Dark Cloud Cover Pattern in Forex Trading

Dark Cloud Cover ek candlestick pattern hai jo trend reversal ki nishani hota hai. Ye pattern aksar bullish trend ke khatam hone aur bearish trend ke shuru hone ka ishara karta hai. Forex trading mein is pattern ka istemal karna traders ke liye bohot maayne rakhta hai. Is article mein hum Dark Cloud Cover pattern ki tafseel, iska success rate, importance, fayde aur nuksan ka jaiza leinge.

1. Dark Cloud Cover Kya Hai?

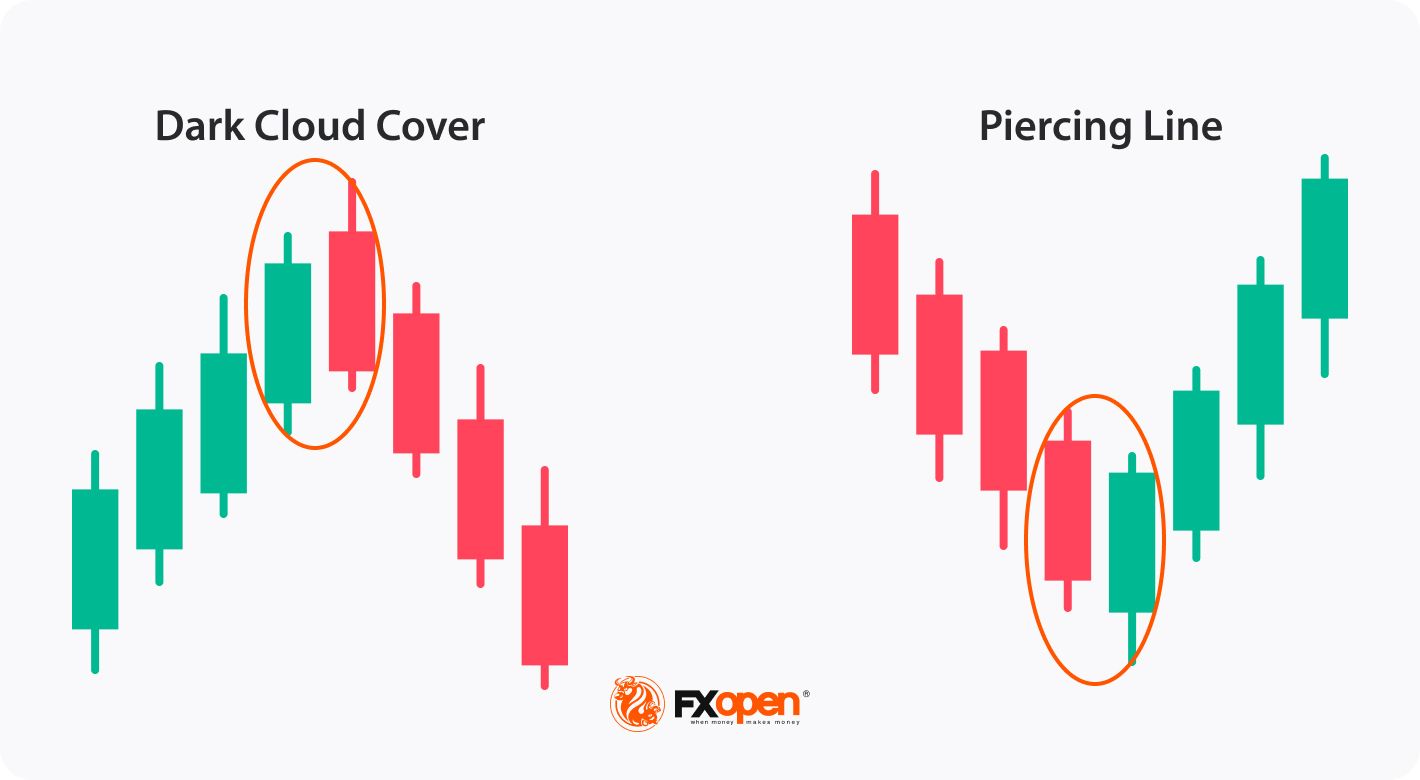

Dark Cloud Cover do candlesticks ka combination hota hai. Ye aksar bullish trend ke peak par banta hai. Is pattern ki pehli candlestick bullish hoti hai jo positive momentum ko darshati hai. Dusri candlestick bearish hoti hai aur pehli candlestick ke close se upar khulti hai lekin pehle ki candlestick ke close se neeche band hoti hai.

Dark Cloud Cover Ka Pattern:

- Pehli Candlestick: Bullish (green) - Yeh candlestick market ki bullish momentum ko darshati hai.

- Dusri Candlestick: Bearish (red) - Yeh candlestick bullish momentum ki khatam hone aur bearish trend shuru hone ka sinal karti hai.

Dark Cloud Cover pattern ka success rate integral analysis pe depend karta hai. Normally, agar yeh pattern strong trend ke peak par banta hai to iska probability higher hota hai ke market reversal hoga. Lekin koi bhi technical analysis pattern 100% accurate nahi hota.

General Statistics:

- Aam tor par is pattern ka success rate 60% se 80% tak hota hai.

- Yeh success rate alag-alag forex pairs, time frames aur market conditions par depend karta hai.

Dark Cloud Cover pattern ki importance iski ability hai market sentiment ka pata lagana. Jab yeh pattern form hota hai to yeh traders ko bullish se bearish sentiment ki taraf shift ka izhaar karta hai.

Key Importance:

- Market Reversal ka Indication: Trend reversal kach kabhi kabhi ho sakta hai aur is pattern ki pehchan aapko iska pata lagane mein madad karegi.

- Risk Management: Is pattern se aap apne stop-loss aur take-profit levels ko better tarike se set kar sakte hain.

- Entry Points: Ye pattern aapko clear entry points provide karta hai jab market reversal ki sambhavna hoti hai.

Dark Cloud Cover pattern ko analyse karne ke liye traders ko kuch key points par focus karna chahiye:

Steps to Use Dark Cloud Cover:

- Candlestick Analysis: Candlestick patterns ka detail se analyse karna zaroori hai. Pehli bullish candlestick ko dekhein jisse bullish trend confirm hota hai.

- Confirmation Candlestick: Jab dusri candlestick regular bearish ho, toh yeh aapko sell signal de sakti hai.

- Volume Analysis: Volume ke saath pattern ka formation bhi important hota hai. Agar high volume ke saath formation hota hai toh pattern bharpur strength darshata hai.

- Support/Resistance Levels: Existing support and resistance levels ko dekhna zaroori hai kyunki yeh additional confirmation de sakte hain.

Jaise ke kisi bhi trading strategy ya pattern ke sath, Dark Cloud Cover bhi apne faide aur nuksan rakhta hai.

Fayday:

- Trend Reversal Indication: Yeh pattern aapko market ki reversal ki sambhavana dikhata hai.

- Entry and Exit Points: Aasan entry aur exit points provide karta hai jo trading decisions ko aasaan banata hai.

- Technical Analysis ka Integral Hissa: Is pattern ko use karke aap apne trading strategy ko behtar bana sakte hain.

- False Signals: Dark Cloud Cover kabhi kabhi false signals de sakta hai. Yani yeh pattern formation ke bawajood market continue bullish rah sakta hai.

- Context ki Ahmiyat: Agar aap sirf pattern par rely karein to aap market ki samajh nahi kar paayenge. Context jaroori hai.

- Stop Loss ki Zaroorat: Trading karte waqt stop-loss zaroor use karna chahiye taake losses ko control kiya ja sake.

Dark Cloud Cover Forex trading mein aik valuable tool hai. Is pattern ki sahi tarah se istemal karne par aap market ki trends ka ache se andaza laga sakte hain. Lekin, kisi bhi trading decision lene se pehle market ka context aur wajah ko samajhna zaroori hai.

Akhir mein, hamesha yaad rakhein ke trading mein risk hota hai, aur koi bhi pattern ya strategy guarantee nahi kar sakti ke aap hamesha profit kamaenge. Dark Cloud Cover ka istemal karne se pehle apni risk tolerance aur trading strategy ko samajhna zaroori hai.

Final Thoughts:

Forex trading karte waqt Dark Cloud Cover jaise patterns ko samajhna zaroori hai. Lekin investments karne se pehle thorough analysis aur practice karna hamesha behtar hota hai.

Is tarah se aap Dark Cloud Cover pattern ki tafseel, iska importance, fayday aur nuksan ko samajh sakte hain, jisse aap apne trading decisions ko behtar bana sakte hain.

تبصرہ

Расширенный режим Обычный режим