Forex trading ek mushkil aur competition wala industry hai jahan traders mufeed trades karne ke liye mukhtalif tools aur techniques istemal karte hain. Aik aise tool ka naam hai Commodity Channel Index (CCI) indicator, jo traders dwara market mein potential overbought ya oversold conditions ka pata lagane ke liye istemal hota hai.

Is article mein, hum CCI indicator trading strategy par guftugu karenge, ye kaise kaam karta hai, aur forex market mein iske faiday aur nuqsanat ke mutaliq baat karenge.

I. CCI Indicator Ki Introducation

Commodity Channel Index (CCI) ek momentum-based oscillator hai jo mojudgi ka price level an average price level ke mutabiq measure karne ke liye istemal hota hai specific period of time. CCI indicator -100 se +100 tak range karta hai, jahan readings +100 se ooper ane par overbought condition ko zahir karti hain aur readings -100 se neeche ane par oversold condition ki taraf ishara deti hain.

CCI indicator ka calculation is formula ke zariye hota hai:

CCI = (Typical Price - Simple Moving Average) / (0.015 x Mean Deviation)

Jahan:

- Typical Price = (High + Low + Close) / 3

- Simple Moving Average = Specific period ke average of Typical Prices

- Mean Deviation = Specific period ke Simple Moving Average se Typical Prices ka average deviation

II. CCI Indicator Trading Strategy

CCI indicator mukhtalif tareeqon se istemal kiya ja sakta hai forex market mein potential trading opportunities ko pehchanne ke liye. Ek common trading strategy jo CCI indicator ka istemal karti hai, wo hai CCI crossover strategy, jo CCI line ko kisi khaas threshold ke ooper ya neeche cross karne ke liye istemal karti hai buy ya sell signals generate karne ke liye.

Yahan CCI crossover strategy ko implement karne ke steps hain:

1. CCI Indicator Parameters Set Karein: Pehla qadam ye hai ke CCI indicator ke parameters ko set karein, including the period length aur threshold levels for overbought aur oversold conditions. CCI indicator ke common parameter settings hote hain 14 period length ke sath aur threshold levels +100 for overbought conditions aur -100 for oversold conditions ke liye.

2. CCI Crossovers Ko Pehchanen: unhalate pe dhyan de jahan CCI line +100 level ke upar cross kar rahi ho ta ke buy signal generate ho ya -100 level ke neeche cross kar rahi ho ta ke sell signal generate ho.

3. Signal Ko Confirm Karein: CCI crossover signal ko confirm karne ke liye zaroori hai dosre technical indicators ya chart patterns ke sath taake trade ke safalta ke chances increase ho. Kuch traders CCI indicator ko dosre indicators jaise moving averages ya trend lines ke sath istemal karte hain signal ko confirm karne ke liye.

4. Stop Loss aur Take Profit Levels Place Karein: Risk ko manage karne ke liye stop loss orders place karein taake potential losses ko limit karein aur take profit orders place karein taake profits ko lock kar dein. A common approach ye hota hai ke long trades ke liye recent low ke neeche stop loss order place karein aur short trades ke liye recent high ke upar stop loss order place karein.

5. Trade Ko Monitor Karein: Trade ko nazdeek se monitor karein aur stop loss aur take profit levels ko adjust karte rahein jab trade progress hoti hai. Traders ko profits ko protect karne ke liye trailing stop losses bhi consider karna chahiye in case of a reversal.

III. CCI Indicator Trading Strategy Ke Fawaid aur Nuqsanat

Jaise koi bhi trading strategy, CCI indicator trading strategy ke apne faiday aur nuqsanat hote hain. Yahan kuch potential benefits aur drawbacks hain CCI indicator ka istemal karne ke liye forex trading mein:

Fawaid:

- CCI indicator ek versatile tool hai jo mukhtalif market conditions aur timeframes mein istemal kiya ja sakta hai.

- CCI crossover strategy relatively simple aur easy to implement hai, jo ise beginner aur experienced traders ke liye suitable banata hai.

- CCI indicator traders ko market mein potential overbought ya oversold conditions ka pata lagane mein madad karta hai, jisse profitable trading opportunities paida hoti hain.

Nuqsanat:

- CCI indicator false signals generate kar sakta hai, khas kar choppy ya ranging market conditions mein, jo traders ke liye losses le kar aata hai.

- CCI crossover strategy price movements ke peechay reh sakta hai, jisse trading opportunities miss hone ya delayed entry signals aane ke chances hote hain.

- CCI indicator ek lagging indicator hai, matlab ye future price movements aur trends ko accurately predict nahi kar sakta.

IV. Conclusion

Akhri mein, Commodity Channel Index (CCI) indicator traders ke liye ek fayede mand tool ho sakta hai forex market mein potential trading opportunities ko identify karne ke liye overbought ya oversold conditions par base karte hue. CCI crossover strategy ek popular trading strategy hai jo traders ko CCI indicator istemal karke buy aur sell signals generate karne mein madad karta hai.

Magar, zaroori hai ke traders CCI indicator ko dosre technical indicators aur risk management techniques ke sath istemal karein taake successful trades ke probability ko increase karein. Traders ko CCI indicator ke limitations ka bhi maloom hona chahiye aur changing market conditions ke base par apni trading strategy ko adjust karne ke liye tayyar rehne chahiye.

Overall, CCI indicator trading strategy traders ke liye ek mufeed tool ho sakta hai unke trading arsenal mein shamil karne ke liye aur unki trading performance ko improve karne ke liye forex market mein.

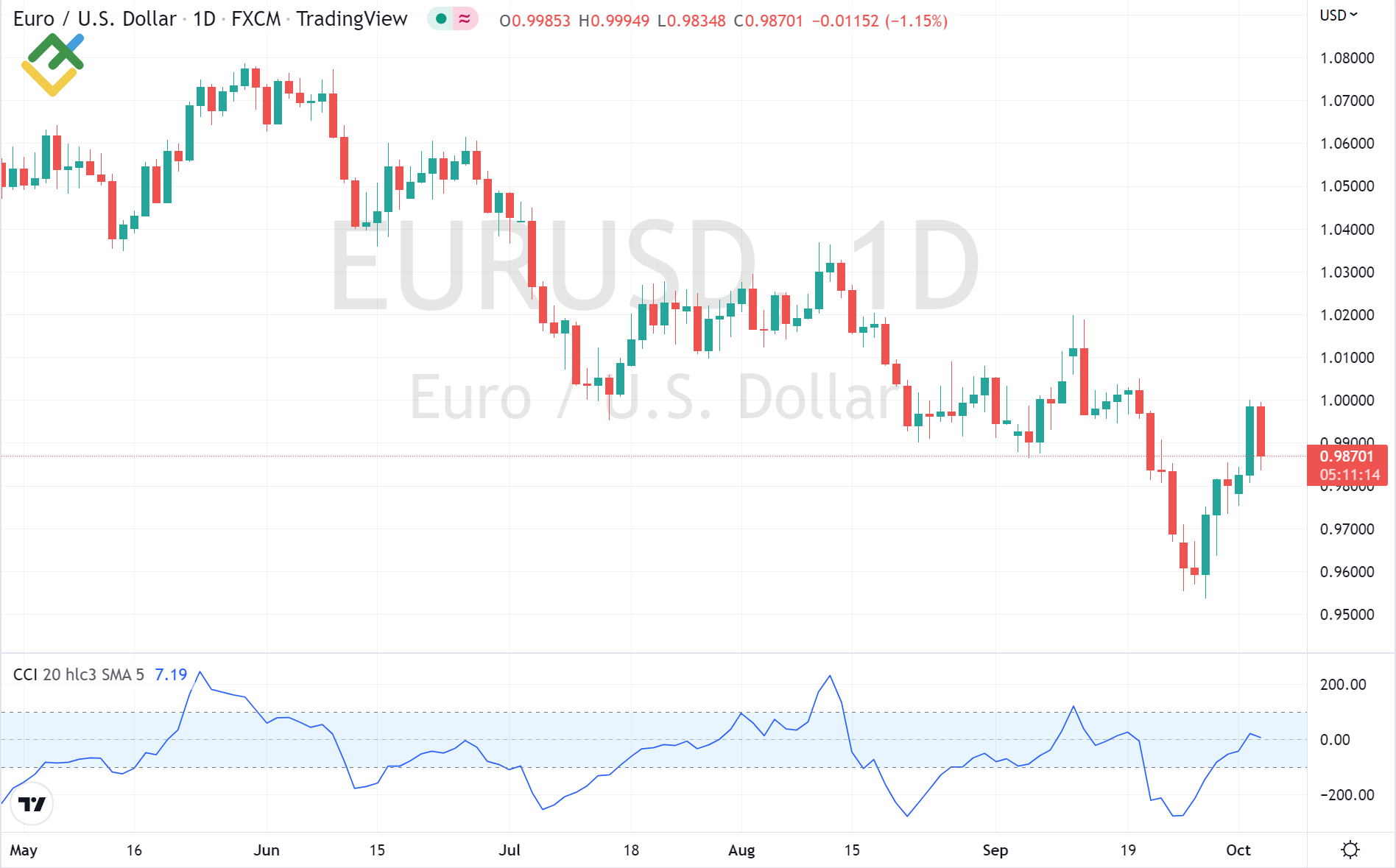

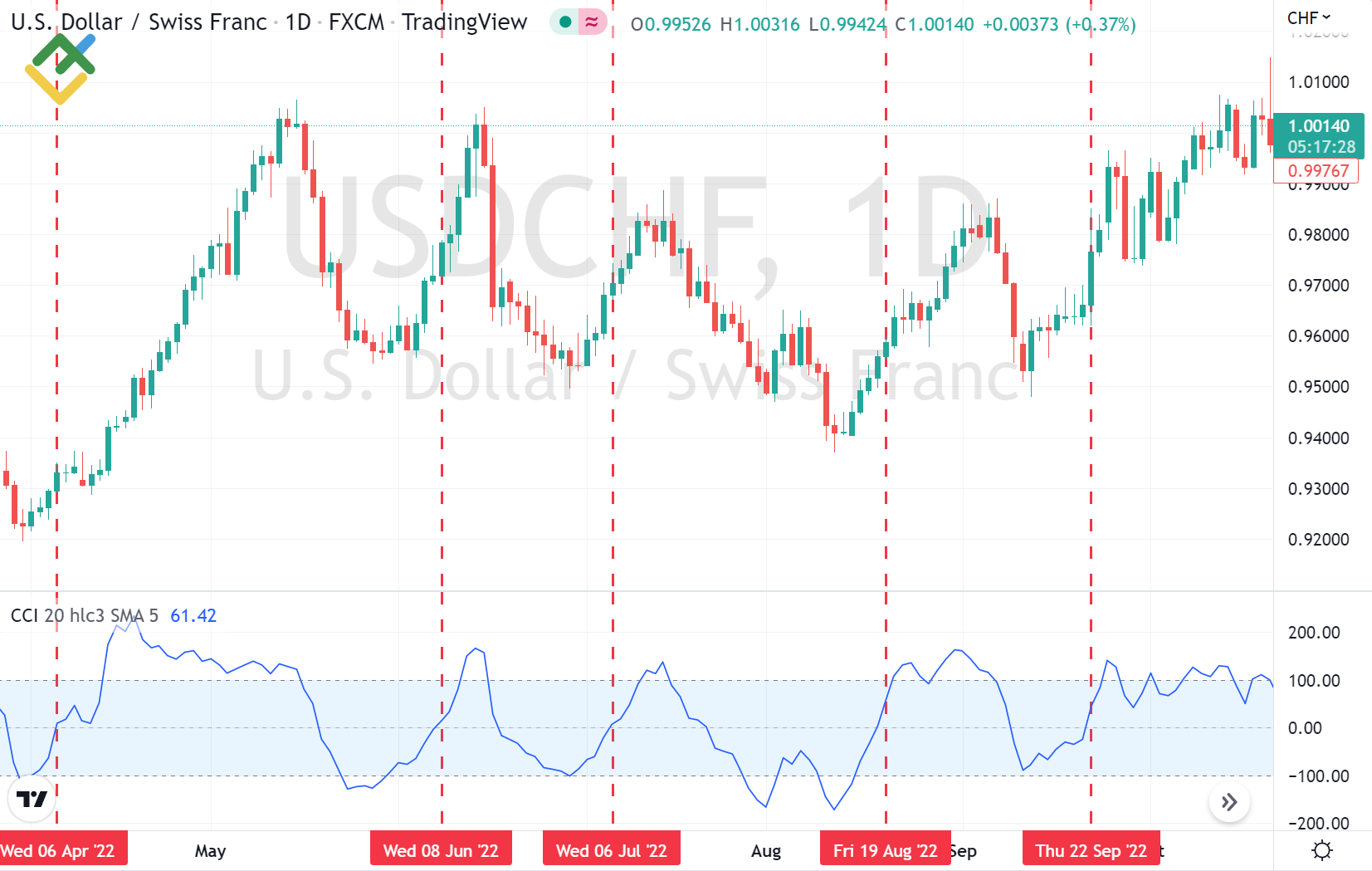

blue vertical line en ke movement ko he neshan zad kar sakte hey jab CCI indicator 0 level ay nechay he cross kar sakta hey or trading end kay bad e kay signal ke confirmation ke ja sakte hein trading ko selling ke confirmation karni chihay

blue vertical line en ke movement ko he neshan zad kar sakte hey jab CCI indicator 0 level ay nechay he cross kar sakta hey or trading end kay bad e kay signal ke confirmation ke ja sakte hein trading ko selling ke confirmation karni chihay

تبصرہ

Расширенный режим Обычный режим