Balance of Power Indicator

Balance of Power (BoP) Indicator aik financial tool hai jo stock market traders aur investors use karte hain taake market trends ko samajh saken. Ye indicator market mein bulls (buyers) aur bears (sellers) ke darmiyan power balance ko measure karta hai. BoP indicator ke zariye, traders ye dekh sakte hain ke market mein kis taraf zyada pressure hai, buying ya selling. Ye indicator price movements ka analysis karke, future price direction ko predict karne mein madadgar hota hai.

BoP Indicator Ka Matlab

BoP Indicator ki buniyad yeh hai ke agar ek stock ki closing price uski opening price se zyada hai, to market bulls ke control mein hai. Aur agar closing price opening price se kam hai, to market bears ke control mein hai. Ye indicator stock ka daily price action calculate karta hai aur market ki internal strength ko samajhne mein madad deta hai.

Calculation of BoP Indicator

BoP Indicator calculate karne ka tareeqa simple hai. Is mein following formula use hota hai:

BoP=(Close−Open)−(High−Low)High−Low\text{BoP} = \frac{(\text{Close} - \text{******) - (\text{High} - \text{Low})}{\text{High} - \text{Low}}BoP=High−Low(Close−Open)−(High−Low)

Yahaan par:

Is formula ka maqsad ye hai ke market participants ke darmiyan buying aur selling pressure ka difference nikalna. Positive BoP value indicate karti hai ke market mein bulls dominate kar rahe hain, jab ke negative value indicate karti hai ke bears dominate kar rahe hain.

BoP Indicator ka Chart Par Istemaal

BoP Indicator ko chart par plot karke dekhna asaan hota hai. Generally, BoP indicator ko zero line ke around plot kiya jata hai:

BoP Indicator aur Trading Strategies

BoP Indicator ko use karke different trading strategies banayi ja sakti hain. Ye indicator standalone use ho sakta hai ya phir doosre indicators ke saath combine karke zyada accurate signals hasil kiye ja sakte hain. Kuch common strategies yeh hain:

Advantages aur Limitations of BoP Indicator

Advantages:

Limitations:

BoP Indicator ek useful tool hai jo market mein bulls aur bears ke darmiyan power balance ko measure karta hai. Iske zariye traders aur investors market trends ko samajh kar informed decisions le sakte hain. Magar BoP indicator ko doosre technical indicators ke saath combine karke use karna zyada faydemand hai taake zyada accurate signals hasil kiye ja saken.

Balance of Power (BoP) Indicator aik financial tool hai jo stock market traders aur investors use karte hain taake market trends ko samajh saken. Ye indicator market mein bulls (buyers) aur bears (sellers) ke darmiyan power balance ko measure karta hai. BoP indicator ke zariye, traders ye dekh sakte hain ke market mein kis taraf zyada pressure hai, buying ya selling. Ye indicator price movements ka analysis karke, future price direction ko predict karne mein madadgar hota hai.

BoP Indicator Ka Matlab

BoP Indicator ki buniyad yeh hai ke agar ek stock ki closing price uski opening price se zyada hai, to market bulls ke control mein hai. Aur agar closing price opening price se kam hai, to market bears ke control mein hai. Ye indicator stock ka daily price action calculate karta hai aur market ki internal strength ko samajhne mein madad deta hai.

Calculation of BoP Indicator

BoP Indicator calculate karne ka tareeqa simple hai. Is mein following formula use hota hai:

BoP=(Close−Open)−(High−Low)High−Low\text{BoP} = \frac{(\text{Close} - \text{******) - (\text{High} - \text{Low})}{\text{High} - \text{Low}}BoP=High−Low(Close−Open)−(High−Low)

Yahaan par:

- Close: Din ka closing price

- Open: Din ka opening price

- High: Din ka highest price

- Low: Din ka lowest price

Is formula ka maqsad ye hai ke market participants ke darmiyan buying aur selling pressure ka difference nikalna. Positive BoP value indicate karti hai ke market mein bulls dominate kar rahe hain, jab ke negative value indicate karti hai ke bears dominate kar rahe hain.

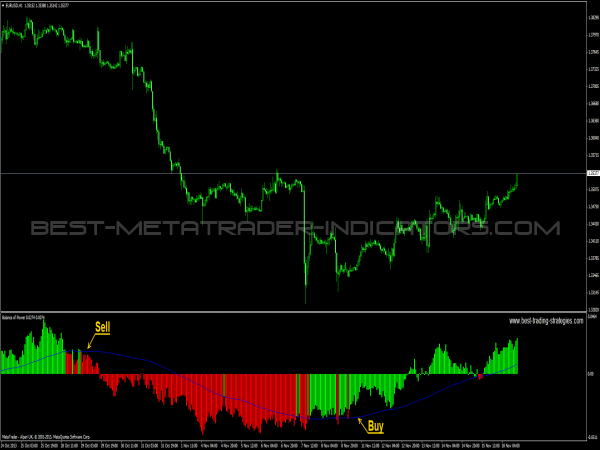

BoP Indicator ka Chart Par Istemaal

BoP Indicator ko chart par plot karke dekhna asaan hota hai. Generally, BoP indicator ko zero line ke around plot kiya jata hai:

- Positive Values (Above Zero): Bullish signal. Ye indicate karta hai ke market mein buying pressure zyada hai.

- Negative Values (Below Zero): Bearish signal. Ye indicate karta hai ke market mein selling pressure zyada hai.

BoP Indicator aur Trading Strategies

BoP Indicator ko use karke different trading strategies banayi ja sakti hain. Ye indicator standalone use ho sakta hai ya phir doosre indicators ke saath combine karke zyada accurate signals hasil kiye ja sakte hain. Kuch common strategies yeh hain:

- Trend Confirmation: Agar BoP indicator positive ho aur price bhi upar ja rahi ho, to ye trend continuation ka signal ho sakta hai. Iska matlab hai ke market mein bulls dominate kar rahe hain aur price aur bhi upar ja sakti hai.

- Reversals: BoP indicator ko reversals identify karne ke liye bhi use kiya ja sakta hai. Agar BoP indicator negative ho aur suddenly positive ho jaye, to ye market reversal ka signal ho sakta hai. Iska matlab hai ke market trend shift ho raha hai aur price upar ja sakti hai.

- Divergence: BoP indicator aur price ke darmiyan divergence bhi ek strong signal hota hai. Agar price upar ja rahi ho magar BoP indicator neeche ja raha ho, to ye bearish divergence hota hai aur price gir sakti hai. Aur agar price neeche ja rahi ho magar BoP indicator upar ja raha ho, to ye bullish divergence hota hai aur price barh sakti hai.

Advantages aur Limitations of BoP Indicator

Advantages:

- Simple to Calculate: BoP indicator ko calculate karna asaan hai aur ismein complex calculations involve nahi hoti.

- Versatile: Ye indicator different time frames aur market conditions mein use ho sakta hai.

- Effective in Trend Analysis: BoP indicator trend confirmation aur reversals identify karne mein madadgar hota hai.

Limitations:

- False Signals: Kabhi kabar BoP indicator false signals bhi de sakta hai, especially in volatile markets.

- Standalone Reliability: BoP indicator ko standalone use karna risky ho sakta hai, isliye ise doosre indicators ke saath combine karna better hai.

BoP Indicator ek useful tool hai jo market mein bulls aur bears ke darmiyan power balance ko measure karta hai. Iske zariye traders aur investors market trends ko samajh kar informed decisions le sakte hain. Magar BoP indicator ko doosre technical indicators ke saath combine karke use karna zyada faydemand hai taake zyada accurate signals hasil kiye ja saken.

تبصرہ

Расширенный режим Обычный режим