Swing Point Trading Mein Kya Hota Hai?

Swing point trading ek popular trading technique hai jo traders ko markets ki price movements ko analyze karne aur unse profit kamane mein madad karti hai. Is technique ka focus short-term price movements par hota hai, jahan traders price ki fluctuations se fayda uthate hain. Iska concept samajhne ke liye, humein pehle swing points ka samajhna zaroori hai.

Swing Points Ka Matlab

Swing points trading charts par un points ko refer karte hain jahan price ne apni direction ko change kiya hota hai. Yeh do tarah ke hote hain:

Swing points identify karne se traders ko market ke turning points aur potential entry ya exit points dekhne mein asani hoti hai.

Swing Points Identify Karna

Swing points ko identify karne ke liye, traders usually candlestick charts ka use karte hain. Candlesticks price movements ko visually represent karte hain aur inhe dekh kar swing highs aur swing lows ko identify kiya ja sakta hai.

Swing Points Ka Use Karna

Swing points ko identify karne ke baad, traders inhe trading decisions banane mein use karte hain. Yahan kuch common strategies hain jo swing points ke saath use hoti hain:

Risk Management

Swing point trading mein risk management bhi bohot important hai. Swing points ko identify karke, traders stop-loss levels aur profit targets set kar sakte hain. Stop-loss levels ek predefined price level hota hai jahan trader apni position ko loss me band kar deta hai taake zyada loss na ho. Profit targets wo predefined price level hote hain jahan trader apni position ko profit me band kar deta hai.

Swing point trading ek effective technique hai jo traders ko market ke short-term movements ko analyze karne aur trading decisions banane mein madad karti hai. Swing highs aur swing lows ko identify karke, traders support aur resistance levels, trend reversals aur entry/exit points dekh sakte hain. Effective risk management ke saath, swing point trading se consistent profits kamaye ja sakte hain.

Swing point trading ek popular trading technique hai jo traders ko markets ki price movements ko analyze karne aur unse profit kamane mein madad karti hai. Is technique ka focus short-term price movements par hota hai, jahan traders price ki fluctuations se fayda uthate hain. Iska concept samajhne ke liye, humein pehle swing points ka samajhna zaroori hai.

Swing Points Ka Matlab

Swing points trading charts par un points ko refer karte hain jahan price ne apni direction ko change kiya hota hai. Yeh do tarah ke hote hain:

- Swing High: Yeh wo point hota hai jahan price temporarily apni upar jaane ki movement ko rok kar niche aane lagti hai. Yeh ek local maximum ko indicate karta hai.

- Swing Low: Yeh wo point hota hai jahan price temporarily apni niche jaane ki movement ko rok kar upar jaane lagti hai. Yeh ek local minimum ko indicate karta hai.

Swing points identify karne se traders ko market ke turning points aur potential entry ya exit points dekhne mein asani hoti hai.

Swing Points Identify Karna

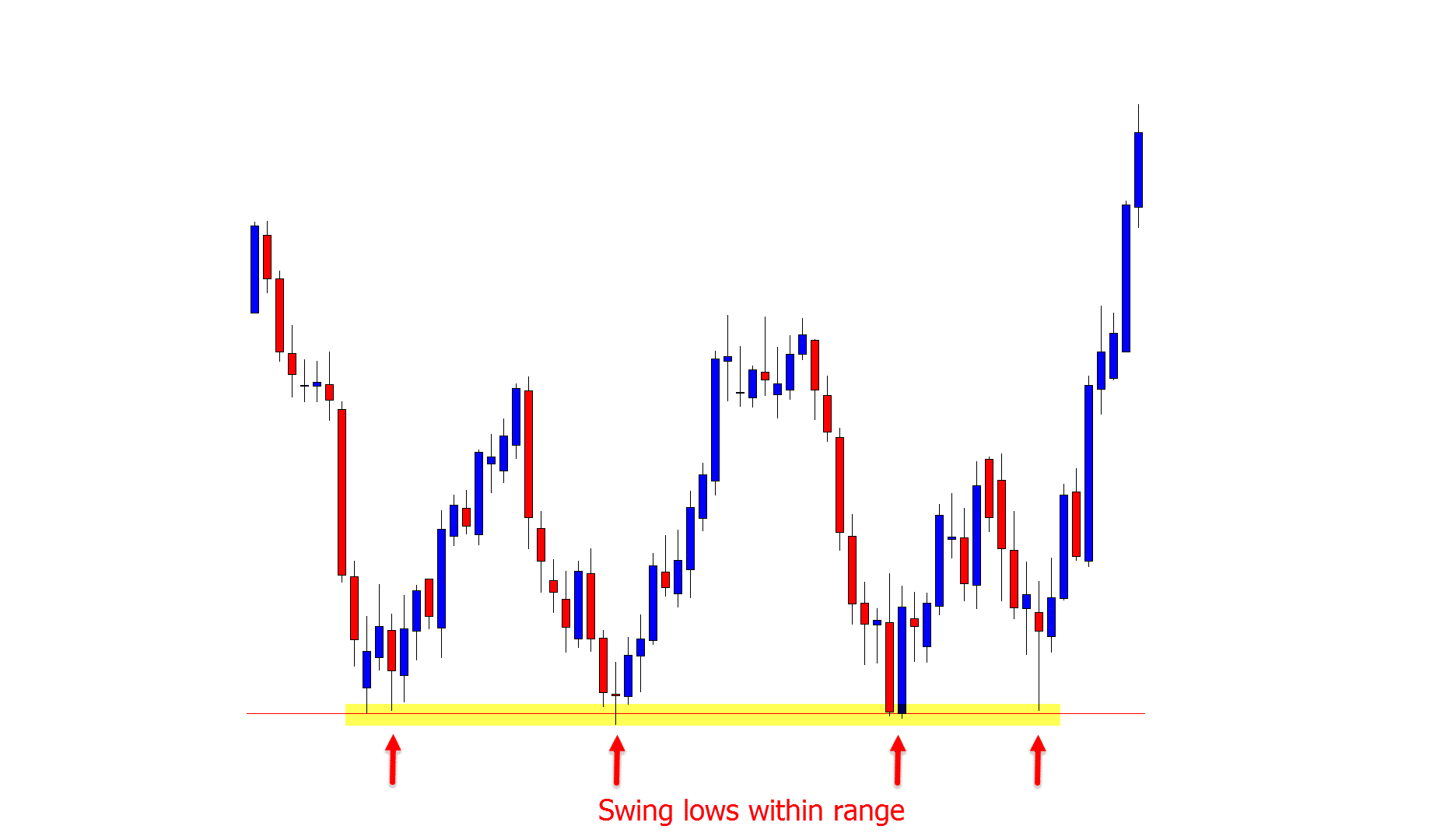

Swing points ko identify karne ke liye, traders usually candlestick charts ka use karte hain. Candlesticks price movements ko visually represent karte hain aur inhe dekh kar swing highs aur swing lows ko identify kiya ja sakta hai.

- Swing High Identify Karna:

- Ek swing high tab hota hai jab price ne ek high banaya aur phir do consecutive periods mein low bana.

- Example ke taur par, agar price ne $50 ko touch kiya aur phir agle do periods mein $48 aur $46 tak aayi, to $50 ek swing high hoga.

- Swing Low Identify Karna:

- Ek swing low tab hota hai jab price ne ek low banaya aur phir do consecutive periods mein high banaya.

- Example ke taur par, agar price $30 tak gir gayi aur phir agle do periods mein $32 aur $34 tak gayi, to $30 ek swing low hoga.

Swing Points Ka Use Karna

Swing points ko identify karne ke baad, traders inhe trading decisions banane mein use karte hain. Yahan kuch common strategies hain jo swing points ke saath use hoti hain:

- Support Aur Resistance Levels:

- Swing highs aur swing lows ko support aur resistance levels identify karne ke liye use kiya ja sakta hai. Swing lows as support aur swing highs as resistance ka kaam karte hain.

- Agar price ek swing high ke paas hai, to yeh resistance ka kaam karega aur price wahan se niche aasakti hai. Agar price ek swing low ke paas hai, to yeh support ka kaam karega aur price wahan se upar ja sakti hai.

- Trend Reversals:

- Swing points ko trend reversals identify karne ke liye bhi use kiya ja sakta hai. Agar price ek swing high ko break karti hai, to yeh indicate kar sakta hai ke trend bullish ho raha hai. Agar price ek swing low ko break karti hai, to yeh indicate kar sakta hai ke trend bearish ho raha hai.

- Entry Aur Exit Points:

- Swing points ko trading positions ke entry aur exit points determine karne ke liye bhi use kiya ja sakta hai. Example ke taur par, agar ek trader dekh raha hai ke price ek swing high ko break kar rahi hai, to yeh buy signal ho sakta hai. Isi tarah, agar price ek swing low ko break kar rahi hai, to yeh sell signal ho sakta hai.

Risk Management

Swing point trading mein risk management bhi bohot important hai. Swing points ko identify karke, traders stop-loss levels aur profit targets set kar sakte hain. Stop-loss levels ek predefined price level hota hai jahan trader apni position ko loss me band kar deta hai taake zyada loss na ho. Profit targets wo predefined price level hote hain jahan trader apni position ko profit me band kar deta hai.

Swing point trading ek effective technique hai jo traders ko market ke short-term movements ko analyze karne aur trading decisions banane mein madad karti hai. Swing highs aur swing lows ko identify karke, traders support aur resistance levels, trend reversals aur entry/exit points dekh sakte hain. Effective risk management ke saath, swing point trading se consistent profits kamaye ja sakte hain.

تبصرہ

Расширенный режим Обычный режим