pattern ek technical analysis tool hai jo generally "Head and Shoulders" aur "Inverse Head and Shoulders" patterns ke sath istemal hota hai. Yeh pattern ek trendline hoti hai jo in patterns ke "shoulders" ke beech mein kheenchhi jati hai. Iska maqsad market ke potential reversal points ko identify karna aur entry aur exit points ko determine karna hota hai.

**Neckline Pattern Ka Kaam Kaise Karta Hai?**

1. **Formation of Neckline:** Neckline ek horizontal ya slightly sloping line hoti hai jo head and shoulders pattern ke shoulders ke low points ko join karti hai. Yeh line market ke support aur resistance levels ko define karti hai.

2. **Support aur Resistance:** Neckline ko support level (head and shoulders pattern mein) ya resistance level (inverse head and shoulders pattern mein) ke tor par dekha jata hai. Jab price neckline ke level ko break karti hai, to yeh ek strong signal hota hai ke trend reverse ya continue ho raha hai.

3. **Confirmation:** Jab price neckline ko break karti hai, traders ko confirmation milta hai ke pattern complete ho gaya hai aur price trend ke direction mein move karne wali hai. Yeh confirmation volume aur other technical indicators ke sath milkar kiya jata hai.

**Neckline Pattern Ki Ahmiyat**

1. **Support Aur Resistance Levels:** Neckline pattern support aur resistance levels ko define karta hai jo price action ke potential reversal points ko indicate karta hai. Yeh levels trading decisions aur stop-loss placements ke liye important hote hain.

2. **Pattern Completion:** Agar price neckline ke level ko break karti hai, to yeh indicate karta hai ke pattern complete ho gaya hai aur market trend ke reversal ya continuation ka signal mil raha hai. Traders is signal ko entry ya exit points set karne ke liye use karte hain.

3. **Risk Management:** Neckline pattern risk management mein bhi madad karta hai. Agar price neckline ke support/resistance level se break ho jati hai, to yeh market trend ke change ka signal hai. Traders yeh dekhte hain ke price level ke upar ya neeche move karti hai aur accordingly stop-loss orders set karte hain.

**Neckline Pattern Ki Characteristics**

1. **Horizontal Ya Sloping:** Neckline zaroori nahi ke horizontal hi ho, yeh slightly upward ya downward slope bhi ho sakti hai. Yeh slope pattern ke context aur market trend ke mutabiq hota hai.

2. **Pattern Validation:** Neckline ke saath price action aur volume ka analysis zaroori hai. Agar neckline ke breakout ke waqt volume increase hota hai, to yeh pattern ki validity ko confirm karta hai.

3. **Market Conditions:** Market conditions aur external factors bhi pattern ke effectiveness ko impact kar sakte hain. Economic news aur geopolitical events bhi pattern ke outcome ko influence kar sakte hain.

**Conclusion**

Neckline pattern technical analysis ka ek important tool hai jo market ke reversal aur continuation signals ko identify karne mein madad karta hai. Is pattern ka sahi istemal karne se traders market trends ko behtar samajh sakte hain aur informed trading decisions le sakte hain. Lekin, kisi bhi technical pattern ki analysis karte waqt market conditions aur other indicators ko bhi consider karna chahiye taake trading decisions well-rounded aur effective hon.

Aapko is topic se bohot si knowledge aur insight milne ki umeed hai.

تبصرہ

Расширенный режим Обычный режим