Range bound market ka matlab hai woh market jahan price consistently ek specific high aur low ke beech trade karti hai. Yeh situation aksar tab hoti hai jab market participants ke darmiyan uncertainty zyada ho ya phir koi significant news ya trend develop nahi ho raha hota.

- Support Level: Woh price point jahan buyers demand ko increase kar dete hain aur price neeche girne se pehle bounce karti hai.

- Resistance Level: Woh price point jahan sellers ki intensity badh jati hai aur price further upward move nahi kar pati.

Jab market clearly in do levels ke darmiyan confined rehti hai, to hum kehte hain ke market range bound hai. Is condition ko samajhna aur identify karna, range bound trading strategy ke liye pehla aur sab se zaroori qadam hai.

Key Components of Range Bound Trading Range bound trading ko effectively implement karne ke liye kuch basic elements ko samajhna zaroori hai:

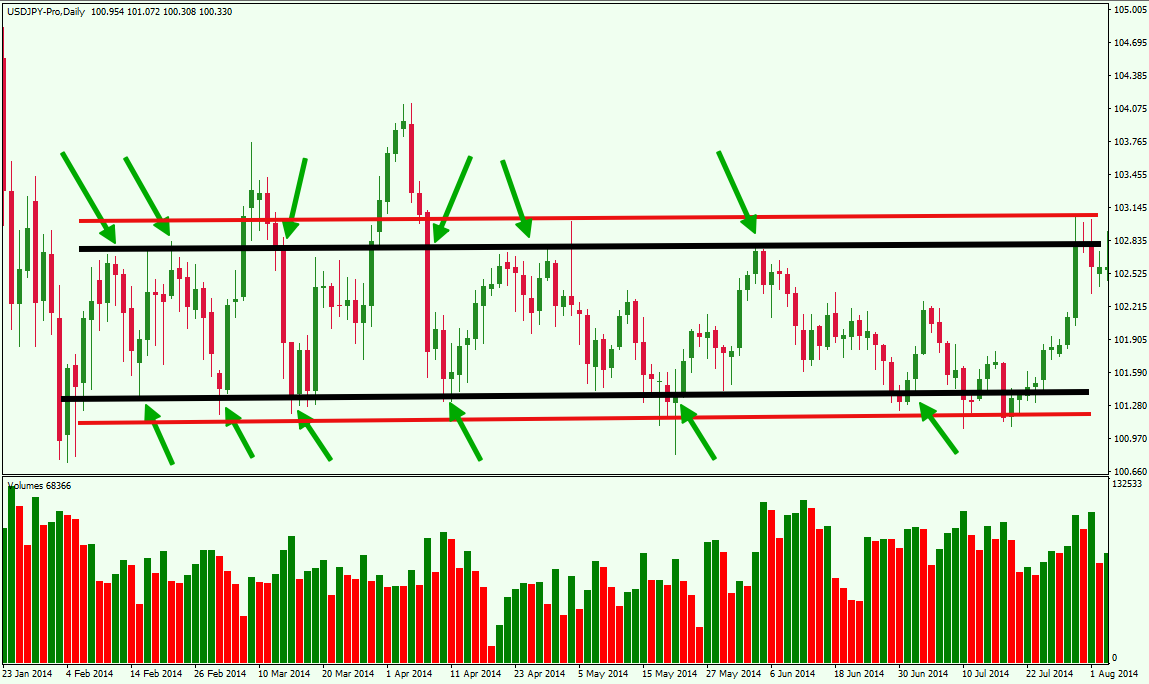

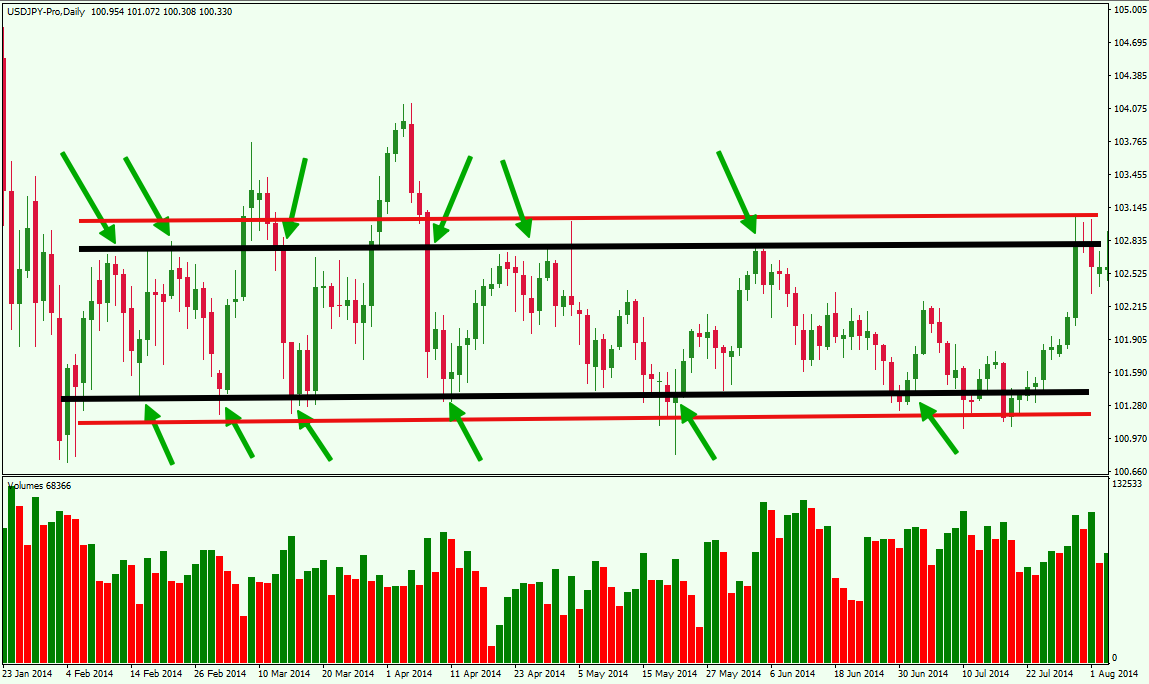

- Range Identification: Pehle price charts ko observe kar ke clear support aur resistance levels ko identify karna hota hai. Aksar horizontal lines draw kar ke aap in levels ko mark kar sakte hain.

- Entry and Exit Points: Jab price support level ke nazdeek hoti hai, to yeh buy ka signal samjha jata hai. Isi tarah, resistance level ke qareeb sell karna profitable ho sakta hai.

- Time Frame Selection: Range bound trading strategy ko intraday, swing ya even medium term time frames mein use kiya ja sakta hai. Har time frame ke liye range ki width aur market dynamics different ho sakti hain.

- Technical Indicators: Indicators jaise ke Relative Strength Index (RSI), Bollinger Bands, aur Moving Averages trader ko confirmatory signals dete hain ke market abhi bhi range bound hai ya break out hone wala hai.

Technical Analysis in Range Bound Trading

Technical Analysis in Range Bound Trading Technical analysis range bound markets ko samajhne ke liye ek powerful tool hai. Kuch important indicators aur tools jo is strategy mein use hote hain woh ye hain:

- Relative Strength Index (RSI): RSI overbought (70 se upar) aur oversold (30 se neeche) conditions ko indicate karta hai. Jab price support level par pohanchti hai aur RSI oversold zone mein hota hai, to yeh buy signal deta hai. Resistance ke paas overbought condition mein RSI sell signal ke taur par kaam karta hai.

- Bollinger Bands: Bollinger Bands price ke volatility ko measure karte hain. Agar bands narrow ho jate hain, to yeh indicate karta hai ke market mein consolidation ho raha hai aur range bound trading ke liye favorable conditions hain.

- Moving Averages: Short term aur long term moving averages se market ka trend assess kiya ja sakta hai. Agar moving averages flat ya sideways move kar rahe hon, to yeh range bound condition ka sign hota hai.

- Stochastic Oscillator: Yeh indicator bhi market ke overbought aur oversold conditions ko highlight karta hai, jis se aap ko entry aur exit points determine karne mein madad milti hai.

Developing a Range Bound Trading Strategy Range bound trading strategy ko develop karne ke liye pehle market analysis aur range identification bohot zaroori hai. Is process ko mukhtasar taur par samajhne ke liye ye steps follow kiye ja sakte hain:

- Chart Analysis: Apne preferred time frame ka chart kholen aur historical price action ko dekh kar support aur resistance levels ko mark karein. Horizontal lines draw karna is process ko asaan bana deta hai.

- Indicator Confirmation: RSI, Bollinger Bands, aur Stochastic Oscillator jaise indicators se confirm karein ke market abhi bhi ek confined range ke andar trade kar rahi hai. Agar in indicators se signal mil raha ho ke market overbought ya oversold hai, to entry aur exit points ko accordingly plan karein.

- Entry Points: Jab price support level tak pohanchti hai aur technical indicators buy signal dete hain, to long position enter karein.

- Exit Points: Resistance level ke paas profit book karne ke liye exit signal hota hai. Yeh points aapke risk management ke hisaab se set kiye jate hain.

- Stop Loss Setting: Har trade ke liye pre-determined stop loss level set karna zaroori hai, taake agar price unexpected direction mein move kare, to aapka nuksan limited rahe.

Risk Management in Range Bound Trading Har trading strategy ki tarah, range bound trading mein risk management bohot aham hai. Kuch key risk management techniques ye hain:

- Stop Loss Orders: Hamesha predefined stop loss ka istemal karein. Agar price support ya resistance level ko break kar deti hai, to stop loss se aapke losses control mein rehte hain.

- Position Sizing: Apne capital ka ek specific percentage risk mein invest karein. Position size ko adjust karne se aap large losses se bach sakte hain.

- Diversification: Sirf ek asset ya market par focus na karein. Multiple instruments mein diversify karne se overall portfolio risk kam hota hai.

- Regular Monitoring: Market conditions continuously change hoti rehti hain. Apne trades ko regular monitor karte hue exit ya adjust karne ke decisions timely lene chahiye.

Identifying Range Bound Markets Range bound markets ko identify karna ek fundamental skill hai jo aapke overall trading success ko influence karta hai. Is ke liye:

- Historical Price Data: Past price movements ko observe karein aur dekhain ke price consistently ek specific high aur low ke beech move kar rahi hai.

- Box Patterns: Aksar price charts par ek "box" pattern nazar aata hai jisme price repeatedly ek hi range ko test karta hai. Ye box aapke liye clear boundaries set karta hai.

- Trendlines: Horizontal trendlines draw karein jo support aur resistance ko represent karti hain. Agar price in lines ke darmiyan reh kar move karti hai, to market range bound hai.

Practical Example of Range Bound Trading Maan lijiye ke aap ek stock ya forex pair ka chart dekh rahe hain aur aapne notice kiya ke price lagatar 100 rupees ke support level aur 110 rupees ke resistance level ke darmiyan trade kar rahi hai. Aapka analysis yeh batata hai ke market mein koi significant news nahi hai aur buyers aur sellers ke darmiyan equilibrium hai.

- Entry: Jab price 100 rupees ke qareeb aati hai aur RSI oversold condition indicate karta hai, to aap long position le sakte hain.

- Profit Booking: Price jab 110 rupees ke paas pohanchti hai aur overbought condition nazar aati hai, to aap apni position exit kar sakte hain.

- Stop Loss: Agar price support ko break kar deti hai, to stop loss order automatically aapke losses ko limit kar dega.

Is tarah se, aap market ke oscillations ka faida uthate hue small but consistent profits generate kar sakte hain.

The Role of Technical Indicators in Enhancing Strategy Technical indicators aapki range bound trading strategy ko refine karne mein madadgar sabit hote hain. Kuch specific indicators jin ko aap integrate kar sakte hain:

- RSI (Relative Strength Index): RSI aapko market ke overbought ya oversold conditions ko clearly indicate karta hai. Ye aapko batata hai ke kab market mein reversal ke chances zyada hain.

- Bollinger Bands: In bands ki help se aap market ki volatility aur range ko measure kar sakte hain. Agar bands narrow ho rahe hon, to market consolidation ke phase mein hai.

- Stochastic Oscillator: Ye indicator similar tarah se overbought aur oversold signals deta hai, jo aapke entry aur exit points ko confirm karte hain.

- Pivot Points: Daily ya weekly pivot points se aap additional support aur resistance levels ko identify kar sakte hain, jo aapke trade decisions ko aur zyada robust banate hain.

Advanced Techniques in Range Bound Trading Jo traders advanced techniques istemal karte hain, woh range bound trading mein apni edge ko barha sakte hain. In advanced techniques mein shamil hain:

- Divergence Analysis: Kabhi kabhi price chart aur oscillators (jaise RSI) ke darmiyan divergence nazar aata hai. Agar price range ke andar oscillate kar rahi hai lekin RSI divergence dikhata hai, to yeh potential reversal signal ho sakta hai.

- Multiple Time Frame Analysis: Alag alag time frames (jaise ke daily, hourly, aur 15-minute charts) ka analysis karke aapko overall market context milta hai. Yeh technique aapko identify karne mein madad karti hai ke short term fluctuations range bound trend ke against to nahi ho rahe.

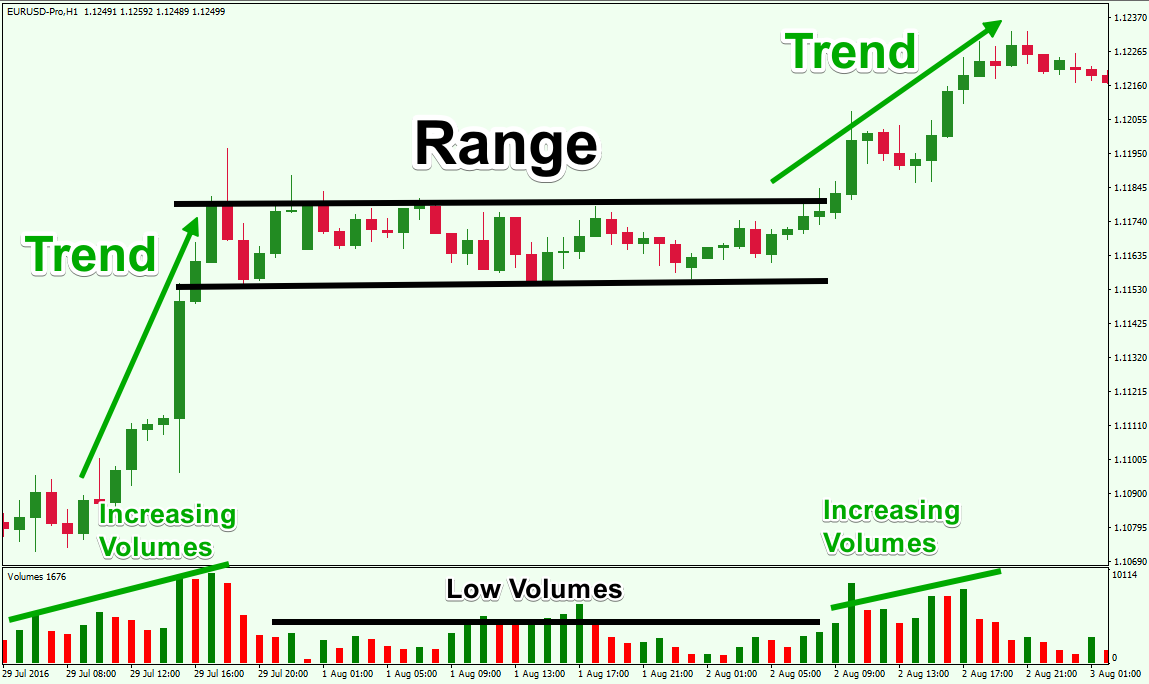

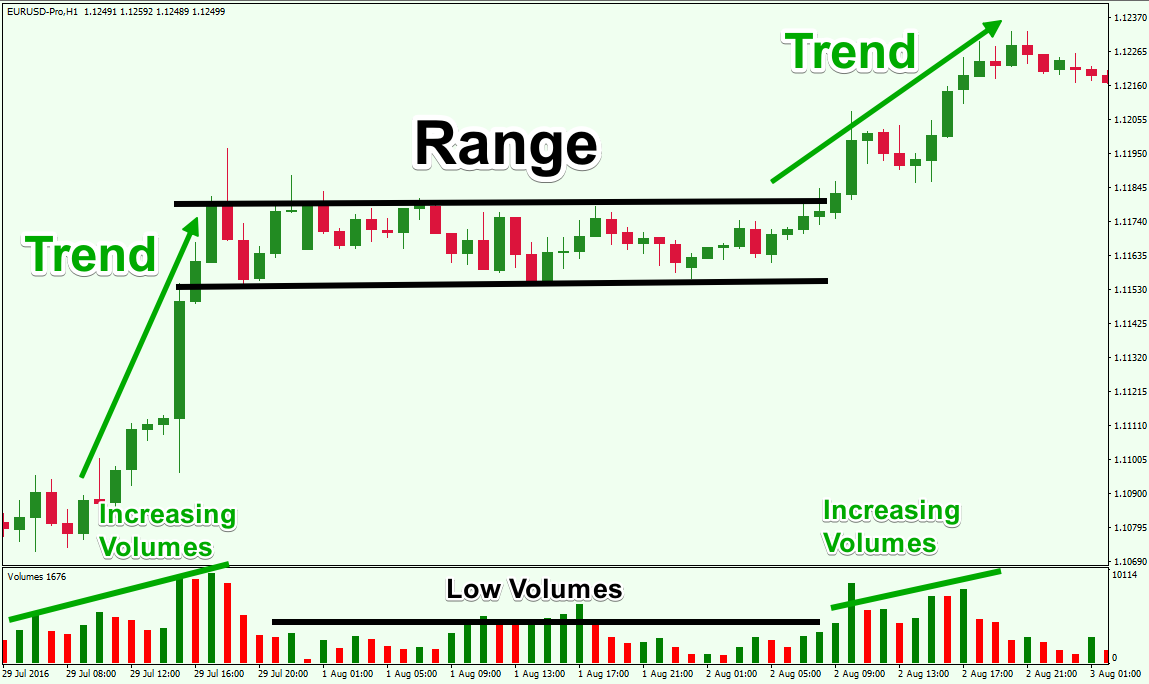

- Volume Analysis: Trading volume ka analysis aapko batata hai ke support ya resistance levels par kitna trading activity ho rahi hai. Agar volume support ya resistance par spike ho, to yeh indicate karta hai ke woh levels strong hain.

Psychological Factors in Range Bound Trading Trading mein sirf technical analysis hi nahi balki psychological factors bhi bohot important hain. Range bound market mein, jab price continuously ek range ke andar move karti rehti hai, to kai baar traders ko lagta hai ke market stagnant hai. Is situation mein sabr aur discipline sab se zyada aham ho jate hain.

- Patience: Range bound trading mein zyada tar profits small moves se generate hote hain. Is liye patience rakhna aur har choti movement se apne emotions ko control mein rakhna bohot zaroori hai.

- Discipline: Apni predefined strategy ko strictly follow karna chahiye. Agar market unexpected move kare, to panic mein aakar impulsive decisions na lein.

- Consistency: Har trade ke liye risk management rules ko follow karna, jaise ke stop loss aur proper position sizing, long term success ke liye essential hai.

- Adaptability: Market conditions kabhi bhi change ho sakti hain. Agar range break out ho jata hai, to aapko apni strategy ko turant adjust karna chahiye.

Common Mistakes and How to Avoid Them Range bound trading ke dauran kuch common mistakes hoti hain jin se bachna zaroori hai:

- Overtrading: Market confined range mein rehti hai, lekin har choti movement pe trade karne se transaction costs barh sakti hain aur aap emotional ho sakte hain.

- Ignoring Breakouts: Kabhi kabhi market suddenly range se break out kar jati hai. Aise scenarios mein timely exit na lena ya trade ko hold karna aapke liye nuksan ka sabab ban sakta hai.

- Poor Risk Management: Stop loss ya position sizing ko ignore karna bohot bari mistake hai. Har trade ke liye risk ko clearly define karein.

- Failure to Monitor Market News: Market mein koi significant news release hone se range bound conditions temporary tor par khatam ho sakti hain. Is liye news events ko ignore na karein.

Backtesting and Strategy Validation Har successful trading strategy ki tarah, range bound trading ko bhi backtest karna bohot zaroori hai. Backtesting se aap dekh sakte hain ke aapki strategy historical data par kaisi perform karti hai.

- Historical Data Analysis: Apne chosen market ka historical data lein aur dekhein ke past mein price kaise support aur resistance levels ke darmiyan move karti rahi hai.

- Parameter Optimization: Backtesting ke zariye aap identify kar sakte hain ke kaunse parameters (jaise ke stop loss levels, target profits, indicator thresholds) best work karte hain.

- Paper Trading: Real money invest karne se pehle paper trading ya demo account pe apni strategy ko test karna bohot mufeed hota hai. Is se aapko confidence milta hai ke aapki strategy live markets mein bhi kaam karegi.

Integration with Other Trading Strategies Range bound trading strategy ko doosri strategies ke sath integrate kar ke aap apne trading edge ko aur enhance kar sakte hain.

- Breakout Strategies: Agar market long time tak range bound rehti hai aur phir ek breakout signal generate hota hai, to aap apne range bound trading signals ko switch kar ke breakout strategy follow kar sakte hain.

- Trend Reversal Strategies: Kabhi kabhi range bound conditions ke end mein trend reversal ka signal milta hai. Is point par aapko apni positions ko reverse karne ke liye tayar rehna chahiye.

- Scalping: Short term traders, especially scalpers, range bound market mein choti choti price movements se profit capture karne ke liye rapid trades karte hain. Is mein aapko bohot fast execution aur tight spreads ki zaroorat hoti hai.

Adapting the Strategy to Different Markets

Adapting the Strategy to Different Markets Har market ka behavior alag hota hai, is liye range bound trading strategy ko adapt karna bhi zaroori hai.

- Forex Market: Forex market mein liquidity zyada hone ke wajah se price movements subtle hoti hain. Aapko tight ranges aur quick moves ke liye zyada sensitive hona padega.

- Stock Market: Stocks mein price swings zyada ho sakte hain, is liye support aur resistance levels ko define karne mein thoda zyada wide range dekhne ko mil sakta hai.

- Commodities and Indices: In markets mein bhi range bound conditions dekhne ko milti hain, lekin economic news aur seasonal trends ka bhi asar hota hai. Har market ki unique characteristics ko samajh kar strategy adjust karna profitable trading ke liye zaroori hai.Range bound trading strategy ek aisi technique hai jo stable, consolidation phase mein market ke oscillations se profit generate karne ka mauka deti hai. Yeh strategy aapko clear entry aur exit points provide karti hai jab market support aur resistance ke darmiyan confined rehti hai. Lekin, har strategy ki tarah, is mein bhi proper risk management, discipline, aur continuous market analysis ki zaroorat hoti hai.

Agar aap apne analysis ko robust banane ke liye technical indicators jaise RSI, Bollinger Bands, Moving Averages, aur Stochastic Oscillator ka sahi istemal karte hain, to aap effectively range bound trading ke signals ko capture kar sakte hain. Saath hi, apne trading plan ko backtest kar ke aur paper trading ke zariye validate karna aapko long term success ki taraf le jata hai.

Range bound trading ke dauran patience aur emotional control aapke best dost ban jate hain. Market ke confined moves se zyada ummeed na rakhein aur har trade ko ek disciplined approach se execute karein. Agar market kabhi range break out kar jaye to apne risk management rules ko follow karte hue turant adjust karna hi behtareen strategy hai.