Forex trading mein candlestick patterns ka istemal bohot ahem hota hai, aur Tri Star Candlestick Pattern bhi ismein ek important pattern hai. Yeh pattern market trend aur price action ke baray mein zaroori maloomat faraham karta hai. Is article mein hum Tri Star Candlestick Pattern ke baray mein mukhtasar tafseelat aur iske istemal ki ahmiyat par baat karenge.

Tri Star Candlestick Pattern Kya Hai?

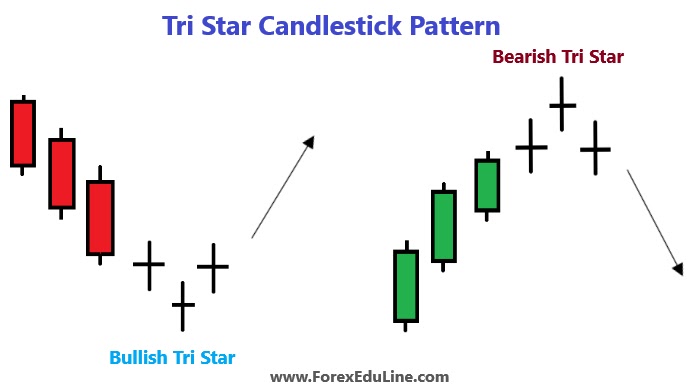

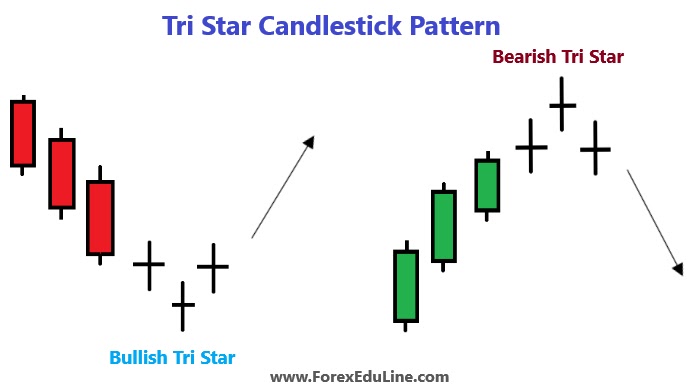

Tri Star Candlestick Pattern ek reversal pattern hai jo market ke trend ka pata lagane mein madad deta hai. Yeh pattern teen candlesticks se bana hota hai, jin mein middle candlestick baqi do candlesticks ke darmiyan hoti hai. Jab market mein yeh pattern nazar aata hai, to yeh indicate karta hai ke current trend khatam ho kar opposite direction mein badalne wala hai.

Tri Star Candlestick Pattern Ki Tashkeel

Tri Star Candlestick Pattern ki tashkeel kafi simple hai. Is pattern mein teen consecutive candlesticks shamil hote hain. Pehli candlestick uptrend ke doran ban kar close hoti hai. Doosri candlestick gap down ke sath open hoti hai aur pehli candlestick ke close ke neeche hoti hai. Teesri candlestick pehli do candlesticks ke darmiyan close hoti hai.

Tri Star Candlestick Pattern Ki Ahmiyat

Tri Star Candlestick Pattern forex trading mein ahmiyat rakhta hai kyun ke iska zikar aam tor par trend reversal ke doran hota hai. Is pattern ko mil kar aur dosri technical analysis tools ke sath istemal karke traders market direction ka andaza lagate hain. Agar yeh pattern sahi tarah se samjha jaye aur sahi waqt par trade kiya jaye to isse ache results mil sakte hain.

Tri Star Candlestick Pattern Ka Istemal

Tri Star Candlestick Pattern ka istemal karne ke liye traders ko sabar aur tawajjo ki zaroorat hoti hai. Is pattern ko pehchanne ke liye traders ko market ke price action ko closely observe karna parta hai. Iske ilawa, traders ko market sentiment aur dosri technical analysis tools ka bhi istemal karna chahiye.

Tri Star Candlestick Pattern Ke Fayde

Tri Star Candlestick Pattern ke istemal se traders ko kuch faiday mil sakte hain, jaise:

Tri Star Candlestick Pattern Kya Hai?

Tri Star Candlestick Pattern ek reversal pattern hai jo market ke trend ka pata lagane mein madad deta hai. Yeh pattern teen candlesticks se bana hota hai, jin mein middle candlestick baqi do candlesticks ke darmiyan hoti hai. Jab market mein yeh pattern nazar aata hai, to yeh indicate karta hai ke current trend khatam ho kar opposite direction mein badalne wala hai.

Tri Star Candlestick Pattern Ki Tashkeel

Tri Star Candlestick Pattern ki tashkeel kafi simple hai. Is pattern mein teen consecutive candlesticks shamil hote hain. Pehli candlestick uptrend ke doran ban kar close hoti hai. Doosri candlestick gap down ke sath open hoti hai aur pehli candlestick ke close ke neeche hoti hai. Teesri candlestick pehli do candlesticks ke darmiyan close hoti hai.

Tri Star Candlestick Pattern Ki Ahmiyat

Tri Star Candlestick Pattern forex trading mein ahmiyat rakhta hai kyun ke iska zikar aam tor par trend reversal ke doran hota hai. Is pattern ko mil kar aur dosri technical analysis tools ke sath istemal karke traders market direction ka andaza lagate hain. Agar yeh pattern sahi tarah se samjha jaye aur sahi waqt par trade kiya jaye to isse ache results mil sakte hain.

Tri Star Candlestick Pattern Ka Istemal

Tri Star Candlestick Pattern ka istemal karne ke liye traders ko sabar aur tawajjo ki zaroorat hoti hai. Is pattern ko pehchanne ke liye traders ko market ke price action ko closely observe karna parta hai. Iske ilawa, traders ko market sentiment aur dosri technical analysis tools ka bhi istemal karna chahiye.

Tri Star Candlestick Pattern Ke Fayde

Tri Star Candlestick Pattern ke istemal se traders ko kuch faiday mil sakte hain, jaise:

- Trend Reversal Ka Pata: Is pattern ke zariye traders ko market mein trend reversal ka pata lag jata hai, jo unhe future trading decisions mein madad faraham karta hai.

- Entry aur Exit Points: Tri Star Candlestick Pattern ke istemal se traders sahi entry aur exit points tay kar sakte hain, jo unhe profit maximization mein madadgar sabit hote hain.

- Risk Management: Is pattern ke istemal se traders apne risk ko minimize kar sakte hain, aur apne trades ko effecti...

تبصرہ

Расширенный режим Обычный режим