ADVANCE DECLINE LINE STRATEGY IN FOREX TRADING

INTRODUCTION

Advance-Decline Line (AD Line) ek popular market breadth indicator hai jo forex trading mein use hota hai. Ye indicator market ki overall strength ya weakness ko measure karta hai.

INDICATOR COMPONENTS

AD Line market breadth ko measure karta hai by calculating the difference between advancing securities aur declining securities. Iska calculation simple hai: Advancing Securities Wo securities jin ki prices increase ho rahi hain. Declining Securities Wo securities jin ki prices decrease ho rahi hain.

CALCULATION METHOD

DAILY CALCULATION

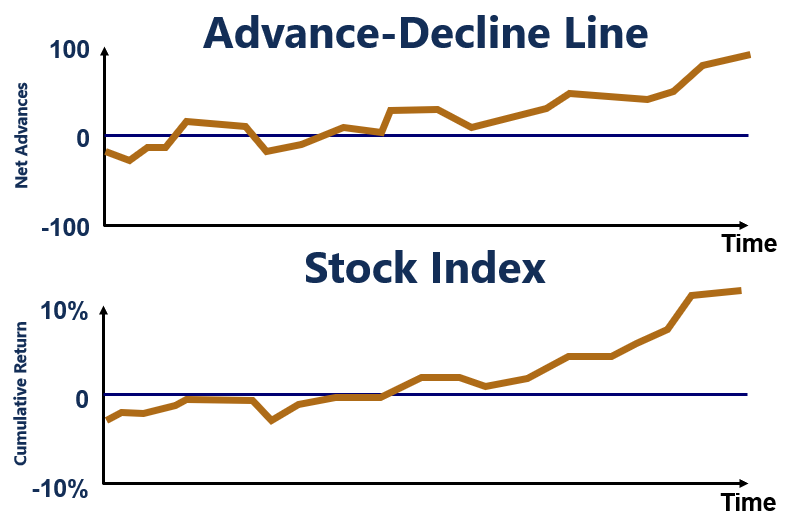

Har din, advancing securities ki count se declining securities ki count subtract ki jaati hai.

CUMULATIVE CALCULATION

Ye difference cumulative basis par add kiya jata hai to form the AD Line.

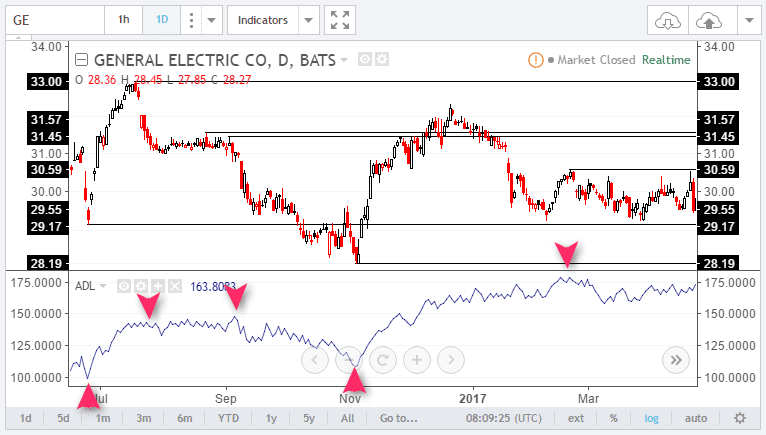

BULLISH SIGNAL

Jab AD Line upar ja rahi ho aur prices bhi increase ho rahi hoon, to market mein bullish trend ka signal hota hai.

BEARISH SIGNAL

Jab AD Line neeche ja rahi ho aur prices decrease ho rahi hoon, to market mein bearish trend ka signal hota hai.

DIVERGENCE

Jab price aur AD Line different directions mein move kar rahe hoon, to trend reversal ka potential signal hota hai. For example, agar prices increase ho rahi hain lekin AD Line decrease ho rahi hai, to bullish trend weak ho sakta hai.

INDICATOR MECHANICS

AD Line ka use market breadth ko measure karne ke liye hota hai, jo ki ek important aspect hai market trends aur potential reversals ko identify karne ke liye. Ye indicator individual forex pairs ke saath kaam nahi karta, balki overall market breadth ke liye use hota hai.

TRADING STRATEGY

AD Line ka use price trends ko confirm karne ke liye hota hai. Jab AD Line aur price ek hi direction mein move karte hain, to trend strong hota hai. Jab price aur AD Line diverge karte hain, to potential trend reversal ka signal hota hai. AD Line ka use market sentiment ko gauge karne ke liye bhi hota hai. Strong AD Line bullish sentiment ka indicator hoti hai, jabke weak AD Line bearish sentiment ka indicator hoti hai. Advance-Decline Line ek valuable tool hai forex traders ke liye jo market breadth aur sentiment ko measure karne mein help karta hai. Iska sahi istimaal karke traders market trends aur potential reversals ko effectively identify kar sakte hain aur apni trading strategies ko enhance kar sakte hain.

INTRODUCTION

Advance-Decline Line (AD Line) ek popular market breadth indicator hai jo forex trading mein use hota hai. Ye indicator market ki overall strength ya weakness ko measure karta hai.

INDICATOR COMPONENTS

AD Line market breadth ko measure karta hai by calculating the difference between advancing securities aur declining securities. Iska calculation simple hai: Advancing Securities Wo securities jin ki prices increase ho rahi hain. Declining Securities Wo securities jin ki prices decrease ho rahi hain.

CALCULATION METHOD

DAILY CALCULATION

Har din, advancing securities ki count se declining securities ki count subtract ki jaati hai.

CUMULATIVE CALCULATION

Ye difference cumulative basis par add kiya jata hai to form the AD Line.

BULLISH SIGNAL

Jab AD Line upar ja rahi ho aur prices bhi increase ho rahi hoon, to market mein bullish trend ka signal hota hai.

BEARISH SIGNAL

Jab AD Line neeche ja rahi ho aur prices decrease ho rahi hoon, to market mein bearish trend ka signal hota hai.

DIVERGENCE

Jab price aur AD Line different directions mein move kar rahe hoon, to trend reversal ka potential signal hota hai. For example, agar prices increase ho rahi hain lekin AD Line decrease ho rahi hai, to bullish trend weak ho sakta hai.

INDICATOR MECHANICS

AD Line ka use market breadth ko measure karne ke liye hota hai, jo ki ek important aspect hai market trends aur potential reversals ko identify karne ke liye. Ye indicator individual forex pairs ke saath kaam nahi karta, balki overall market breadth ke liye use hota hai.

TRADING STRATEGY

AD Line ka use price trends ko confirm karne ke liye hota hai. Jab AD Line aur price ek hi direction mein move karte hain, to trend strong hota hai. Jab price aur AD Line diverge karte hain, to potential trend reversal ka signal hota hai. AD Line ka use market sentiment ko gauge karne ke liye bhi hota hai. Strong AD Line bullish sentiment ka indicator hoti hai, jabke weak AD Line bearish sentiment ka indicator hoti hai. Advance-Decline Line ek valuable tool hai forex traders ke liye jo market breadth aur sentiment ko measure karne mein help karta hai. Iska sahi istimaal karke traders market trends aur potential reversals ko effectively identify kar sakte hain aur apni trading strategies ko enhance kar sakte hain.

تبصرہ

Расширенный режим Обычный режим