Net Volume Indicator.

Net Volume Indicator ka Introduction.

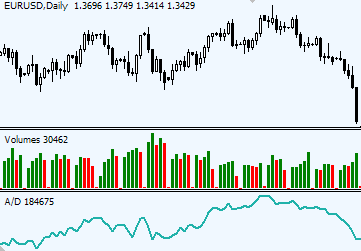

Net Volume Indicator ek technical analysis tool hai jo forex market mein volume aur price movement ka rishta dekhta hai. Ye indicator traders ko yeh samajhne mein madad karta hai ke market ka trend kis direction mein ja raha hai aur is mein kitni strength hai.

Volume ka Concept.

Forex market mein volume ka matlab hai ke kitne units (lots) trade ho rahe hain ek specific period mein. Jab volume zyada hota hai, toh iska matlab hai ke zyada interest hai us currency pair mein. Volume kam hone ka matlab hai ke kam interest hai.

Net Volume Calculation.

Net Volume Indicator ko calculate karne ke liye, pehle hamein har bar ka volume dekhna padta hai.

Net Volume ko calculate karne ke liye, hum positive aur negative volumes ko net karte hain.

Net Volume=Positive Volume−Negative Volume\text{Net Volume} = \text{Positive Volume} - \text{Negative Volume}Net Volume=Positive Volume−Negative Volume

Indicator ka Kaam.

Net Volume Indicator yeh dekhta hai ke price movement ke sath sath volume kaise change ho raha hai. Yeh trend confirmation aur reversal points dhoondhne mein madadgar hota hai.

Trend Confirmation.

Jab price aur Net Volume Indicator dono ek hi direction mein move karte hain, toh yeh trend confirmation hota hai. Yani agar price upward ja raha hai aur Net Volume bhi positive hai, toh yeh bullish trend ki confirmation hai. Aur agar price downward ja raha hai aur Net Volume negative hai, toh yeh bearish trend ki confirmation hai.

Divergence.

Divergence tab hoti hai jab price aur Net Volume Indicator different directions mein move karte hain. Agar price upward ja raha hai lekin Net Volume negative hai, toh yeh potential trend reversal ka sign hota hai. Similarly, agar price downward ja raha hai lekin Net Volume positive hai, toh yeh bhi trend reversal ka signal ho sakta hai.

Trading Strategy.

Limitations.

Har indicator ki tarah, Net Volume Indicator bhi apni limitations rakhta hai. Forex market mein exact volume data milna mushkil hota hai kyunki yeh centralized market nahi hai. Is liye kuch situations mein yeh indicator accurate signals nahi de sakta.

Net Volume Indicator ka Introduction.

Net Volume Indicator ek technical analysis tool hai jo forex market mein volume aur price movement ka rishta dekhta hai. Ye indicator traders ko yeh samajhne mein madad karta hai ke market ka trend kis direction mein ja raha hai aur is mein kitni strength hai.

Volume ka Concept.

Forex market mein volume ka matlab hai ke kitne units (lots) trade ho rahe hain ek specific period mein. Jab volume zyada hota hai, toh iska matlab hai ke zyada interest hai us currency pair mein. Volume kam hone ka matlab hai ke kam interest hai.

Net Volume Calculation.

Net Volume Indicator ko calculate karne ke liye, pehle hamein har bar ka volume dekhna padta hai.

- Agar closing price previous closing price se zyada ho, toh volume positive hota hai.

- Agar closing price previous closing price se kam ho, toh volume negative hota hai.

Net Volume ko calculate karne ke liye, hum positive aur negative volumes ko net karte hain.

Net Volume=Positive Volume−Negative Volume\text{Net Volume} = \text{Positive Volume} - \text{Negative Volume}Net Volume=Positive Volume−Negative Volume

Indicator ka Kaam.

Net Volume Indicator yeh dekhta hai ke price movement ke sath sath volume kaise change ho raha hai. Yeh trend confirmation aur reversal points dhoondhne mein madadgar hota hai.

Trend Confirmation.

Jab price aur Net Volume Indicator dono ek hi direction mein move karte hain, toh yeh trend confirmation hota hai. Yani agar price upward ja raha hai aur Net Volume bhi positive hai, toh yeh bullish trend ki confirmation hai. Aur agar price downward ja raha hai aur Net Volume negative hai, toh yeh bearish trend ki confirmation hai.

Divergence.

Divergence tab hoti hai jab price aur Net Volume Indicator different directions mein move karte hain. Agar price upward ja raha hai lekin Net Volume negative hai, toh yeh potential trend reversal ka sign hota hai. Similarly, agar price downward ja raha hai lekin Net Volume positive hai, toh yeh bhi trend reversal ka signal ho sakta hai.

Trading Strategy.

- Trend Following: Net Volume Indicator ko use kar ke traders trend ki direction aur strength confirm kar sakte hain. Agar price aur Net Volume dono increase ho rahe hain, toh buying opportunities dekhi ja sakti hain. Aur agar price aur Net Volume dono decrease ho rahe hain, toh selling opportunities dekhi ja sakti hain.

- Trend Reversal: Divergence ka istemal kar ke traders trend reversal points identify kar sakte hain. Agar price aur Net Volume different directions mein move kar rahe hain, toh yeh trend ke reverse hone ka signal ho sakta hai. Is waqt traders apni positions adjust kar sakte hain ya nayi positions open kar sakte hain.

Limitations.

Har indicator ki tarah, Net Volume Indicator bhi apni limitations rakhta hai. Forex market mein exact volume data milna mushkil hota hai kyunki yeh centralized market nahi hai. Is liye kuch situations mein yeh indicator accurate signals nahi de sakta.

تبصرہ

Расширенный режим Обычный режим