Introduction.

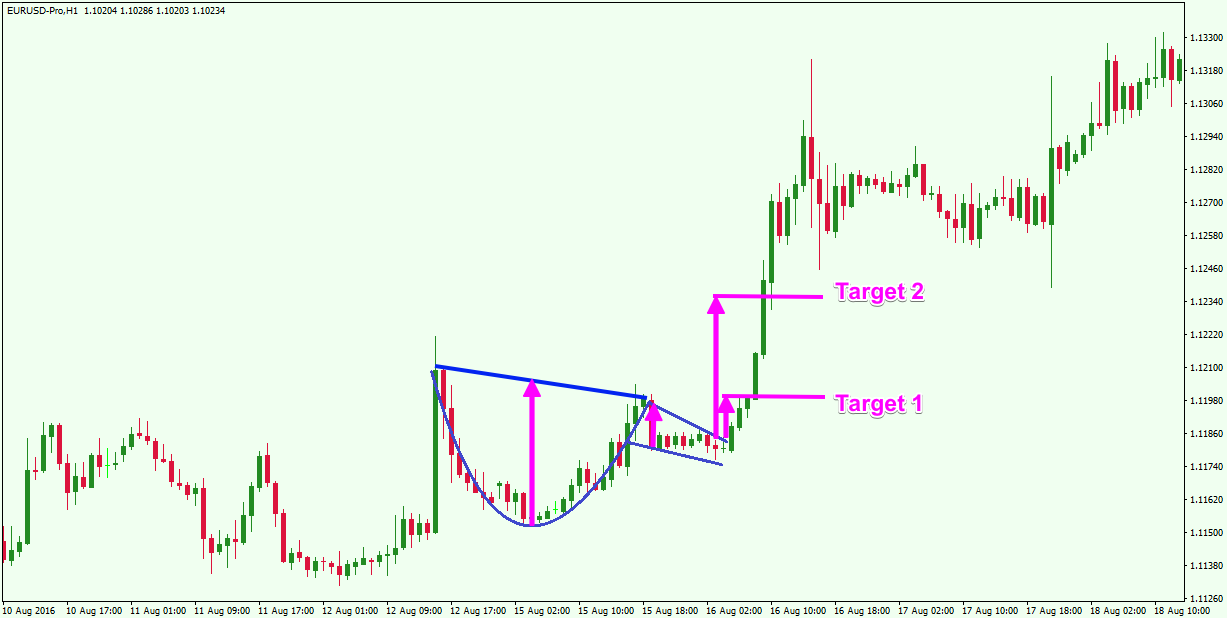

Cup aur handle chart pattern ek mashhoor technical analysis tool hai jo investors aur traders ko madad karta hai future price movements ko predict karne mein. Yeh pattern aam tor par bullish continuation pattern hota hai jo price ki uptrend ko continue karne ka ishara deta hai.

Cup Pattern.

Cup pattern aik rounding bottom ki tarah dikhta hai. Yeh pattern tab banta hai jab price pehle girta hai, phir stabilize hota hai, aur phir dheere dheere recover karta hai.

Kuch khas characteristics:

Handle Pattern.

Handle cup ke baad form hota hai aur yeh ek short-term consolidation phase ko represent karta hai. Handle pattern horizontal ya thoda sa downward sloping channel ki shakal mein hota hai.

Kuch khas characteristics:

Pattern Formation ka Tareeqa.

Trading Strategy.

Practical Example.

Agar kisi stock ka price pehle $50 se girkar $40 par aa jaye, phir $50 tak recover ho, aur phir $45 par consolidate kare, toh yeh cup aur handle pattern banta hai. Jab price $50 ki resistance ko break karti hai, toh yeh bullish signal hota hai aur yeh expect kiya jata hai ke price aur upar jayegi.

Benefits aur Limitations.

Benefits:

Limitations:

Cup aur handle chart pattern ek mashhoor technical analysis tool hai jo investors aur traders ko madad karta hai future price movements ko predict karne mein. Yeh pattern aam tor par bullish continuation pattern hota hai jo price ki uptrend ko continue karne ka ishara deta hai.

Cup Pattern.

Cup pattern aik rounding bottom ki tarah dikhta hai. Yeh pattern tab banta hai jab price pehle girta hai, phir stabilize hota hai, aur phir dheere dheere recover karta hai.

Kuch khas characteristics:

- Depth: Cup ka depth vary kar sakta hai, magar aam tor par yeh shallow hota hai.

- Duration: Cup ko form hone mein kuch weeks se lekar kuch months tak lag sakte hain.

Handle Pattern.

Handle cup ke baad form hota hai aur yeh ek short-term consolidation phase ko represent karta hai. Handle pattern horizontal ya thoda sa downward sloping channel ki shakal mein hota hai.

Kuch khas characteristics:

- Depth: Handle ka depth aam tor par shallow hota hai, jo cup ka 1/3 ya kam part hota hai.

- Duration: Handle ko form hone mein kuch din se kuch weeks lag sakte hain.

Pattern Formation ka Tareeqa.

- Initial Drop: Pehle price girti hai aur yeh cup ka left side banata hai.

- Stabilization: Phir price stable hoti hai aur cup ka bottom form hota hai.

- Recovery: Iske baad price recover karti hai aur cup ka right side banata hai.

- Handle Formation: Cup complete hone ke baad, price thoda sa consolidate karti hai aur handle banata hai.

- Breakout: Jab handle complete hota hai aur price handle ke upper resistance level ko tor deti hai, yeh bullish breakout ka ishara hota hai.

Trading Strategy.

- Entry Point: Jab price handle ki resistance line ko break karti hai, yeh entry ka signal hota hai.

- Stop Loss: Handle ke lowest point ke thoda niche stop loss set karna chahiye.

- Profit Target: Price ka target estimate karne ke liye, cup ki depth ko measure karke breakout point se add karna hota hai.

Practical Example.

Agar kisi stock ka price pehle $50 se girkar $40 par aa jaye, phir $50 tak recover ho, aur phir $45 par consolidate kare, toh yeh cup aur handle pattern banta hai. Jab price $50 ki resistance ko break karti hai, toh yeh bullish signal hota hai aur yeh expect kiya jata hai ke price aur upar jayegi.

Benefits aur Limitations.

Benefits:

- Reliability: Aam tor par yeh pattern kaafi reliable hota hai.

- Easy Identification: Visual form ki wajah se isse identify karna asaan hota hai.

Limitations:

- Time-consuming: Cup aur handle form hone mein waqt lagta hai.

- False Signals: Kabhi kabhi false breakouts bhi ho sakte hain jo losses ka sabab ban sakte hain.

تبصرہ

Расширенный режим Обычный режим