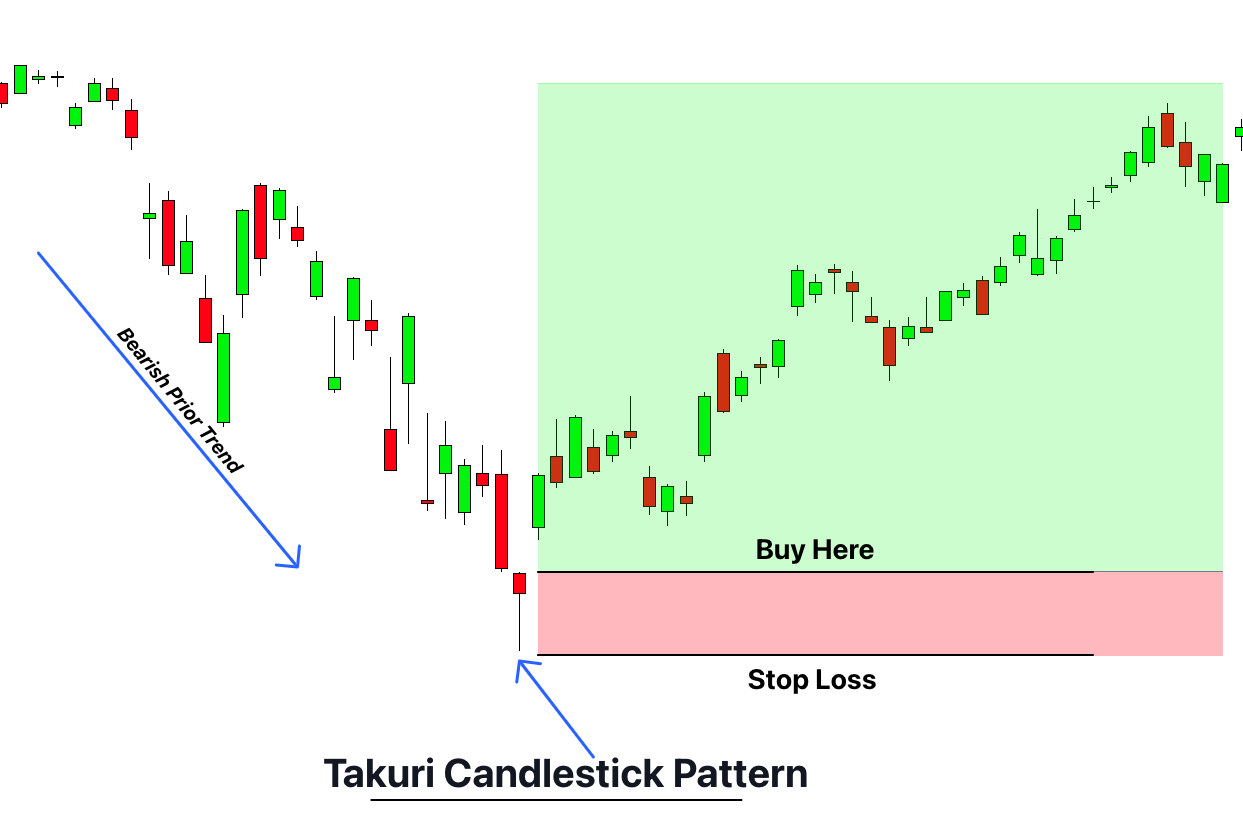

What is Takuri Candlestick pattern?

forex market mein Takuri candlestick pattern aik unique kesam ka single candlestick pattern hota hey yeh candlestick pattern bullish trend reversal candlestick pattern hota hey forex market mein es candlestick pattern ke shape nayab hote hey forex market mein candlestick pattern ke body bohut he chote hote hey lowerr wick mein ghair mamole long hote hey upper wick ghaib hote hey lower wick ke lambai aam tor par 3 gena hote hey yeh candlestick black or white color mein hote hey forex market mein candlestick kay rang mein koi farq nahi parta hey trend basic tor par Takuri line candlestick pattern kay sath he bullish reversal janay wala hota hey

Understanding Takuri Candlestick Pattern

yeh candlestick pattern forex chart kay nechay zahair ho sakta hey es ko forex market ky bearish trend kay reversal janay ko he identify keya ja sakta hey or forex market mein bull aa jain gay forex market mein candlestick ke body batate hey keh forex market mein opening or close kay darmean mein he gap hota hey es candlestick pattern say zahair hota hey keh forex market mein sab say low points ko shamel karnay ke zaroorat hote hey jaisa keh pattern confirmation karta hey market mein buyer move ho jatay hein kunkeh anay wale market bullish kay jazbaat ko he identify karte hey

Trading strategy with Takuri candlestick Pattern

yeh candlestick pattern forex market mein bullish reversal janay kay jazbat ke akace bhe karta hey forex market mein bulls apni strength ko phir say hasel kar rahay hotay hein mostaqbel qareeb mein prices increase honay wale hote hey es ley yeh assert buy ka best chance hota hey forex market mein anay wale price short selling ko identify karte hey ager yeh candlestick support zone mein nazar atte hey to forex market kay assert buy ka kabel e aitmad time hota hey

kai dafa Takuri candlestick pattern price mein gap ko he identify karte hey es kay bad kuch trader candlestick kay opening mein market mein enter hotay hein or bullish kay trend mein zyada say zyada profit hasel hota hey

Risk Management

es kesam kay candlestick pattern mein stop loss ko candlestick ke body kay nechay he rakh deya jata hey long lower wick batata hey market kay sab say low point ko talash karnay ke koshesh karne chihay stop loss ko candlestick kay belkul nechay rakha jana chihay

ATR ka trailing stop indicator ko he estamal karna chihay jes say trade ko close keya ja sakta hey

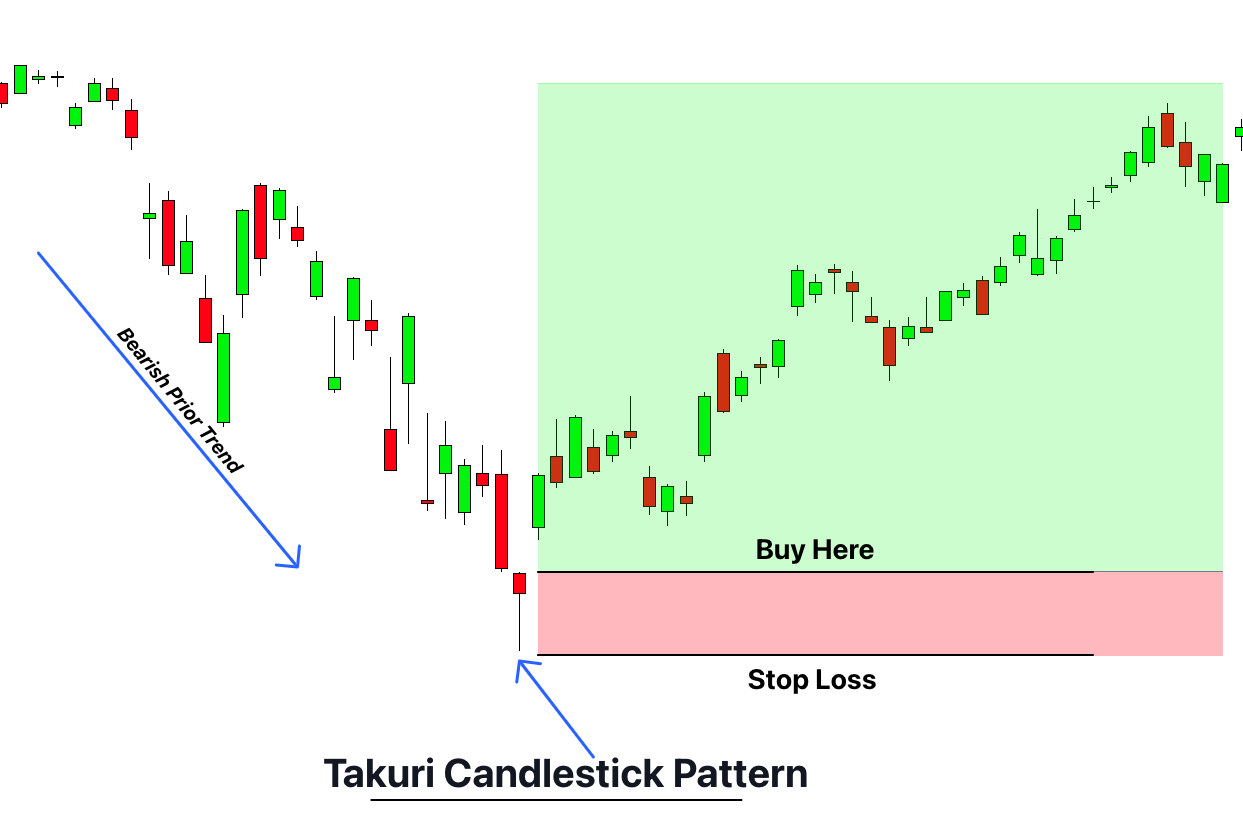

forex market mein Takuri candlestick pattern aik unique kesam ka single candlestick pattern hota hey yeh candlestick pattern bullish trend reversal candlestick pattern hota hey forex market mein es candlestick pattern ke shape nayab hote hey forex market mein candlestick pattern ke body bohut he chote hote hey lowerr wick mein ghair mamole long hote hey upper wick ghaib hote hey lower wick ke lambai aam tor par 3 gena hote hey yeh candlestick black or white color mein hote hey forex market mein candlestick kay rang mein koi farq nahi parta hey trend basic tor par Takuri line candlestick pattern kay sath he bullish reversal janay wala hota hey

Understanding Takuri Candlestick Pattern

yeh candlestick pattern forex chart kay nechay zahair ho sakta hey es ko forex market ky bearish trend kay reversal janay ko he identify keya ja sakta hey or forex market mein bull aa jain gay forex market mein candlestick ke body batate hey keh forex market mein opening or close kay darmean mein he gap hota hey es candlestick pattern say zahair hota hey keh forex market mein sab say low points ko shamel karnay ke zaroorat hote hey jaisa keh pattern confirmation karta hey market mein buyer move ho jatay hein kunkeh anay wale market bullish kay jazbaat ko he identify karte hey

Trading strategy with Takuri candlestick Pattern

yeh candlestick pattern forex market mein bullish reversal janay kay jazbat ke akace bhe karta hey forex market mein bulls apni strength ko phir say hasel kar rahay hotay hein mostaqbel qareeb mein prices increase honay wale hote hey es ley yeh assert buy ka best chance hota hey forex market mein anay wale price short selling ko identify karte hey ager yeh candlestick support zone mein nazar atte hey to forex market kay assert buy ka kabel e aitmad time hota hey

kai dafa Takuri candlestick pattern price mein gap ko he identify karte hey es kay bad kuch trader candlestick kay opening mein market mein enter hotay hein or bullish kay trend mein zyada say zyada profit hasel hota hey

Risk Management

es kesam kay candlestick pattern mein stop loss ko candlestick ke body kay nechay he rakh deya jata hey long lower wick batata hey market kay sab say low point ko talash karnay ke koshesh karne chihay stop loss ko candlestick kay belkul nechay rakha jana chihay

ATR ka trailing stop indicator ko he estamal karna chihay jes say trade ko close keya ja sakta hey

تبصرہ

Расширенный режим Обычный режим