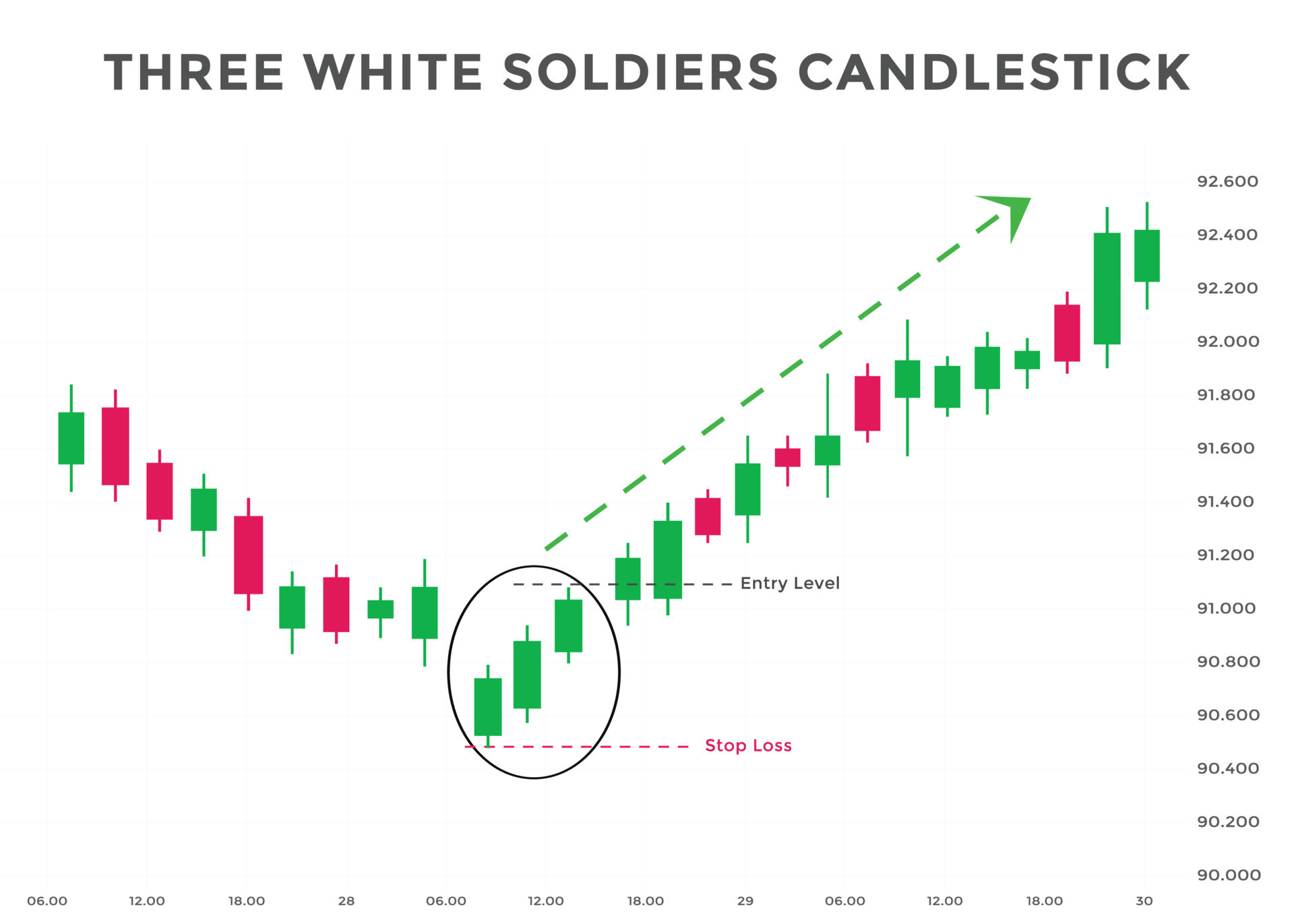

Forex trading mein, "Three Advance White Soldiers" ek bullish reversal pattern hai jo price chart par dekha jaa sakta hai. Ye pattern teen bullish candlesticks se banta hai, jin mein har ek candlestick pehle se zyada high level par close karta hai.ye Zaida upper level tk ja kr close kea jata h.

Ye pattern trend reversal ke liye kaafi powerful hota hai aur traders is se profit earn kar sakte hain. Is pattern ko samajhne ke liye, aage diye gaye teen advance white soldiers ke baare mein jaan len.

1. First Advance White Soldier:

Ye candlestick ek uptrend ke baad aata hai aur previous candlestick se zyada high level par close karta hai. Is mein bulls dominate karte hain aur price ko up move karte hain.is me ap price up down kr skty hen.

2. Second Advance White Soldier:

Ye candlestick pehle wale candlestick se zyada high level par close karta hai. Is mein bhi bulls dominate karte hain aur price ko up move karte hain.

3. Third Advance White Soldier:

Ye candlestick pehle dono candlesticks se zyada high level par close karta hai. Is mein bhi bulls dominate karte hain aur price ko up move karte hain.is me apko zda knowledge hna chaye ta k acha profit ml sky.

Conclusion

Jab teen advance white soldiers pattern form ho jaata hai, to is se yeh samjha jaa sakta hai ke market trend reversal honewala hai aur price up move karega. Traders is pattern ko samajh kar apni trading strategies ko bana sakte hain aur profit earn kar sakte hain.

تبصرہ

Расширенный режим Обычный режим