Drogan Fly Doji in Forex Trading.

Introduction.

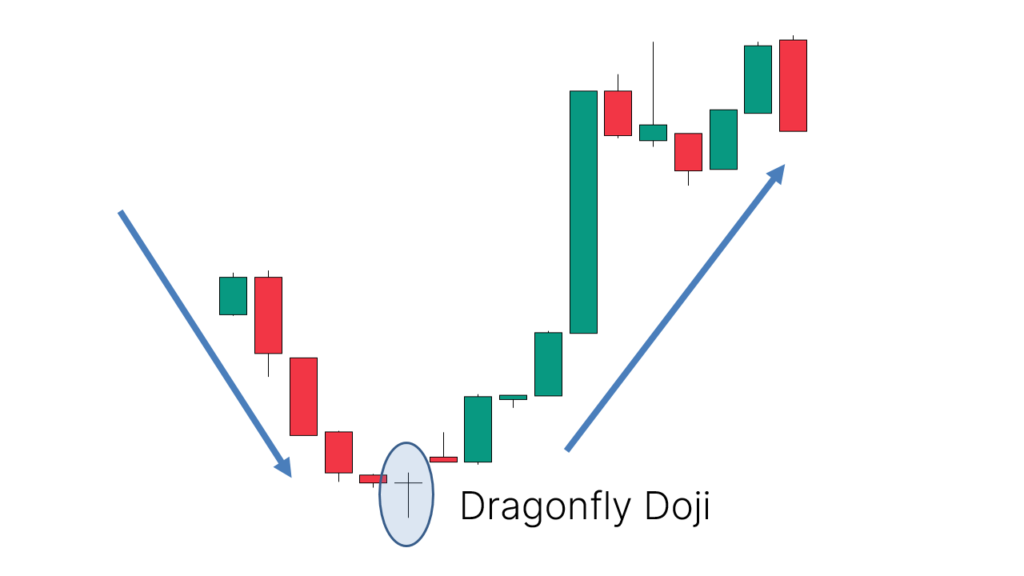

Drogan Fly Doji aik bohot important candlestick pattern hai jo Forex trading mein bullish reversal signal ke taur par use hota hai. Yeh pattern humein market mein shift aur potential buying opportunities ke bare mein batata hai.

Candlestick Patterns.

Candlestick patterns trading ke liye bohot zaroori hain kyunke yeh market sentiment aur price action ke bare mein valuable information provide karte hain. Drogan Fly Doji bhi unhi patterns mein se ek hai.

Drogan Fly Doji Ka Structure.

Drogan Fly Doji candlestick pattern tab banta hai jab.

Yeh is baat ka signal hai ke sellers ne price ko niche push karne ki koshish ki lekin buyers ne price ko wapas open level ke kareeb le aaye.

Drogan Fly Doji Ka Matlab.

Drogan Fly Doji ka matlab hota hai ke market mein sellers ka pressure tha lekin buyers ne strong comeback kiya aur price ko wapas original level par le aaye. Yeh pattern bullish reversal signal hota hai, jo yeh batata hai ke market ab neeche se upar jaane ki potential rakhta hai.

Drogan Fly Doji Ka Forex Trading Mein Use.

Trading mein hamesha risk management ka khayal rakhna chahiye aur sirf ek pattern par rely karke decisions nahi lene chahiye. Drogan Fly Doji ko ek tool ke taur par use karte hue, market ki overall situation ka bhi analysis karna zaroori hai.

Introduction.

Drogan Fly Doji aik bohot important candlestick pattern hai jo Forex trading mein bullish reversal signal ke taur par use hota hai. Yeh pattern humein market mein shift aur potential buying opportunities ke bare mein batata hai.

Candlestick Patterns.

Candlestick patterns trading ke liye bohot zaroori hain kyunke yeh market sentiment aur price action ke bare mein valuable information provide karte hain. Drogan Fly Doji bhi unhi patterns mein se ek hai.

Drogan Fly Doji Ka Structure.

Drogan Fly Doji candlestick pattern tab banta hai jab.

- Open, high, aur close price lagbhag barabar hoti hain.

- Candle ka lower shadow bohot lamba hota hai.

- Upper shadow bilkul nahi hoti ya bohot choti hoti hai.

Yeh is baat ka signal hai ke sellers ne price ko niche push karne ki koshish ki lekin buyers ne price ko wapas open level ke kareeb le aaye.

Drogan Fly Doji Ka Matlab.

Drogan Fly Doji ka matlab hota hai ke market mein sellers ka pressure tha lekin buyers ne strong comeback kiya aur price ko wapas original level par le aaye. Yeh pattern bullish reversal signal hota hai, jo yeh batata hai ke market ab neeche se upar jaane ki potential rakhta hai.

Drogan Fly Doji Ka Forex Trading Mein Use.

- Trend Reversal Identification: Drogan Fly Doji ka sabse bada faida yeh hai ke yeh ek bearish trend ke baad bullish reversal ko indicate karta hai. Jab yeh pattern bottom mein banta hai to iska matlab hota hai ke market ab reversal ke liye ready hai.

- Entry Points: Drogan Fly Doji traders ko entry points identify karne mein help karta hai. Jab yeh pattern support level par banta hai to yeh buy signal deta hai. Traders yahan par long positions open kar sakte hain.

- Stop Loss Placement: Drogan Fly Doji pattern use karte waqt stop loss place karna bhi zaroori hota hai. Stop loss ko pattern ke low point ke niche place karna chahiye taake potential loss ko minimize kiya ja sake.

- Combination with Other Indicators: Drogan Fly Doji ko doosre technical indicators jaise ke moving averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence) ke sath use karke trading decisions aur bhi accurate banaye ja sakte hain.

Trading mein hamesha risk management ka khayal rakhna chahiye aur sirf ek pattern par rely karke decisions nahi lene chahiye. Drogan Fly Doji ko ek tool ke taur par use karte hue, market ki overall situation ka bhi analysis karna zaroori hai.

تبصرہ

Расширенный режим Обычный режим