Bearish Harami Candle Stick Pattern.

Introduction.

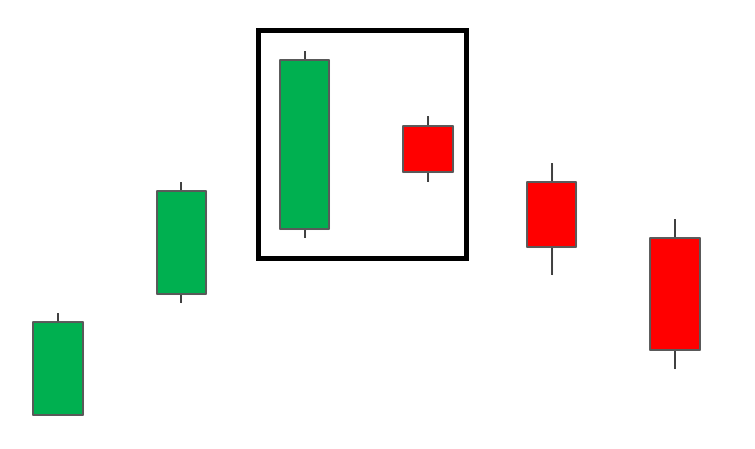

Bearish Harami ek candlestick pattern hota hai jo trend reversal ko indicate karta hai. Yeh pattern do candles se mil kar banta hai. Pehli candle bari hoti hai aur bullish (white/green) hoti hai, jabke doosri candle choti hoti hai aur bearish (black/red) hoti hai. Yeh pattern market ke upar jaane ke trend ko reverse karke neeche laane ki nishani hoti hai.

Formation.

Bearish Harami pattern do candles se mil kar banta hai.

Key Characteristics

Interpretation.

Yeh pattern market ke reversal ko indicate karta hai.

Trading Strategy.

Bearish Harami ko identify karke traders apni trading strategy bana sakte hain.

Example

Agar market ek strong uptrend mein chal raha hai aur Bearish Harami pattern form hota hai.

Introduction.

Bearish Harami ek candlestick pattern hota hai jo trend reversal ko indicate karta hai. Yeh pattern do candles se mil kar banta hai. Pehli candle bari hoti hai aur bullish (white/green) hoti hai, jabke doosri candle choti hoti hai aur bearish (black/red) hoti hai. Yeh pattern market ke upar jaane ke trend ko reverse karke neeche laane ki nishani hoti hai.

Formation.

Bearish Harami pattern do candles se mil kar banta hai.

- Pehli Candle: Pehli candle bullish hoti hai aur iska body bara hota hai. Yeh signify karta hai ke buyers market mein dominant hain.

- Doosri Candle: Doosri candle bearish hoti hai lekin iska body pehli candle ke body ke andar hota hai. Yeh indicate karta hai ke sellers ne control le liya hai aur buying momentum kam ho raha hai.

Key Characteristics

- Pehli Candle: Bara bullish candle hoti hai jo strong uptrend ko dikhata hai.

- Doosri Candle: Choti bearish candle hoti hai jo pehli candle ke range ke andar close hoti hai.

- Color Combination: Pehli candle white/green hoti hai aur doosri candle black/red hoti hai.

- Volume: Volume pehli candle par zyada hota hai jabke doosri candle par kam hota hai.

Interpretation.

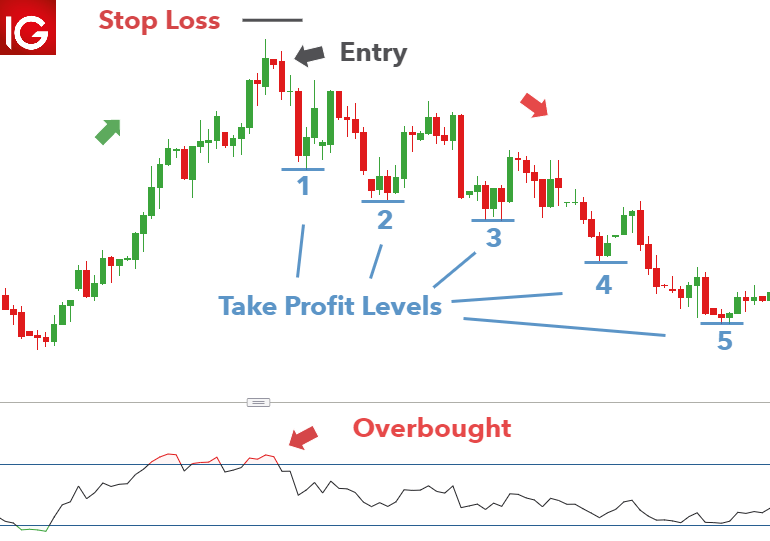

Yeh pattern market ke reversal ko indicate karta hai.

- Uptrend: Pehli candle ke bullish hone ka matlab hai ke market uptrend mein hai.

- Reversal Signal: Doosri candle ke bearish hone ka matlab hai ke selling pressure barh gaya hai aur uptrend ka momentum kam ho gaya hai.

- Confirmation: Agle trading session mein agar market niche jata hai to yeh Bearish Harami pattern ko confirm kar deta hai.

Trading Strategy.

Bearish Harami ko identify karke traders apni trading strategy bana sakte hain.

- Entry Point: Jab Bearish Harami pattern confirm ho jaye, traders short position le sakte hain.

- Stop Loss: Stop loss pehli candle ke high ke upar set karna chahiye.

- Target: Target price previous support levels ya trend lines ko dekh kar decide kiya ja sakta hai.

Example

Agar market ek strong uptrend mein chal raha hai aur Bearish Harami pattern form hota hai.

- Day 1: Pehli candle ek strong bullish candle hoti hai.

- Day 2: Doosri candle choti bearish candle hoti hai jo pehli candle ke range ke andar close hoti hai.

- Day 3: Market niche jata hai, Bearish Harami confirm hota hai.

تبصرہ

Расширенный режим Обычный режим