Bullish Harami Candle: Forex Trading Mein Tashkeel aur Istemal

Muqaddima

Forex trading duniya ka sabse bara aur liquid financial market hai jahan currencies ka tabdeel hoga hota hai. Is market mein kaamiyab rehne ke liye, traders ko price movements aur trend reversals ko samajhna zaroori hota hai. In sab mein candlestick patterns ka khaas ahmiyat hota hai. Is maqalay mein hum "Bullish Harami Candle" ke baaray mein tafseeli guftagu karenge, ke iski ahmiyat kya hai, iska istemal kaise hota hai, aur iske fayday aur nuksan kya hain.

Bullish Harami Candle Ki Pehchan

Bullish Harami Kya Hai?

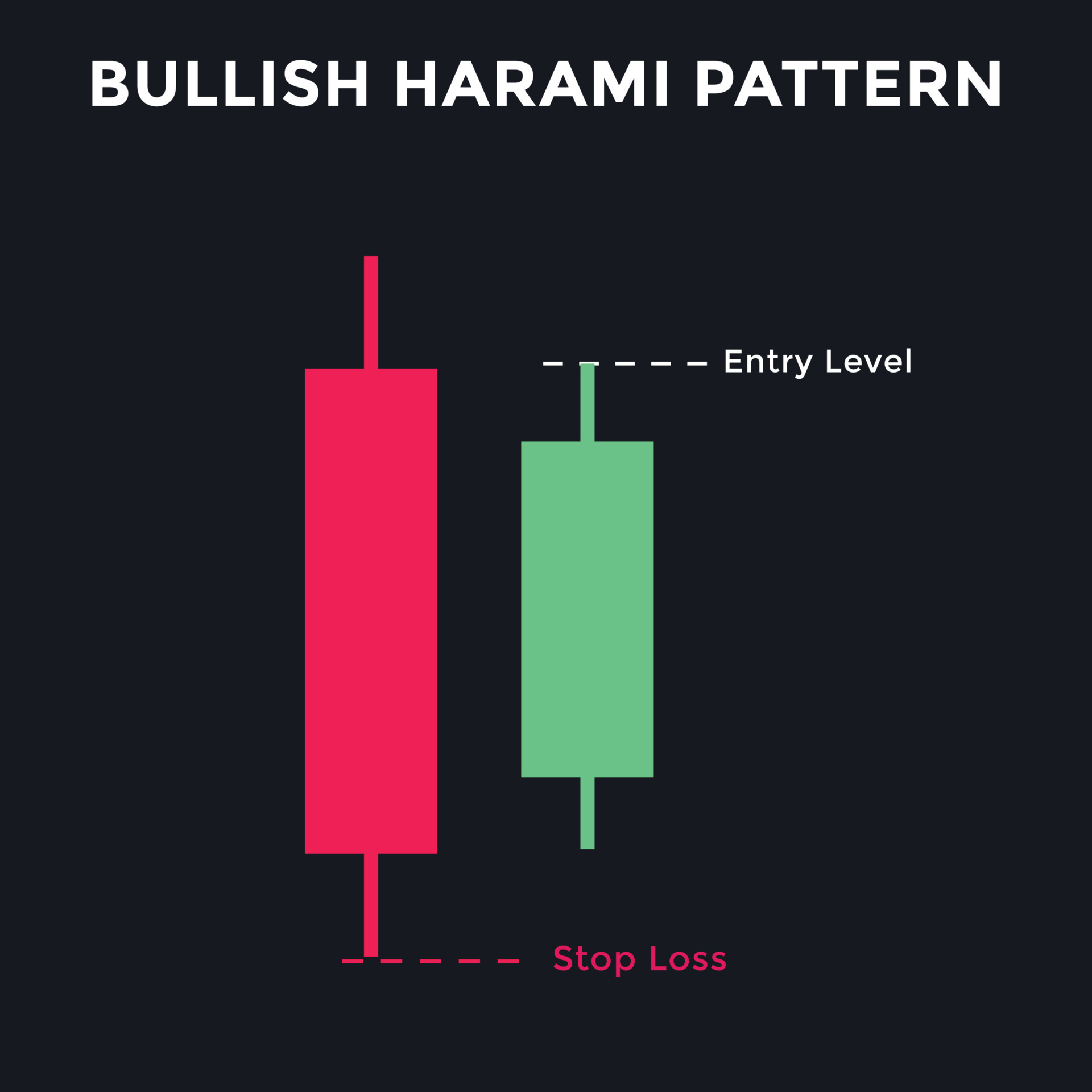

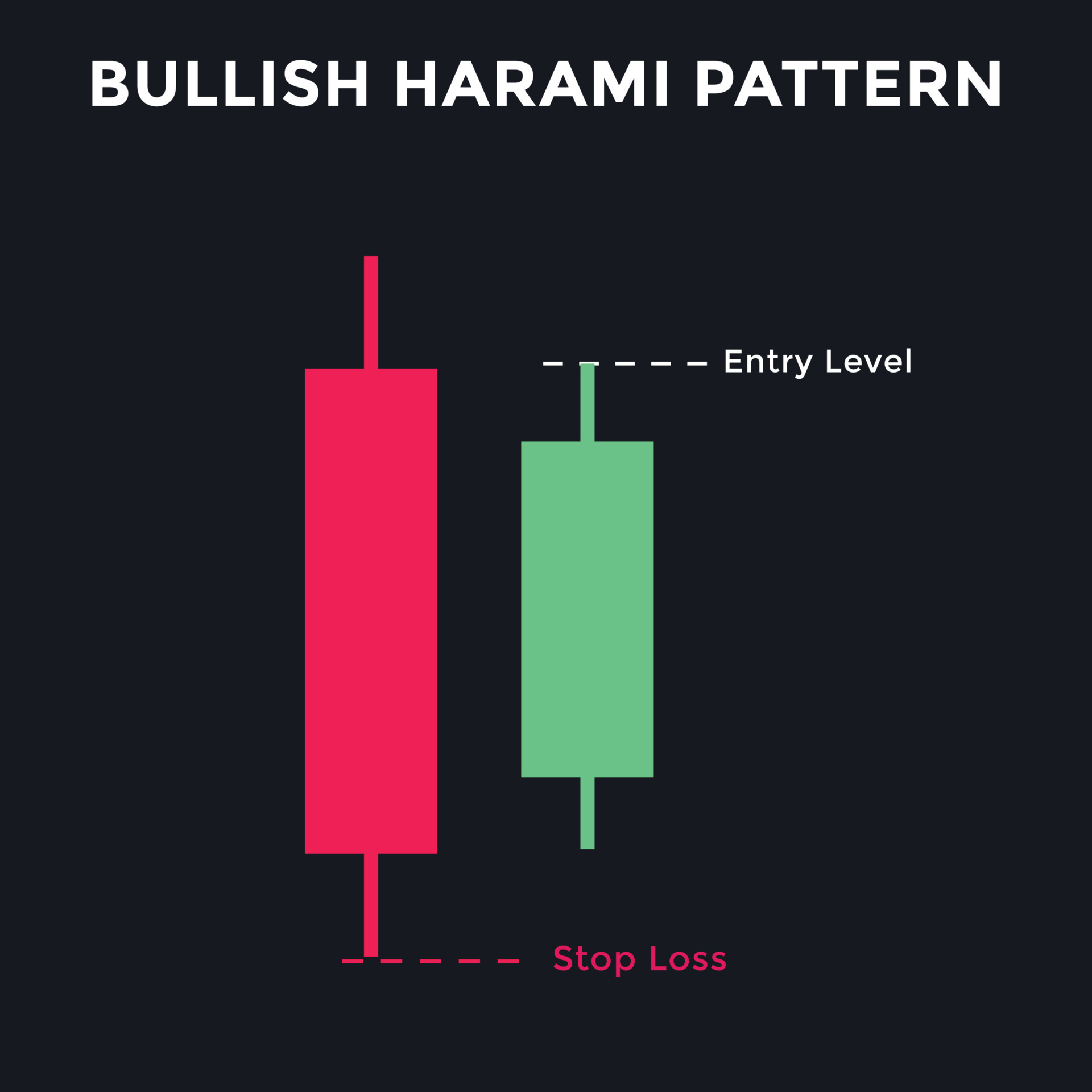

Bullish Harami ek do candlestick pattern hai jo trend reversal ko darust karta hai. Is pattern ki pehli candle lambi bearish (red) hoti hai, jabke doosri candle choti bullish (green) hoti hai. Iska matlab yeh hai ke pehli candle mein sellers ne bhaari control rakha, lekin doosri candle mein buyers thodi tawajju detey hain.

Pattern Ki Tashkeel

Trend Reversal Signal

Bullish Harami ka sab se bara signal yeh hota hai ke yeh trend reversal ko indicate karta hai. Jab traders is pattern ko dekhte hain, unhein yeh ehsaas hota hai ke market bullish hone ki taraf reh rahi hai, jo unhein buy positions lene ka mauqa diya jata hai.

Market Sentiment Ka Indication

Is pattern ki madad se traders market ki bhavanaon ya sentiment ke baare mein jaan sakte hain. Pehli candle ka bearish hona kaafi sellers ke entry ko darust karta hai, jabke doosri candle ka bullish hona buyers ki entry ka yeh signal hai ke wo bullish trend ko support kar rahe hain.

Entry aur Exit Points Ka Tayin

Bullish Harami candle ko dekh kar, traders apne entry aur exit points aasani se tay kar sakte hain. Agar yeh pattern kisi support level par ban raha ho, to yeh strong buying opportunity ko indicate karta hai.

Bullish Harami Candle Ka Istemal Kaise Karein?

Chart Analysis

Bullish Harami candle ka confirmation ka intezar karna chahiye. Jab doosri candle ke baad koi bullish candle banegi, to yeh bullish trend ki confirmation degi.

Risk Management

Risk management bohot zaroori hai. Har trade ke saath stop loss zaroor lagana chahiye, taake agar market expected direction mein na chale, to nuqsan ahista ahista ho.

Bullish Harami Candle Ke Fayday

Easy to Recognize

Bullish Harami pattern ko charts par pehchanana mushkil nahi hota, jo isse traders ke liye aasaan aur practical banata hai.

Trend Reversal Indication

Yeh pattern trend reversal ko indicate karta hai, jo ki ek bohot hi useful signal hai.

Controlled Risk

Is pattern ka istemal karte hue traders controlled risk ke sath trading kar sakte hain kyunke yeh ek defined entry aur exit point dikhata hai.

Bullish Harami Candle Ke Nuksan

False Signals Ka Khauf

Kabhi kabar, Bullish Harami pattern false signals bhi de sakta hai. Agar is pattern ke baad market bullish nahi hoti, to traders ko nuqsan uthana parta hai.

Market Conditions Se Asar

Har bullish harami candle market conditions par depend karti hai. Agar overall market bearish trend mein hai, to yeh pattern itni effective nahi hai.

Emotional Trading

Traders aksar emotional trading karte hain aur is pattern par overly depend karte hain, jo lead kar sakta hai ghair bhari trading strategies ki taraf.

Bullish Harami Ka Comparison Baki Patterns Se

Pin Bar Candlestick

Pin bar candle bhi ek trend reversal signal hai lekin iska khaas ahmiyat yeh hai ke yeh sirf ek candle par depend karta hai. Iske muqablay mein, Bullish Harami pattern do candles ka combination hai jo market sentiment ko behtar tarah samjhta hai.

Engulfing Pattern

Engulfing pattern, jaise ke Bullish Harami, trend changes ko indicate karta hai. Lekin, engulfing candle mein pehli candle doosri candle ko poori tarah engulf karti hai. Yeh zyada powerful signal hota hai lekin Bullish Harami ke comparison mein, iski complexity zyada hoti hai.

Conclusion

Bullish Harami candle Forex trading mein ek important tool hai jisse traders market trends aur reversals ko samajh sakte hain. Is pattern ka istemal karte waqt hamesha risk management ka khayal rakhna chahiye. Yeh pattern clearly entry aur exit points dikhata hai, lekin traders ko behtareen trading decisions lenay ke liye iske illawat market conditions aur dusre technical indicators ka bhi istamal karna chahiye.

Aakhir mein, Bullish Harami trading ke liye ek powerful pattern hai, lekin iska samajh kar conscientiously istemal karna zaroori hai. Is pattern ko samajhne aur kick karne se traders apki trading strategy ko behter bana sakte hain aur market ke fluctuations se faida utha sakte hain.

Muqaddima

Forex trading duniya ka sabse bara aur liquid financial market hai jahan currencies ka tabdeel hoga hota hai. Is market mein kaamiyab rehne ke liye, traders ko price movements aur trend reversals ko samajhna zaroori hota hai. In sab mein candlestick patterns ka khaas ahmiyat hota hai. Is maqalay mein hum "Bullish Harami Candle" ke baaray mein tafseeli guftagu karenge, ke iski ahmiyat kya hai, iska istemal kaise hota hai, aur iske fayday aur nuksan kya hain.

Bullish Harami Candle Ki Pehchan

Bullish Harami Kya Hai?

Bullish Harami ek do candlestick pattern hai jo trend reversal ko darust karta hai. Is pattern ki pehli candle lambi bearish (red) hoti hai, jabke doosri candle choti bullish (green) hoti hai. Iska matlab yeh hai ke pehli candle mein sellers ne bhaari control rakha, lekin doosri candle mein buyers thodi tawajju detey hain.

Pattern Ki Tashkeel

- Pehli Candle: Lambi bearish candle jo market ke andar strong selling pressure ko darust karti hai.

- Doosri Candle: Choti bullish candle jo pehli candle ke andar finish hoti hai. Iski closure pehli candle ki low se upar honi chahiye.

Trend Reversal Signal

Bullish Harami ka sab se bara signal yeh hota hai ke yeh trend reversal ko indicate karta hai. Jab traders is pattern ko dekhte hain, unhein yeh ehsaas hota hai ke market bullish hone ki taraf reh rahi hai, jo unhein buy positions lene ka mauqa diya jata hai.

Market Sentiment Ka Indication

Is pattern ki madad se traders market ki bhavanaon ya sentiment ke baare mein jaan sakte hain. Pehli candle ka bearish hona kaafi sellers ke entry ko darust karta hai, jabke doosri candle ka bullish hona buyers ki entry ka yeh signal hai ke wo bullish trend ko support kar rahe hain.

Entry aur Exit Points Ka Tayin

Bullish Harami candle ko dekh kar, traders apne entry aur exit points aasani se tay kar sakte hain. Agar yeh pattern kisi support level par ban raha ho, to yeh strong buying opportunity ko indicate karta hai.

Bullish Harami Candle Ka Istemal Kaise Karein?

Chart Analysis

- Charts par Bullish Harami pattern ko pehchanne ke liye price action aur volume analysis zaroori hai. Agar yeh pattern kisi strong support level par ban raha hai, to iski reliability aur zyada badh jati hai.

Bullish Harami candle ka confirmation ka intezar karna chahiye. Jab doosri candle ke baad koi bullish candle banegi, to yeh bullish trend ki confirmation degi.

Risk Management

Risk management bohot zaroori hai. Har trade ke saath stop loss zaroor lagana chahiye, taake agar market expected direction mein na chale, to nuqsan ahista ahista ho.

Bullish Harami Candle Ke Fayday

Easy to Recognize

Bullish Harami pattern ko charts par pehchanana mushkil nahi hota, jo isse traders ke liye aasaan aur practical banata hai.

Trend Reversal Indication

Yeh pattern trend reversal ko indicate karta hai, jo ki ek bohot hi useful signal hai.

Controlled Risk

Is pattern ka istemal karte hue traders controlled risk ke sath trading kar sakte hain kyunke yeh ek defined entry aur exit point dikhata hai.

Bullish Harami Candle Ke Nuksan

False Signals Ka Khauf

Kabhi kabar, Bullish Harami pattern false signals bhi de sakta hai. Agar is pattern ke baad market bullish nahi hoti, to traders ko nuqsan uthana parta hai.

Market Conditions Se Asar

Har bullish harami candle market conditions par depend karti hai. Agar overall market bearish trend mein hai, to yeh pattern itni effective nahi hai.

Emotional Trading

Traders aksar emotional trading karte hain aur is pattern par overly depend karte hain, jo lead kar sakta hai ghair bhari trading strategies ki taraf.

Bullish Harami Ka Comparison Baki Patterns Se

Pin Bar Candlestick

Pin bar candle bhi ek trend reversal signal hai lekin iska khaas ahmiyat yeh hai ke yeh sirf ek candle par depend karta hai. Iske muqablay mein, Bullish Harami pattern do candles ka combination hai jo market sentiment ko behtar tarah samjhta hai.

Engulfing Pattern

Engulfing pattern, jaise ke Bullish Harami, trend changes ko indicate karta hai. Lekin, engulfing candle mein pehli candle doosri candle ko poori tarah engulf karti hai. Yeh zyada powerful signal hota hai lekin Bullish Harami ke comparison mein, iski complexity zyada hoti hai.

Conclusion

Bullish Harami candle Forex trading mein ek important tool hai jisse traders market trends aur reversals ko samajh sakte hain. Is pattern ka istemal karte waqt hamesha risk management ka khayal rakhna chahiye. Yeh pattern clearly entry aur exit points dikhata hai, lekin traders ko behtareen trading decisions lenay ke liye iske illawat market conditions aur dusre technical indicators ka bhi istamal karna chahiye.

Aakhir mein, Bullish Harami trading ke liye ek powerful pattern hai, lekin iska samajh kar conscientiously istemal karna zaroori hai. Is pattern ko samajhne aur kick karne se traders apki trading strategy ko behter bana sakte hain aur market ke fluctuations se faida utha sakte hain.

تبصرہ

Расширенный режим Обычный режим