Butterfly Spread Pattern Forex trading men ek aisa pattern hai jo traders ke liye bahut faydemand sabit hota hai. Is pattern ka istemaal karke traders apni trading strategies ko aur behtar bana sakte hain. Is article mein hum Butterfly Spread Pattern ke bry mein Roman Urdu mein baat karenge aur is ka istemaal kaise kiya jata hai uske bare mein bhi batayenge.

Butterfly Spread Pattern Kya Hai

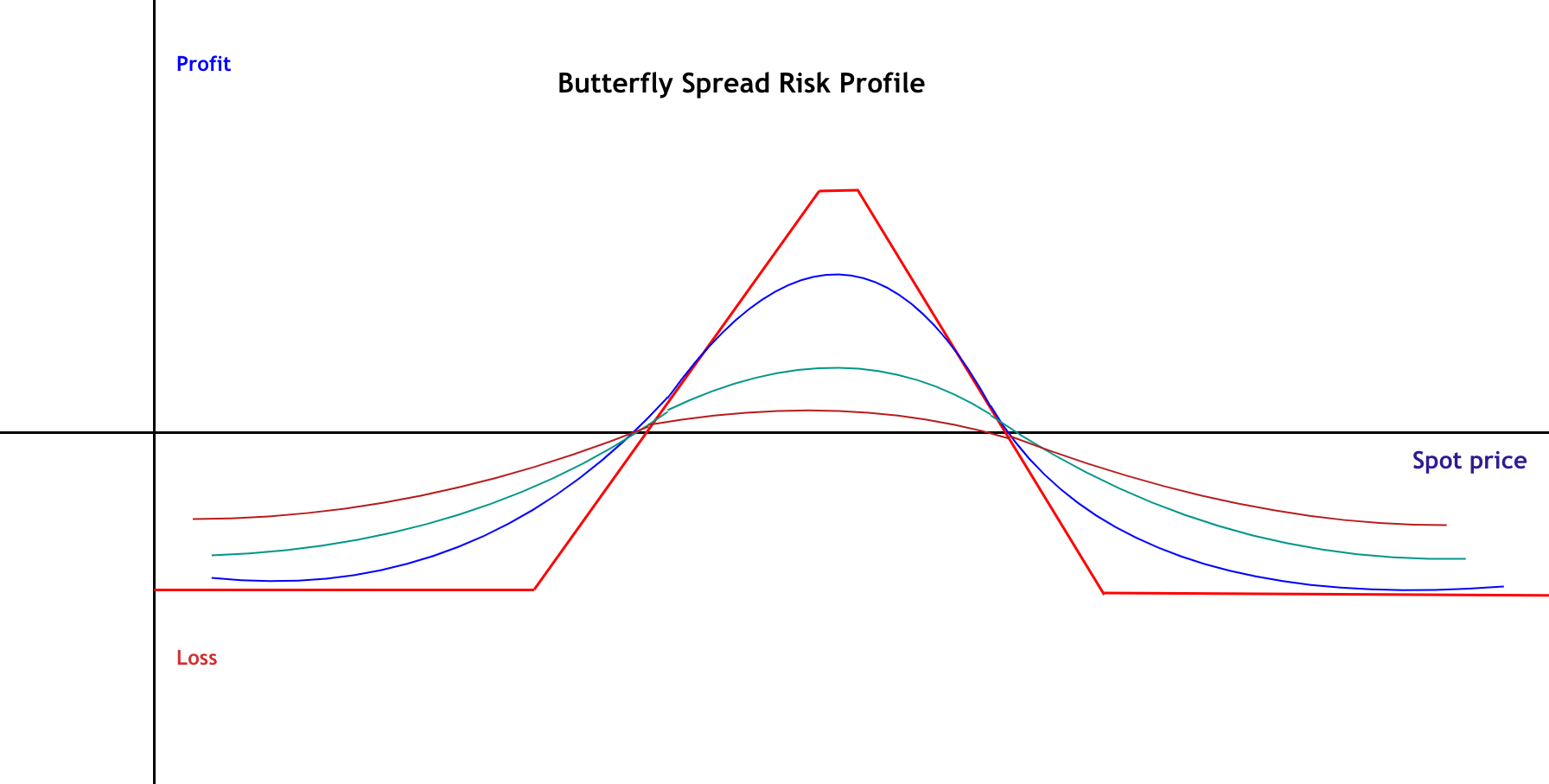

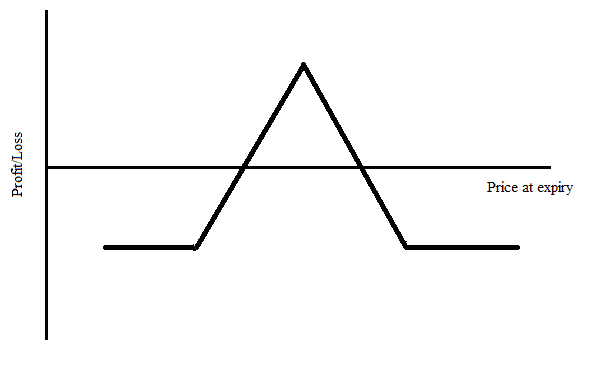

Butterfly Spread Pattern, Forex market mein ek technical analysis tool hai jis ki madad se traders market trends ko samajhne mein madad milti hai. Is pattern mein traders ek specific price range k andar khareedne aur bechne ki strategies banate hain. Butterfly Spread Pattern mein traders 3 options positions ko combine karte hain.

Butterfly Spread Pattern Ke 3 Types:

1. Call Butterfly Spread

2. Put Butterfly Spread

3. Iron Butterfly Spread

Call Butterfly Spread:

Call Butterfly Spread mein traders call options ke positions ko combine karte hain. Is spread mein traders ek call option ko khareedte hen aur doosri call options ko bechte hain. Is pattern mein traders ko ek specific strike price range ko follow karna hota hai.

Put Butterfly Spread:

Put Butterfly Spread mein traders put options ke positions ko combine karte hain. Is spread mein traders ek put option ko khareedte hain aur doosri put options ko bechte hain. Is pattern mein traders ko ek specific strike price range ko follow karna hota hai.

Iron Butterfly Spread:

Iron Butterfly Spread mein traders call aur put options ke positions ko combine karte hain. Is spread mein traders aik call option ko khareedte hain aur doosri call options ko bechte hain sath hi sath ek put option ko khareedte hain aur doosri put options ko bechte hain. Is pattern mein traders ko ek specific strike price range ko follow karna hota hai.

Butterfly Spread Pattern Ka Istemaal:

Butterfly Spread Pattern ka istemaal traders market trends ke analysis ke liye karte hain. Is pattern ka istemaal karne se traders ko ek specific range ke andar khareedne aur bechne ki strategies banane mein madad milti hai. Is pattern ke istemaal se traders apni trading strategies ko aur behtar bana sakty hain aur apni trading performance ko improve kar sakte hain.

Conclusion:

Butterfly Spread Pattern Forex trading mein ek bahut faydemand pattern h jis ki madad se traders apni trading strategies ko aur behtar bana sakte hain. Is pattern ka istemaal karne se traders ko market trends ke analysis ke liye madad milti hai aur traders apni trading performance ko improve kar sakte hain.

Butterfly Spread Pattern Kya Hai

Butterfly Spread Pattern, Forex market mein ek technical analysis tool hai jis ki madad se traders market trends ko samajhne mein madad milti hai. Is pattern mein traders ek specific price range k andar khareedne aur bechne ki strategies banate hain. Butterfly Spread Pattern mein traders 3 options positions ko combine karte hain.

Butterfly Spread Pattern Ke 3 Types:

1. Call Butterfly Spread

2. Put Butterfly Spread

3. Iron Butterfly Spread

Call Butterfly Spread:

Call Butterfly Spread mein traders call options ke positions ko combine karte hain. Is spread mein traders ek call option ko khareedte hen aur doosri call options ko bechte hain. Is pattern mein traders ko ek specific strike price range ko follow karna hota hai.

Put Butterfly Spread:

Put Butterfly Spread mein traders put options ke positions ko combine karte hain. Is spread mein traders ek put option ko khareedte hain aur doosri put options ko bechte hain. Is pattern mein traders ko ek specific strike price range ko follow karna hota hai.

Iron Butterfly Spread:

Iron Butterfly Spread mein traders call aur put options ke positions ko combine karte hain. Is spread mein traders aik call option ko khareedte hain aur doosri call options ko bechte hain sath hi sath ek put option ko khareedte hain aur doosri put options ko bechte hain. Is pattern mein traders ko ek specific strike price range ko follow karna hota hai.

Butterfly Spread Pattern Ka Istemaal:

Butterfly Spread Pattern ka istemaal traders market trends ke analysis ke liye karte hain. Is pattern ka istemaal karne se traders ko ek specific range ke andar khareedne aur bechne ki strategies banane mein madad milti hai. Is pattern ke istemaal se traders apni trading strategies ko aur behtar bana sakty hain aur apni trading performance ko improve kar sakte hain.

Conclusion:

Butterfly Spread Pattern Forex trading mein ek bahut faydemand pattern h jis ki madad se traders apni trading strategies ko aur behtar bana sakte hain. Is pattern ka istemaal karne se traders ko market trends ke analysis ke liye madad milti hai aur traders apni trading performance ko improve kar sakte hain.

تبصرہ

Расширенный режим Обычный режим