what is doji candlestick pattern

forex market mein doji candlestick pattern aik kesam ka single candlestick pattern hota hey jes ke forex market mein security ke price open or close ke level aik he hote hey jaisa keh forex market kay chart par candlestick ke shape say he zahair hota hey Doji candlestick forex market mein cross or reversal trend ke shape mein bante hey market os time mein koi decision nahi lay rehe hotehey market mein jab doji bante hey to trend tabdel honay wala hota hey

Understanding Doji candlestick pattern

forex market mein doji candlestick pattern mein forex market mein price aik he jaice hote hey forex market mein high low open or close ke level aik he jaice hote hey

technical analysis mein es bat ka kheyal yeh hota hey keh forex market kay stock kay baray mein malomat frahm ke jate hein estarah say keh pechle price kay baray mein anay wale pricce ka koi relation nahi hota hey stock ke asal price or reality say bhe es ka koi taulaq nahi hota hey technical analysis mein sab say zyada imkane trading ka sjor ka estamal keya jata hey

forex market mein doji candlestick pattern os time banta hey jab forex market mein security e start priceor end price aik he jaice hote hey yeh forex market kay bohut say trend mein tabdele ko bhe identify karte hey jes ka matlab yeh hota hey keh galti ya galat ke security price kay start price or end price sab aik he jaisay hotay hein yeh forex market mein basic tor par ghair janab dar signal samjha jata hey

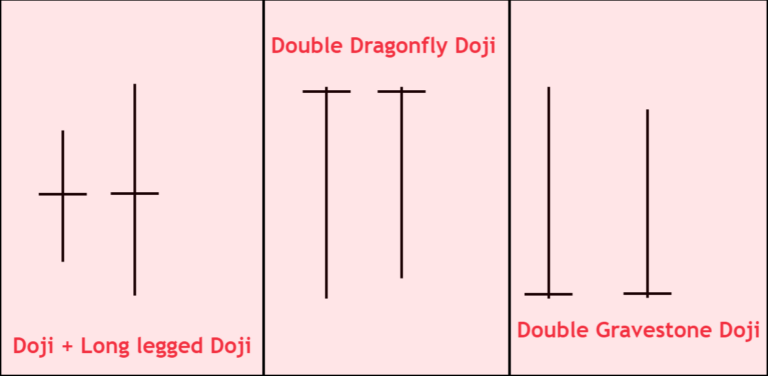

oper de gay tasweer say bhe ap daikh saktay hein keh doji candlestick pattern jama ka neshan hey Doji ka oper wala head day ke sab say price ko waah karta hey or nechay wala head day ke sab say low price ke nimandge karta hey or hrizontal part aik taraf ke end price or dosree taraf say start price ko wazah karta hey

Green rang ke Doji kaisay bante hey

aik green rang ke doji mein security ke end price security ke start price say bhe zyada hote hey start or end price kay darmean mein farq kam hota hey nechay de gay taweer ko bhe daikh saktay hein

oper de gai tasweer say pata chalta hey keh forex market ke start price end price say thore ce kam hey hallankeh security price mein start or end price aik dosray kay close hein Doji candlestick ke green body patle ce hey jes say zahair ho raha hey keh start price or end price kay darmean mei farq serf 1 -minute ka hey

Red doji kaisay bante hey

market mein red range ke doji es bat ke tarf eshara karte hey forex market mein low price high say zyada hey market mein start ke end price kay darmean mein farq bohut he kam hota hey nechay de gay tasweer mein bhe ap daikh saktay hein

jaisa keh ap nechay dde gay tasweer say bhe daikh saktay hein keh forex market mein start price end price say bhe thore zyada hey hallankeh start price or end price aik dosray kay bohut he close hein or forex market mein start price or end price mein 1 minute ka farq hey or doji candlestick ke body red hote hey

Trade with Doji candlestick pattern

nechay GBP/USD ka chart deya geya hey Doji star forex market ke majodah kame mein he zahair hote hey doji candlestick pattern say pata chalta hey keh forex market buyer or selle dono control mein nahi hein es point par note kar kay trader ko supporting signal talash karna chihay nechay deya geya chart forex stock mein indicator ka estamal kar raha hey jo keh es bat ko zahair karta hey keh forex market es time oversold kay area mein he hey jes say bullish trend mein ezafa hota hey

forex market mein doji candlestick pattern aik kesam ka single candlestick pattern hota hey jes ke forex market mein security ke price open or close ke level aik he hote hey jaisa keh forex market kay chart par candlestick ke shape say he zahair hota hey Doji candlestick forex market mein cross or reversal trend ke shape mein bante hey market os time mein koi decision nahi lay rehe hotehey market mein jab doji bante hey to trend tabdel honay wala hota hey

Understanding Doji candlestick pattern

forex market mein doji candlestick pattern mein forex market mein price aik he jaice hote hey forex market mein high low open or close ke level aik he jaice hote hey

technical analysis mein es bat ka kheyal yeh hota hey keh forex market kay stock kay baray mein malomat frahm ke jate hein estarah say keh pechle price kay baray mein anay wale pricce ka koi relation nahi hota hey stock ke asal price or reality say bhe es ka koi taulaq nahi hota hey technical analysis mein sab say zyada imkane trading ka sjor ka estamal keya jata hey

forex market mein doji candlestick pattern os time banta hey jab forex market mein security e start priceor end price aik he jaice hote hey yeh forex market kay bohut say trend mein tabdele ko bhe identify karte hey jes ka matlab yeh hota hey keh galti ya galat ke security price kay start price or end price sab aik he jaisay hotay hein yeh forex market mein basic tor par ghair janab dar signal samjha jata hey

oper de gay tasweer say bhe ap daikh saktay hein keh doji candlestick pattern jama ka neshan hey Doji ka oper wala head day ke sab say price ko waah karta hey or nechay wala head day ke sab say low price ke nimandge karta hey or hrizontal part aik taraf ke end price or dosree taraf say start price ko wazah karta hey

Green rang ke Doji kaisay bante hey

aik green rang ke doji mein security ke end price security ke start price say bhe zyada hote hey start or end price kay darmean mein farq kam hota hey nechay de gay taweer ko bhe daikh saktay hein

oper de gai tasweer say pata chalta hey keh forex market ke start price end price say thore ce kam hey hallankeh security price mein start or end price aik dosray kay close hein Doji candlestick ke green body patle ce hey jes say zahair ho raha hey keh start price or end price kay darmean mei farq serf 1 -minute ka hey

Red doji kaisay bante hey

market mein red range ke doji es bat ke tarf eshara karte hey forex market mein low price high say zyada hey market mein start ke end price kay darmean mein farq bohut he kam hota hey nechay de gay tasweer mein bhe ap daikh saktay hein

jaisa keh ap nechay dde gay tasweer say bhe daikh saktay hein keh forex market mein start price end price say bhe thore zyada hey hallankeh start price or end price aik dosray kay bohut he close hein or forex market mein start price or end price mein 1 minute ka farq hey or doji candlestick ke body red hote hey

Trade with Doji candlestick pattern

nechay GBP/USD ka chart deya geya hey Doji star forex market ke majodah kame mein he zahair hote hey doji candlestick pattern say pata chalta hey keh forex market buyer or selle dono control mein nahi hein es point par note kar kay trader ko supporting signal talash karna chihay nechay deya geya chart forex stock mein indicator ka estamal kar raha hey jo keh es bat ko zahair karta hey keh forex market es time oversold kay area mein he hey jes say bullish trend mein ezafa hota hey

تبصرہ

Расширенный режим Обычный режим