Article: Leading vs Lagging Indicators in Forex Trading

Leading Indicators aLagging Indicators . In this article we are in two types

1.

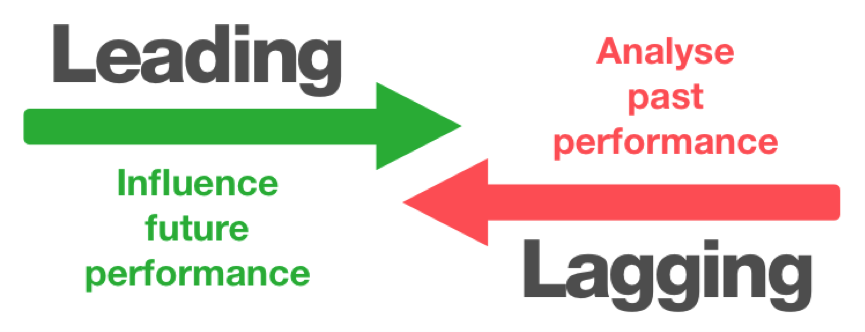

Leading indicators are signals that indicate future price movements in advance. These indicators can tell traders about a potential price reversal or breakout in advance, so they can take a position in advance. These indicators are mostly useful for short-term predictions and focus on price changes that may occur in the future.

Some common leading

2. Lagging Indicators Kya Hain?

Lagging indicators wo signals hain jo market trend ke confirm hone ke baad hi activate hote hain. Yeh indicators past price movement aur historical data par base karte hain. Lagging indicators ka kaam ye hai ke wo pehle se initiate hui trend ki confirmation dete hain, yaani agar ek trend start ho gaya hai to lagging indicator us trend ki strength aur direction ko confirm karne mein madadgar sabit hota hai.

Lagging indicators zyadatar long-term analysis ke liye use hote hain aur inka focus trend ke follow-up par hota hai. Yeh indicators itne jaldi signal nahi dete lekin jab dete hain to wo zyadatar reliable hote hain kyunke wo past trends par base karte hain. Kuch famous lagging indicators mein Moving Averages (MA), Bollinger Bands aur Parabolic SAR shamil hain.

3. Leading Indicators ka Faida aur Nuksan

Leading indicators ka sabse bara faida ye hai ke ye traders ko pehle se entry aur exit points ka andaza dete hain. Yeh jaldi signals dete hain aur agar sahi analyze kiya jaye to traders ko short-term trading mein kaafi faida ho sakta hai. Aam tor par, scalpers aur day traders leading indicators ko zyada use karte hain kyunke unka focus quick profits par hota hai.

Lekin, inka nuksan ye hai ke leading indicators aksar false signals bhi dete hain. Kyunke ye price ke short-term movement par focus karte hain, is wajah se kai dafa market ke chhote fluctuations ko bhi major signal samajh liya jata hai. Is wajah se, agar in indicators ko bina kisi aur analysis ke use kiya jaye to ye risky ho sakta hai.

4. Lagging Indicators ka Faida aur Nuksan

Lagging indicators reliable signals dete hain aur traders ko trend ke confirm hone ka wait karne mein madadgar hote hain. Yeh indicators long-term investors ke liye useful hote hain kyunke ye unko pehle se established trend ko follow karne ka mauka dete hain. Iska faida ye hai ke traders ko market ke false moves mein phasne ka khatra kam hota hai aur wo ek clear aur confirmed trend ke saath trade karte hain.

Lekin, lagging indicators ka nuksan ye hai ke ye signals late provide karte hain. Iska matlab ye hai ke trend initiate hone ke baad hi yeh indicators signal dete hain, jis ki wajah se kuch early profit miss ho jata hai. Long-term traders jo patience ke saath kaam karte hain, wo lagging indicators ko prefer karte hain lekin quick profits ke liye yeh indicators mushkil ho sakte hain.

5. Leading aur Lagging Indicators ka Combo Istemaal

Forex trading mein kaafi traders leading aur lagging indicators ko combine karte hain taake wo market ko behtar understand kar saken. Ek combination approach yeh hoti hai ke pehle leading indicator se entry point find kiya jaye aur lagging indicator se trend ke confirm hone ka wait kiya jaye. Iss tarah se, traders ko advance signals bhi mil jate hain aur trend confirmation bhi hoti hai jo unke trades ko aur reliable bana deti hai.

Agar hum ek example dekhain, to koi trader RSI aur Moving Average ko combine kar sakta hai. RSI jo ke ek leading indicator hai, wo overbought aur oversold conditions ko indicate karta hai. Iske baad, Moving Average jo ke ek lagging indicator hai, us trend ko confirm karne mein madadgar hoga. Is tarah ke combination se risk kam hota hai aur trading decisions zyada accurate hote hain.

6. Kaunsa Indicator Best Hai?

Ye sawal ke konsa indicator best hai, iska jawab depend karta hai trader ke trading style aur goals par. Agar ek trader short-term trading mein interested hai aur jaldi signals chahta hai to wo leading indicators ko prefer karega. Aise traders jo scalping aur day trading mein hote hain wo aksar leading indicators ko apni strategy mein shamil karte hain.

Dusri taraf, agar ek trader long-term trend ke sath ride lena chahta hai aur zyada reliable signals ki talash mein hai, to wo lagging indicators par focus karega. Swing traders aur long-term investors lagging indicators ko zyada use karte hain kyunke ye unko reliable aur stable trend ki confirmation dete hain.

Conclusion

Forex trading mein leading aur lagging indicators ka apna apna role hai aur dono ki importance alag hai. Leading indicators market ke movements ko pehle se indicate karte hain jabke lagging indicators trend ki confirmation dete hain. Ek successful trader ke liye ye samajhna zaroori hai ke kab aur kaise in indicators ka istemal kiya jaye. Leading aur lagging indicators ka combo istamal karna aik behtar strategy ho sakta hai jo risk ko reduce aur accuracy ko increase karta hai.

تبصرہ

Расширенный режим Обычный режим