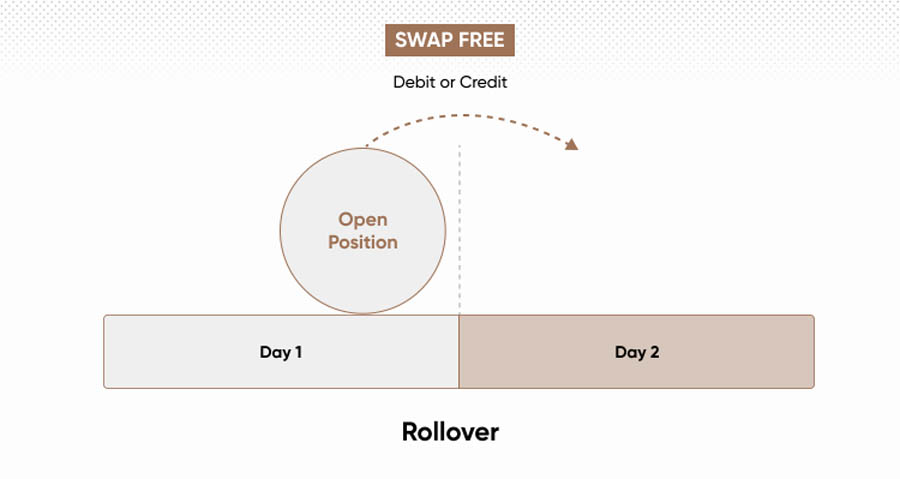

Rollover ko Forex Trading mein swap ke naam se bhi jana jata hai. Rollover, Forex Trading mein ek aisa concept hai jismein trading ke dauran kiye gaye open positions ko next day ke liye transfer kiya jata hai. Ismein positions ki value aur interest rate ke according swap kiya jata hai.

Rollover introduction

Rollover, Forex Trading mein ek important concept hai jismein traders ke open positions ko next day ke liye transfer kiya jata hai. Is process mein positions ki value aur interest rate ke according swap kiya jata hai. Yeh process har din kiya jata hai aur iski value ko overnight interest rate ke according calculate kiya jata hai.

Rollover work

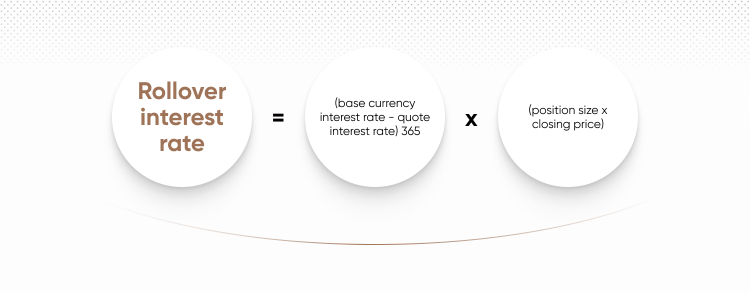

Rollover, Forex Trading mein is tarah kaam karta hai ki jab trading day khatam hota hai to positions ko next day ke liye transfer kiya jata hai. Is process mein positions ki value aur overnight interest rate ke according swap kiya jata hai. Agar trader ne long position liya hai to uski value ko overnight interest rate se multiply kiya jata hai aur agar trader ne short position liya hai to uski value ko over night interest rate se divide kiya jata hai.

Rollover value

Rollover ki value overnight interest rate ke according calculate ki jati hai. Agar trader ne long position liya hai to uski value ko overnight interest rate se multiply kiya jata hai aur agar trader ne short position liya hai to uski value ko overnight interest rate se divide kiya jata hai. Is tarah se Rollover ki value calculate ki jti hai.

Conclusion

Rollover, Forex Trading mein ek important concept hai jismein traders ke open positions ko next day ke liye transfer kiya jata hai. Is process mein positions ki value aur interest rate ke according swap kiya jata hai. Rollover ki value overnight interest rate ke according calculate ki jati hai. Isliye traders ko Rollover ke baare mein acche se samajh lena chahiye aur iske liye apne broker sy consult karna chahiye.

تبصرہ

Расширенный режим Обычный режим