Topic : Support and Resistance Line Location

Support Aur Resistance Kya Hai?

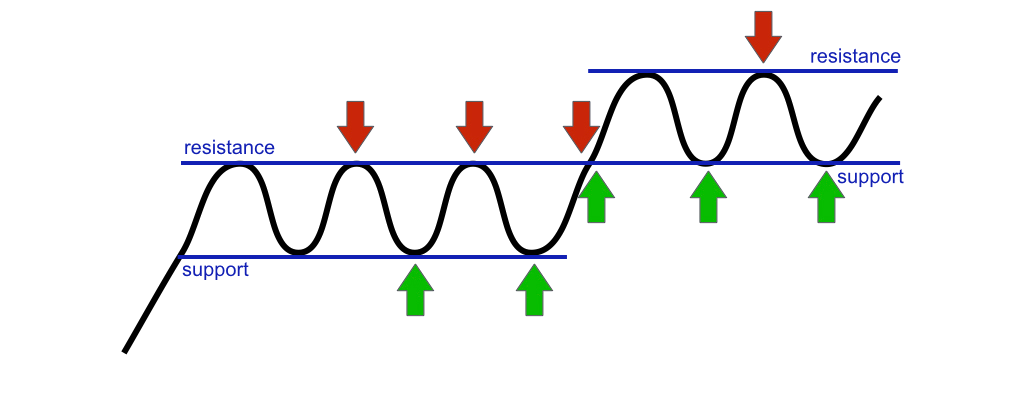

Support aur resistance trading ke important concepts hain jo market ki price movements ko samajhne mein madad karte hain. Support wo price level hai jahan demand strong hoti hai aur price ko niche girne se rokta hai. Resistance wo price level hai jahan supply strong hoti hai aur price ko oopar jane se rokta hai.

Support Line Location Kaise Karein?

- Historical Price Data:

- Support line locate karne ke liye historical price data ko analyze karein. Wo points identify karein jahan price ne pehle bounce back kiya ho. Yeh points future mein bhi support level ban sakte hain.

- Round Numbers:

- Traders often psychological levels par trade karte hain, jaise round numbers (e.g., $50, $100). Yeh levels frequently support ki tarah kaam karte hain kyunke in par buying interest zyada hota hai.

- Volume Analysis:

- High volume areas ko dekh kar bhi support levels identify kiya ja sakta hai. Jab price kisi level par high volume ke sath trade hui ho, to wo level strong support ban sakta hai.

Resistance Line Location Kaise Karein?

- Previous Highs:

- Resistance line locate karne ke liye previous highs ko dekhain. Wo points identify karein jahan price ne pehle resistance face kiya ho aur neeche gir gaya ho. Yeh points future mein bhi resistance level ban sakte hain.

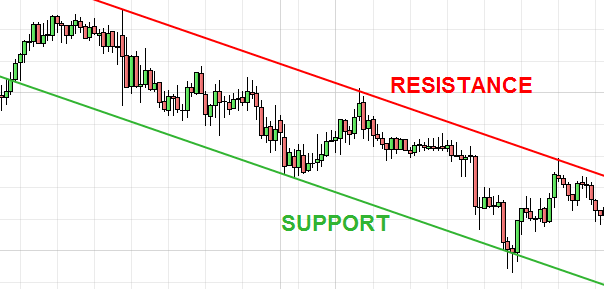

- Trendlines:

- Resistance lines ko trendlines draw karke bhi locate kiya ja sakta hai. Jab price continuously lower highs bana rahi ho to downward trendline resistance ki tarah act karegi.

- Technical Indicators:

- Technical indicators jaise Moving Averages aur Fibonacci Retracement bhi resistance levels ko identify karne mein madadgar hote hain. Jab price in indicators ke kareeb hoti hai, to resistance face kar sakti hai.

Support Aur Resistance Ko Kaise Use Karein?

- Entry and Exit Points:

- Support aur resistance levels ko entry aur exit points ke liye use karein. Support ke kareeb buy positions aur resistance ke kareeb sell positions consider kar sakte hain.

- Stop-Loss Placement:

- Stop-loss orders ko support aur resistance levels ke thoda neeche ya oopar place karein taake market noise se bach sakein aur position secure rahe.

- Trend Confirmation:

- Support aur resistance levels ko trend confirmation ke liye bhi use kiya ja sakta hai. Agar price support ko break kar de to downtrend aur resistance ko break kar de to uptrend ki confirmation milti hai.

Conclusion

Support aur resistance lines locate karna trading ka essential part hai. Historical price data, round numbers, volume analysis, previous highs, trendlines, aur technical indicators ko use karke in levels ko identify kar sakte hain. Yeh levels trading decisions ko guide karte hain aur risk management mein madadgar hote hain. Effective support aur resistance analysis se trading success ko enhance kiya ja sakta hai.

تبصرہ

Расширенный режим Обычный режим