Forex trading mein candlestick patterns kaafi ahem role ada karte hain, aur in mein se ek mukhtalif candlestick patterns mein se ek hai Inverted Hammer. Yeh pattern traders ko market trend ke bare mein useful information provide karta hai, aur prices ke future movement ka hint deta hai. Is article mein, hum Inverted Hammer candlestick pattern ke ahmiyat aur istemal ke baare mein baat karenge, sath hi is ke fayde aur nuksan bhi discuss karenge.

Inverted Hammer Candlestick Pattern:

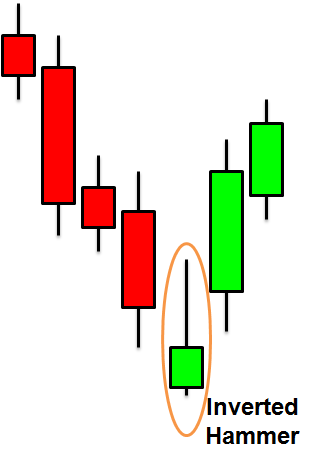

Inverted Hammer candlestick pattern ek bullish reversal signal hai, jo normal hammer ke ulta hota hai. Is pattern mein, market ke bottom par price initially low hota hai, phir price upward move karta hai aur candle ka close near high hota hai. Yeh pattern market mein bearish pressure ke baad dikhta hai aur indicate karta hai ke market bullish trend mein change hone wala hai.

Forex trading mein Iski Ahmiyat:

Inverted Hammer pattern market mein trend reversal ke signals provide karta hai, jisse traders price ke future movement ka idea bana sakte hain. Agar market mein downtrend chal raha hai aur Inverted Hammer pattern form hota hai, to yeh indicate karta hai ke market bullish trend mein change hone wala hai. Is pattern ka istemal karke traders apne trading decisions ko improve kar sakte hain aur profit earn kar sakte hain.

Inverted Hammer Ka Istemal:

Inverted Hammer pattern ko identify karne ke liye traders ko candlestick charts ko closely observe karna hota hai. Inverted Hammer ko confirm karne ke liye, traders ko volume ke sath price action ko bhi dekhna hota hai. Agar Inverted Hammer pattern ke baad price upward move karta hai, to yeh pattern confirm hota hai aur traders ko entry point provide karta hai.

Inverted Hammer Ke Fayde:

- Inverted Hammer pattern traders ko trend reversal ke early signals provide karta hai.

- Is pattern ke istemal se traders apne trading decisions ko improve kar sakte hain.

- Inverted Hammer pattern ke sath volume analysis karke traders reliable signals generate kar sakte hain.

Inverted Hammer Ke Nuksan:

- Inverted Hammer pattern ke false signals bhi ho sakte hain, jisse traders ko loss ho sakta hai.

- Agar traders volume ke sath price action ko ignore karte hain, to Inverted Hammer ke sahi interpretation mein dikkat ho sakti hai.

Inverted Hammer Pattern Aur Risk Management:

Inverted Hammer pattern ke istemal ke sath, traders ko risk management ka bhi khayal rakhna important hota hai. Stop loss aur take profit levels ko properly set karna crucial hai, takay traders apne losses ko minimize kar sake aur profits ko maximize kar sake.

Conclusion:

Inverted Hammer candlestick pattern forex trading mein important tool hai, jo traders ko trend reversal signals provide karta hai. Is pattern ko identify karke, traders apne trading strategies ko improve kar sakte hain aur profitable trades kar sakte hain. Lekin traders ko false signals se bachne ke liye proper analysis aur risk management ka istemal karna important hai.

Is article mein, humne Inverted Hammer candlestick pattern ke ahmiyat aur istemal ke baare mein baat ki, sath hi is ke fayde aur nuksan bhi discuss kiye. Umeed hai ke yeh information aap ke liye helpful hogi aur aap forex trading mein apne success ko boost karne mein madadgar sabit hogi.

تبصرہ

Расширенный режим Обычный режим