Mat hold candlestick pattern:

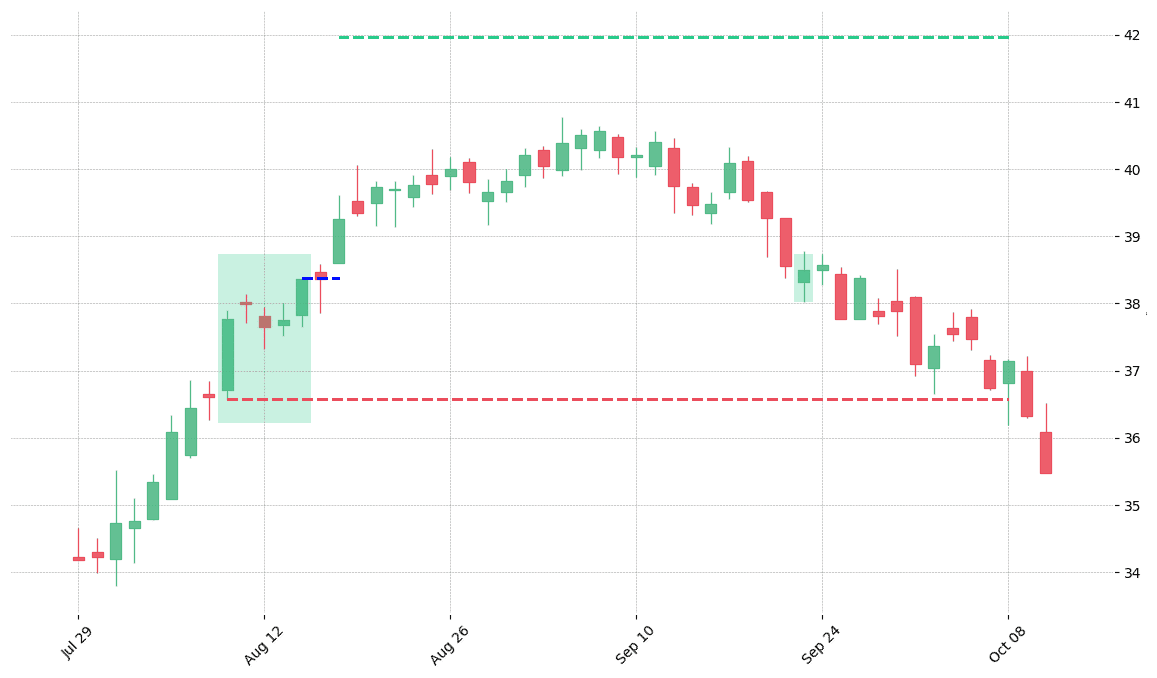

Assalam o alaikum!Dear my friends Mat Hold Pattern, candlestick charts par nazar aane wala aik specific pattern hy jo market mein aik strong uptrend ke baad aata hy. Ye pattern typically bullish hota hy aur market ke continuation ko darust karta hy. Mat Hold Pattern ki pehchan ke liye kuch key features hote hein:

Important features of Mat hold candlestick pattern:

Uptrend ke Baad Aata Hy:

Mat Hold Pattern market mein aik strong uptrend ke baad aata hy, jo ke indicate karta hy ke buyers market mein control mein hein.

Large White Candle:

Is pattern ki pehli candle, jo ke uptrend ke part hoti hy, bohot badi hoti hy. Ye candle buyers ke dominance ko darust karta hy.

Small Candlestick Body:

Mat Hold Pattern ki doosri candle aik choti si body ki hoti hy, jo ke pehli candle ki range ke andar rehti hy. Ye choti si body indicate karta hy ke market mein uncertainty hy.

Isolated Gap:

Mat Hold Pattern mein doosri candle ke baad aik isolated gap hota hy, jo ke do candles ke darmiyan hota hy. Is gap ki wajah se market mein aik short-term pause hota hy.

Uptrend ka Continuation:

Mat Hold Pattern ke baad market mein uptrend ka continuation hota hy, jo ke traders ke liye aik bullish signal hy.

Uses of Mat Hold candlestick Pattern:

Dear forex Traders Mat Hold Pattern ka istemaal kar ke market trends ko samajhte hein aur future price movements ko predict karte hein. Agar ye pattern sahi taur par pehchana jata hy, to ye traders ko aik indication deta hy ke market mein uptrend jari hy aur wo apne positions ko hold kar sakte hein.Yeh important hy ke traders apne decisions ko samajhdaranae se lein aur sirf aik pattern par pura bharosa na karein. Technical analysis ke sath-sath, market fundamentals ko bhi madde nazar rakha jaye.

Conclusion:

Dear forex members Mat Hold Pattern aik useful technical indicator hy jo market trends ko samajhne mein madad karta hy. Traders ko chahiye ke is pattern ko samajhne ka dhang seaikhein aur apne decisions ko carefully aur cautious taur par lein. Market mein hamesha risk hota hy, aur har trading decision ko carefully weigh kiya jana chahiye. Mat Hold pattern aik useful tool hy jo traders ko market ke future movements ka hint dene mein madad karta hy. Is pattern ki sahi pehchan aur samajh traders ko aik edge deti hy, laikin har trading decision ko carefully analyze karna important hy. Mat Hold pattern ke sath judi hui technical analysis skills se traders apne trading game ko improve kar sakte hein.

Assalam o alaikum!Dear my friends Mat Hold Pattern, candlestick charts par nazar aane wala aik specific pattern hy jo market mein aik strong uptrend ke baad aata hy. Ye pattern typically bullish hota hy aur market ke continuation ko darust karta hy. Mat Hold Pattern ki pehchan ke liye kuch key features hote hein:

Important features of Mat hold candlestick pattern:

Uptrend ke Baad Aata Hy:

Mat Hold Pattern market mein aik strong uptrend ke baad aata hy, jo ke indicate karta hy ke buyers market mein control mein hein.

Large White Candle:

Is pattern ki pehli candle, jo ke uptrend ke part hoti hy, bohot badi hoti hy. Ye candle buyers ke dominance ko darust karta hy.

Small Candlestick Body:

Mat Hold Pattern ki doosri candle aik choti si body ki hoti hy, jo ke pehli candle ki range ke andar rehti hy. Ye choti si body indicate karta hy ke market mein uncertainty hy.

Isolated Gap:

Mat Hold Pattern mein doosri candle ke baad aik isolated gap hota hy, jo ke do candles ke darmiyan hota hy. Is gap ki wajah se market mein aik short-term pause hota hy.

Uptrend ka Continuation:

Mat Hold Pattern ke baad market mein uptrend ka continuation hota hy, jo ke traders ke liye aik bullish signal hy.

Uses of Mat Hold candlestick Pattern:

Dear forex Traders Mat Hold Pattern ka istemaal kar ke market trends ko samajhte hein aur future price movements ko predict karte hein. Agar ye pattern sahi taur par pehchana jata hy, to ye traders ko aik indication deta hy ke market mein uptrend jari hy aur wo apne positions ko hold kar sakte hein.Yeh important hy ke traders apne decisions ko samajhdaranae se lein aur sirf aik pattern par pura bharosa na karein. Technical analysis ke sath-sath, market fundamentals ko bhi madde nazar rakha jaye.

Conclusion:

Dear forex members Mat Hold Pattern aik useful technical indicator hy jo market trends ko samajhne mein madad karta hy. Traders ko chahiye ke is pattern ko samajhne ka dhang seaikhein aur apne decisions ko carefully aur cautious taur par lein. Market mein hamesha risk hota hy, aur har trading decision ko carefully weigh kiya jana chahiye. Mat Hold pattern aik useful tool hy jo traders ko market ke future movements ka hint dene mein madad karta hy. Is pattern ki sahi pehchan aur samajh traders ko aik edge deti hy, laikin har trading decision ko carefully analyze karna important hy. Mat Hold pattern ke sath judi hui technical analysis skills se traders apne trading game ko improve kar sakte hein.

تبصرہ

Расширенный режим Обычный режим