Introduction

Assalamu alaikum friends spining chart pattern kya hai, for ex trading Mein main aapko bataunga ki Spinning Top Pattern hakikat kya hai aur iska tamam experience share karunga kyunki yah Mera Hak Hai aapse share karna Agar press per kam karna hai to main apna khata kar raha hun aur aap bhi is topic per apna najriya pesh Karen

Spinning Top Pattern

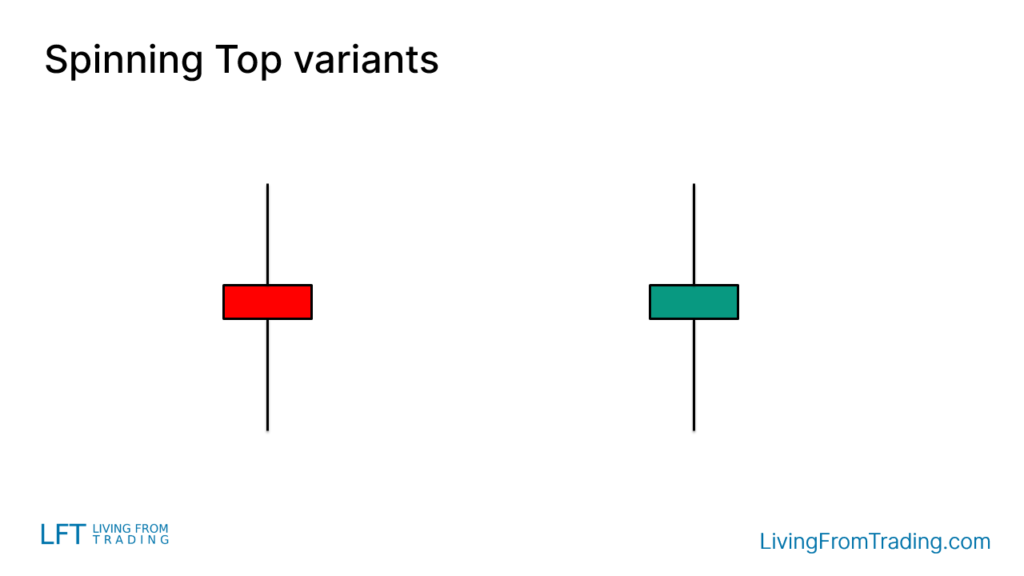

spinning wheel pattern aik kesam ka candle pattern hota hey jo keh forex market kay signal ko indicate kar sakta hey jo keh forex market mein ghair yaqen sorat e hall ko identify kar sakta hey es kesam ke cadlestick ke tareef khod aik short body say he ke ja sakte hey jes kay charon taraf ke long wick dono taraf say he jore hove hote hey spinner ya to bearish hota hey ya phir bullish candlestick ban jata hey yeh candlestick pattern up trend down trend ya phir consolidation kay inside mein on ban jata hey jo keh forex market kay mumkana trend reversal kay end mein on ban saktu hey

Understanding the pinwheel pattern

forex market mein spinning top pattern ko identify karna bay had zaroore hota hey jo keh forex market ke buyer or seller ke wazah nomaindge karte hey jo keh aik dosray ko chor daytay hein jes kay result mein price mein aik jaice on level hote hey trading strategy mein spinning wheel pattern ko Shamel karnay kay bay had faiday hotay hein jo keh kam say kam time mein investor ke pehchan ke jate hey

es kay pechay forex markt ke pehchan kay sath formation mokamal honay sabaq mel jata hey trader forex chart nominal prices ko complete prices karnay ja rahay thay ko zyada or low dono taraf on montaqel kar daytay hein or forex market mein closing price wapes heloot rehe or start ke cena he bohut he close hot hey

Trade the pinwheel pattern

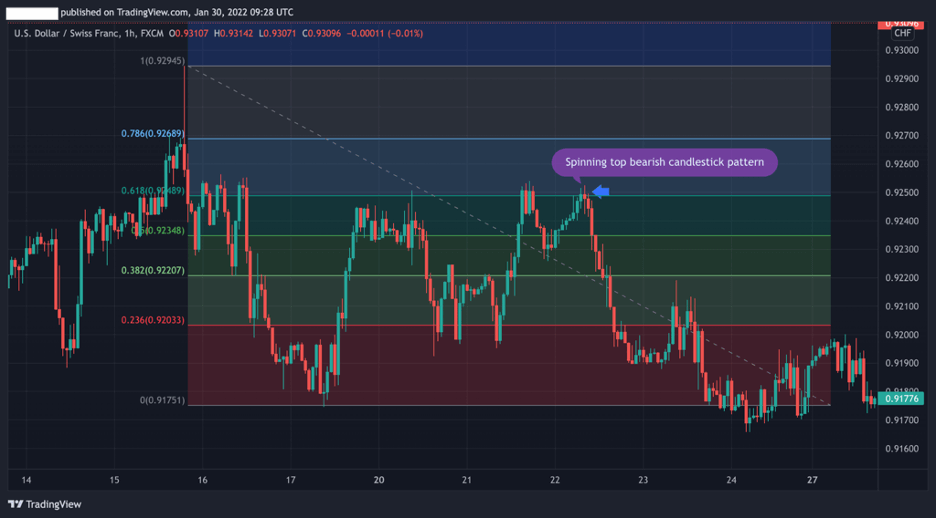

forex market ke spinning top trade mein yeh samjhna bhe bay had zaroore hota hey keh yeh forx market kay overall trend kay hawalay say kahan par he bante hey de gay mesal mein forex market ke aik amle mesal ko letchay batya ja ke confirmation a hey jes kay zarey say he ke jate he

Assalamu alaikum friends spining chart pattern kya hai, for ex trading Mein main aapko bataunga ki Spinning Top Pattern hakikat kya hai aur iska tamam experience share karunga kyunki yah Mera Hak Hai aapse share karna Agar press per kam karna hai to main apna khata kar raha hun aur aap bhi is topic per apna najriya pesh Karen

Spinning Top Pattern

spinning wheel pattern aik kesam ka candle pattern hota hey jo keh forex market kay signal ko indicate kar sakta hey jo keh forex market mein ghair yaqen sorat e hall ko identify kar sakta hey es kesam ke cadlestick ke tareef khod aik short body say he ke ja sakte hey jes kay charon taraf ke long wick dono taraf say he jore hove hote hey spinner ya to bearish hota hey ya phir bullish candlestick ban jata hey yeh candlestick pattern up trend down trend ya phir consolidation kay inside mein on ban jata hey jo keh forex market kay mumkana trend reversal kay end mein on ban saktu hey

Understanding the pinwheel pattern

forex market mein spinning top pattern ko identify karna bay had zaroore hota hey jo keh forex market ke buyer or seller ke wazah nomaindge karte hey jo keh aik dosray ko chor daytay hein jes kay result mein price mein aik jaice on level hote hey trading strategy mein spinning wheel pattern ko Shamel karnay kay bay had faiday hotay hein jo keh kam say kam time mein investor ke pehchan ke jate hey

es kay pechay forex markt ke pehchan kay sath formation mokamal honay sabaq mel jata hey trader forex chart nominal prices ko complete prices karnay ja rahay thay ko zyada or low dono taraf on montaqel kar daytay hein or forex market mein closing price wapes heloot rehe or start ke cena he bohut he close hot hey

Trade the pinwheel pattern

forex market ke spinning top trade mein yeh samjhna bhe bay had zaroore hota hey keh yeh forx market kay overall trend kay hawalay say kahan par he bante hey de gay mesal mein forex market ke aik amle mesal ko letchay batya ja ke confirmation a hey jes kay zarey say he ke jate he

تبصرہ

Расширенный режим Обычный режим