Bullish Meeting Line Candlestick Pattern.

Introduction.

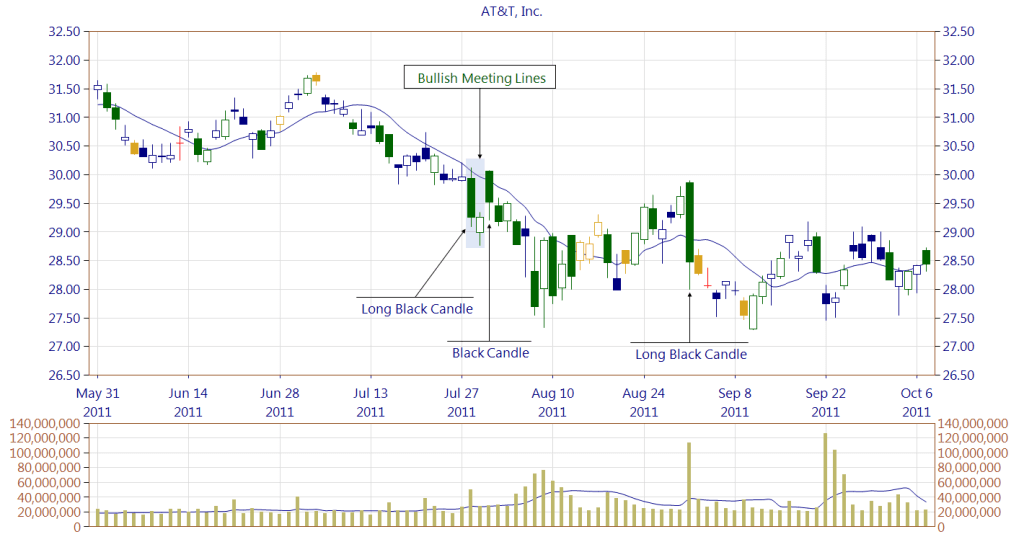

Bullish Meeting Line Candlestick Pattern aik technical analysis tool hai jo stock market mein bullish reversal ko indicate karta hai. Ye pattern do din ka hota hai aur is ka aksar matlub hota hai ke market downtrend se uptrend ki taraf janay wala hai.

Definition.

Bullish Meeting Line Candlestick Pattern tab banta hai jab ek bearish (negative) candlestick ke baad ek bullish (positive) candlestick aati hai. Pehli candlestick market ka girawat dikhati hai aur dusri candlestick market ki wapas upar janay ki koshish dikhati hai. Ye pattern tab complete hota hai jab dusri candlestick pehli candlestick ke close ke barabar ya is ke qareeb close hoti hai.

Structure of Bullish Meeting Line.

Significance.

Ye pattern significant is liye hota hai kyun ke ye market ke sentiment mein tabdili ko dikhata hai. Jab dusri candlestick pehli candlestick ke close ke barabar close hoti hai, to ye batata hai ke buyers ne sellers ka pressure khatam kar diya hai aur ab market upar janay ke chances zyada hain.

How to Identify.

Bullish Meeting Line Candlestick Pattern ko identify karne ke liye aapko ye dekhna hoga.

Example.

Agar aik stock ka price pehle 100 rupees tha aur gir kar 90 rupees per agaya, aur agle din wapas barh kar 90 rupees per close hota hai, to ye Bullish Meeting Line Pattern ban sakta hai. Pehli din bearish candlestick banegi aur agle din bullish candlestick banegi jo pehli candlestick ke close ke barabar ya is ke qareeb close hogi.

Trading Strategy.

Bullish Meeting Line Pattern dekh kar traders aksar buy ka decision lete hain, kyun ke ye pattern indicate karta hai ke market ab upar ja sakti hai. Lekin, ye zaroori hai ke aap doosre technical indicators aur market conditions ka bhi analysis karen pehle ke koi final decision len.

Introduction.

Bullish Meeting Line Candlestick Pattern aik technical analysis tool hai jo stock market mein bullish reversal ko indicate karta hai. Ye pattern do din ka hota hai aur is ka aksar matlub hota hai ke market downtrend se uptrend ki taraf janay wala hai.

Definition.

Bullish Meeting Line Candlestick Pattern tab banta hai jab ek bearish (negative) candlestick ke baad ek bullish (positive) candlestick aati hai. Pehli candlestick market ka girawat dikhati hai aur dusri candlestick market ki wapas upar janay ki koshish dikhati hai. Ye pattern tab complete hota hai jab dusri candlestick pehli candlestick ke close ke barabar ya is ke qareeb close hoti hai.

Structure of Bullish Meeting Line.

- First Candlestick: Pehli candlestick bearish hoti hai jo ke market ki girawat ko dikhati hai. Is ka color aksar lal ya kala hota hai, jo negative trend ko show karta hai.

- Second Candlestick: Dusri candlestick bullish hoti hai jo market ki taraf se recovery ko dikhati hai. Ye candlestick pehli candlestick ke close ke qareeb close hoti hai, lekin iska color sabz ya safed hota hai jo positive trend ko show karta hai.

Significance.

Ye pattern significant is liye hota hai kyun ke ye market ke sentiment mein tabdili ko dikhata hai. Jab dusri candlestick pehli candlestick ke close ke barabar close hoti hai, to ye batata hai ke buyers ne sellers ka pressure khatam kar diya hai aur ab market upar janay ke chances zyada hain.

How to Identify.

Bullish Meeting Line Candlestick Pattern ko identify karne ke liye aapko ye dekhna hoga.

- Downtrend: Pehle market mein downtrend hona chahiye.

- Bearish Candlestick: Pehli candlestick bearish honi chahiye.

- Bullish Candlestick: Dusri candlestick bullish honi chahiye jo pehli candlestick ke close ke qareeb close hoti hai.

Example.

Agar aik stock ka price pehle 100 rupees tha aur gir kar 90 rupees per agaya, aur agle din wapas barh kar 90 rupees per close hota hai, to ye Bullish Meeting Line Pattern ban sakta hai. Pehli din bearish candlestick banegi aur agle din bullish candlestick banegi jo pehli candlestick ke close ke barabar ya is ke qareeb close hogi.

Trading Strategy.

Bullish Meeting Line Pattern dekh kar traders aksar buy ka decision lete hain, kyun ke ye pattern indicate karta hai ke market ab upar ja sakti hai. Lekin, ye zaroori hai ke aap doosre technical indicators aur market conditions ka bhi analysis karen pehle ke koi final decision len.

تبصرہ

Расширенный режим Обычный режим