Mukadma

Symmetrical Triangle Pattern ek ahem technical analysis tool hai jo traders aur investors ke liye price movements aur market trends ko samajhne mein madadgar hota hai. Yeh pattern commonly chart analysis mein dekha jata hai aur iska istemal trading strategies banane ke liye hota hai. Is maqalah mein, hum Symmetrical Triangle Pattern ke mukhtalif pehluon par baat kareinge, jaise ke yeh pattern kya hai, iske faide aur nuqsanat, aur effective trading strategies kaise banai jayein.

Symmetrical Triangle Pattern Kya Hai?

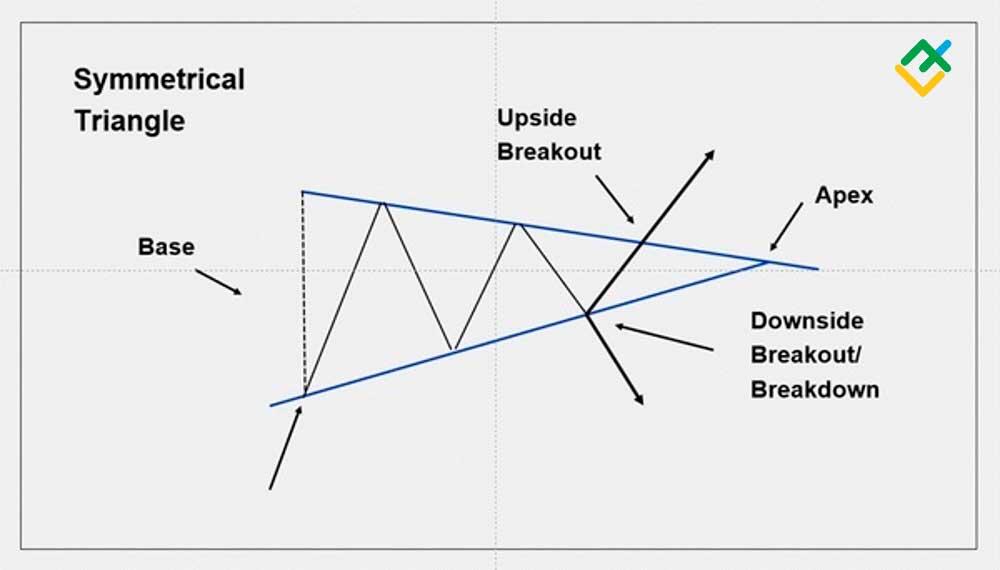

Symmetrical Triangle Pattern ek price formation hai jo market ke consolidation phase ko dikhata hai. Yeh pattern tab banta hai jab price range ko tighten karta hai, jo indicates karta hai ke buying aur selling pressures ke darmiyan balance hai. Is pattern ke do sloping trend lines hote hain: ek ascending (upar ki taraf) aur doosra descending (neeche ki taraf). Jab yeh do lines ek dosray ko meet karte hain, to yeh pattern ban jata hai.

Formation Ka Tarika

- Price Action: Symmetrical Triangle Pattern tab banta hai jab price ek clockwise movement dikhata hai, jis mein high points lower high aur low points higher low ke sath form hotay hain.

- Consolidation Phase: Yeh pattern market ke transition ya consolidation phase ko dikhata hai, jahan price kisi trend ke strengthen hone se pehle narrow range mein move karta hai.

- Breakout Point: Generally, yeh pattern 1-3 months ke dauran banta hai, aur uske baad price kisi direction (upar ya neeche) breakout karta hai.

Faide

- Market Sentiment Ka Indication: Symmetrical Triangle Pattern investor ki market sentiment ko samajhne mein madad karta hai. Is pattern se pata chalta hai ke market buyers aur sellers ke darmiyan kis taraf shift ho raha hai.

- Clear Entry aur Exit Points: Is pattern ke milne se traders ko clear entry aur exit points ka idea milta hai, jo unhe trades open karne mein madadgar hote hain.

- Risk Management: Symmetrical Triangle Pattern ke sath trading karne se traders ko stop loss set karne ka bhi sahara milta hai, jo unke capital ko protect karta hai.

- Volatility Ka Pata Chalta Hai: Symmetrical Triangle Pattern breaking point ke sath volatility ka indication dekhta hai, jo traders ke liye profitable opportunities create kar sakta hai.

- False Breakouts: Kabhi kabhi market false breakout de sakta hai. Iska matlab hai ke price expected direction mein nahi chal rahaa hota, jo traders ke liye nuksaan ka sabab ban sakta hai.

- Time-Consuming: Is pattern ki formation ko hone mein waqt lag sakta hai. Kabhi kabhi traders ko pattern ko form hone tak intizaar karna padta hai, jo unke liquidity risk ko barha sakta hai.

- Limited Information: Symmetrical Triangle Pattern sirf price movements ka indication deta hai. Isse market ke fundamental aspects ko nahi dekha ja sakta, jo nuksan ka sabab ban sakta hai.

1. Chart Analysis

Is pattern ko identify karne ke liye sabse pehla step chart analysis hai. Traders ko price movements aur high aur low points ko identify karna hoga. Symmetrical Triangle Pattern ko samajhne ke liye daily charts ka istemal aesaan hota hai.

2. Pattern Confirmation

Pattern ki formation ke baad, confirmed breakout ke liye wait karna zaroori hai. Traders ko price ko triangle ki upper ya lower trend line ke upar ya neeche move karte dekhna hoga.

3. Entry Point

Entry point tab hota hai jab price triangle ki upper trend line ko breakout kare. Is time par traders ko buy signal milta hai. Agar price lower trend line ko breakout kare, to sell signal milta hai.

4. Stop Loss Setup

Risk management ke liye stop loss set karna zaroori hai. Stop loss ko triangle ki opposite side ke thoda sa peechay set karna chahiye, taake zaroorat par trade ko close kiya ja sake.

5. Profit Target

Profit target establish karne ke liye traders ko pattern ke height ko analyze karna chahiye. High aur low points ko dekhte hue potential profit target setup karna madadgar hota hai.

6. Market Conditions

Traders ko market conditions ko dekhna bhi zaroori hai. Kabhi kabhi external news ya events bhi price movements ko affect karte hain. Yeh bhi dekhna hoga ke kya market bullish hai ya bearish.

Practical Example

Ab hum ek practical example ke zariye Symmetrical Triangle Pattern ko samajhte hain.

Case Study

Maalijiye ek stock ka price 100 se start hota hai aur dheere dheere 90 aur 110 ki taraf high aur low points form karta hai. Jab price 90 se 110 tak consolidate hota hai, to symmetrical triangle banta hai.

- Chart Dekhna: Price chart par high aur low points ko identify karein.

- Triangle Confirm Karna: Jab price upper trend line ko break kare, tab traders ko buy signal milega.

- Stop Loss: Is case mein, stop loss ko 90 ke neeche set karna chahiye.

- Profit Target: Agar price triangle ki height ko 20 points tak move karta hai (jaise ke 110-90), to profit target 20 points upar set hota hai.

Symmetrical Triangle Pattern ek valuable tool hai jo traders ko market ke sentiment aur price movements ko samajhne mein madad karta hai. Is pattern ko effectively seekhna aur istemal karna zaroori hai taake profitable trades kiye ja sakein. Trace karne ke liye clear entry aur exit points, stop loss setup, aur profit target kaise establish karna hai, yeh sab basic strategies hain jo traders ko is pattern ke saath help karte hain.

Yeh patterns sirf price movements ka indication nahi, balki market ki overall sentiment aur potential trend reversals ko bhi dikhate hain. Traders ko yeh baat samajhni chahiye ke ko koi single pattern ya indicator market ke dynamics ko puri tarah samajhne ke liye kaafi nahi hota.

Aakhir mein, market ke external factors ko bhi dekhna aur analyze karna nahi bhoolna chahiye, taake humare trading decisions informed aur profitable ho sakein. Trading ka safar involves continuous learning, sabr, aur risk management. Symmetrical Triangle Pattern ek ahem tools hai, lekin isse saath saath fundamental analysis aur market trends ko bhi samajhna equally important hai.

تبصرہ

Расширенный режим Обычный режим