Market Swoon Ka Impact

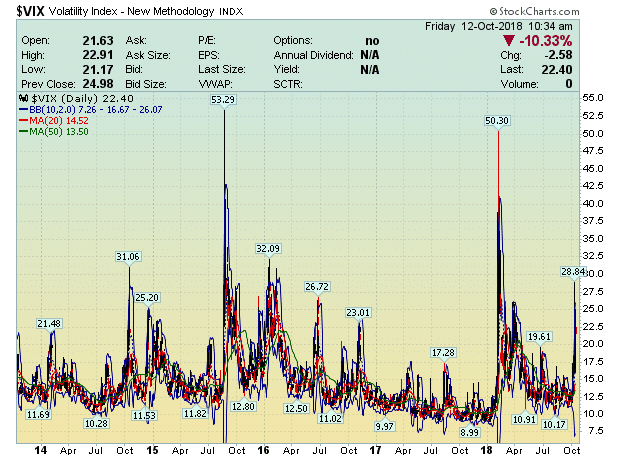

Market swoon ka matlab hota hai ek sudden aur tezi se giravat jo financial markets mein hoti hai. Iska asar investors ke sentiment par hota hai aur unki confidence ko kamzor kar deta hai. Market swoon ki wajah se investors ko nuksan ho sakta hai agar wo sahi samay par nahi react karte.

Market swoon ek pattern bhi ho sakta hai jo financial markets mein observe kiya ja sakta hai. Is pattern mein market mein ek sudden aur tezi se giravat hoti hai jiska koi specific reason nahi hota, lekin overall market sentiment aur economic indicators se related ho sakti hai.

Market swoon ke wajood ke kayi reasons ho sakte hain. Ye ho sakta hai ek economic indicator ka sudden change ho, geopolitical tensions ya kisi specific sector ya stock ke negative news aane ki wajah se bhi ho sakta hai. Iske alawa market swoon ka asar bhi ho sakta hai global events ya news par.

Market swoon ke chalte investors ko nuksan bhi ho sakta hai. Jab market mein sudden giravat hoti hai to investors apne investments ke value mein kami dekh sakte hain jo unke assets ko kamzor kar sakta hai. Iske alawa stock prices mein giravat se investors ko panic ho sakta hai aur unhe apni positions close karne ka pressure mehsoos ho sakta hai.

Market Swoon Ko Handle Karne Ke Tareeqe

Market swoon se investors ko protect karne ke liye kuch strategies hain jo wo apna sakte hain. Ek strategy hai stop-loss orders lagana jisse agar stock price specific level tak gir jata hai to investor ka position automatically close ho jata hai. Iske alawa diversified portfolio maintain karna bhi ek important strategy hai jisse risk spread out hota hai.

Market swoon ka asar ek specific time period tak hota hai jisme investors ka sentiment negative hota hai. Is time period mein market volatility bhi badh jati hai aur prices me fluctuations dekhi ja sakti hain. Investors ko patience aur discipline maintain karke apne investment ke liye wait karna chahiye.

Is market swoon ka asar long term investors ko kam hota hai jo apne investments ko long term ke liye dekhte hain. Short term investors ko market swoon se jyada nuksan ho sakta hai kyunki unka investment time frame chota hota hai. Isliye investors ko market conditions ko observe karte hue apne strategies ko adjust karna chahiye.

In conclusion, market swoon ek common phenomenon hai financial markets mein jo investors ke sentiment par asar dalta hai. Iska pattern observe kiya ja sakta hai aur iske wajah se investors ko nuksan bhi ho sakta hai. Investors ko market conditions ko samajh kar apne investment strategies ko adjust karna chahiye taaki market swoon se nuksan se bacha ja sake.

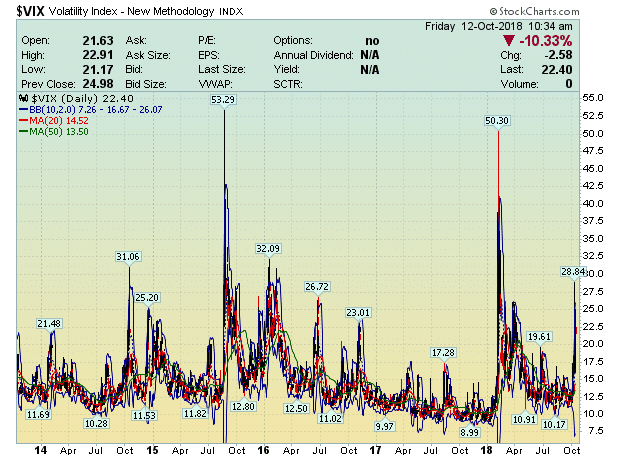

Market swoon ka matlab hota hai ek sudden aur tezi se giravat jo financial markets mein hoti hai. Iska asar investors ke sentiment par hota hai aur unki confidence ko kamzor kar deta hai. Market swoon ki wajah se investors ko nuksan ho sakta hai agar wo sahi samay par nahi react karte.

Market swoon ek pattern bhi ho sakta hai jo financial markets mein observe kiya ja sakta hai. Is pattern mein market mein ek sudden aur tezi se giravat hoti hai jiska koi specific reason nahi hota, lekin overall market sentiment aur economic indicators se related ho sakti hai.

Market swoon ke wajood ke kayi reasons ho sakte hain. Ye ho sakta hai ek economic indicator ka sudden change ho, geopolitical tensions ya kisi specific sector ya stock ke negative news aane ki wajah se bhi ho sakta hai. Iske alawa market swoon ka asar bhi ho sakta hai global events ya news par.

Market swoon ke chalte investors ko nuksan bhi ho sakta hai. Jab market mein sudden giravat hoti hai to investors apne investments ke value mein kami dekh sakte hain jo unke assets ko kamzor kar sakta hai. Iske alawa stock prices mein giravat se investors ko panic ho sakta hai aur unhe apni positions close karne ka pressure mehsoos ho sakta hai.

Market Swoon Ko Handle Karne Ke Tareeqe

Market swoon se investors ko protect karne ke liye kuch strategies hain jo wo apna sakte hain. Ek strategy hai stop-loss orders lagana jisse agar stock price specific level tak gir jata hai to investor ka position automatically close ho jata hai. Iske alawa diversified portfolio maintain karna bhi ek important strategy hai jisse risk spread out hota hai.

Market swoon ka asar ek specific time period tak hota hai jisme investors ka sentiment negative hota hai. Is time period mein market volatility bhi badh jati hai aur prices me fluctuations dekhi ja sakti hain. Investors ko patience aur discipline maintain karke apne investment ke liye wait karna chahiye.

Is market swoon ka asar long term investors ko kam hota hai jo apne investments ko long term ke liye dekhte hain. Short term investors ko market swoon se jyada nuksan ho sakta hai kyunki unka investment time frame chota hota hai. Isliye investors ko market conditions ko observe karte hue apne strategies ko adjust karna chahiye.

In conclusion, market swoon ek common phenomenon hai financial markets mein jo investors ke sentiment par asar dalta hai. Iska pattern observe kiya ja sakta hai aur iske wajah se investors ko nuksan bhi ho sakta hai. Investors ko market conditions ko samajh kar apne investment strategies ko adjust karna chahiye taaki market swoon se nuksan se bacha ja sake.

تبصرہ

Расширенный режим Обычный режим