Introduction of Spinning top candlestick pattern

Spinning Top pattern ka trading signal market ke direction ke baare mein clear nahi hota. Lekin, jab yeh pattern significant support ya resistance levels ke nazdeek appear hota hai, tab yeh market reversal ya continuation ka signal de sakta hai. Is pattern ke trading signals ko confirmatory indicators ke sath use karna zaroori hai.Agar Spinning Top pattern bullish trend ke baad appear hota hai, to yeh trend reversal ya consolidation ka signal ho sakta hai. Traders ko iske sath bullish confirmation signals jaise Moving Average Crossover ya RSI readings bhi dekhni chahiye. Yeh confirmation signals pattern ke accuracy ko enhance karte hain.Bearish Spinning Top ke case me, agar yeh pattern uptrend ke baad appear hota hai, to yeh bearish reversal ya consolidation ka signal ho sakta hai. Is pattern ke sath bearish confirmation signals jaise MACD Crossovers ya trendline breaks ko dekhna zaroori hai. Yeh signals pattern ke reliability ko increase karte hain.

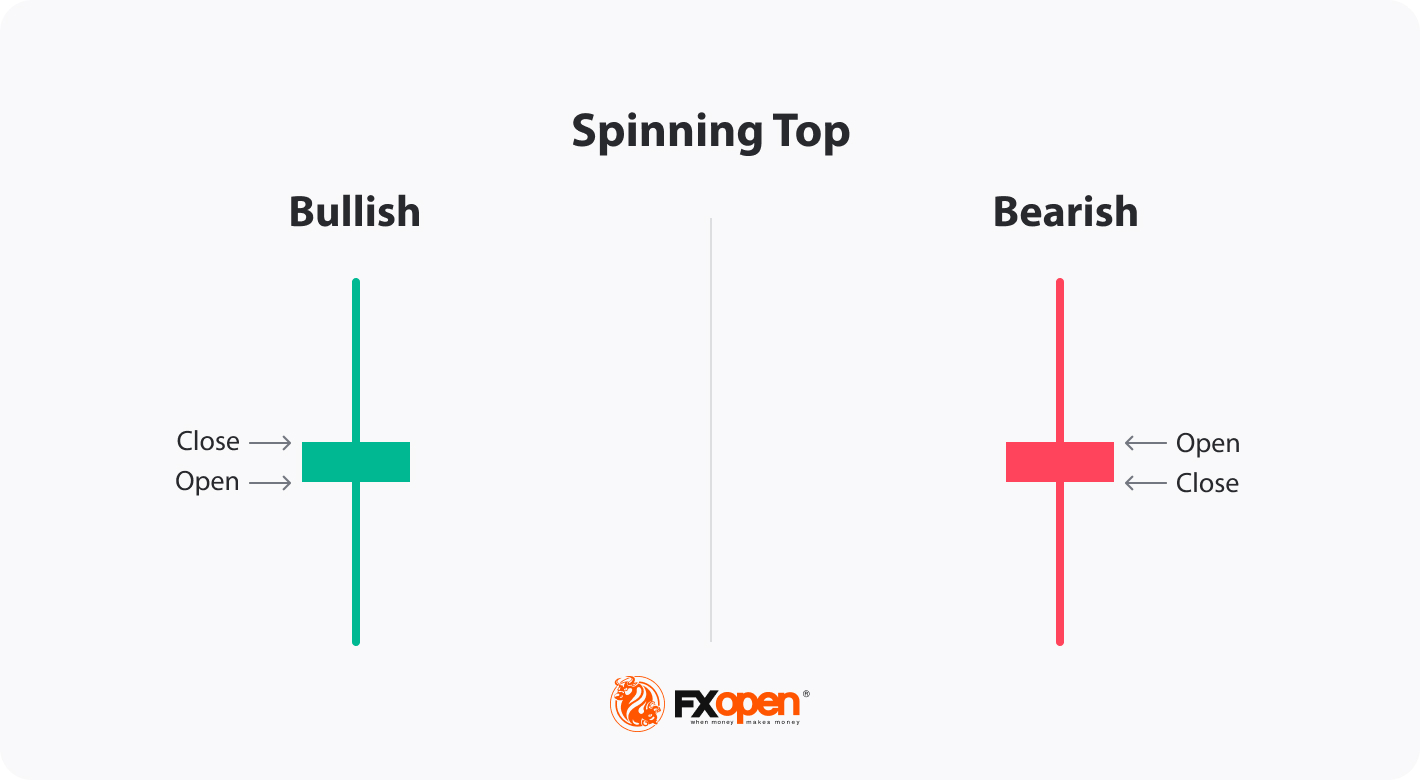

Formation and Identification

Spinning Top pattern ko identify karna relatively aasan hai agar aap technical analysis ki basic understanding rakhte hain. Is pattern ki pehchaan ke liye aapko yeh dekhna hoga ke candlestick ki body chhoti hai aur shadows lambi hain. Iski body opening aur closing price ke beech ka difference show karti hai, jabke shadows market ki volatility ko represent karti hain.Spinning Top ki body chhoti aur shadows lambi hoti hain. Body ka size market ke indecision ko reflect karta hai, jabke shadows market ke higher aur lower prices ko dikhati hain. Yeh combination market ke uncertainty aur lack of clear direction ko highlight karta hai.Pattern ki pehchaan karte waqt, yeh bhi important hai ke aap candlestick ke location aur market context ko samjhein. Agar Spinning Top trend ke reversal points ke nazdeek appear hota hai, to yeh market ke future movement ke bare me kuch hints provide kar sakta hai. Is pattern ko single candlestick ke form me bhi analyse kiya ja sakta hai aur larger chart patterns ke sath bhi dekha ja sakta hai.

Treading strategies

Spinning Top pattern ko trading strategy me incorporate karna kaafi effective ho sakta hai agar aap pattern ke signals ko sahi tarah se analyse karen. Trading strategy me pattern ke confirmation signals, risk management aur trading rules ka hona zaroori hai.Agar Spinning Top pattern appear hota hai, to aapko iske baad confirmation signals dekhne chahiye. Agar pattern bullish hai aur confirmation signals bhi bullish hain, to aap long position open kar sakte hain. Agar pattern bearish hai aur confirmation signals bhi bearish hain, to aap short position open kar sakte hain.Stop loss aur take profit levels ko zaroor set karna chahiye. Stop loss aapki potential losses ko control karne me madad karta hai, jabke take profit levels aapke trading goals ko achieve karne me help karte hain. Risk-reward ratio ko bhi consider karna chahiye.

Spinning Top pattern ka trading signal market ke direction ke baare mein clear nahi hota. Lekin, jab yeh pattern significant support ya resistance levels ke nazdeek appear hota hai, tab yeh market reversal ya continuation ka signal de sakta hai. Is pattern ke trading signals ko confirmatory indicators ke sath use karna zaroori hai.Agar Spinning Top pattern bullish trend ke baad appear hota hai, to yeh trend reversal ya consolidation ka signal ho sakta hai. Traders ko iske sath bullish confirmation signals jaise Moving Average Crossover ya RSI readings bhi dekhni chahiye. Yeh confirmation signals pattern ke accuracy ko enhance karte hain.Bearish Spinning Top ke case me, agar yeh pattern uptrend ke baad appear hota hai, to yeh bearish reversal ya consolidation ka signal ho sakta hai. Is pattern ke sath bearish confirmation signals jaise MACD Crossovers ya trendline breaks ko dekhna zaroori hai. Yeh signals pattern ke reliability ko increase karte hain.

Formation and Identification

Spinning Top pattern ko identify karna relatively aasan hai agar aap technical analysis ki basic understanding rakhte hain. Is pattern ki pehchaan ke liye aapko yeh dekhna hoga ke candlestick ki body chhoti hai aur shadows lambi hain. Iski body opening aur closing price ke beech ka difference show karti hai, jabke shadows market ki volatility ko represent karti hain.Spinning Top ki body chhoti aur shadows lambi hoti hain. Body ka size market ke indecision ko reflect karta hai, jabke shadows market ke higher aur lower prices ko dikhati hain. Yeh combination market ke uncertainty aur lack of clear direction ko highlight karta hai.Pattern ki pehchaan karte waqt, yeh bhi important hai ke aap candlestick ke location aur market context ko samjhein. Agar Spinning Top trend ke reversal points ke nazdeek appear hota hai, to yeh market ke future movement ke bare me kuch hints provide kar sakta hai. Is pattern ko single candlestick ke form me bhi analyse kiya ja sakta hai aur larger chart patterns ke sath bhi dekha ja sakta hai.

Treading strategies

Spinning Top pattern ko trading strategy me incorporate karna kaafi effective ho sakta hai agar aap pattern ke signals ko sahi tarah se analyse karen. Trading strategy me pattern ke confirmation signals, risk management aur trading rules ka hona zaroori hai.Agar Spinning Top pattern appear hota hai, to aapko iske baad confirmation signals dekhne chahiye. Agar pattern bullish hai aur confirmation signals bhi bullish hain, to aap long position open kar sakte hain. Agar pattern bearish hai aur confirmation signals bhi bearish hain, to aap short position open kar sakte hain.Stop loss aur take profit levels ko zaroor set karna chahiye. Stop loss aapki potential losses ko control karne me madad karta hai, jabke take profit levels aapke trading goals ko achieve karne me help karte hain. Risk-reward ratio ko bhi consider karna chahiye.

تبصرہ

Расширенный режим Обычный режим