Bullish Doji Star Candlestick Pattern: Ek Fikrati Analysis

Candlestick patterns trading ki duniya mein aik ahem role ada karte hain. Un mein se aik popular pattern hai "Bullish Doji Star," jo ke technical analysis mein investors aur traders ke liye ek valuable signal hota hai. Is article mein hum is pattern ko detail se samajhne ki koshish karain ge, aur yeh jaanne ki koshish karain ge ke yeh pattern kis tarah se market trends ko predict karne mein madadgar ho sakta hai.

1. Bullish Doji Star Kya Hai?

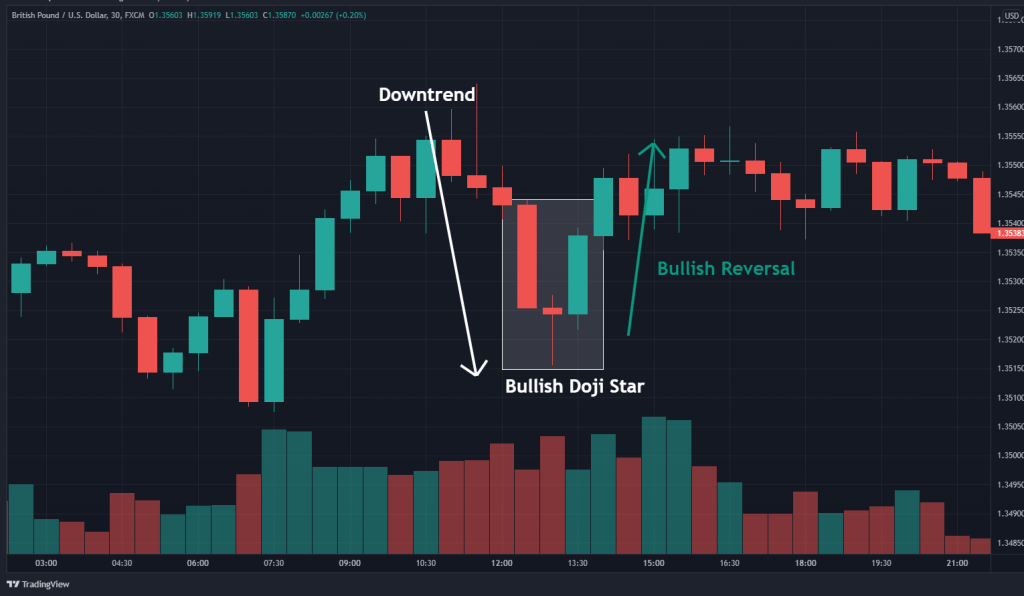

Bullish Doji Star aik candlestick pattern hai jo aksar ek downtrend ke baad banta hai. Is pattern mein teen candlesticks shamil hotay hain. Pehla candlestick long red (bearish) body hota hai jo market ke downtrend ko dikhata hai. Doosra candlestick Doji hota hai, jo ek chhoti body rakhta hai aur upper aur lower shadows kaafi lambay hotay hain. Doji ka shape market mein uncertainty aur confusion ko dikhata hai. Teesra candlestick aik bullish candle hota hai, jo pehle ke trend ke ulte direction mein hota hai.

Is pattern ka formation indicate karta hai ke market mein ek reversal ho sakta hai, jahan sellers ki grip kam ho rahi hoti hai aur buyers market mein enter karte hain.

2. Bullish Doji Star Ki Interpretation

Jab Bullish Doji Star pattern banta hai, to iska matlab hota hai ke market mein bearish momentum kam ho raha hai aur bullish trend ka start ho sakta hai. Pehla red candle bearish market ko dikhata hai, lekin doosra Doji candlestick jo uncertainty ko indicate karta hai, yeh signal deta hai ke sellers ki power kam ho gayi hai. Teesra green (bullish) candlestick buyers ke dominance ko represent karta hai aur yeh reversal ki confirmation hoti hai.

Is pattern ki sab se khas baat yeh hai ke yeh market mein trend reversal ko dikhane wala signal hota hai. Agar yeh pattern kisi major support level par ban raha ho to yeh aur bhi zyada significant ho sakta hai.

3. Pattern Ke Liye Ideal Market Conditions

Bullish Doji Star tab zyada effective hota hai jab market ek strong downtrend mein ho. Jab price ne niche ki taraf aik sustained move kiya ho aur phir Doji pattern ban jaye, to yeh trend reversal ka aik strong signal hota hai. Ideal conditions mein yeh pattern support level par ban sakta hai, jo ke market mein buyers ki entry ko encourage karta hai.

Is pattern ko confirm karne ke liye, teesra bullish candlestick important hota hai. Agar yeh candlestick strong bullish momentum ke saath market ko upar ki taraf push karta hai, to pattern ka signal strong hota hai. Agar yeh candle weak ho, to signal kam reliable ho sakta hai.

4. Bullish Doji Star Aur Risk Management

Har trading signal ke sath risk management ka hona zaroori hai, aur Bullish Doji Star bhi is se alag nahi hai. Jab aap is pattern ke zariye trade karte hain, to risk ko manage karna bohot zaroori hota hai. Yeh pattern aapko ek potential reversal signal deta hai, lekin market kabhi bhi unpredictable ho sakti hai.

Aap apne stop loss ko pattern ke neeche rakh sakte hain. Agar market Doji pattern ke baad neeche jata hai, to yeh aapke stop loss trigger ho sakta hai, jo ke aapko loss se bachata hai. Iske ilawa, position size ka khayal rakhein aur apni risk-to-reward ratio ko set karna na bhoolain.

5. Bullish Doji Star Ko Confirm Karna

Har candlestick pattern ko confirm karna zaroori hota hai, aur Bullish Doji Star bhi is se mustasna nahi hai. Is pattern ki confirmation ke liye kuch additional tools aur indicators ka use kiya ja sakta hai. Sab se pehle, volume ka analysis karna zaroori hota hai. Agar teesra bullish candlestick volume ke sath aata hai, to yeh confirmation hota hai ke market mein genuine buying interest hai. Agar volume low ho, to yeh signal kam strong ho sakta hai.

Iske ilawa, aap moving averages ka bhi use kar sakte hain. Agar price moving averages ke upar chala jata hai, to yeh pattern ki confirmation ho sakti hai. Technical indicators, jaise RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence), bhi aapke analysis ko confirm kar sakte hain. Agar in indicators se bhi bullish signals mil rahe hoon, to pattern ka signal stronger hota hai.

6. Bullish Doji Star Ki Limitations Aur Alternatives

Har pattern ke kuch limitations bhi hoti hain, aur Bullish Doji Star bhi is se mustasna nahi hai. Sab se badi limitation yeh hai ke yeh pattern false signals de sakta hai, khaas kar agar market mein koi major news ya event ho jo market ko unpredictable bana de. Isliye, is pattern ko kisi aur technical analysis tools ke saath confirm karna zaroori hota hai.

Agar aap Bullish Doji Star pattern par trade kar rahe hain, to aapko market ki broader trend ko bhi dekhna chahiye. Agar long-term trend bearish hai, to yeh pattern sirf short-term reversal ko indicate kar sakta hai. Aapko apni trading strategy ko market conditions ke mutabiq adjust karna hoga.

Conclusion

Bullish Doji Star ek powerful candlestick pattern hai jo downtrend ke baad market mein reversal ka signal deta hai. Is pattern ko samajhna aur effectively use karna har trader ke liye zaroori hai. Lekin, har trading signal ki tarah, is pattern ko bhi confirm karne ki zaroorat hoti hai. Risk management, confirmation tools, aur market conditions ko samajh kar aap is pattern ka faida uthaa sakte hain. Agar aap apni trading strategy ko theek se plan karte hain, to Bullish Doji Star aapko successful trades mein madad de sakta hai.

Candlestick patterns trading ki duniya mein aik ahem role ada karte hain. Un mein se aik popular pattern hai "Bullish Doji Star," jo ke technical analysis mein investors aur traders ke liye ek valuable signal hota hai. Is article mein hum is pattern ko detail se samajhne ki koshish karain ge, aur yeh jaanne ki koshish karain ge ke yeh pattern kis tarah se market trends ko predict karne mein madadgar ho sakta hai.

1. Bullish Doji Star Kya Hai?

Bullish Doji Star aik candlestick pattern hai jo aksar ek downtrend ke baad banta hai. Is pattern mein teen candlesticks shamil hotay hain. Pehla candlestick long red (bearish) body hota hai jo market ke downtrend ko dikhata hai. Doosra candlestick Doji hota hai, jo ek chhoti body rakhta hai aur upper aur lower shadows kaafi lambay hotay hain. Doji ka shape market mein uncertainty aur confusion ko dikhata hai. Teesra candlestick aik bullish candle hota hai, jo pehle ke trend ke ulte direction mein hota hai.

Is pattern ka formation indicate karta hai ke market mein ek reversal ho sakta hai, jahan sellers ki grip kam ho rahi hoti hai aur buyers market mein enter karte hain.

2. Bullish Doji Star Ki Interpretation

Jab Bullish Doji Star pattern banta hai, to iska matlab hota hai ke market mein bearish momentum kam ho raha hai aur bullish trend ka start ho sakta hai. Pehla red candle bearish market ko dikhata hai, lekin doosra Doji candlestick jo uncertainty ko indicate karta hai, yeh signal deta hai ke sellers ki power kam ho gayi hai. Teesra green (bullish) candlestick buyers ke dominance ko represent karta hai aur yeh reversal ki confirmation hoti hai.

Is pattern ki sab se khas baat yeh hai ke yeh market mein trend reversal ko dikhane wala signal hota hai. Agar yeh pattern kisi major support level par ban raha ho to yeh aur bhi zyada significant ho sakta hai.

3. Pattern Ke Liye Ideal Market Conditions

Bullish Doji Star tab zyada effective hota hai jab market ek strong downtrend mein ho. Jab price ne niche ki taraf aik sustained move kiya ho aur phir Doji pattern ban jaye, to yeh trend reversal ka aik strong signal hota hai. Ideal conditions mein yeh pattern support level par ban sakta hai, jo ke market mein buyers ki entry ko encourage karta hai.

Is pattern ko confirm karne ke liye, teesra bullish candlestick important hota hai. Agar yeh candlestick strong bullish momentum ke saath market ko upar ki taraf push karta hai, to pattern ka signal strong hota hai. Agar yeh candle weak ho, to signal kam reliable ho sakta hai.

4. Bullish Doji Star Aur Risk Management

Har trading signal ke sath risk management ka hona zaroori hai, aur Bullish Doji Star bhi is se alag nahi hai. Jab aap is pattern ke zariye trade karte hain, to risk ko manage karna bohot zaroori hota hai. Yeh pattern aapko ek potential reversal signal deta hai, lekin market kabhi bhi unpredictable ho sakti hai.

Aap apne stop loss ko pattern ke neeche rakh sakte hain. Agar market Doji pattern ke baad neeche jata hai, to yeh aapke stop loss trigger ho sakta hai, jo ke aapko loss se bachata hai. Iske ilawa, position size ka khayal rakhein aur apni risk-to-reward ratio ko set karna na bhoolain.

5. Bullish Doji Star Ko Confirm Karna

Har candlestick pattern ko confirm karna zaroori hota hai, aur Bullish Doji Star bhi is se mustasna nahi hai. Is pattern ki confirmation ke liye kuch additional tools aur indicators ka use kiya ja sakta hai. Sab se pehle, volume ka analysis karna zaroori hota hai. Agar teesra bullish candlestick volume ke sath aata hai, to yeh confirmation hota hai ke market mein genuine buying interest hai. Agar volume low ho, to yeh signal kam strong ho sakta hai.

Iske ilawa, aap moving averages ka bhi use kar sakte hain. Agar price moving averages ke upar chala jata hai, to yeh pattern ki confirmation ho sakti hai. Technical indicators, jaise RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence), bhi aapke analysis ko confirm kar sakte hain. Agar in indicators se bhi bullish signals mil rahe hoon, to pattern ka signal stronger hota hai.

6. Bullish Doji Star Ki Limitations Aur Alternatives

Har pattern ke kuch limitations bhi hoti hain, aur Bullish Doji Star bhi is se mustasna nahi hai. Sab se badi limitation yeh hai ke yeh pattern false signals de sakta hai, khaas kar agar market mein koi major news ya event ho jo market ko unpredictable bana de. Isliye, is pattern ko kisi aur technical analysis tools ke saath confirm karna zaroori hota hai.

Agar aap Bullish Doji Star pattern par trade kar rahe hain, to aapko market ki broader trend ko bhi dekhna chahiye. Agar long-term trend bearish hai, to yeh pattern sirf short-term reversal ko indicate kar sakta hai. Aapko apni trading strategy ko market conditions ke mutabiq adjust karna hoga.

Conclusion

Bullish Doji Star ek powerful candlestick pattern hai jo downtrend ke baad market mein reversal ka signal deta hai. Is pattern ko samajhna aur effectively use karna har trader ke liye zaroori hai. Lekin, har trading signal ki tarah, is pattern ko bhi confirm karne ki zaroorat hoti hai. Risk management, confirmation tools, aur market conditions ko samajh kar aap is pattern ka faida uthaa sakte hain. Agar aap apni trading strategy ko theek se plan karte hain, to Bullish Doji Star aapko successful trades mein madad de sakta hai.

تبصرہ

Расширенный режим Обычный режим