Pullback candlestick pattern:

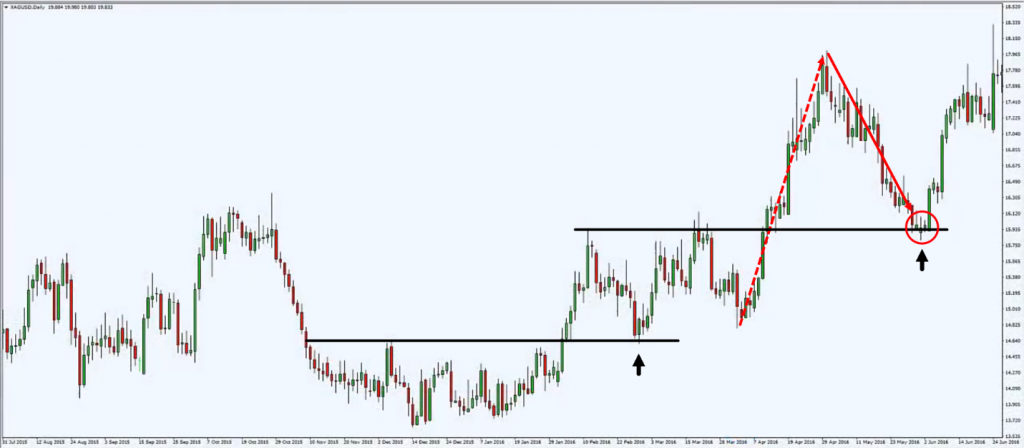

Dear trading Partners Pullback Candlestick Pattern aik technical analysis tool hy jo financial markets mein trend reversal aur trend continuation ko samajhne ke liye istemal hota hy.Yeh pattern traders ko market ke temporary reversals ya retracements ko identify karne mein madad karta hy. Pullback Candlestick Pattern ka formation jab market mein ek strong trend ke against hota hai aur price temporarily opposite direction mein move karta hai. Yani ke, agar market mein uptrend hai, toh pullback candlestick pattern ka formation bearish retracement ko darust karta hai, aur agar market mein downtrend hai, toh is pattern ka formation bullish retracement ko indicate karta hai.

Characteristics keys of Pullback Candlestick Pattern:

Small Body:

Pullback candlestick pattern ka pehla characteristic hota hy ke iska body chota hota hy, indicating ke price mein retracement hone par major change nahi hota.

Long Wick (Shadow):

Pullback candlestick mein lambi wick (shadow) hoti hy, jo trend reversal ko darust karti hy.Yeh indicate karta hy ke retracement hone par market mein buying ya selling pressure ka significant change hota hy.

Opposite Direction Move:

Pullback candlestick pattern ka formation opposite direction mein hota hy, laikin overall trend ke against.Agar uptrend hy,toh pullback bearish candle ko indicate karta hy, aur agar downtrend hy, toh pullback bullish candle ko indicate karta hy.

Trading with Pullback Candlestick Pattern:

Dear forex Traders pullback candlestick pattern ke formation ke baad entry points tay karte hein. Agar uptrend ke doran bearish pullback candle ban rahi hy, toh traders short positions le sakte hein, aur agar downtrend ke doran bullish pullback candle ban rahi hy, toh long positions le sakte hein.Stop-loss orders ko strategically place karna important hy taki traders apne positions ko protect kar sakein.Take-profit levels ko support/resistance levels ya trendline ke tay kiye ja sakte hein. Pullback Candlestick Pattern Ka dehan rakhein.Traders pullback candlestick pattern ke formation ke baad entry points tay karte hain. Agar uptrend ke doran bearish pullback candle ban rahi hai, toh traders short positions le sakty hein, aur agar downtrend ke doran bullish pullback candle ban rahi hai, toh long positions le sakty hein.

Dear trading Partners Pullback Candlestick Pattern aik technical analysis tool hy jo financial markets mein trend reversal aur trend continuation ko samajhne ke liye istemal hota hy.Yeh pattern traders ko market ke temporary reversals ya retracements ko identify karne mein madad karta hy. Pullback Candlestick Pattern ka formation jab market mein ek strong trend ke against hota hai aur price temporarily opposite direction mein move karta hai. Yani ke, agar market mein uptrend hai, toh pullback candlestick pattern ka formation bearish retracement ko darust karta hai, aur agar market mein downtrend hai, toh is pattern ka formation bullish retracement ko indicate karta hai.

Characteristics keys of Pullback Candlestick Pattern:

Small Body:

Pullback candlestick pattern ka pehla characteristic hota hy ke iska body chota hota hy, indicating ke price mein retracement hone par major change nahi hota.

Long Wick (Shadow):

Pullback candlestick mein lambi wick (shadow) hoti hy, jo trend reversal ko darust karti hy.Yeh indicate karta hy ke retracement hone par market mein buying ya selling pressure ka significant change hota hy.

Opposite Direction Move:

Pullback candlestick pattern ka formation opposite direction mein hota hy, laikin overall trend ke against.Agar uptrend hy,toh pullback bearish candle ko indicate karta hy, aur agar downtrend hy, toh pullback bullish candle ko indicate karta hy.

Trading with Pullback Candlestick Pattern:

Dear forex Traders pullback candlestick pattern ke formation ke baad entry points tay karte hein. Agar uptrend ke doran bearish pullback candle ban rahi hy, toh traders short positions le sakte hein, aur agar downtrend ke doran bullish pullback candle ban rahi hy, toh long positions le sakte hein.Stop-loss orders ko strategically place karna important hy taki traders apne positions ko protect kar sakein.Take-profit levels ko support/resistance levels ya trendline ke tay kiye ja sakte hein. Pullback Candlestick Pattern Ka dehan rakhein.Traders pullback candlestick pattern ke formation ke baad entry points tay karte hain. Agar uptrend ke doran bearish pullback candle ban rahi hai, toh traders short positions le sakty hein, aur agar downtrend ke doran bullish pullback candle ban rahi hai, toh long positions le sakty hein.

تبصرہ

Расширенный режим Обычный режим