Dark Cloud Cover Pattern in Forex Trading

Dark Cloud Cover Pattern Kya Hai?

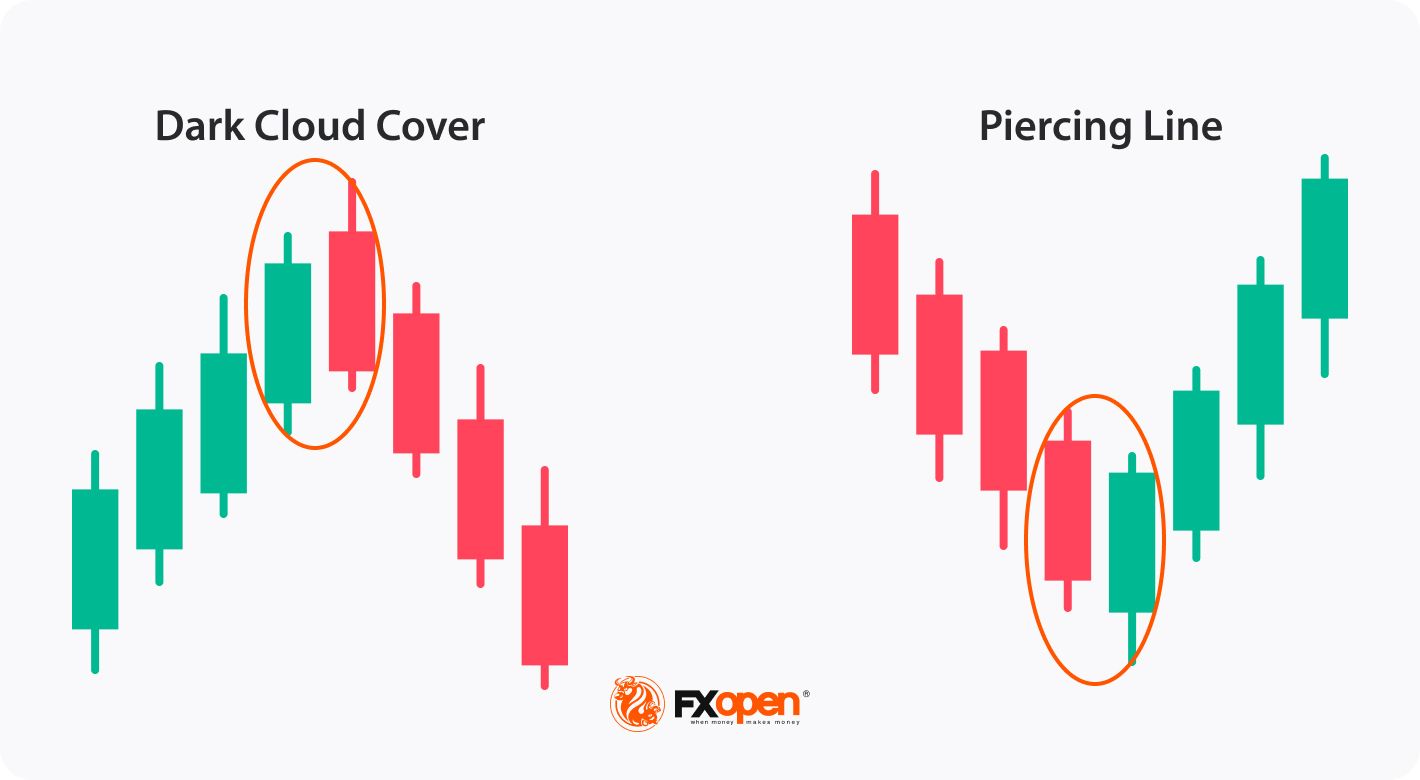

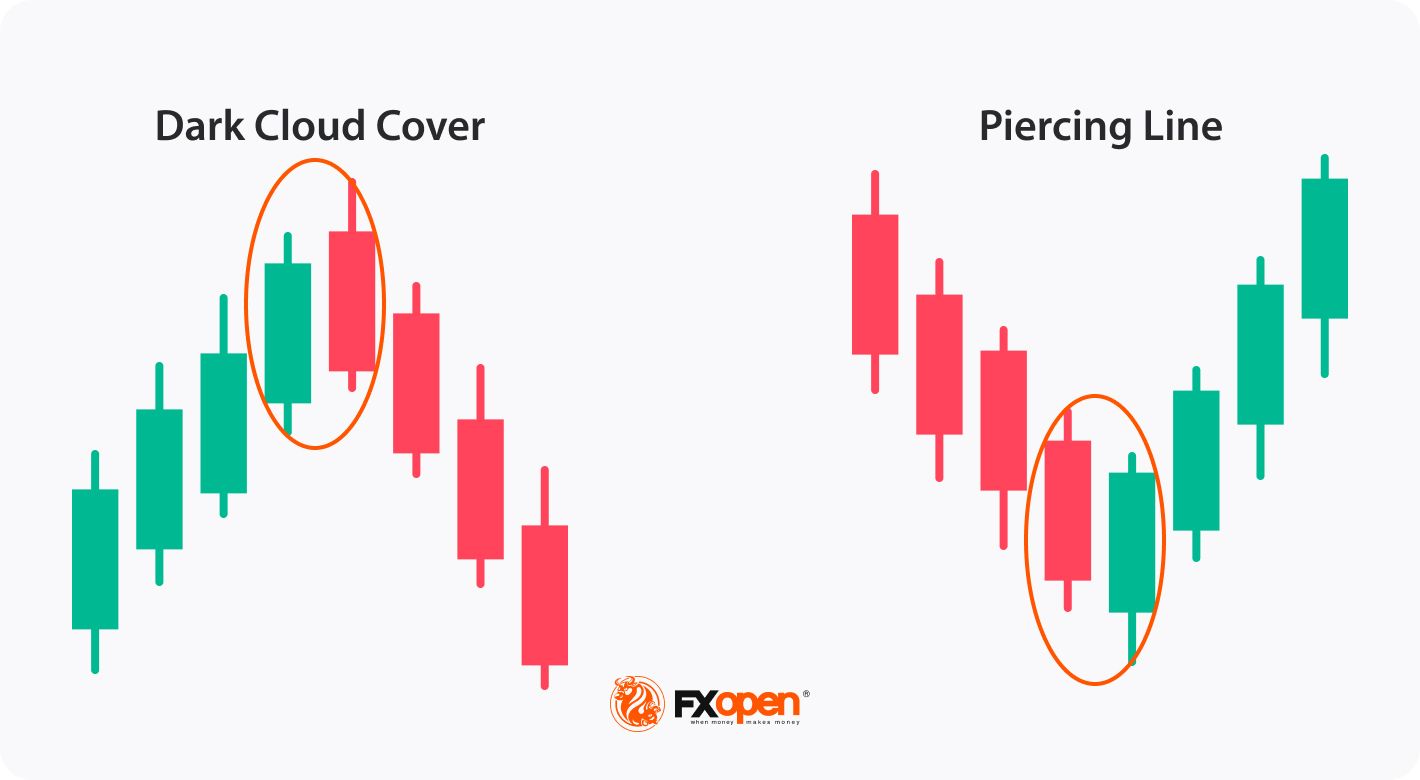

Dark Cloud Cover aik bearish reversal candlestick pattern hai jo do candlesticks par mabni hota hai. Yeh pattern aksar uptrend ke beech banta hai aur yeh yeh darshata hai ke market mein momentum badal raha hai. Pehla candlestick bullish hota hai jo ke pichlay din ki highest price ko close karne ke baad khatam hota hai. Doosra candlestick mukhtalif rang ka hota hai (amadatan red ya black) aur pehle candlestick ki body ke aad se niche khulta hai, lekin phir bhi pehle candlestick ki closing price ka 50% ya usse zyada cover kar leta hai.

Dark Cloud Cover ke Aham Pehlu

1. Identification

Dark Cloud Cover ko samajhne ke liye, pehle item ko identify karna zyada zaroori hai. Ismein do halat hain:

Dark Cloud Cover ka matlab hota hai ke bullish sentiment ab decrease ho raha hai. Jab investors ko lagta hai ke market ki upward trend khatam ho rahi hai, woh selling karne lagte hain, jo ke price ko niche ki taraf le jaata hai.

3. Confirmation

Dark Cloud Cover ke signal ko tabhi ishtemal karna chahiye jab aapko is ka confirmation milta hai. Confirmation ki talash mein, teesra candlestick ka dekhna zaroori hota hai: agar teesra candlestick bhi bearish hota hai, to yeh ek strong confirmation hota hai ke market bearish ho raha hai.

Dark Cloud Cover Ka Success Rate

Dark Cloud Cover ki success rate ka waqi kaafi high hota hai, lekin yeh kabhi kabhi market ke mood aur overall sentiment par depend karta hai. Research ke mutabiq, agar yeh pattern general market conditions ke saath align hota hai, to iska success rate 60% se zyada ho sakta hai. Lekin agar market volatility zyada ho ya unexpected news aayi ho, to iska success rate kam ho sakta hai.

Factors Affecting Success Rate

Dark Cloud Cover ka Forex trading mein kaafi importance hai kyunki:

1. Entry Points

Dark Cloud Cover ko dekhtay huye entry point tab banana chahiye jab aap teesra bearish candlestick dekhte hain. Yeh confirmation hota hai ke downward trend aane wala hai.

2. Stop Loss

Stop loss ko aap pehle bullish candlestick ki high ke just upar rakhein. Yeh risk ko kam karne mein madad dega agar market aap ki expectation ke mutabiq na chale.

3. Take Profit Level

Take profit ko previous support levels par rakhein. Yeh is baat ko ensure karta hai ke aapne profits ko capture kiya hai jab market nicha jaata hai.

Faydah aur Nuksan

Faydah

Dark Cloud Cover pattern Forex trading mein ek powerful tool hai, lekin traders ko isay samajhne aur sahi tarah se istemal karne ki zarurat hai. Iski importance high accuracy, risk management, aur market psychology ke samajh mein hai. Sahi tarah se istemal karne par, yeh pattern profitable trades mein assistance de sakta hai. Lekin hamesha market conditions ko dhyan mein rakhein aur thorough analysis karna na bhoolen kyunki yeh strategy kabhi kabhi false signals bhi generate kar sakti hai.

Is tareeqay se Dark Cloud Cover pattern ko samajhne se aur iski importance ko pehchaanne se traders ko behtar decision-making mein madad milti hai aur wo apni trading strategy ko behtar bana sakte hain. Traders ko yeh bhi zaruri hai ke wo emotional trading se bachein aur disciplined rahain.

Dark Cloud Cover Pattern Kya Hai?

Dark Cloud Cover aik bearish reversal candlestick pattern hai jo do candlesticks par mabni hota hai. Yeh pattern aksar uptrend ke beech banta hai aur yeh yeh darshata hai ke market mein momentum badal raha hai. Pehla candlestick bullish hota hai jo ke pichlay din ki highest price ko close karne ke baad khatam hota hai. Doosra candlestick mukhtalif rang ka hota hai (amadatan red ya black) aur pehle candlestick ki body ke aad se niche khulta hai, lekin phir bhi pehle candlestick ki closing price ka 50% ya usse zyada cover kar leta hai.

Dark Cloud Cover ke Aham Pehlu

1. Identification

Dark Cloud Cover ko samajhne ke liye, pehle item ko identify karna zyada zaroori hai. Ismein do halat hain:

- Pehla Candlestick: Yeh bada bullish (green) candlestick hota hai jo market ke positive momentum ko darshata hai.

- Doosra Candlestick: Yeh bearish (red) candlestick hota hai jo pehle candlestick ki body ke 50% se zyada tak close karta hai.

Dark Cloud Cover ka matlab hota hai ke bullish sentiment ab decrease ho raha hai. Jab investors ko lagta hai ke market ki upward trend khatam ho rahi hai, woh selling karne lagte hain, jo ke price ko niche ki taraf le jaata hai.

3. Confirmation

Dark Cloud Cover ke signal ko tabhi ishtemal karna chahiye jab aapko is ka confirmation milta hai. Confirmation ki talash mein, teesra candlestick ka dekhna zaroori hota hai: agar teesra candlestick bhi bearish hota hai, to yeh ek strong confirmation hota hai ke market bearish ho raha hai.

Dark Cloud Cover Ka Success Rate

Dark Cloud Cover ki success rate ka waqi kaafi high hota hai, lekin yeh kabhi kabhi market ke mood aur overall sentiment par depend karta hai. Research ke mutabiq, agar yeh pattern general market conditions ke saath align hota hai, to iska success rate 60% se zyada ho sakta hai. Lekin agar market volatility zyada ho ya unexpected news aayi ho, to iska success rate kam ho sakta hai.

Factors Affecting Success Rate

- Market Conditions: Markets jab stable aur trending hote hain to yeh pattern zyada effective hota hai.

- News Events: Important news releases ka market par asar ho sakta hai.

- Volume: High trading volume ke saath Dark Cloud Cover pattern zyada reliable hota hai.

Dark Cloud Cover ka Forex trading mein kaafi importance hai kyunki:

- Reversal Signal: Yeh pattern ek strong bearish reversal ka signal deta hai, jo traders ko trading decisions lene mein madad deta hai.

- Risk Management: Is pattern ko istemal karke traders apne stop-loss levels ko theek kar sakte hain.

- Market Psychology: Yeh pattern market psychology ko darshata hai aur investors ki emotions ko samajhne mein madadgar hota hai.

1. Entry Points

Dark Cloud Cover ko dekhtay huye entry point tab banana chahiye jab aap teesra bearish candlestick dekhte hain. Yeh confirmation hota hai ke downward trend aane wala hai.

2. Stop Loss

Stop loss ko aap pehle bullish candlestick ki high ke just upar rakhein. Yeh risk ko kam karne mein madad dega agar market aap ki expectation ke mutabiq na chale.

3. Take Profit Level

Take profit ko previous support levels par rakhein. Yeh is baat ko ensure karta hai ke aapne profits ko capture kiya hai jab market nicha jaata hai.

Faydah aur Nuksan

Faydah

- High Accuracy: Dark Cloud Cover pattern aksar accurate signals provide karta hai agar achi market conditions hain.

- Kem Risk: Sahi entry aur stop loss points ke sath, is pattern ka istemal karne se risk kam ho sakta hai.

- Simple Analysis: Is pattern ko identify karna kaafi asan hai aur yeh traders ki analysis ko simplify karta hai.

- False Signals: Kabhi kabhi yeh pattern false signals bhi de sakta hai, jo trade loss ka sabab ban sakta hai.

- News Impact: Agar koi major news aaye to yeh pattern kaam nahi karega, jo traders ko nuqsan de sakta hai.

- Limited Time Frame: Yeh pattern typically short-term trends ke liye kaam karta hai, aur long-term analysis mein iski effective nahi hoti.

Dark Cloud Cover pattern Forex trading mein ek powerful tool hai, lekin traders ko isay samajhne aur sahi tarah se istemal karne ki zarurat hai. Iski importance high accuracy, risk management, aur market psychology ke samajh mein hai. Sahi tarah se istemal karne par, yeh pattern profitable trades mein assistance de sakta hai. Lekin hamesha market conditions ko dhyan mein rakhein aur thorough analysis karna na bhoolen kyunki yeh strategy kabhi kabhi false signals bhi generate kar sakti hai.

Is tareeqay se Dark Cloud Cover pattern ko samajhne se aur iski importance ko pehchaanne se traders ko behtar decision-making mein madad milti hai aur wo apni trading strategy ko behtar bana sakte hain. Traders ko yeh bhi zaruri hai ke wo emotional trading se bachein aur disciplined rahain.

تبصرہ

Расширенный режим Обычный режим