what is open range breakout trading strategy

forex market mein open range breakout trading strategy forex market mein aik kesam ke trading strategy hote hey jo keh market kay foran bad he open hote hey forex market mein aam tor par prices aik chote ce limit mein montaqel ho jate hein forex trader ko es bat ka yaqen nahi hota hey keh jab forex market ke prices es limit say out ho jate hein to forex market ke price aik he direction mein wazah barhnay lagte hey or yeh zyada tar poray den tak es tarah he chalte rehte hein es ko hum open range breakout trading strategy kehtay hein

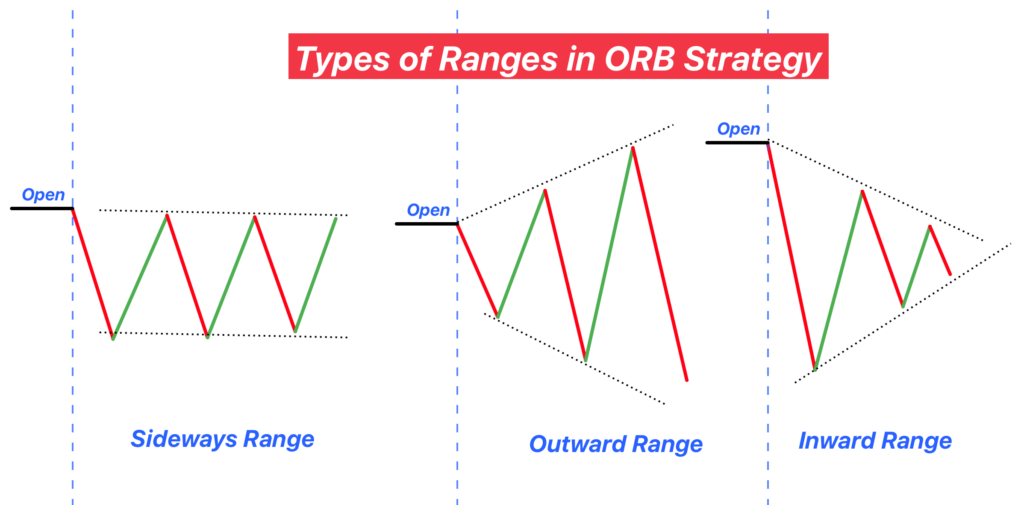

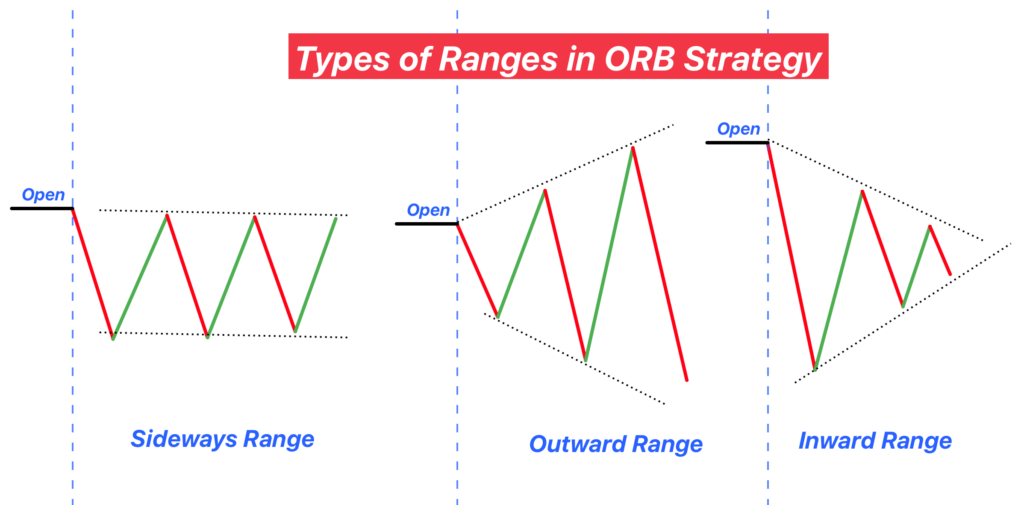

Types of open range breakout trading strategy

forex market ke opening kay bad prices aam tor par kese aik direction ke taraf movement karte hein en ko limited karnay kay ley ap open range breakout trading strategy ka estamal kartay hein forex market mein es trading strategy ka best tarekay say estamal karnay mein madad mell sakte hey aay teen aam eksam ke lmited kay baray mein bat kartay hein

Sideways Range

forex market mein sideways range kay baray min sochna chihay jaisakeh direction door janay kay bad agay pechay movement hote hey aisa woh apna zahain nahi bana saktay hein keh kahan pe jana hey aisa os time hota hey jab forex market kay trader aik jaice buy ya sell kar rahay hotay hein lahza price kese wazah point mein up ya down kay baghair movement kar rehe hote hey

Inward Consolidation

batne stable tab hota hey jab forex market ke prices aik dosray kay pass ana start ho jate hein es bat ka taswor karen keh logon ka aik hajoom aik group mein sakhat say ssakhat hota ja raha hota hey es say zahair hota hey keh jald aik bara step ho sakta hey kunkeh trader mohtat ho rahay hotay hein abhi tak koi bhe price ke direction agay barhnay kay ley ready nahi hote hey yeh tafan say pehlay kamoshe ke tarah hota hey

outward range

forex market mein outward range jo keh forex market mein zahaire stable kay opposite hote hey forex market mein prices mazeed phailna start ho jate hein es ka matlab yeh hota hey keh trader bare movement karna start kar dayta hey prices ani limit say out honay kay ley rady hote hein yeh es bat ke allamat hota hey keh strong trend aik he direction start karnay wala hey

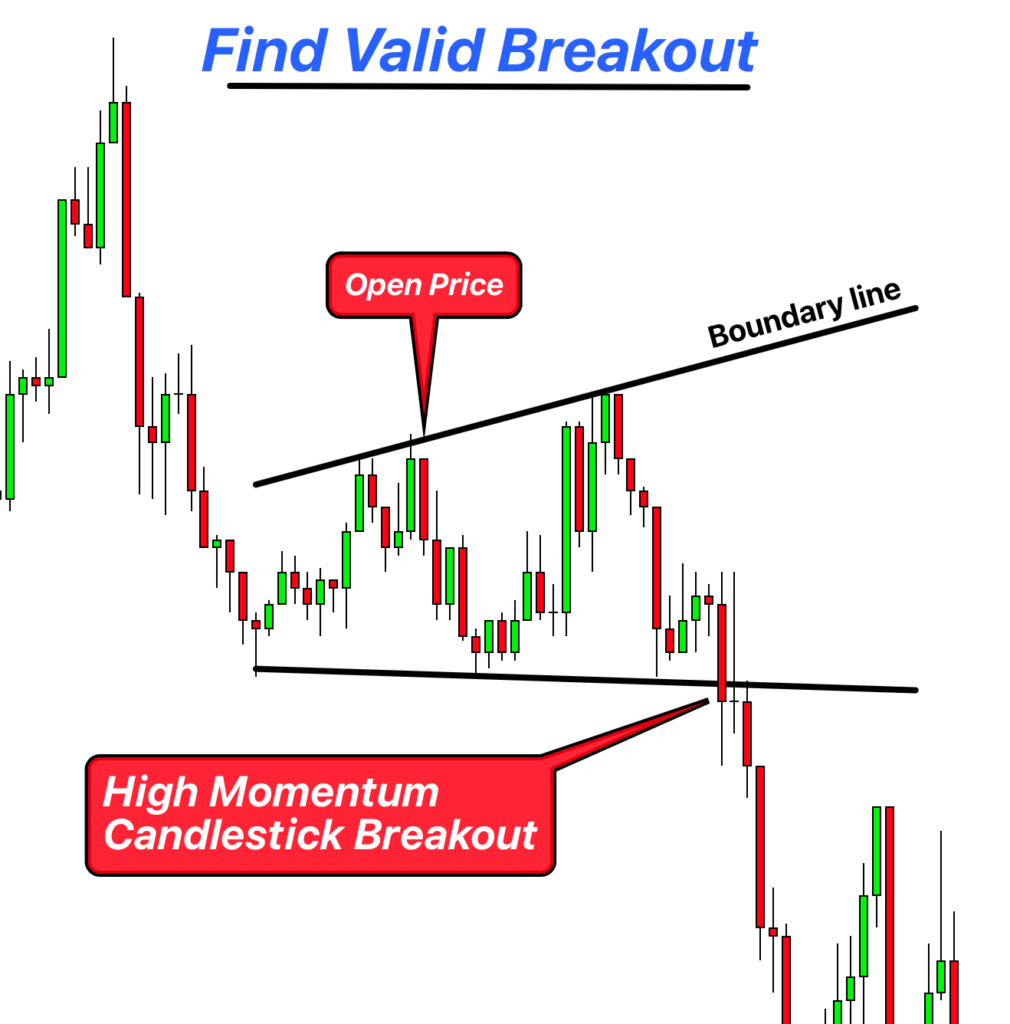

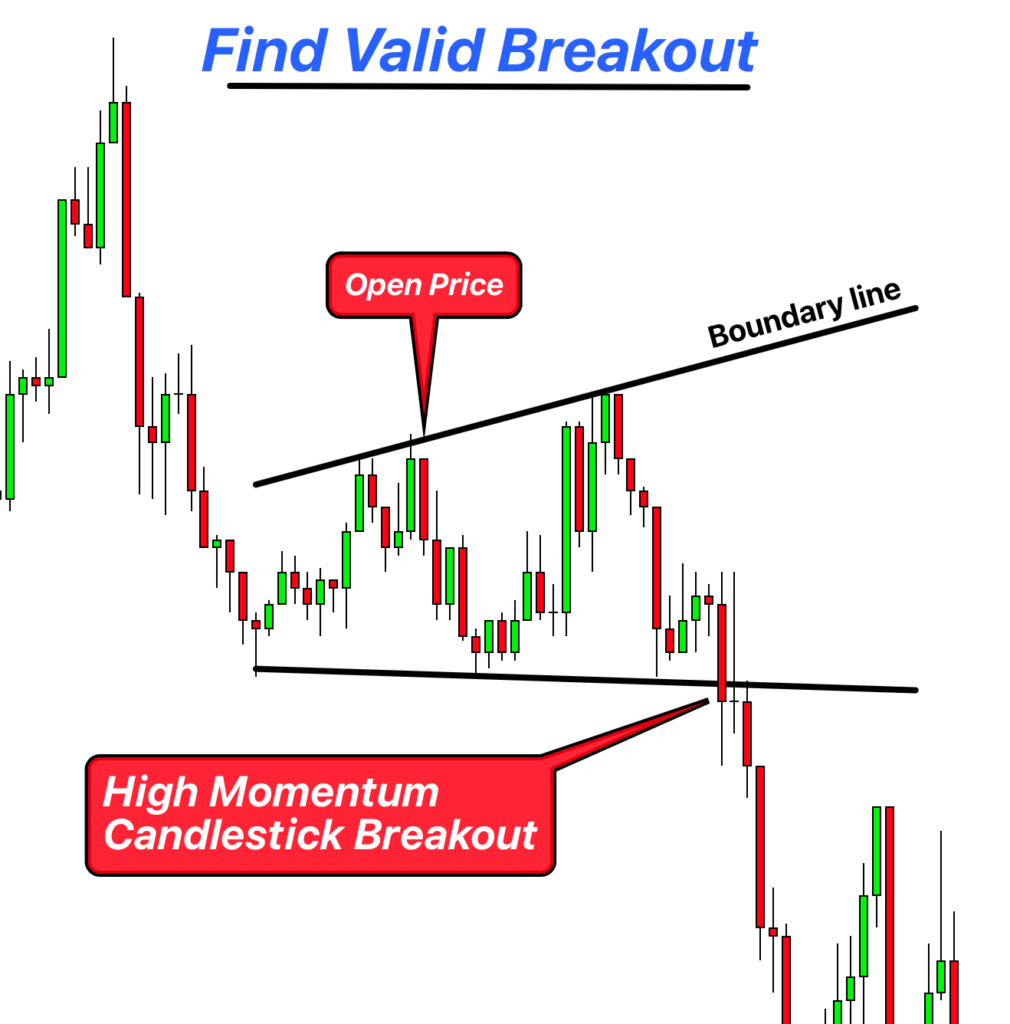

Find valid breakout

breakout kay bad forex market ke prices range mein he movement nahi kar sakte hein hum nay forex market mein en ke pehlay say he pehchan karne hote hey trader aik he direction par agree ho rahay hotay hhein to zyada tar trader buy kar rahay hotay hein prices barah rehe hote hein or jab sell kar rahay hotay hein to prices ger rehe hote hein

forex market mein open range breakout trading strategy forex market mein aik kesam ke trading strategy hote hey jo keh market kay foran bad he open hote hey forex market mein aam tor par prices aik chote ce limit mein montaqel ho jate hein forex trader ko es bat ka yaqen nahi hota hey keh jab forex market ke prices es limit say out ho jate hein to forex market ke price aik he direction mein wazah barhnay lagte hey or yeh zyada tar poray den tak es tarah he chalte rehte hein es ko hum open range breakout trading strategy kehtay hein

Types of open range breakout trading strategy

forex market ke opening kay bad prices aam tor par kese aik direction ke taraf movement karte hein en ko limited karnay kay ley ap open range breakout trading strategy ka estamal kartay hein forex market mein es trading strategy ka best tarekay say estamal karnay mein madad mell sakte hey aay teen aam eksam ke lmited kay baray mein bat kartay hein

Sideways Range

forex market mein sideways range kay baray min sochna chihay jaisakeh direction door janay kay bad agay pechay movement hote hey aisa woh apna zahain nahi bana saktay hein keh kahan pe jana hey aisa os time hota hey jab forex market kay trader aik jaice buy ya sell kar rahay hotay hein lahza price kese wazah point mein up ya down kay baghair movement kar rehe hote hey

Inward Consolidation

batne stable tab hota hey jab forex market ke prices aik dosray kay pass ana start ho jate hein es bat ka taswor karen keh logon ka aik hajoom aik group mein sakhat say ssakhat hota ja raha hota hey es say zahair hota hey keh jald aik bara step ho sakta hey kunkeh trader mohtat ho rahay hotay hein abhi tak koi bhe price ke direction agay barhnay kay ley ready nahi hote hey yeh tafan say pehlay kamoshe ke tarah hota hey

outward range

forex market mein outward range jo keh forex market mein zahaire stable kay opposite hote hey forex market mein prices mazeed phailna start ho jate hein es ka matlab yeh hota hey keh trader bare movement karna start kar dayta hey prices ani limit say out honay kay ley rady hote hein yeh es bat ke allamat hota hey keh strong trend aik he direction start karnay wala hey

Find valid breakout

breakout kay bad forex market ke prices range mein he movement nahi kar sakte hein hum nay forex market mein en ke pehlay say he pehchan karne hote hey trader aik he direction par agree ho rahay hotay hhein to zyada tar trader buy kar rahay hotay hein prices barah rehe hote hein or jab sell kar rahay hotay hein to prices ger rehe hote hein

تبصرہ

Расширенный режим Обычный режим