Engulfing candlestick Pattern:

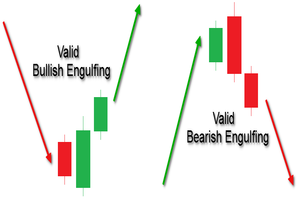

Dear my friends "Engulfing Pattern" aik candlestick pattern hy jo market trend reversal ko indicate karta hy. Ye pattern jab hota hy, toh aik candle dusre candle ko puri tarah se cover karta hy, isse hi iska naam "engulfing" aata hy. Engulfing pattern do tarah ka hota hy. Bullish Engulfing aur Bearish Engulfing.

Bullish Engulfing Pattern:

Dear forex members Bullish engulfing pattern aik uptrend ke baad aata hy aur bearish candle ko engulf karta hy. Yeh bullish reversal ko suggest karta hy, yaani ke buyers ne control ko regain kiya hy aur ab market mein bullish momentum hy.

Characteristics:

1:Pehli candle bearish hota hy.

2:Dusri candle, pehle wale bearish candle ko puri tarah se cover karti hy aur khud bhi upper side tak extend hota hy.

3:Bullish engulfing pattern ke baad market mein uptrend hone ke chances hote hein.

Bearish Engulfing Pattern:

Dear forex traders Bearish engulfing pattern aik uptrend ke baad aati hy aur bullish candle ko engulf karta hy. Yeh bearish reversal ko suggest karta hy, yaani ke sellers ne control ko regain kiya hy aur ab market mein bearish momentum hy.

Characteristics:

1:Pehli candle bullish hoti hy.

2:Dusri candle, pehle wale bullish candle ko puri tarah se cover karti hy aur khud bhi lower side tak extend hota hy.

3:Bearish engulfing pattern ke baad market mein downtrend hone ke chances hote hein.

Trading Strategy with Engulfing Pattern:

Dear trading partners Jab engulfing pattern market par appear hota hy, toh traders isse trend reversal ka signal samajhte hein.Bullish engulfing pattern ke baad, traders long (buy) positions le sakte hein.Bearish engulfing pattern ke baad, traders short (sell) positions le sakte hein.Stop-loss orders ka istemal kiya jata hy taki agar trade galat ho, toh nuksan kam ho sake.

Key Points:

1:Engulfing patterns strong reversal signals hote hein laikin hamesha 100% sahi nahi hote.

2:Confirmation ke liye, doosre technical indicators aur analysis tools ka istemal bhi kiya jata hy.

3:Market conditions aur time frame ko bhi consider karna important hy.

Dear my friends "Engulfing Pattern" aik candlestick pattern hy jo market trend reversal ko indicate karta hy. Ye pattern jab hota hy, toh aik candle dusre candle ko puri tarah se cover karta hy, isse hi iska naam "engulfing" aata hy. Engulfing pattern do tarah ka hota hy. Bullish Engulfing aur Bearish Engulfing.

Bullish Engulfing Pattern:

Dear forex members Bullish engulfing pattern aik uptrend ke baad aata hy aur bearish candle ko engulf karta hy. Yeh bullish reversal ko suggest karta hy, yaani ke buyers ne control ko regain kiya hy aur ab market mein bullish momentum hy.

Characteristics:

1:Pehli candle bearish hota hy.

2:Dusri candle, pehle wale bearish candle ko puri tarah se cover karti hy aur khud bhi upper side tak extend hota hy.

3:Bullish engulfing pattern ke baad market mein uptrend hone ke chances hote hein.

Bearish Engulfing Pattern:

Dear forex traders Bearish engulfing pattern aik uptrend ke baad aati hy aur bullish candle ko engulf karta hy. Yeh bearish reversal ko suggest karta hy, yaani ke sellers ne control ko regain kiya hy aur ab market mein bearish momentum hy.

Characteristics:

1:Pehli candle bullish hoti hy.

2:Dusri candle, pehle wale bullish candle ko puri tarah se cover karti hy aur khud bhi lower side tak extend hota hy.

3:Bearish engulfing pattern ke baad market mein downtrend hone ke chances hote hein.

Trading Strategy with Engulfing Pattern:

Dear trading partners Jab engulfing pattern market par appear hota hy, toh traders isse trend reversal ka signal samajhte hein.Bullish engulfing pattern ke baad, traders long (buy) positions le sakte hein.Bearish engulfing pattern ke baad, traders short (sell) positions le sakte hein.Stop-loss orders ka istemal kiya jata hy taki agar trade galat ho, toh nuksan kam ho sake.

Key Points:

1:Engulfing patterns strong reversal signals hote hein laikin hamesha 100% sahi nahi hote.

2:Confirmation ke liye, doosre technical indicators aur analysis tools ka istemal bhi kiya jata hy.

3:Market conditions aur time frame ko bhi consider karna important hy.

تبصرہ

Расширенный режим Обычный режим