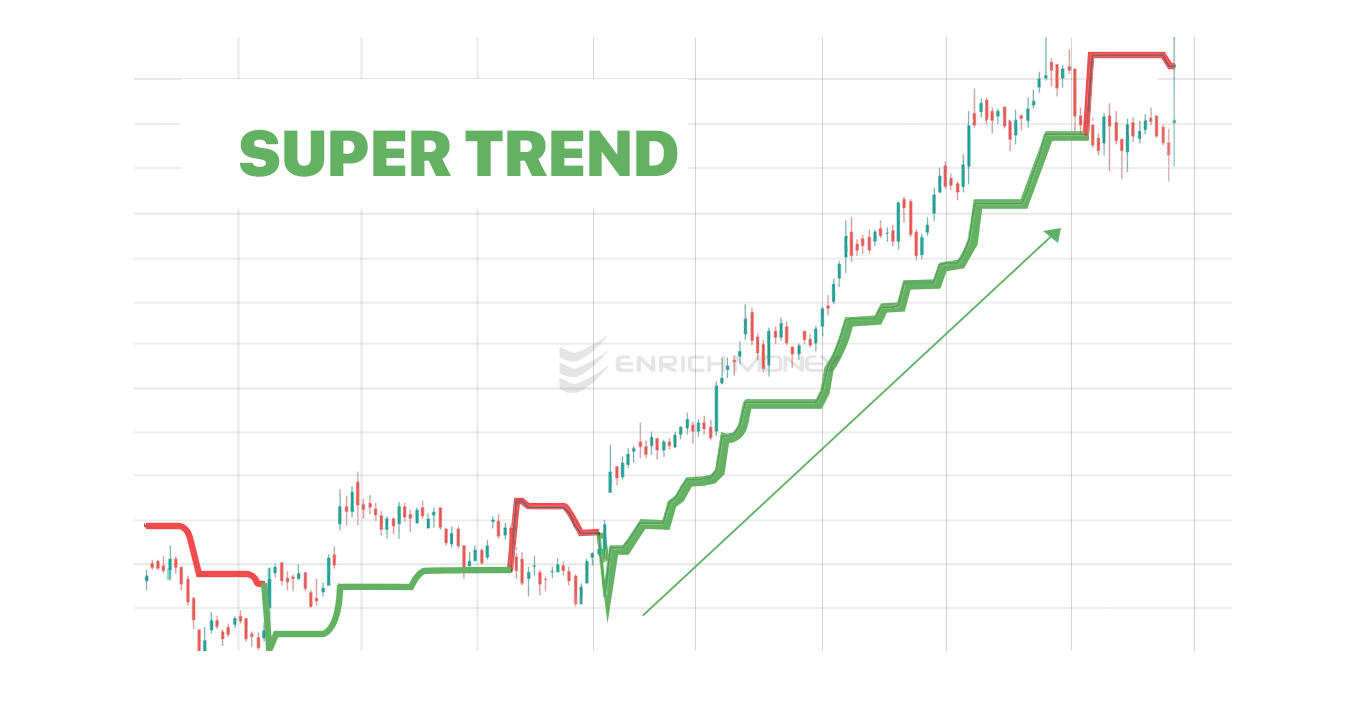

Super Trend Indicator trading procedure ka matlab hai ke kis tarah se traders Super Trend Indicator ka istemal kar ke trading kar sakte hain. Super Trend Indicator ek technical analysis tool hai jo market trends ko identify karne mein madad deta hai. Is indicator ke istemal se traders market ka direction aur price trends ko samajh sakte hain aur profitable trading decisions le sakte hain.

Super Trend Indicator ki popularity traders ke darmiyan bohot zyada hai kyunki ye ek simple aur effective tool hai jo market trends ko identify karne mein madad deta hai. Is indicator ko use kar ke traders market mein hone wale price movements ko predict kar sakte hain aur is se trading strategy ko improve kar sakte hain.

Super Trend Indicator Trading Procedure ke liye kuch steps hain jo traders ko follow karne chahiye:

Step 1: Indicator Installation

Sab se pehle traders ko Super Trend Indicator ko apne trading platform par install karna hoga. Is ke liye traders ko apne broker ya trading platform ke help section se instructions follow karke indicator ko install karna hoga.

Step 2: Indicator Settings

Super Trend Indicator ke settings ki customization traders ki trading strategy par depend karti hai. Traders ko indicator ki settings mein parameters jaise ki period length aur multiplier ko adjust karna hoga. Ye settings traders ke risk tolerance aur trading style par depend karti hai.

Step 3: Indicator Interpretation

Super Trend Indicator ka interpretation traders ko market trends ke bare mein information deta hai. Indicator ke signals ko samajhna important hai taake traders sahi trading decisions le saken. Jab indicator price ke upar ya niche move kare, ya trend change ho, tab traders ko apni trading strategy ke according positions open ya close kar sakte hain.

Step 4: Entry and Exit Points

Super Trend Indicator ke signals ke basis par traders ko entry aur exit points determine karne chahiye. Jab indicator bullish signal deta hai, tab traders long position le sakte hain aur jab bearish signal aata hai, tab short position lena sahi ho sakta hai. Is ke alawa, traders ko risk management ke liye stop loss aur take profit levels bhi set karne chahiye.

Step 5: Risk Management

Super Trend Indicator trading procedure mein risk management ka bohot bara role hota hai. Traders ko hamesha apne risk tolerance ke hisab se positions open karna chahiye aur stop loss orders ka istemal kar ke apne losses ko minimize karne ki koshish karni chahiye. Risk management ke bina trading karna bohot risky ho sakta hai, is liye traders ko always apne risk levels ka khayal rakhna chahiye.

Step 6: Practice and Backtesting

Super Trend Indicator ka istemal kar ke trading karna ek skill hai jo practice se develop hoti hai. Traders ko apne trading strategies ko backtest karna chahiye taake wo apne results ko improve kar sake. Backtesting trading strategies ke performance ko analyze karne ka acha tareeqa hai aur traders ko apne mistakes ko recognize karne mein madad karta hai.

Overall, Super Trend Indicator trading procedure traders ko market trends ko samajhne mein aur profitable trading decisions lene mein madad deta hai. Is indicator ka istemal kar ke traders ko apne trading strategy ko improve karne mein madad milti hai aur wo market mein successful trading kar sakte hain. Is liye, traders ko Super Trend Indicator ko apne trading arsenal mein shamil karne ki salahiyat hai.

Super Trend Indicator ki popularity traders ke darmiyan bohot zyada hai kyunki ye ek simple aur effective tool hai jo market trends ko identify karne mein madad deta hai. Is indicator ko use kar ke traders market mein hone wale price movements ko predict kar sakte hain aur is se trading strategy ko improve kar sakte hain.

Super Trend Indicator Trading Procedure ke liye kuch steps hain jo traders ko follow karne chahiye:

Step 1: Indicator Installation

Sab se pehle traders ko Super Trend Indicator ko apne trading platform par install karna hoga. Is ke liye traders ko apne broker ya trading platform ke help section se instructions follow karke indicator ko install karna hoga.

Step 2: Indicator Settings

Super Trend Indicator ke settings ki customization traders ki trading strategy par depend karti hai. Traders ko indicator ki settings mein parameters jaise ki period length aur multiplier ko adjust karna hoga. Ye settings traders ke risk tolerance aur trading style par depend karti hai.

Step 3: Indicator Interpretation

Super Trend Indicator ka interpretation traders ko market trends ke bare mein information deta hai. Indicator ke signals ko samajhna important hai taake traders sahi trading decisions le saken. Jab indicator price ke upar ya niche move kare, ya trend change ho, tab traders ko apni trading strategy ke according positions open ya close kar sakte hain.

Step 4: Entry and Exit Points

Super Trend Indicator ke signals ke basis par traders ko entry aur exit points determine karne chahiye. Jab indicator bullish signal deta hai, tab traders long position le sakte hain aur jab bearish signal aata hai, tab short position lena sahi ho sakta hai. Is ke alawa, traders ko risk management ke liye stop loss aur take profit levels bhi set karne chahiye.

Step 5: Risk Management

Super Trend Indicator trading procedure mein risk management ka bohot bara role hota hai. Traders ko hamesha apne risk tolerance ke hisab se positions open karna chahiye aur stop loss orders ka istemal kar ke apne losses ko minimize karne ki koshish karni chahiye. Risk management ke bina trading karna bohot risky ho sakta hai, is liye traders ko always apne risk levels ka khayal rakhna chahiye.

Step 6: Practice and Backtesting

Super Trend Indicator ka istemal kar ke trading karna ek skill hai jo practice se develop hoti hai. Traders ko apne trading strategies ko backtest karna chahiye taake wo apne results ko improve kar sake. Backtesting trading strategies ke performance ko analyze karne ka acha tareeqa hai aur traders ko apne mistakes ko recognize karne mein madad karta hai.

Overall, Super Trend Indicator trading procedure traders ko market trends ko samajhne mein aur profitable trading decisions lene mein madad deta hai. Is indicator ka istemal kar ke traders ko apne trading strategy ko improve karne mein madad milti hai aur wo market mein successful trading kar sakte hain. Is liye, traders ko Super Trend Indicator ko apne trading arsenal mein shamil karne ki salahiyat hai.

تبصرہ

Расширенный режим Обычный режим