Forex trading duniya ke sab se bara aur liquid financial market hai, jahan har roz trillion dollar ki trading hoti hai. Agar aap is field mein successful banna chahte hain, to PriceActionTrading ka samajh hona zaruri hai. Price action ka matlab hai ki aap market ke price movements ka analysis karke trading decisions lete hain, bina kisi indicator ya complex tool ke. Yeh ek advanced aur effective technique hai, jo professional traders ke liye kaafi kaargar sabit hoti hai. Price action trading ek strategy hai jo market ke historicalpricedata par focus karti hai. Yeh trading ka ek aisa style hai jo indicators ko avoid karta hai aur charts ko asaan aur clean rakhta hai. Traders price ke candlestick patterns, support aur resistance levels, aur marketstructure ko analyze karke apne trades place karte hain.

Example: Agar ek currency pair ka price ek important support level par hai aur wahan bullish candlestick pattern banta hai, to trader yeh assume karta hai ke price wahan se upar jayega.

Advance Price Action ke Core Elements

1. Market Structure

Market structure ka matlab hai ke aap samajh sakein ke market kis direction mein chal raha hai:

2. Support aur Resistance Levels

Candlestick patterns price action ke analysis mein ek ahem role ada karte hain. Advanced price action mein, aapko in patterns ki samajh honi chahiye:

4. Trendlines aur Channels

Advanced price action traders ko yeh samajhni aati hai ke har breakout sahi nahi hota. Kabhi kabhi price temporarily ek level todta hai, lekin phir wapas original range mein aa jata hai. Isay false breakout kehte hain.

How to Avoid False Breakouts:

Order blocks wo areas hain jahan bade institutions apne trades place karte hain. Price action traders in areas ko pehchan kar apne trades ko optimize karte hain. Order blocks aksar:

Price Action ko Kaise Apply Karein

Advanced Tools for Price Action Traders

Example: Agar ek currency pair ka price ek important support level par hai aur wahan bullish candlestick pattern banta hai, to trader yeh assume karta hai ke price wahan se upar jayega.

Advance Price Action ke Core Elements

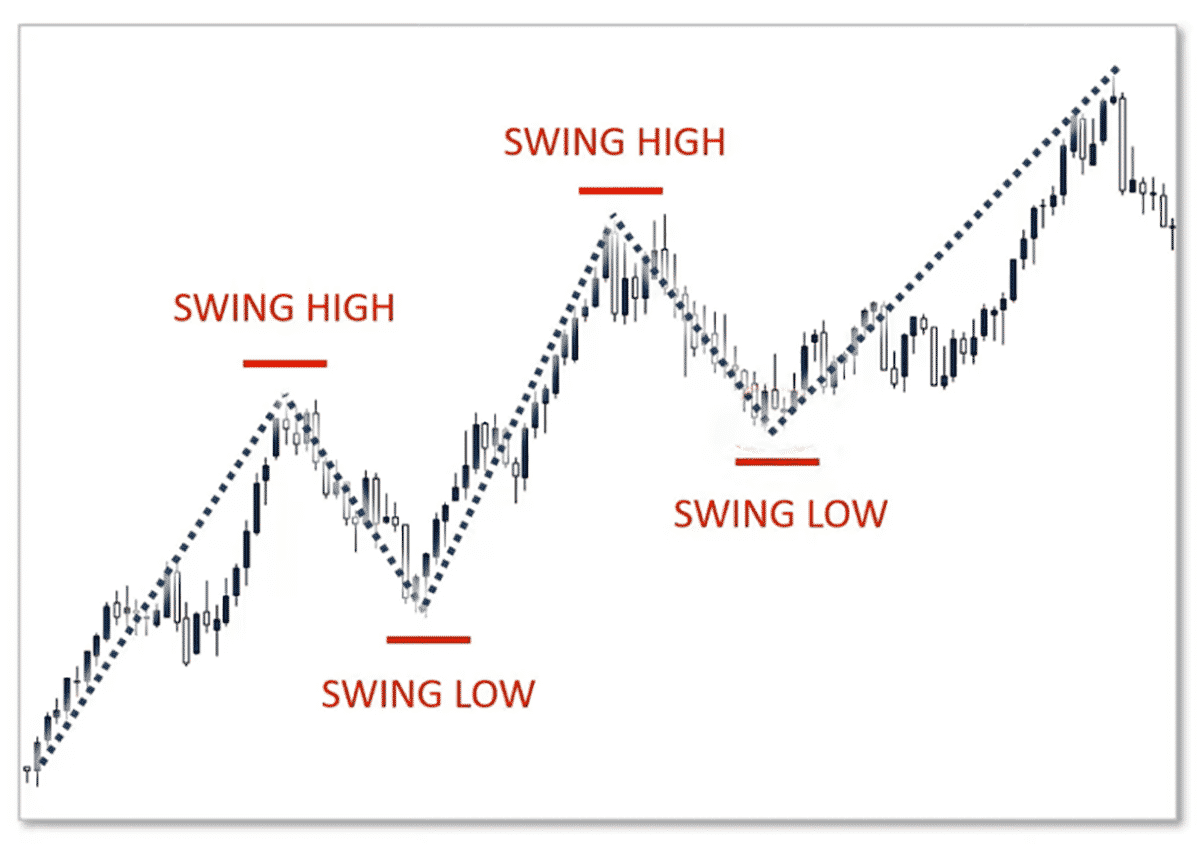

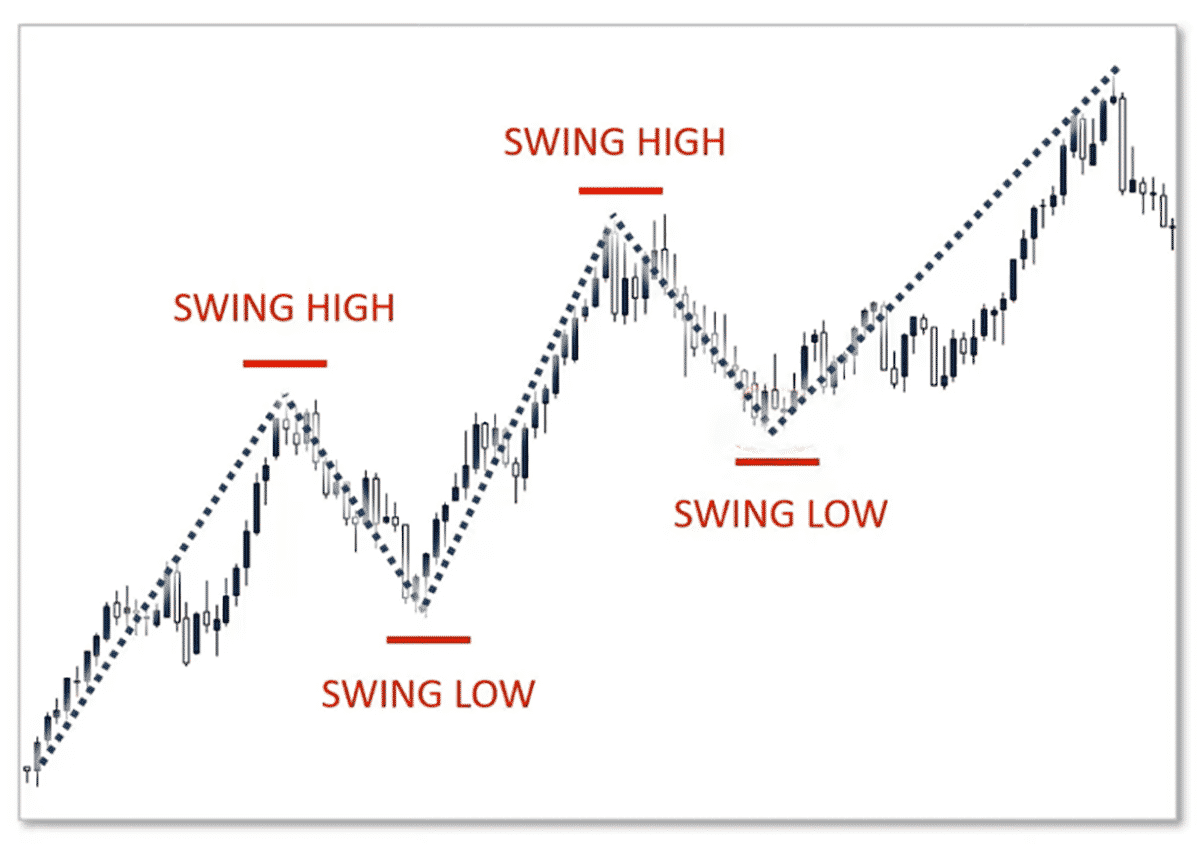

1. Market Structure

Market structure ka matlab hai ke aap samajh sakein ke market kis direction mein chal raha hai:

- Uptrend: Higher highs (HH) aur higher lows (HL).

- Downtrend: Lower highs (LH) aur lower lows (LL).

- Sideways/Range-bound Market: Price ek limited range mein chal raha ho.

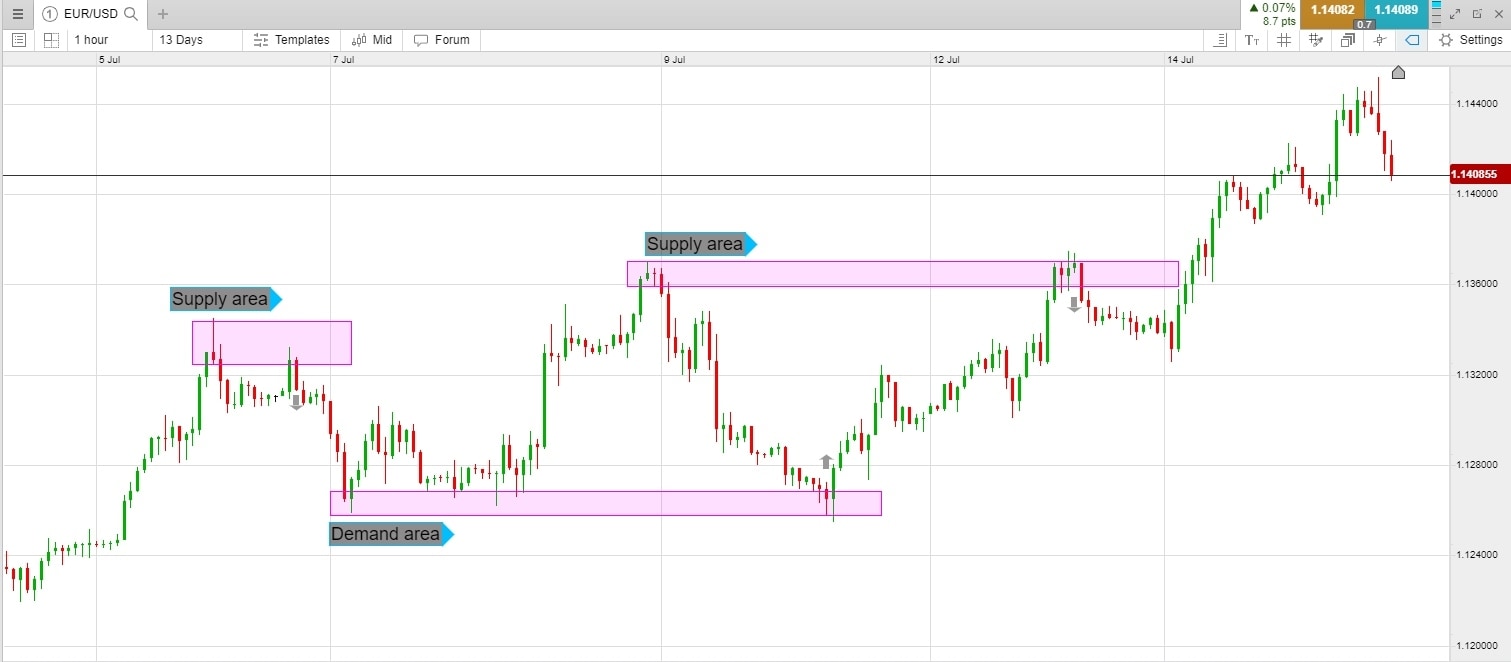

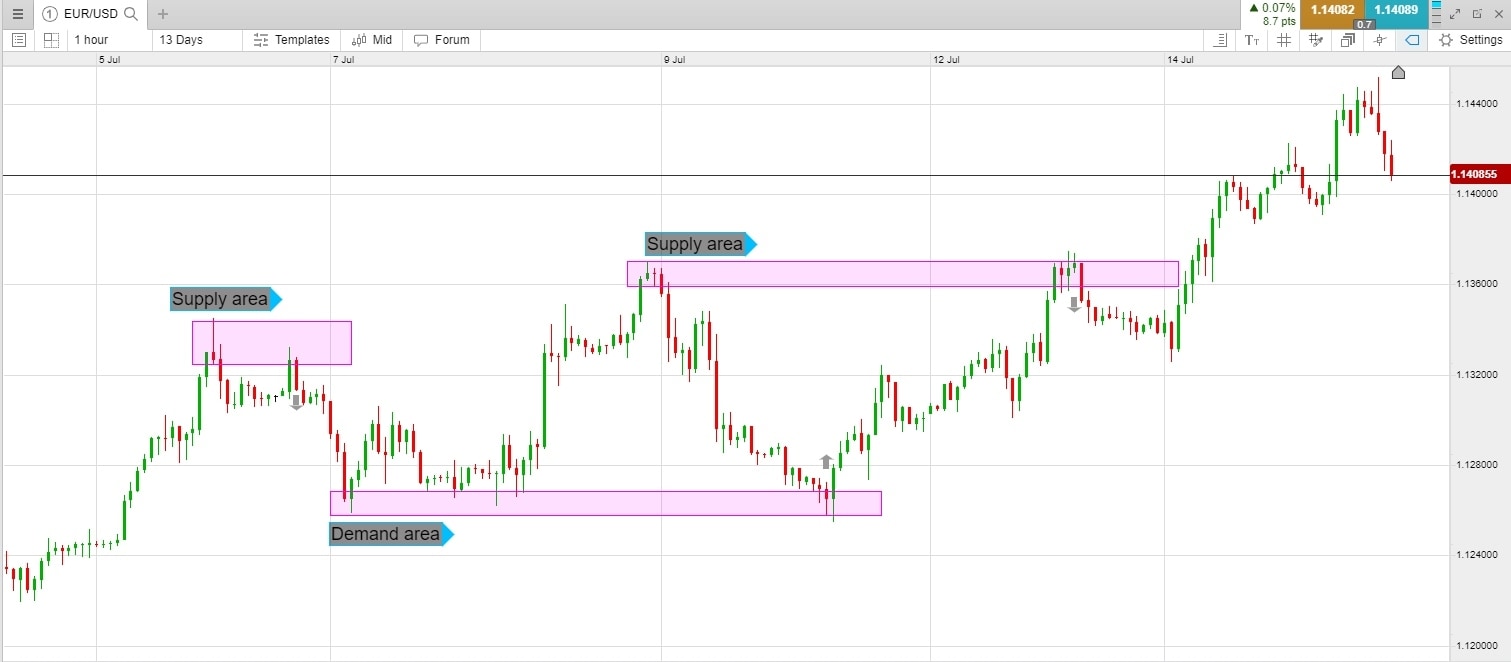

2. Support aur Resistance Levels

- Support Level: Wo level jahan price niche girte waqt rukta hai ya bounce karta hai.

- Resistance Level: Wo level jahan price upar chalte waqt rukta hai ya neeche girta hai.

- Dynamic Support/Resistance: Moving averages ko dynamic support aur resistance ke taur par use karte hain.

- Supply and Demand Zones: Support aur resistance zones identify karte hain jahan price kaafi baar react karta hai.

Candlestick patterns price action ke analysis mein ek ahem role ada karte hain. Advanced price action mein, aapko in patterns ki samajh honi chahiye:

- Reversal Patterns:

- Hammer aur Shooting Star

- Engulfing Patterns

- Morning Star aur Evening Star

- Continuation Patterns:

- Flags aur Pennants

- Inside Bar

- Maruboz

4. Trendlines aur Channels

- Trendlines: Yeh ek simple line hoti hai jo higher lows (uptrend) ya lower highs (downtrend) ko connect karti hai.

- Channels: Jab price ek specific range mein move karta hai to aap parallel lines draw karke price ka range samajh sakte hain.

Advanced price action traders ko yeh samajhni aati hai ke har breakout sahi nahi hota. Kabhi kabhi price temporarily ek level todta hai, lekin phir wapas original range mein aa jata hai. Isay false breakout kehte hain.

How to Avoid False Breakouts:

- Higher timeframes ka analysis karna.

- Volume indicators ke saath confluence dhundhna.

Order blocks wo areas hain jahan bade institutions apne trades place karte hain. Price action traders in areas ko pehchan kar apne trades ko optimize karte hain. Order blocks aksar:

- Support aur Resistance zones ke aas-paas hotay hain.

- Supply aur Demand areas mein hotay hain.

Price Action ko Kaise Apply Karein

- Multiple Timeframe Analysis

- Higher timeframes (daily ya 4-hour) par trend identify karein.

- Lower timeframes (1-hour ya 15-minute) par entry aur exit points dhundhein.

- Confluence Find Karein

- Sirf ek signal par rely na karein. Agar support level, candlestick pattern, aur trendline breakout ek hi waqt par ho raha hai, to us trade ka success rate zyada hoga.

- Risk Management

- Advance price action ka faida sirf tab hota hai jab aap apne risk ko control karte hain.

- Stop Loss aur Take Profit ko define karein.

- Ek trade mein apne account ka sirf 1-2% risk karein.

- Practice aur Backtesting

- Historical charts ka analysis karna aur demo trading karna zaruri hai. Isse aapko apni strategy ke flaws aur strengths ka pata chalega.

- Simplicity: Indicators ke clutter ke bina charts clean hote hain.

- Flexibility: Har timeframe aur market mein kaam karta hai.

- High Probability Trades: Confluence ke sath high-probability setups identify hote hain.

- Better Risk Management: Stop loss aur profit targets accurately place kiye ja sakte hain.

- Overtrading: Har signal ko trade mat karein.

- Emotional Trading: Apne trading plan par stick karein.

- Ignoring Fundamentals: Sirf price action ke basis par news aur events ko ignore mat karein.

Advanced Tools for Price Action Traders

- TradingView: Advanced charting tools ke liye.

- MyFxBook: Performance tracking aur analysis ke liye.

- ************: Fundamental events aur news ke liye.

تبصرہ

Расширенный режим Обычный режим