what is Hammer Candlestick pattern?

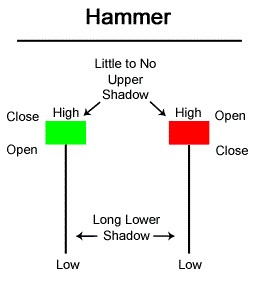

forex market mein hammer candlestick pattern price ka aik candlestick chart pattern hota hey yeh os time banta hey jab koi security ke price apnay chart par analysis kar rehe hote hey laken start ke price close honay kay period mein rally ko nekalte hey yeh candlestick pattern hammer ke shape ka mein pattern banata hey jo keh real body say kam az kam double hota hey lower shadow real body kay size ka kam az kam double hota hey candlestick ke body kay start price or end price mein he gap ho jata hey jabkeh shadow es pattern kay high price or low price ko zahair kar saktay hein

Understanding Hammer Candlestick Pattern

security ke price mein kame kay sath hammer os time banta hota hey jo yeh batata hy keh market mechay ketaraf koshesh kar rehe hote hey forex market mein hammer seller kund gan ke taraf say aik mumkana had bande ke taraf eshara karta hey price mein ezafay kay sath he price mumkana reveersal janay ka eshara kar sakte hey yeh sab forex market mein aik he period kay doran hota hey price opening say pehlay grte hey laken price kay phir say dobara group ban jatay hein

Hammer candlestick pattern T ke shape ka pattern hota hey yh os time tak price ko reversal nahi lay kar jate hey jab tak price ke confirmation nahi ho jate hey

forex market mein es bat ke confirmation hone jab hammer kay bad close honay wale price oper ke taraf close ho jate hey mesal kay tor par confirmation candlestick strong buy ko he identify kar sakte hey candlestick kay trader aam tor par confirmation candlestick kay bad long position mein enter honay or short position say exit ho jatay hein new price kay nechay hammer kay nechay stop loss rakha ja sakta hey

Trade ke example

:max_bytes(150000):strip_icc():format(webp)/hammercandlestick-5c620b2ac9e77c0001566ce8.jpg)

forex market mein hammer candlestick pattern ke oper mesal de gai hey forex market ka chart price ke kame ko he zahair kar sakta hey jes kay bad hammer pattern banta hota hey jokeh real body say log hota hey Hammer price kay mumkana reversal janay ke taraf eshara karta hey

forex market mein es ke confirmation agle candlestick par he nazar atte hey Hammer ke close price qareeb qareeb tak bole jate hey

trader aam tor par confirmation candlestick kay bad buy kay ley step kartay hein aik stop loss hammer candlestick pattern kay nechay rakh deya jata hey yeh mumkana tor par hammer ke lower body say he nechay rakh deya jata hey or price ke confirmation candlestick kay jare tor par he barah jate hey

forex market mein hammer candlestick pattern price ka aik candlestick chart pattern hota hey yeh os time banta hey jab koi security ke price apnay chart par analysis kar rehe hote hey laken start ke price close honay kay period mein rally ko nekalte hey yeh candlestick pattern hammer ke shape ka mein pattern banata hey jo keh real body say kam az kam double hota hey lower shadow real body kay size ka kam az kam double hota hey candlestick ke body kay start price or end price mein he gap ho jata hey jabkeh shadow es pattern kay high price or low price ko zahair kar saktay hein

Understanding Hammer Candlestick Pattern

security ke price mein kame kay sath hammer os time banta hota hey jo yeh batata hy keh market mechay ketaraf koshesh kar rehe hote hey forex market mein hammer seller kund gan ke taraf say aik mumkana had bande ke taraf eshara karta hey price mein ezafay kay sath he price mumkana reveersal janay ka eshara kar sakte hey yeh sab forex market mein aik he period kay doran hota hey price opening say pehlay grte hey laken price kay phir say dobara group ban jatay hein

Hammer candlestick pattern T ke shape ka pattern hota hey yh os time tak price ko reversal nahi lay kar jate hey jab tak price ke confirmation nahi ho jate hey

forex market mein es bat ke confirmation hone jab hammer kay bad close honay wale price oper ke taraf close ho jate hey mesal kay tor par confirmation candlestick strong buy ko he identify kar sakte hey candlestick kay trader aam tor par confirmation candlestick kay bad long position mein enter honay or short position say exit ho jatay hein new price kay nechay hammer kay nechay stop loss rakha ja sakta hey

Trade ke example

:max_bytes(150000):strip_icc():format(webp)/hammercandlestick-5c620b2ac9e77c0001566ce8.jpg)

forex market mein hammer candlestick pattern ke oper mesal de gai hey forex market ka chart price ke kame ko he zahair kar sakta hey jes kay bad hammer pattern banta hota hey jokeh real body say log hota hey Hammer price kay mumkana reversal janay ke taraf eshara karta hey

forex market mein es ke confirmation agle candlestick par he nazar atte hey Hammer ke close price qareeb qareeb tak bole jate hey

trader aam tor par confirmation candlestick kay bad buy kay ley step kartay hein aik stop loss hammer candlestick pattern kay nechay rakh deya jata hey yeh mumkana tor par hammer ke lower body say he nechay rakh deya jata hey or price ke confirmation candlestick kay jare tor par he barah jate hey

تبصرہ

Расширенный режим Обычный режим