Spinning Top Candlestick Pattern: Forex Trading Mein Unki Ahmiyat

1. Introduction

Forex trading mein candlestick patterns ka use traders ke liye ek ahm tool hota hai, jo unhein market ki bhavnaon aur price movements ko samajhne mein madad karte hain. Aaj hum "Spinning Top" candlestick pattern par ghor karenge, jo ke ek important signal hai price reversals ya continuation ke liye. Is maqale mein hum Spinning Top pattern ki definitions, characteristics, significance, aur trading strategies ka jaiza lenge.

2. Spinning Top Candlestick Kya Hota Hai?

2.1. Definition

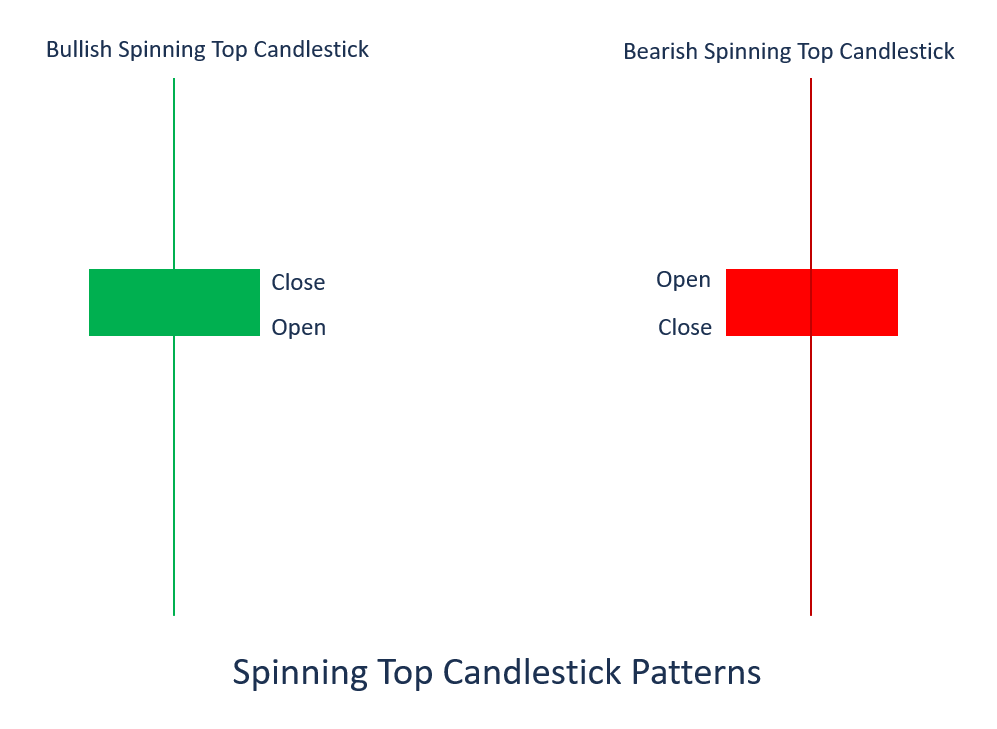

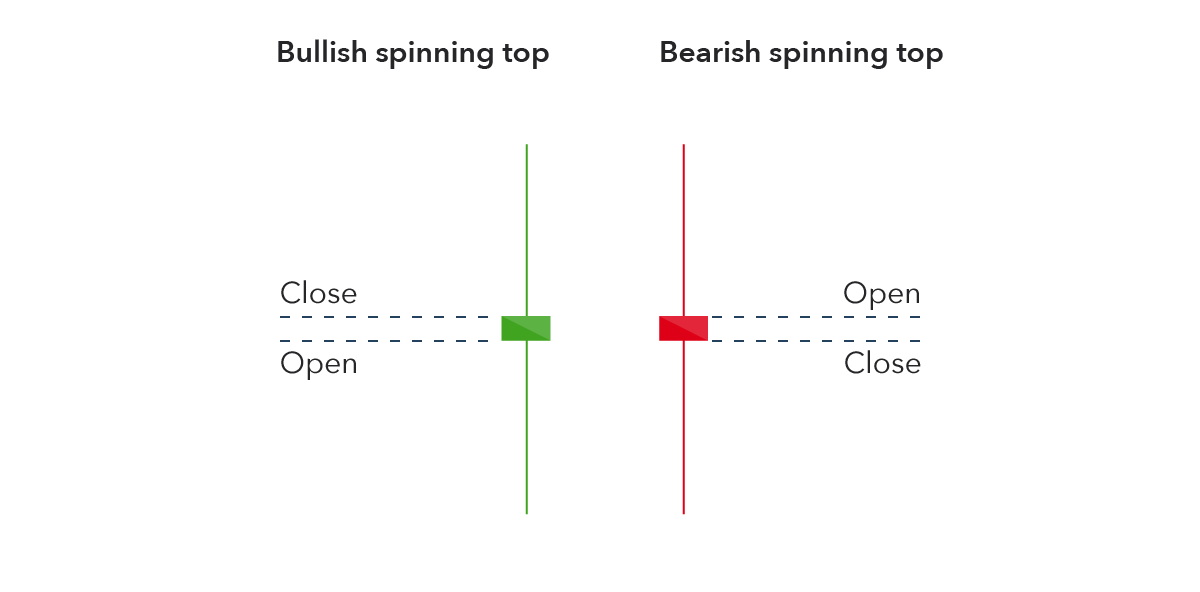

Spinning Top ek aisa candlestick pattern hai jiska body chhota hota hai lekin upper aur lower shadows kaafi lambay hote hain. Yeh pattern market ke indecisiveness ya uncertainty ko darshata hai.

2.2. Characteristics

3.1. Market Sentiment

Spinning Top pattern market ki bhavnaon ko mazbooti se darshata hai. Jab yeh pattern emerge hota hai, toh iska matlab hota hai ke market mein traders ke beech confusion hai. Yeh pattern aam tor par reversal ya continuation trends ki taraf ishara karta hai.

3.2. Reversal Signals

Agar Spinning Top bullish trend ke baad aata hai, toh yeh ek reversal signal ki tarah dekha ja sakta hai. Iska matlab hota hai ke market sentiment shift hone wala hai.

Aksar bearish trend ke baad agar yeh pattern banta hai toh yeh bullish reversal ki taraf ishara karta hai.

3.3. Confirmation Ki Zarurat

Spinning Top khud ek strong signal nahi hota. Iski effectiveness ko samajhne ke liye traders ko confirmation candlestick ke saath dekhna chahiye.

4. Trading Strategies for Spinning Top Candlestick Pattern

4.1. Identifying the Pattern

Pattern ko identify karne ke liye traders ko candlestick charts par dhyaan dena chahiye. Agar yeh pattern market mein dikhai de raha hai toh yeh trading decision lene ka mauka ho sakta hai.

4.2. Entry and Exit Points

4.2.1. Entry Point

Traders ko stop loss ko uski body ke neeche ya upar rakhna chahiye, yeh depend karta hai ke woh bullish ya bearish trade kar rahe hain.

4.2.3. Take Profit

Take profit targets ko resistance ya support level ke aas-paas tayin karna chahiye, yeh is baat par depend karta hai ke market kis taraf ja raha hai.

4.3. Using Other Indicators

Spinning Top pattern ki effectiveness ko behter banane ke liye, traders ko dusre technical indicators ka istemal karna chahiye jaise ke Moving Averages, RSI (Relative Strength Index), ya MACD (Moving Average Convergence Divergence).

5. Spinning Top Pattern ke Faida aur Nuqsan

5.1. Faida

Spinning Top Candlestick Pattern Forex trading mein ek valuable tool hai jo traders ko market ke sentiment aur price movements ka andaza lagane mein madad karta hai. Aaj ke is maqale mein humne dekha ke kis tarah se yeh pattern market trends aur reversals ko samajhne mein madad karta hai. Is ke sath hi, traders ko chahiye ke yeh pattern ke saath dusre indicators ka istemal karein taake zyada accurate decisions le sakein.

Trading mein hamesha risk management ko dhyaan mein rakhein aur apni research karein. Spinning Top pattern ko seekhna aur istemal karna trading skills ko behtar banane mein madadgar sabit hoga. Apne experiences aur observations ko note karna na bhoolen, kyunki yeh sab kuch seekhne ka ek hissa hai.

Yeh maqala aapko Spinning Top pattern ki acchi tarah samajh dila sakta hai aur trading mein aapki maharat ko behter banane mein madadgar sabit hoga. Happy Trading!

1. Introduction

Forex trading mein candlestick patterns ka use traders ke liye ek ahm tool hota hai, jo unhein market ki bhavnaon aur price movements ko samajhne mein madad karte hain. Aaj hum "Spinning Top" candlestick pattern par ghor karenge, jo ke ek important signal hai price reversals ya continuation ke liye. Is maqale mein hum Spinning Top pattern ki definitions, characteristics, significance, aur trading strategies ka jaiza lenge.

2. Spinning Top Candlestick Kya Hota Hai?

2.1. Definition

Spinning Top ek aisa candlestick pattern hai jiska body chhota hota hai lekin upper aur lower shadows kaafi lambay hote hain. Yeh pattern market ke indecisiveness ya uncertainty ko darshata hai.

2.2. Characteristics

- Chhoti Body: Spinning Top ki body chhoti hoti hai, jo yeh darshata hai ke buyers aur sellers dono kaafi tahqiqat kar rahe hain.

- Lambe Shadows: Upper aur lower shadows kaafi lambay hote hain, yeh darshata hai ke price ne dono taraf movement kiya hai phir bhi close price near to open ke aas-paas hoti hai.

- Color: Body ka color bullish (green) ya bearish (red) ho sakta hai, chahe yeh positive ya negative sentiment darshata ho.

3.1. Market Sentiment

Spinning Top pattern market ki bhavnaon ko mazbooti se darshata hai. Jab yeh pattern emerge hota hai, toh iska matlab hota hai ke market mein traders ke beech confusion hai. Yeh pattern aam tor par reversal ya continuation trends ki taraf ishara karta hai.

3.2. Reversal Signals

Agar Spinning Top bullish trend ke baad aata hai, toh yeh ek reversal signal ki tarah dekha ja sakta hai. Iska matlab hota hai ke market sentiment shift hone wala hai.

Aksar bearish trend ke baad agar yeh pattern banta hai toh yeh bullish reversal ki taraf ishara karta hai.

3.3. Confirmation Ki Zarurat

Spinning Top khud ek strong signal nahi hota. Iski effectiveness ko samajhne ke liye traders ko confirmation candlestick ke saath dekhna chahiye.

4. Trading Strategies for Spinning Top Candlestick Pattern

4.1. Identifying the Pattern

Pattern ko identify karne ke liye traders ko candlestick charts par dhyaan dena chahiye. Agar yeh pattern market mein dikhai de raha hai toh yeh trading decision lene ka mauka ho sakta hai.

4.2. Entry and Exit Points

4.2.1. Entry Point

- Bullish Reversal: Agar Spinning Top bearish trend ke beech mein ban raha hai, traders ko iski confirmation ke liye agla bullish candle dekhna chahiye. Jab next candle closing price Spinning Top se zyada ho tu yeh entry point ho sakta hai.

- Bearish Reversal: Agar Spinning Top bullish trend ke beech mein ban raha hai, toh bearish confirmation candle dekh aur uske baad sell position lena.

Traders ko stop loss ko uski body ke neeche ya upar rakhna chahiye, yeh depend karta hai ke woh bullish ya bearish trade kar rahe hain.

4.2.3. Take Profit

Take profit targets ko resistance ya support level ke aas-paas tayin karna chahiye, yeh is baat par depend karta hai ke market kis taraf ja raha hai.

4.3. Using Other Indicators

Spinning Top pattern ki effectiveness ko behter banane ke liye, traders ko dusre technical indicators ka istemal karna chahiye jaise ke Moving Averages, RSI (Relative Strength Index), ya MACD (Moving Average Convergence Divergence).

5. Spinning Top Pattern ke Faida aur Nuqsan

5.1. Faida

- Market Sentiment Ko Samajhna: Spinning Top traders ko market ki needs aur desires ko samajhne mein madad karta hai.

- Trend Reversal Points: Yeh pattern trend reversal points ko identify karne mein madadgar hota hai.

- Flexible Trading: Traders is pattern ko kisi bhi time frame par use kar sakte hain, be it hourly, daily, ya weekly charts.

- False Signals: Spinning Top kabhi kabhi false signals bhi de sakta hai, jo traders ko confusion mein daal sakta hai.

- Confirmation Ka Intizaaar: Traders ko confirmation candle ka intezaar karna padta hai, jo kabhi kabhi late ho sakti hai.

- Market Conditions: Market mein liquidity aur volatility bhi effect karte hain is pattern ki effectiveness ko.

Spinning Top Candlestick Pattern Forex trading mein ek valuable tool hai jo traders ko market ke sentiment aur price movements ka andaza lagane mein madad karta hai. Aaj ke is maqale mein humne dekha ke kis tarah se yeh pattern market trends aur reversals ko samajhne mein madad karta hai. Is ke sath hi, traders ko chahiye ke yeh pattern ke saath dusre indicators ka istemal karein taake zyada accurate decisions le sakein.

Trading mein hamesha risk management ko dhyaan mein rakhein aur apni research karein. Spinning Top pattern ko seekhna aur istemal karna trading skills ko behtar banane mein madadgar sabit hoga. Apne experiences aur observations ko note karna na bhoolen, kyunki yeh sab kuch seekhne ka ek hissa hai.

Yeh maqala aapko Spinning Top pattern ki acchi tarah samajh dila sakta hai aur trading mein aapki maharat ko behter banane mein madadgar sabit hoga. Happy Trading!

تبصرہ

Расширенный режим Обычный режим