FALLING THREE PATTERN IN FOREX TRADING

OBJECTIVE

Falling Three Pattern forex trading ka aik technical chart pattern hai jo traders ko trend ki prediction karne mein madad deta hai. Is pattern mein market ki girawat hone ki indication hoti hai jab trend mein kisi khaas tarah ki formation nazar aati hai.Falling Three Pattern ka matlab hota hai ke jab market mein ek downtrend chal raha hota hai, to yeh pattern market ki temporary rukawat ya correction ko indicate karta hai. Is pattern ki wajah se traders ko yeh samjhne mein madad milti hai ke trend kis tarah se proceed kar sakta hai.

FORMATION

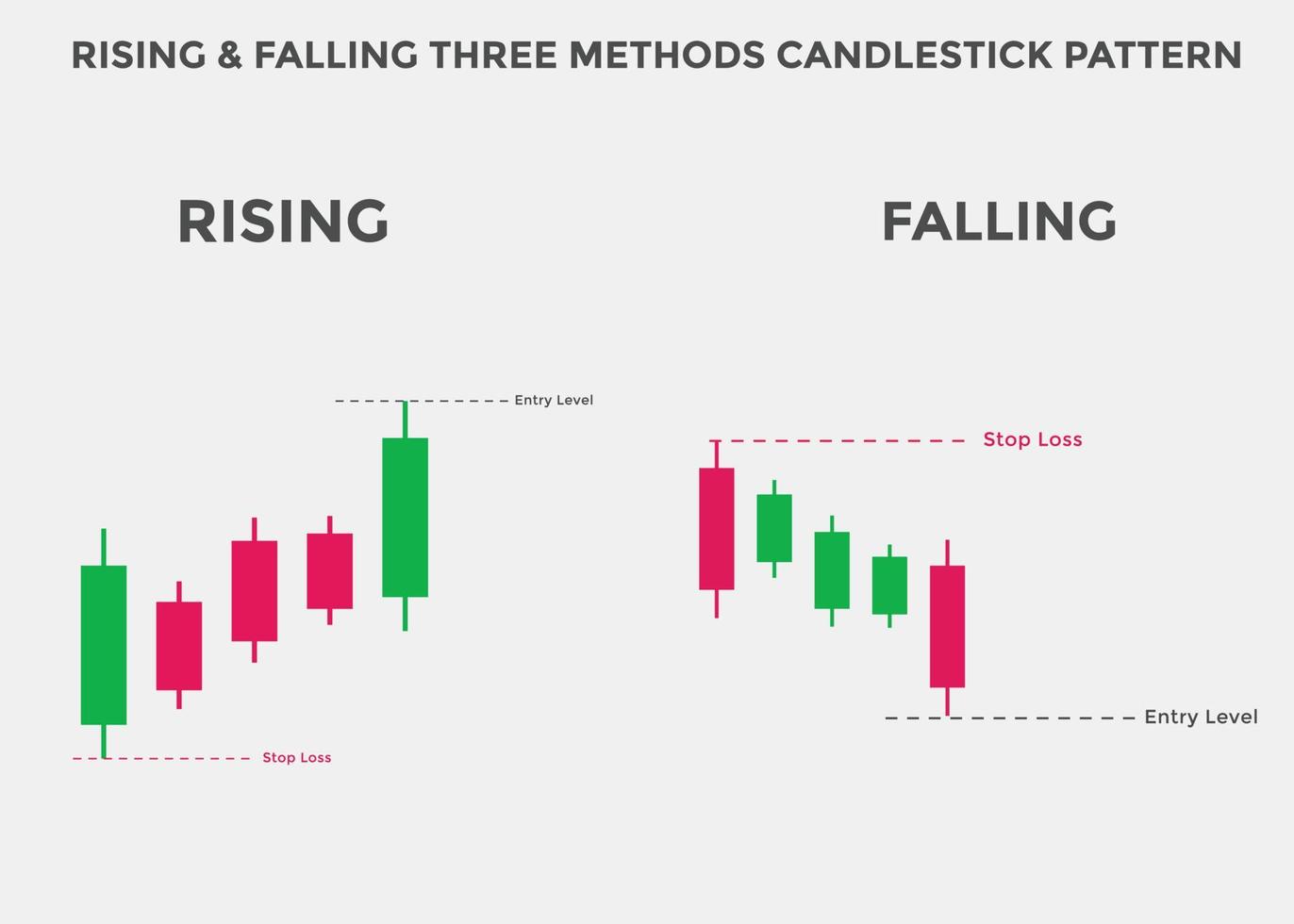

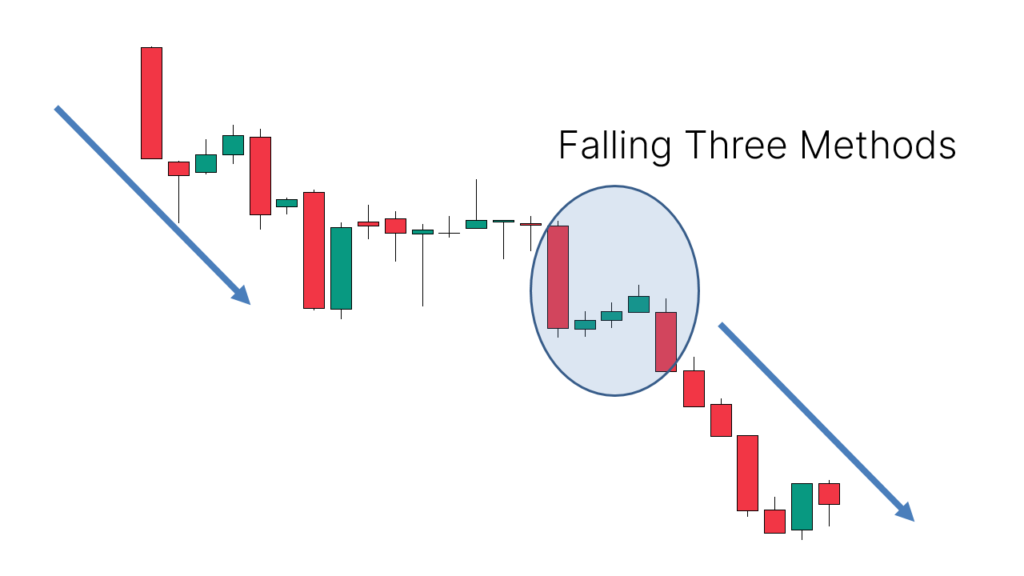

Is pattern mein panch candlesticks ka group hota hai jo neechay di gayi sequence ko follow karte hain:

1. Aik bara bearish (girawati) candlestick.

2. Teen choti bullish (barhti) candlesticks jin mein se do mein shadows ya wicks nazar aate hain. Yeh candlesticks pehli candlestick ki body mein samil hoti hain.

3. Aik bara bearish (girawati) candlestick jo pehli candlestick ki body ko cover karta hai.

ENTRY AND EXIT

Traders is pattern ko dekhtay hue entry aur exit points decide kar sakte hain. Entry point pehli bearish candlestick ke neechay entry kiya ja sakta hai jab trend gir raha hota hai aur exit point last bearish candlestick ke neechay decide kiya ja sakta hai.

TRADING ANALYSIS

Jaisa ke har trading pattern mein hota hai, Falling Three Pattern bhi akela hi ek indicator nahi hai. Traders ko is pattern ke sath doosre technical aur fundamental tools ka istemal karna chahiye taa ke sahi trading decision liya ja sake.

Is tarah se, Falling Three Pattern forex trading mein ek important tool hai jo traders ko trend analysis mein madad deta hai. Yaad rahe ke trading mein risk ka bhi hissa hota hai, is liye hamesha apni research karain aur trading plan ke sath kaam karain.

OBJECTIVE

Falling Three Pattern forex trading ka aik technical chart pattern hai jo traders ko trend ki prediction karne mein madad deta hai. Is pattern mein market ki girawat hone ki indication hoti hai jab trend mein kisi khaas tarah ki formation nazar aati hai.Falling Three Pattern ka matlab hota hai ke jab market mein ek downtrend chal raha hota hai, to yeh pattern market ki temporary rukawat ya correction ko indicate karta hai. Is pattern ki wajah se traders ko yeh samjhne mein madad milti hai ke trend kis tarah se proceed kar sakta hai.

FORMATION

Is pattern mein panch candlesticks ka group hota hai jo neechay di gayi sequence ko follow karte hain:

1. Aik bara bearish (girawati) candlestick.

2. Teen choti bullish (barhti) candlesticks jin mein se do mein shadows ya wicks nazar aate hain. Yeh candlesticks pehli candlestick ki body mein samil hoti hain.

3. Aik bara bearish (girawati) candlestick jo pehli candlestick ki body ko cover karta hai.

ENTRY AND EXIT

Traders is pattern ko dekhtay hue entry aur exit points decide kar sakte hain. Entry point pehli bearish candlestick ke neechay entry kiya ja sakta hai jab trend gir raha hota hai aur exit point last bearish candlestick ke neechay decide kiya ja sakta hai.

TRADING ANALYSIS

Jaisa ke har trading pattern mein hota hai, Falling Three Pattern bhi akela hi ek indicator nahi hai. Traders ko is pattern ke sath doosre technical aur fundamental tools ka istemal karna chahiye taa ke sahi trading decision liya ja sake.

Is tarah se, Falling Three Pattern forex trading mein ek important tool hai jo traders ko trend analysis mein madad deta hai. Yaad rahe ke trading mein risk ka bhi hissa hota hai, is liye hamesha apni research karain aur trading plan ke sath kaam karain.

تبصرہ

Расширенный режим Обычный режим