Mat Hold Candlestick Pattern: Forex Trading Mein Istemaal Aur Ahmiyat

1. Muqaddima

Forex trading yaani foreign exchange trading mein kai qisam ke patterns aur indicators hote hain jo traders ko market ki progress ko samajne mein madad dete hain. In patterns mein se ek ahem pattern "Mat Hold Candlestick Pattern" hai. Is maqalay mein hum is pattern ki tafseel, is ka istemal, aur is ki ahmiyat par roshni dalenge.

2. Mat Hold Candlestick Pattern Kya Hai?

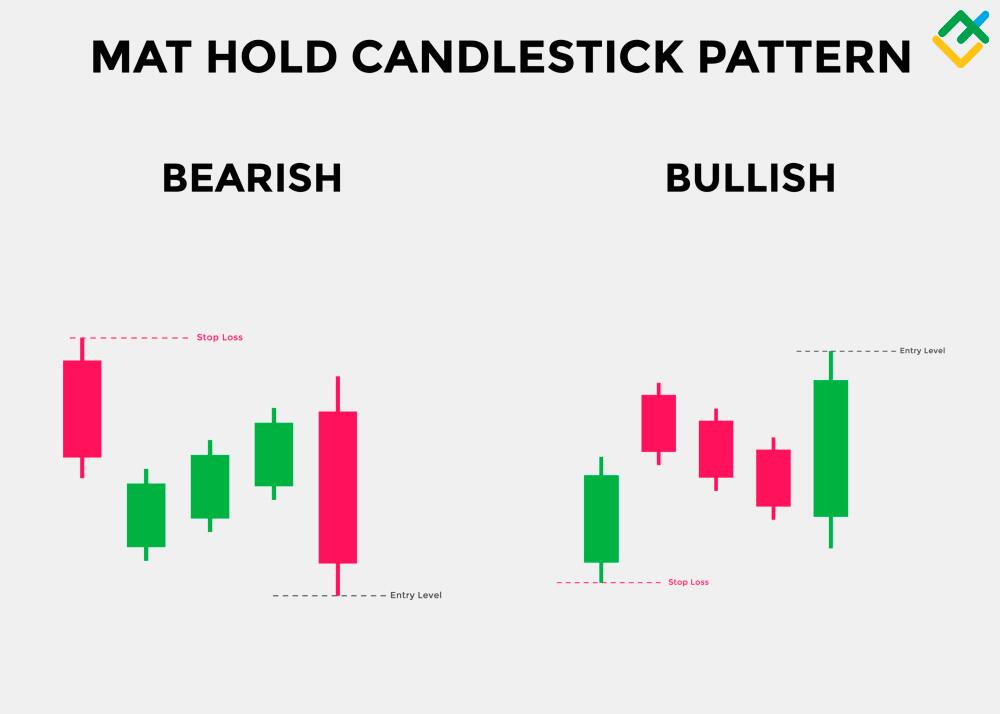

Mat Hold pattern ek bullish reversal pattern hai jo aksar downtrend ke baad banta hai. Ye pattern paanch candles par mushtamil hota hai:

Mat Hold pattern ke kuch mukhtalif components hain jo ise market analysis mein madadgar banate hain:

a. Pehli Candle

Pehli candle market ki bearish momentum ko dikhati hai. Is candle ki closing price pehle se girti hai.

b. Doosri Candle

Doosri candle aksar chhoti hoti hai aur iski body kaafi tight hoti hai. Ye momentum ka ruk jana dikhati hai.

c. Teesri Candle

Teesri candle kaafi taqatwar hoti hai aur ye market mein bullish reversal ki taraf ishara karti hai.

d. Chouthi Candle

Chouthi candle is trend ki taqat ko aur mazid misaal karti hai, jo traders ke liye confirmation hota hai.

e. Paanchwi Candle

Ye candle market ki overall direction yaani bullish trend ko mazid mazboot karti hai.

4. Forex Trading Mein Istemal

Mat Hold pattern ka forex trading mein istemal kaafi ahmiyat rakhta hai:

a. Trend Reversal

Ye pattern aksar downtrend ke baad bullish trend ki taraf ishara karta hai. Is pattern ka istemal traders ko market ki direction ko samajhne mein madad karta hai.

b. Entry Point

Traders Mat Hold pattern ke baad dosri ya teesri candle ke closure ko dekhtay hain taake wo entry point tay kar saken. Agar teesri candle ki closing strong hai to ye beetay slippage ko kam karti hai.

c. Stop Loss Aur Take Profit

Is pattern ke saath stop loss ko rakhna bhi zaruri hai taake loss ko control kiya ja sake. Stop loss ko pehli candle ke neeche rakha jata hai jabke take profit level ko teesri candle ki high par rakhte hain.

5. Faida aur Nuqsan

Mat Hold pattern ke kuch faide aur nuqsanat hain jo traders ko samajhni chahiye:

Faida

Mat Hold pattern ka analysis karna kaafi zaroori hai taake iski effectiveness ko samjha ja sake. Aapko kuch factors par diyaan dena hoga:

a. Volume Analysis

Volume analysis se aap ye jaan sakte hain ke kya market mein sufficient buying interest hai. Teesri candle jab zyada volume ke sath banti hai, to ye zyada significant hota hai.

b. Trend Confirmation

Kisi bhi pattern ko confirm karne ke liye sirf candles par hi nahi balki overall trend par bhi nazar rakhni chahiye.

c. Time Frame

Short-term aur long-term analysis ke liye alag time frames ka istemal karna chahiye. Mat Hold pattern kaafi time frames par banta hai, lekin daily aur weekly charts par ye zyada effective hota hai.

7. Conclusion

Mat Hold Candlestick Pattern ek valuable tool hai jo forex traders ko market ke reversal points samajhne mein madad karta hai. Is pattern ki saharat se traders entry aur exit points ko better tareeqe se plan kar sakte hain, khas kar downtrend ke dauran.

Forex trading mein is pattern ka istemal aapko market ki gehraiyon tak le jaa sakta hai, lekin zaroori hai ke aap is pattern ki asal meaning aur uss ke faide aur nuqsanat ko samjhein taake aap ek informed decision le sakein.

Umeed hai ke ye maqala aapko Mat Hold pattern ki ahmiyat, istemal, aur analysis ki samajh dene mein madadgar sabit hoga.

1. Muqaddima

Forex trading yaani foreign exchange trading mein kai qisam ke patterns aur indicators hote hain jo traders ko market ki progress ko samajne mein madad dete hain. In patterns mein se ek ahem pattern "Mat Hold Candlestick Pattern" hai. Is maqalay mein hum is pattern ki tafseel, is ka istemal, aur is ki ahmiyat par roshni dalenge.

2. Mat Hold Candlestick Pattern Kya Hai?

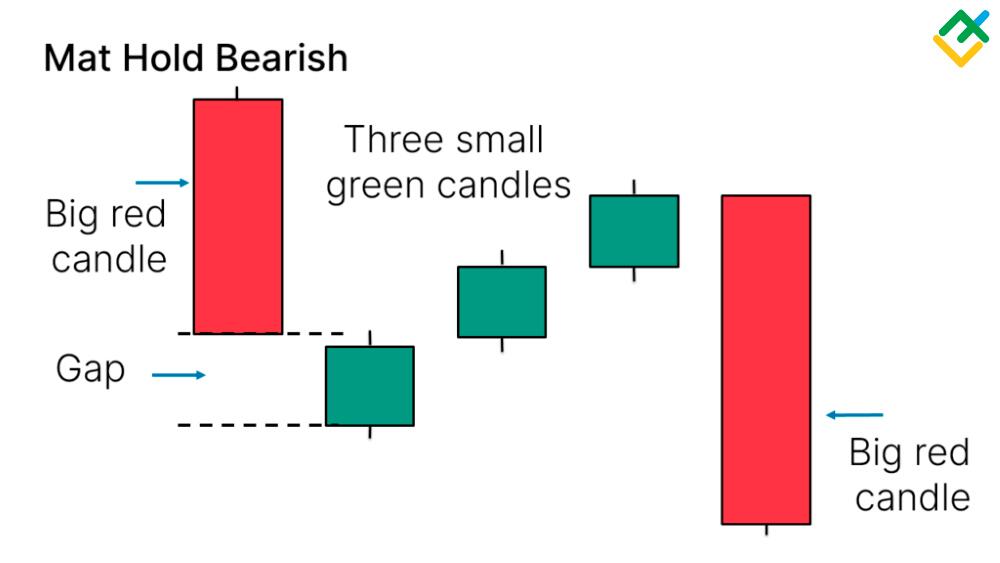

Mat Hold pattern ek bullish reversal pattern hai jo aksar downtrend ke baad banta hai. Ye pattern paanch candles par mushtamil hota hai:

- Pehli Candle: Ye candle downtrend ki hoti hai.

- Doosri Candle: Ye candle chhoti hoti hai aur iski body pehli candle ki range mein hoti hai, jise "Doji" bhi kaha jata hai.

- Teesri Candle: Ye candle achi khasi bullish candle hoti hai jo doosri candle se zyada bara hoti hai. Ye candle purani downtrend ko khatam karti hai.

- Chouthi Candle: Chouthi candle bhi bullish hoti hai aur teesri candle ki closure ke baad banti hai.

- Paanchwi Candle: Ye candle bhi bullish hoti hai aur market mein taqat ka izafa dikhati hai.

Mat Hold pattern ke kuch mukhtalif components hain jo ise market analysis mein madadgar banate hain:

a. Pehli Candle

Pehli candle market ki bearish momentum ko dikhati hai. Is candle ki closing price pehle se girti hai.

b. Doosri Candle

Doosri candle aksar chhoti hoti hai aur iski body kaafi tight hoti hai. Ye momentum ka ruk jana dikhati hai.

c. Teesri Candle

Teesri candle kaafi taqatwar hoti hai aur ye market mein bullish reversal ki taraf ishara karti hai.

d. Chouthi Candle

Chouthi candle is trend ki taqat ko aur mazid misaal karti hai, jo traders ke liye confirmation hota hai.

e. Paanchwi Candle

Ye candle market ki overall direction yaani bullish trend ko mazid mazboot karti hai.

4. Forex Trading Mein Istemal

Mat Hold pattern ka forex trading mein istemal kaafi ahmiyat rakhta hai:

a. Trend Reversal

Ye pattern aksar downtrend ke baad bullish trend ki taraf ishara karta hai. Is pattern ka istemal traders ko market ki direction ko samajhne mein madad karta hai.

b. Entry Point

Traders Mat Hold pattern ke baad dosri ya teesri candle ke closure ko dekhtay hain taake wo entry point tay kar saken. Agar teesri candle ki closing strong hai to ye beetay slippage ko kam karti hai.

c. Stop Loss Aur Take Profit

Is pattern ke saath stop loss ko rakhna bhi zaruri hai taake loss ko control kiya ja sake. Stop loss ko pehli candle ke neeche rakha jata hai jabke take profit level ko teesri candle ki high par rakhte hain.

5. Faida aur Nuqsan

Mat Hold pattern ke kuch faide aur nuqsanat hain jo traders ko samajhni chahiye:

Faida

- Accurate Signals: Ye pattern market ke direction ka ek strong signal deta hai.

- Reversal Indicator: Traders ko market ki reversal ki taraf ishara deta hai.

- Simplicity: Is pattern ko samajhna kaafi aasaan hai, jo naye traders ko madad karta hai.

- False Signals: Ye pattern kabhi kabhi false signals bhi de sakta hai, jo looton ka sabab ben sakta hai.

- Market Volatility: Forex market kaafi volatile hota hai, jise Mat Hold pattern ke dauran kabhi kabhi market sudden movements ka shikaari banati hai.

- Trading Costs: Frequent trades ki wajah se transaction costs bhi barh sakti hain.

Mat Hold pattern ka analysis karna kaafi zaroori hai taake iski effectiveness ko samjha ja sake. Aapko kuch factors par diyaan dena hoga:

a. Volume Analysis

Volume analysis se aap ye jaan sakte hain ke kya market mein sufficient buying interest hai. Teesri candle jab zyada volume ke sath banti hai, to ye zyada significant hota hai.

b. Trend Confirmation

Kisi bhi pattern ko confirm karne ke liye sirf candles par hi nahi balki overall trend par bhi nazar rakhni chahiye.

c. Time Frame

Short-term aur long-term analysis ke liye alag time frames ka istemal karna chahiye. Mat Hold pattern kaafi time frames par banta hai, lekin daily aur weekly charts par ye zyada effective hota hai.

7. Conclusion

Mat Hold Candlestick Pattern ek valuable tool hai jo forex traders ko market ke reversal points samajhne mein madad karta hai. Is pattern ki saharat se traders entry aur exit points ko better tareeqe se plan kar sakte hain, khas kar downtrend ke dauran.

Forex trading mein is pattern ka istemal aapko market ki gehraiyon tak le jaa sakta hai, lekin zaroori hai ke aap is pattern ki asal meaning aur uss ke faide aur nuqsanat ko samjhein taake aap ek informed decision le sakein.

Umeed hai ke ye maqala aapko Mat Hold pattern ki ahmiyat, istemal, aur analysis ki samajh dene mein madadgar sabit hoga.

تبصرہ

Расширенный режим Обычный режим